Notes to Condensed Consolidated Financial Statements

(unaudited)

1. Basis of Presentation

Unless the context otherwise requires, the use of the terms “Best Buy,” “we,” “us” and “our” in these Notes to Condensed Consolidated Financial Statements refers to Best Buy Co., Inc. and, as applicable, its consolidated subsidiaries.

In the opinion of management, the accompanying condensed consolidated financial statements contain all adjustments necessary for a fair presentation as prescribed by accounting principles generally accepted in the U.S. (“GAAP”). All adjustments were comprised of normal recurring adjustments, except as noted in these Notes to Condensed Consolidated Financial Statements.

Historically, we have generated a large proportion of our revenue and earnings in the fiscal fourth quarter, which includes the majority of the holiday shopping season. Due to the seasonal nature of our business, interim results are not necessarily indicative of results for the entire fiscal year. The interim financial statements and the related notes included in this Quarterly Report on Form 10-Q should be read in conjunction with the consolidated financial statements and related notes included in our Annual Report on Form 10-K for the fiscal year ended January 29, 2022. The first six months of fiscal 2023 and fiscal 2022 included 26 weeks.

In preparing the accompanying condensed consolidated financial statements, we evaluated the period from July 30, 2022, through the date the financial statements were issued for material subsequent events requiring recognition or disclosure. Other than the Inflation Reduction Act of 2022 that was enacted on August 16, 2022, no such events were identified for the reported periods. See Note 10, Income Taxes, for additional information.

Total Cash, Cash Equivalents and Restricted Cash

Cash, cash equivalents and restricted cash reported on our Condensed Consolidated Balance Sheets are reconciled to the total shown on our Condensed Consolidated Statements of Cash Flows as follows ($ in millions):

| | | | | | | | | | | |

| July 30, 2022 | | January 29, 2022 | | July 31, 2021 |

Cash and cash equivalents | $ | 840 | | | $ | 2,936 | | | $ | 4,340 | |

Restricted cash included in Other current assets | | 312 | | | | 269 | | | | 134 | |

Total cash, cash equivalents and restricted cash | $ | 1,152 | | | $ | 3,205 | | | $ | 4,474 | |

Amounts included in restricted cash are primarily restricted to cover product protection plans provided under our Best Buy Totaltech membership offering and self-insurance liabilities.

2. Restructuring

Restructuring charges were as follows ($ in millions):

| | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| July 30, 2022 | | July 31, 2021 | | July 30, 2022 | | July 31, 2021 |

Fiscal 2023 Resource Optimization Initiative | | $ | 34 | | | $ | - | | | $ | 34 | | | $ | - | |

Mexico Exit and Strategic Realignment(1) | | - | | | | 4 | | | | 1 | | | | (44) | |

Total | $ | 34 | | | $ | 4 | | | $ | 35 | | | $ | (44) | |

(1)Includes ($6) million related to inventory markdowns recorded in Cost of Sales on our Condensed Consolidated Statements of Earnings for the six months ended July 31, 2021.

Fiscal 2023 Resource Optimization Initiative

In light of ongoing changes in business trends, during the second quarter of fiscal 2023, we commenced an enterprise-wide initiative to better align our spending with critical strategies and operations, as well as to optimize our cost structure. We incurred $34 million of charges in our Domestic segment related to termination benefits. We currently expect to incur additional charges through the remainder of fiscal 2023, primarily within our Domestic segment, of approximately $40 million to $65 million related to this initiative.

All charges incurred related to this plan were from continuing operations and were presented within Restructuring charges on our Condensed Consolidated Statements of Earnings. There were $1 million of cash payments related to this initiative during the second quarter of fiscal 2023, and our remaining termination benefits liability as of July 30, 2022, was $33 million.

Mexico Exit and Strategic Realignment

In the third quarter of fiscal 2021, we made the decision to exit our operations in Mexico and began taking other actions to more broadly align our organizational structure in support of our strategy.

Charges incurred in our International segment primarily related to our decision to exit our operations in Mexico. All of our former stores in Mexico were closed as of the first quarter of fiscal 2022.

Charges incurred in our Domestic segment primarily related to actions taken to align our organizational structure in support of our strategy. During the six months ended July 31, 2021, we recorded a $44 million credit primarily due to a reduction in expected termination benefits resulting from adjustments to previously planned organizational changes and higher-than-expected employee retention.

