Filed by Woodside Energy Group Limited

Pursuant to Rule 425 of the Securities Act of 1933

Subject Company: BHP Group Ltd (Commission File No.: 001-09526)

Woodside Petroleum Ltd.

ACN 004 898 962

Mia Yellagonga

11 Mount Street

Perth WA 6000

Australia

T +61 8 9348 4000

www.woodside.com.au

ASX: WPL

OTC: WOPEY

Announcement

Thursday, 19 May 2022

WOODSIDE SHAREHOLDERS APPROVE

MERGER

Woodside shareholders voted to approve the proposed merger (the Merger) with the petroleum business of BHP Group Limited at today’s Annual

General Meeting. 98.66% of the votes submitted were in favour of the Merger.

All conditions precedent necessary to implement the Merger that require a

positive action or event in order to be satisfied have now been satisfied or waived.1

Woodside

expects completion of the Merger to occur on 1 June 2022. The new Woodside shares to be issued to or for the benefit of BHP shareholders are expected to commence trading on the Australian Securities Exchange (ASX) on 2 June 2022.

Trading of Woodside American Depositary Shares on the New York Stock Exchange is expected to commence on 2 June 2022. Trading of Woodside shares on the

Main Market for listed securities of the London Stock Exchange is expected to commence on 6 June 2022.

Resolutions 2, 3(a), 3(b), 3(c), 3(d), 4, 5,

6, 7, 8 and 9 put to the meeting were carried. Resolution 10(a) was not carried and accordingly resolutions 10(b), 10(c) and 10(d) were not put to the meeting as they were conditional on resolution 10(a) being passed. Following is information on the

voting outcome in respect of each resolution put to the meeting:

|

|

|

|

|

|

|

|

|

|

|

|

|

| Item 2 |

|

Approval of the BHP Petroleum Merger |

|

For |

|

|

550,920,381 |

|

|

|

98.66 |

% |

| |

Against |

|

|

7,490,163 |

|

|

|

1.34 |

% |

| |

Abstain |

|

|

1,449,841 |

|

|

|

|

|

| Item 3(a) |

|

Re-election of Dr Sarah Ryan as a

Director |

|

For |

|

|

543,719,203 |

|

|

|

97.48 |

% |

| |

Against |

|

|

14,042,476 |

|

|

|

2.52 |

% |

| |

Abstain |

|

|

2,036,892 |

|

|

|

|

|

| Item 3(b) |

|

Re-election of Ms Ann Pickard as a

Director |

|

For |

|

|

547,005,682 |

|

|

|

98.08 |

% |

| |

Against |

|

|

10,710,649 |

|

|

|

1.92 |

% |

|

|

|

|

Abstain |

|

|

2,084,240 |

|

|

|

|

|

| 1 |

The Merger remains subject to certain conditions precedent that, in the absence of an unforeseen event, will be