All charges incurred related to this plan were from continuing operations and were presented as follows ($ in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Statement of | Three Months Ended July 31, 2021 | | Six Months Ended July 31, 2021 |

| Earnings Location | Domestic | | International | | Total | | Domestic | | International | | Total |

Inventory markdowns | Cost of sales | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | (6) | | | $ | (6) | |

Asset impairments | Restructuring charges | | - | | | | 4 | | | | 4 | | | | - | | | | 7 | | | | 7 | |

Termination benefits | Restructuring charges | | - | | | | - | | | | - | | | | (44) | | | | (1) | | | | (45) | |

| | | | | $ | - | | | $ | 4 | | | $ | 4 | | | $ | (44) | | | $ | - | | | $ | (44) | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Statement of | Cumulative Amount as of July 30, 2022 |

| Earnings Location | | | | Domestic | | International | | Total |

Inventory markdowns | Cost of sales | | | | $ | - | | | $ | 17 | | | $ | 17 | |

Asset impairments(1) | Restructuring charges | | | | | 10 | | | | 63 | | | | 73 | |

Termination benefits | Restructuring charges | | | | | 83 | | | | 19 | | | | 102 | |

Currency translation adjustment | Restructuring charges | | | | | - | | | | 39 | | | | 39 | |

Other(2) | Restructuring charges | | | | | - | | | | 6 | | | | 6 | |

| | | | | $ | 93 | | | $ | 144 | | | $ | 237 | |

(1)Remaining net carrying value approximates fair value and was immaterial as of July 30, 2022.

(2)Other charges are primarily comprised of contract termination costs.

We do not expect to incur material future restructuring charges related to the exit from Mexico or strategic realignment initiatives described above, and no material liability remains as of July 30, 2022.

3. Goodwill and Intangible Assets

Goodwill

Goodwill balances by reportable segment were as follows ($ in millions):

| | | | | | | | | | | | | | | | | | | | | | | |

| July 30, 2022 | | January 29, 2022 | | July 31, 2021 |

| Gross Carrying Amount | | Cumulative Impairment | | Gross Carrying Amount | | Cumulative Impairment | | Gross Carrying Amount | | Cumulative Impairment |

Domestic | $ | 1,452 | | | $ | (67) | | | $ | 1,451 | | | $ | (67) | | | $ | 1,053 | | | $ | (67) | |

International | | 608 | | | | (608) | | | | 608 | | | | (608) | | | | 608 | | | | (608) | |

Total | $ | 2,060 | | | $ | (675) | | | $ | 2,059 | | | $ | (675) | | | $ | 1,661 | | | $ | (675) | |

No impairment charges were recorded during the periods presented.

Definite-Lived Intangible Assets

We have definite-lived intangible assets that are recorded within Other assets on our Condensed Consolidated Balance Sheets as follows ($ in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| July 30, 2022 | | January 29, 2022 | | July 31, 2021 | | Weighted-Average |

| Gross Carrying

Amount | | Accumulated

Amortization | | Gross Carrying

Amount | | Accumulated

Amortization | | Gross Carrying

Amount | | Accumulated

Amortization | | Useful Life Remaining as of July 30, 2022 (in years) |

Customer relationships | $ | 360 | | | $ | 208 | | | $ | 360 | | | $ | 180 | | | $ | 339 | | | $ | 152 | | | | 7.7 | |

Tradenames | | 108 | | | | 47 | | | | 108 | | | | 38 | | | | 81 | | | | 31 | | | | 5.5 | |

Developed technology | | 64 | | | | 46 | | | | 64 | | | | 39 | | | | 56 | | | | 32 | | | | 2.7 | |

Total | $ | 532 | | | $ | 301 | | | $ | 532 | | | $ | 257 | | | $ | 476 | | | $ | 215 | | | | 6.8 | |

Amortization expense was as follows ($ in millions):

| | | | | | | | | | | | | | | | | | | | | |

| | | Statement of | | Three Months Ended | | Six Months Ended |

| | | Earnings Location | | July 30, 2022 | | July 31, 2021 | | July 30, 2022 | | July 31, 2021 |

Amortization expense | SG&A | | | $ | 22 | | | $ | 20 | | | $ | 44 | | | $ | 40 | |

Amortization expense expected to be recognized in future periods is as follows ($ in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | Amortization Expense |

Remainder of fiscal 2023 | | | | | | | | | | | | | | | | | | | | | | | | | $ | 43 | |

Fiscal 2024 | | | | | | | | | | | | | | | | | | | | | | | | | | 61 | |

Fiscal 2025 | | | | | | | | | | | | | | | | | | | | | | | | | | 21 | |

Fiscal 2026 | | | | | | | | | | | | | | | | | | | | | | | | | | 20 | |

Fiscal 2027 | | | | | | | | | | | | | | | | | | | | | | | | | | 18 | |

Fiscal 2028 | | | | | | | | | | | | | | | | | | | | | | | | | | 12 | |

Thereafter | | | | | | | | | | | | | | | | | | | | | | | | | | 56 | |

4. Fair Value Measurements

Fair value measurements are reported in one of three levels based on the lowest level of significant input used: Level 1 (unadjusted quoted prices in active markets); Level 2 (observable market inputs, other than quoted prices included in Level 1); and Level 3 (unobservable inputs that cannot be corroborated by observable market data).

Recurring Fair Value Measurements

Financial assets accounted for at fair value were as follows ($ in millions):

| | | | | | | | | | | | | | | | | | |

| | | | | | | | Fair Value at |

| | Balance Sheet Location(1) | Fair Value Hierarchy | | July 30, 2022 | | January 29, 2022 | | July 31, 2021 |

Assets | | | | | | | | | | | | | | | | | | |

Money market funds(2) | | Cash and cash equivalents | Level 1 | | | $ | 1 | | | $ | 548 | | | $ | 1,113 | |

Time deposits(3) | | Cash and cash equivalents | Level 2 | | | | 26 | | | | 278 | | | | 625 | |

Money market funds(2) | | Other current assets | | | Level 1 | | | | 125 | | | | - | | | | - | |

Time deposits(3) | | Other current assets | | | Level 2 | | | | - | | | | - | | | | 65 | |

Marketable securities that fund deferred compensation(4) | | Other assets | | | Level 1 | | | | 48 | | | | 54 | | | | 54 | |

Interest rate swap derivative instruments(5) | Other assets | | | Level 2 | | | | 19 | | | | 50 | | | | 79 | |

(1)Balance sheet location is determined by length to maturity at date of purchase.

(2)Valued at quoted market prices in active markets at period end.

(3)Valued at face value plus accrued interest at period end, which approximates fair value.

(4)Valued using the performance of mutual funds that trade with sufficient frequency and volume to obtain pricing information on an ongoing basis.

(5)Valued using readily observable market inputs. These instruments are custom, over-the-counter contracts with various bank counterparties that are not traded on an active market. See Note 5, Derivative Instruments, for additional information.

Fair Value of Financial Instruments

The fair values of cash, restricted cash, receivables, accounts payable, short-term debt and other payables approximated their carrying values because of the short-term nature of these instruments. If these instruments were measured at fair value in the financial statements, they would be classified as Level 1 in the fair value hierarchy. Fair values for other instruments held at cost are not readily available, but we estimate that the carrying values for these investments approximate their fair values.

Long-term debt is presented at carrying value on our Condensed Consolidated Balance Sheets. If our long-term debt were recorded at fair value, it would be classified as Level 2 in the fair value hierarchy. Long-term debt balances were as follows ($ in millions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | July 30, 2022 | | January 29, 2022 | | July 31, 2021 |

| | | | | Fair Value | | Carrying Value | | Fair Value | | Carrying Value | | Fair Value | | Carrying Value |

Long-term debt(1) | $ | 1,069 | | | $ | 1,169 | | | $ | 1,205 | | | $ | 1,200 | | | $ | 1,306 | | | $ | 1,229 | |

(1)Excluded debt discounts, issuance costs and finance lease obligations.