deemed to be satisfied on or before 31 May 2022. |

Page 1 of 5

|

|

|

|

|

|

|

|

|

|

|

|

|

| Item 3(c) |

|

Re-election of Mr Frank Cooper as a

Director |

|

For |

|

|

541,104,917 |

|

|

|

97.03 |

% |

| |

Against |

|

|

16,568,702 |

|

|

|

2.97 |

% |

| |

Abstain |

|

|

2,124,285 |

|

|

|

|

|

| Item 3(d) |

|

Re-election of Mr Ben Wyatt as a

Director |

|

For |

|

|

555,927,864 |

|

|

|

99.74 |

% |

| |

Against |

|

|

1,465,392 |

|

|

|

0.26 |

% |

| |

Abstain |

|

|

2,429,871 |

|

|

|

|

|

| Item 4 |

|

Adoption of Remuneration Report |

|

For |

|

|

531,075,843 |

|

|

|

95.39 |

% |

| |

Against |

|

|

25,680,559 |

|

|

|

4.61 |

% |

| |

Abstain |

|

|

2,645,842 |

|

|

|

|

|

| Item 5 |

|

Approval of Grant of Executive Incentive Scheme Awards to CEO & Managing

Director |

|

For |

|

|

537,738,502 |

|

|

|

96.60 |

% |

| |

Against |

|

|

18,915,756 |

|

|

|

3.40 |

% |

| |

Abstain |

|

|

3,030,518 |

|

|

|

|

|

| Item 6 |

|

Reinsertion of proportional takeover provisions |

|

For |

|

|

552,687,022 |

|

|

|

99.18 |

% |

| |

Against |

|

|

4,588,315 |

|

|

|

0.82 |

% |

| |

Abstain |

|

|

2,513,648 |

|

|

|

|

|

| Item 7 |

|

Change of Company Name |

|

For |

|

|

555,452,971 |

|

|

|

99.64 |

% |

| |

Against |

|

|

2,015,042 |

|

|

|

0.36 |

% |

| |

Abstain |

|

|

2,343,108 |

|

|

|

|

|

| Item 8 |

|

Change of External Auditor |

|

For |

|

|

555,444,883 |

|

|

|

99.69 |

% |

| |

Against |

|

|

1,713,289 |

|

|

|

0.31 |

% |

| |

Abstain |

|

|

2,657,703 |

|

|

|

|

|

| Item 9 |

|

Adoption of Climate Report |

|

For |

|

|

281,694,608 |

|

|

|

51.03 |

% |

| |

Against |

|

|

270,274,921 |

|

|

|

48.97 |

% |

| |

Abstain |

|

|

7,819,775 |

|

|

|

|

|

| Item 10(a) |

|

Amendment to the Constitution requisitioned by a group of shareholders |

|

For |

|

|

34,563,853 |

|

|

|

6.43 |

% |

| |

Against |

|

|

503,187,977 |

|

|

|

93.57 |

% |

| |

Abstain |

|

|

21,465,564 |

|

|

|

|

|

Further information, as required by section 251AA(2) of the Corporations Act 2001 (Cth) and ASX Listing Rule 3.13.2, is

attached.

|

|

|

| Contacts: |

|

|

| INVESTORS

Damien Gare W: +61 8 9348 4421

M: +61 417 111 697 E: investor@woodside.com.au |

|

MEDIA

Christine Forster M: +61 484 112 469

E: christine.forster@woodside.com.au |

This announcement was approved and authorised for release by Woodside’s Disclosure Committee.

Page 2 of 5

Important additional information in respect of US securities law

No offer of securities in the United States shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of

1933.

In connection with the proposed Merger, Woodside has filed the Registration Statement (File

No. 333-264268) with the SEC to register the Woodside securities to be issued in connection with the proposed Merger (including a prospectus), which the SEC has declared effective. Woodside and BHP also

plan to file other documents with the SEC regarding the proposed Merger. This communication is not a substitute for the Registration Statement or the prospectus or for any other document that Woodside or BHP may file with the SEC in connection with

the Transaction. US INVESTORS AND US HOLDERS OF WOODSIDE AND BHP SECURITIES ARE URGED TO READ THE REGISTRATION STATEMENT, PROSPECTUS AND OTHER DOCUMENTS RELATING TO THE PROPOSED MERGER (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS TO THOSE DOCUMENTS)

THAT HAVE BEEN OR WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT WOODSIDE, BHP AND THE PROPOSED MERGER. Shareholders will be able to obtain free copies of

the Registration Statement, prospectus and other documents containing important information about Woodside and BHP once those documents are filed with the SEC, through the website maintained by the SEC at http://www.sec.gov. Copies of the documents

may also be obtained from Woodside and BHP without charge.

Page 3 of 5

WOODSIDE PETROLEUM LTD 2022 ANNUAL GENERAL MEETING – VOTING RESULTS

The following information is provided in accordance with section 251AA(2) of the Corporations Act 2001 (Cth) and ASX Listing Rule 3.13.2.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Resolution details |