5. Derivative Instruments

We manage our economic and transaction exposure to certain risks by using foreign exchange forward contracts to hedge against the effect of Canadian dollar exchange rate fluctuations on a portion of our net investment in our Canadian operations and by using interest rate swaps to mitigate the effect of interest rate fluctuations on our $500 million principal amount of notes due October 1, 2028 (“2028 Notes”). In addition, we use foreign currency forward contracts not designated as hedging instruments to manage the impact of fluctuations in foreign currency exchange rates relative to recognized receivable and payable balances denominated in non-functional currencies.

Our derivative instruments designated as net investment hedges and interest rate swaps are recorded on our Condensed Consolidated Balance Sheets at fair value. See Note 4, Fair Value Measurements, for gross fair values of our outstanding derivative instruments and corresponding fair value classifications.

Notional amounts of our derivative instruments were as follows ($ in millions):

| | | | | | | | | | | | | |

Contract Type | | | July 30, 2022 | | January 29, 2022 | | July 31, 2021 |

Derivatives designated as net investment hedges | | | $ | 118 | | | $ | 155 | | | $ | 109 | |

Derivatives designated as interest rate swaps | | | | 500 | | | | 500 | | | | 500 | |

No hedge designation (foreign exchange contracts) | | | | 65 | | | | 68 | | | | 46 | |

Total | | | $ | 683 | | | $ | 723 | | | $ | 655 | |

| | | | | | | | | | | | | |

Effects of our derivatives on our Condensed Consolidated Statements of Earnings were as follows ($ in millions):

| | | | | | | | | | | | | | | | | | | |

| | | | | Gain (Loss) Recognized |

| Statement of | Three Months Ended | | Six Months Ended |

| Earnings Location | July 30, 2022 | | July 31, 2021 | | July 30, 2022 | | July 31, 2021 |

Interest rate swap contracts | Interest expense | $ | 14 | | | $ | 14 | | | $ | (31) | | | $ | (12) | |

Adjustments to carrying value of long-term debt | Interest expense | | (14) | | | | (14) | | | | 31 | | | | 12 | |

Total | | | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

6. Debt

Short-Term Debt

U.S. Revolving Credit Facility

We have a $1.25 billion, five year senior unsecured revolving credit facility agreement (the “Five-Year Facility Agreement”) with a syndicate of banks. The Five-Year Facility Agreement permits borrowings of up to $1.25 billion and expires in May 2026. There were no borrowings outstanding under the Five-Year Facility Agreement as of July 30, 2022, January 29, 2022, or July 31, 2021.

Bank Advance

In conjunction with a solar energy investment, we were advanced $110 million due October 31, 2021. The advance was recorded within Short-term debt on our Condensed Consolidated Balance Sheets as of July 31, 2021, and bore interest at 0.14%. This advance was repaid on October 29, 2021.

Long-Term Debt

Long-term debt consisted of the following ($ in millions):

| | | | | | | | | | | | |

| | July 30, 2022 | | January 29, 2022 | | July 31, 2021 |

Notes, 4.45%, due October 1, 2028 | | $ | 500 | | | $ | 500 | | | $ | 500 | |

Notes, 1.95%, due October 1, 2030 | | | 650 | | | | 650 | | | | 650 | |

Interest rate swap valuation adjustments | | | 19 | | | | 50 | | | | 79 | |

Subtotal | | | 1,169 | | | | 1,200 | | | | 1,229 | |

Debt discounts and issuance costs | | | (10) | | | | (11) | | | | (12) | |

Finance lease obligations | | | 40 | | | | 40 | | | | 40 | |

Total long-term debt | | | 1,199 | | | | 1,229 | | | | 1,257 | |

Less current portion | | | 15 | | | | 13 | | | | 14 | |

Total long-term debt, less current portion | | $ | 1,184 | | | $ | 1,216 | | | $ | 1,243 | |

See Note 4, Fair Value Measurements, for the fair value of long-term debt.

7. Revenue

We generate substantially all of our revenue from contracts with customers for the sale of products and services. Contract balances primarily consist of receivables and liabilities related to product merchandise not yet delivered to customers, unfulfilled membership benefits and services not yet completed, unredeemed gift cards and options that provide a material right to customers, such as our customer loyalty programs. Contract balances were as follows ($ in millions):

| | | | | | | | | | | |

| July 30, 2022 | | January 29, 2022 | | July 31, 2021 |

Receivables, net(1) | $ | 534 | | | $ | 591 | | | $ | 528 | |

Short-term contract liabilities included in: | | | | | | | | | | | |

Unredeemed gift card liabilities | | 273 | | | | 316 | | | | 293 | |

Deferred revenue | | 1,133 | | | | 1,103 | | | | 854 | |

Accrued liabilities | | 78 | | | | 83 | | | | 79 | |

(1)Receivables are recorded net of allowances for doubtful accounts of $21 million, $31 million and $24 million as of July 30, 2022, January 29, 2022, and July 31, 2021, respectively.

During the first six months of fiscal 2023 and fiscal 2022, $1,089 million and $866 million of revenue was recognized, respectively, that was included in the contract liabilities at the beginning of the respective periods.

See Note 12, Segments, for information on our revenue by reportable segment and product category.

8. Earnings per Share

We compute our basic earnings per share based on the weighted-average number of common shares outstanding and our diluted earnings per share based on the weighted-average number of common shares outstanding adjusted by the number of additional shares that would have been outstanding had potentially dilutive common shares been issued.

Reconciliations of the numerators and denominators of basic and diluted earnings per share were as follows ($ and shares in millions, except per share amounts):

| | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| July 30, 2022 | | July 31, 2021 | | July 30, 2022 | | July 31, 2021 |

Numerator | | | | | | | | | | | | | | | |

Net earnings | $ | 306 | | | $ | 734 | | | $ | 647 | | | $ | 1,329 | |

Denominator | | | | | | | | | | | | | | | |

Weighted-average common shares outstanding | | 225.4 | | | | 250.2 | | | | 226.1 | | | | 251.7 | |

Dilutive effect of stock compensation plan awards | | 0.7 | | | | 2.6 | | | | 1.1 | | | | 3.0 | |

Weighted-average common shares outstanding, assuming dilution | | 226.1 | | | | 252.8 | | | | 227.2 | | | | 254.7 | |

| | | | | | | | | | | | | | | |

Potential shares which were anti-dilutive and excluded from weighted-average share computations | 2.1 | | | | - | | | | 1.9 | | | | - | |

| | | | | | | | | | | | | | | |

Basic earnings per share | $ | 1.36 | | | $ | 2.93 | | | $ | 2.86 | | | $ | 5.28 | |

Diluted earnings per share | $ | 1.35 | | | $ | 2.90 | | | $ | 2.85 | | | $ | 5.22 | |

9. Repurchase of Common Stock

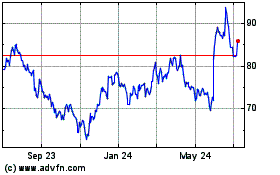

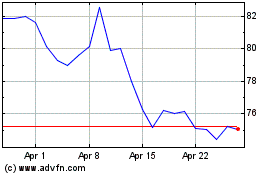

On February 28, 2022, our Board of Directors approved a new $5.0 billion share repurchase program, which replaced the $5.0 billion share repurchase program authorized on February 16, 2021. There is no expiration date governing the period over which we can repurchase shares under this authorization. Share repurchases were paused during the second quarter of fiscal 2023.

Information regarding the shares we repurchased and retired was as follows ($ and shares in millions, except per share amounts):

| | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| July 30, 2022 | | July 31, 2021 | | July 30, 2022 | | July 31, 2021 |

Total cost of shares repurchased | $ | 10 | | | $ | 416 | | | $ | 452 | | | $ | 1,331 | |

Average price per share | $ | 83.71 | | | $ | 112.75 | | | $ | 96.83 | | | $ | 109.92 | |

Number of shares repurchased | | 0.1 | | | | 3.7 | | | | 4.6 | | | | 12.1 | |

As of July 30, 2022, $4.7 billion of the $5.0 billion share repurchase authorization was available.

10. Income Taxes

Unrecognized Tax Benefits

Our income tax returns are routinely examined by domestic and foreign tax authorities. During the second quarter of fiscal 2022, we reduced our unrecognized tax benefits by $101 million relating to multi-jurisdiction, multi-year, non-cash benefits from the resolution of certain discrete tax matters, all of which resulted in a tax benefit.