|

|

Instructions given to validly appointed proxies

(as at proxy close) |

|

|

Direct votes

(as at close of direct voting) |

|

|

Number of votes cast on the poll

(where applicable) |

|

|

Resolution

result |

|

| Resolution |

|

Resolution

type |

|

|

For |

|

|

Against |

|

|

At the

proxy’s

discretion |

|

|

Abstain |

|

|

For |

|

|

Against |

|

|

Abstain |

|

|

For |

|

Against |

|

Abstain* |

|

|

Carried /

Not carried |

|

| 2 Approval of the BHP Petroleum Merger |

|

|

Ordinary |

|

|

|

472,168,743 |

|

|

|

6,879,915 |

|

|

|

5,310,114 |

|

|

|

1,318,217 |

|

|

|

23,098,932 |

|

|

|

597,610 |

|

|

|

129,760 |

|

|

550,920,381

98.66% |

|

7,490,163

1.34% |

|

|

1,449,841 |

|

|

|

Carried |

|

| 3(a) Re-election of Dr Sarah Ryan as a Director |

|

|

Ordinary |

|

|

|

465,702,051 |

|

|

|

13,049,174 |

|

|

|

5,432,674 |

|

|

|

1,353,398 |

|

|

|

22,260,806 |

|

|

|

978,915 |

|

|

|

668,370 |

|

|

543,719,203

97.48% |

|

14,042,476

2.52% |

|

|

2,036,892 |

|

|

|

Carried |

|

| 3(b) Re-election of Ms Ann Pickard as a Director |

|

|

Ordinary |

|

|

|

470,369,404 |

|

|

|

8,381,368 |

|

|

|

5,428,417 |

|

|

|

1,358,108 |

|

|

|

22,294,567 |

|

|

|

905,921 |

|

|

|

709,603 |

|

|

547,005,682

98.08% |

|

10,710,649

1.92% |

|

|

2,084,240 |

|

|

|

Carried |

|

| 3(c) Re-election of Mr Frank Cooper as a Director |

|

|

Ordinary |

|

|

|

464,414,975 |

|

|

|

14,315,293 |

|

|

|

5,432,756 |

|

|

|

1,374,273 |

|

|

|

22,323,353 |

|

|

|

850,474 |

|

|

|

736,264 |

|

|

541,104,917

97.03% |

|

16,568,702

2.97% |

|

|

2,124,285 |

|

|

|

Carried |

|

| 3(d) Re-election of Mr Ben Wyatt as a Director |

|

|

Ordinary |

|

|

|

477,896,918 |

|

|

|

516,839 |

|

|

|

5,435,249 |

|

|

|

1,688,291 |

|

|

|

22,271,917 |

|

|

|

910,133 |

|

|

|

728,041 |

|

|

555,927,864

99.74% |

|

1,465,392

0.26% |

|

|

2,429,871 |

|

|

|

Carried |

|

| 4 Adoption of Remuneration Report |

|

|

Ordinary |

|

|

|

457,382,259 |

|

|

|

21,185,695 |

|

|

|

5,444,486 |

|

|

|

1,501,223 |

|

|

|

19,718,670 |

|

|

|

2,739,180 |

|

|

|

1,087,343 |

|

|

531,075,843

95.39% |

|

25,680,559

4.61% |

|

|

2,645,842 |

|

|

|

Carried |

|

| 5 Approval of Grant of Executive Incentive Scheme Awards to CEO & Managing

Director |

|

|

Ordinary |

|

|

|

464,260,897 |

|

|

|

14,076,856 |

|

|

|

5,419,533 |

|

|

|

1,756,377 |

|

|

|

19,204,757 |

|

|

|

3,402,397 |

|

|

|

1,219,823 |

|

|

537,738,502

96.60% |

|

18,915,756

3.40% |

|

|

3,030,518 |

|

|

|

Carried |

|

Page 4 of 5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Resolution details |

|

|

Instructions given to validly appointed proxies

(as at proxy close) |

|

|

Direct votes

(as at close of direct voting) |

|

|

Number of votes cast on the poll

(where applicable) |

|

|

Resolution

result |

|

| Resolution |

|

Resolution

type |

|

|

For |

|

|

Against |

|

|

At the

proxy’s

discretion |

|

|

Abstain |

|

|

For |

|

|

Against |

|

|

Abstain |

|

|

For |

|

Against |

|

Abstain* |

|

|

Carried /

Not

carried |

|

| 6 Reinsertion of proportional takeover provisions |

|

|

Ordinary |

|

|

|

474,957,487 |

|

|

|

3,713,283 |

|

|

|

5,450,193 |

|

|

|

1,416,334 |

|

|

|

22,010,776 |

|

|

|

878,096 |

|

|

|

1,017,219 |

|

|

552,687,022

99.18% |

|

4,588,315

0.82% |

|

|

2,513,648 |

|

|

|

Carried |

|

| 7 Change of Company Name |

|

|

Ordinary |

|

|

|

478,415,731 |

|

|

|

233,081 |

|

|

|

5,482,291 |

|

|

|

1,406,194 |

|

|

|

21,236,568 |

|

|

|

1,758,948 |

|

|

|

914,575 |

|

|

555,452,971

99.64% |

|

2,015,042

0.36% |

|

|

2,343,108 |

|

|

|

Carried |

|

| 8 Change of External Auditor |

|

|

Ordinary |

|

|

|

477,547,325 |

|

|

|

1,046,006 |

|

|

|

5,485,747 |

|

|

|

1,458,219 |

|

|

|

22,109,531 |

|

|

|

665,386 |

|

|

|

1,135,174 |

|

|

555,444,883

99.69% |

|

1,713,289

0.31% |

|

|

2,657,703 |

|

|

|

Carried |

|

| 9 Adoption of Climate Report |

|

|

Ordinary |

|

|

|

250,024,445 |

|

|

|

223,466,694 |

|

|

|

5,454,971 |

|

|

|

6,585,310 |

|

|

|

21,102,314 |

|

|

|

1,633,511 |

|

|

|

1,170,266 |

|

|

281,694,608

51.03% |

|

270,274,921

48.97% |

|

|

7,819,775 |

|

|

|

Carried |

|

| 10(a) Amendment to the Constitution |

|

|

Special |

|

|

|

22,506,553 |

|

|

|

438,098,543 |

|

|

|

5,401,558 |

|

|

|

18,985,615 |

|

|

|

2,177,925 |

|

|

|

20,755,505 |

|

|

|

976,661 |

|

|

34,563,853

6.43% |

|

503,187,977

93.57% |

|

|

21,465,564 |

|

|

|

Not

carried |

|

| 10(b) Contingent Resolution – Capital protection |

|

|

Ordinary |

|

|

|

68,844,355 |

|

|

|

395,344,245 |

|

|

|

5,394,401 |

|

|

|

15,403,391 |

|

|

|

2,327,266 |

|

|

|

20,695,049 |

|

|

|

887,776 |

|

|

Not applicable – item 10(b) was not required and was not put to the meeting as it was conditional on item 10(a) being passed |

|

| 10(c) Contingent Resolution – Climate-related lobbying |

|

|

Ordinary |

|

|

|

58,326,495 |

|

|

|

401,372,913 |

|

|

|

5,387,270 |

|

|

|

19,899,714 |

|

|

|

2,267,109 |

|

|

|

20,840,105 |

|

|

|

802,877 |

|

|

Not applicable – item 10(c) was not required and was not put to the meeting as it was conditional on item 10(a) being passed |

|

| 10(d) Contingent Resolution – Decommissioning |

|

|

Ordinary |

|

|

|

57,379,199 |

|

|

|

409,109,009 |

|

|

|

5,392,161 |

|

|

|

13,106,023 |

|

|

|

2,263,928 |

|

|

|

20,702,641 |

|

|

|

943,522 |

|

|

Not applicable – item 10(d) was not required and was not put to the meeting as it was conditional on item 10(a) being passed |

|

| * |

Votes cast by a person who abstains on an item are not counted in calculating the required majority on a poll

|

Page 5 of 5

Forward-looking statements

This announcement contains forward-looking statements. The words ‘anticipate’, ‘believe’, ‘aim’, ‘estimate’,

‘expect’, ‘intend’, ‘may’, ‘target’, ‘plan’, ‘forecast’, ‘project’, ‘schedule’, ‘will’, ‘should’, ‘seek’ and other similar words or

expressions are intended to identify forward-looking statements. These forward-looking statements are based on assumptions and contingencies that are subject to change without notice and involve known and unknown risks, uncertainties and other

factors, many of which are beyond the control of Woodside, BHP and their respective related bodies corporate and affiliates (and each of their respective directors, officers, employees, partners, consultants, contractors, agents, advisers and

representatives), and could cause results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by those forward-looking statements or any projections or

assumptions on which those statements are based.

The forward-looking statements are subject to risk factors, including those associated with the oil and

gas industry as well as those in connection with the Transaction. It is believed that the expectations reflected in these statements are reasonable, but they may be affected by a range of variables which could cause actual results or trends to

differ materially, including but not limited to: price fluctuations, actual demand, currency fluctuations, geotechnical factors, drilling and production results, gas commercialisation, development progress, operating results, engineering estimates,

reserve estimates, loss of market, industry competition, environmental risks, physical risks, legislative, fiscal and regulatory developments, economic and financial markets, conditions in various countries, approvals and cost estimates.

Investors are strongly cautioned not to place undue reliance on forward-looking statements, particularly in light of the current economic climate and the

significant uncertainty and disruption caused by the COVID-19 pandemic. Forward-looking statements are provided as a general guide only and should not be relied on as an indication or guarantee of future

performance. These statements may assume the success of the Transaction, BHP’s oil and gas portfolio or Woodside’s business strategies, the success of which may not be realised within the period for which the forward-looking statements may

have been prepared, or at all. No guarantee, representation or warranty, express or implied, is made as to the accuracy, likelihood of achievement or reasonableness of any forecasts, prospects, returns, statements or tax treatment in relation to

future matters contained in this presentation.

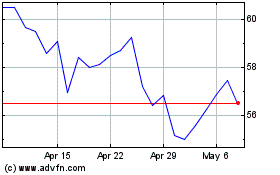

BHP (NYSE:BHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

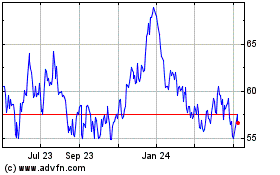

BHP (NYSE:BHP)

Historical Stock Chart

From Apr 2023 to Apr 2024