Inflation Reduction Act of 2022

On August 16, 2022, the U.S. enacted the Inflation Reduction Act of 2022, which, among other things, implements a 15% minimum tax on book income of certain large corporations, a 1% excise tax on net stock repurchases and several tax incentives to promote clean energy. Based on our current analysis of the provisions, we do not believe this legislation will have a material impact on our consolidated financial statements.

11. Contingencies

We are involved in a number of legal proceedings. Where appropriate, we have made accruals with respect to these matters, which are reflected on our Condensed Consolidated Financial Statements. However, there are cases where liability is not probable or the amount cannot be reasonably estimated and, therefore, accruals have not been made. We provide disclosure of matters where we believe it is reasonably possible the impact may be material to our Condensed Consolidated Financial Statements.

12. Segments

Reportable segment and product category revenue information was as follows ($ in millions):

| | | | | | | | | | | | | | | | | | | |

| | | | | Three Months Ended | | Six Months Ended |

| | | | | July 30, 2022 | | July 31, 2021 | | July 30, 2022 | | July 31, 2021 |

Revenue by reportable segment | | | | | | | | | | | | | | | | | | | |

Domestic | | | | | $ | 9,569 | | | $ | 11,011 | | | $ | 19,463 | | | $ | 21,852 | |

International | | | | | | 760 | | | | 838 | | | | 1,513 | | | | 1,634 | |

Total revenue | | | | | $ | 10,329 | | | $ | 11,849 | | | $ | 20,976 | | | $ | 23,486 | |

Revenue by product category | | | | | | | | | | | | | | | | | | | |

Domestic: | | | | | | | | | | | | | | | | | | | |

Computing and Mobile Phones | | | | | $ | 3,964 | | | $ | 4,765 | | | $ | 8,249 | | | $ | 9,558 | |

Consumer Electronics | | | | | | 2,845 | | | | 3,380 | | | | 5,741 | | | | 6,618 | |

Appliances | | | | | | 1,657 | | | | 1,688 | | | | 3,247 | | | | 3,237 | |

Entertainment | | | | | | 508 | | | | 560 | | | | 1,081 | | | | 1,228 | |

Services | | | | | | 516 | | | | 570 | | | | 1,005 | | | | 1,126 | |

Other | | | | | | 79 | | | | 48 | | | | 140 | | | | 85 | |

Total Domestic revenue | | | | | $ | 9,569 | | | $ | 11,011 | | | $ | 19,463 | | | $ | 21,852 | |

International: | | | | | | | | | | | | | | | | | | | |

Computing and Mobile Phones | | | | | $ | 327 | | | $ | 373 | | | $ | 671 | | | $ | 767 | |

Consumer Electronics | | | | | | 223 | | | | 250 | | | | 436 | | | | 467 | |

Appliances | | | | | | 104 | | | | 103 | | | | 175 | | | | 173 | |

Entertainment | | | | | | 51 | | | | 57 | | | | 108 | | | | 122 | |

Services | | | | | | 37 | | | | 40 | | | | 91 | | | | 75 | |

Other | | | | | | 18 | | | | 15 | | | | 32 | | | | 30 | |

Total International revenue | | | | | $ | 760 | | | $ | 838 | | | $ | 1,513 | | | $ | 1,634 | |

Operating income by reportable segment and the reconciliation to consolidated earnings before income tax expense and equity in income (loss) of affiliates was as follows ($ in millions):

| | | | | | | | | | | | | | | | | | | |

| | | | | Three Months Ended | | Six Months Ended |

| | | | | July 30, 2022 | | July 31, 2021 | | July 30, 2022 | | July 31, 2021 |

Domestic | | | | | $ | 343 | | | $ | 757 | | | $ | 772 | | | $ | 1,491 | |

International | | | | | | 28 | | | | 40 | | | | 61 | | | | 75 | |

Total operating income | | | | | | 371 | | | | 797 | | | | 833 | | | | 1,566 | |

Other income (expense): | | | | | | | | | | | | | | | | | | | |

Investment income (loss) and other | | | | 3 | | | | 3 | | | | (2) | | | | 6 | |

Interest expense | | | | | | (7) | | | | (6) | | | | (13) | | | | (12) | |

Earnings before income tax expense and equity in income (loss) of affiliates | $ | 367 | | | $ | 794 | | | $ | 818 | | | $ | 1,560 | |

Assets by reportable segment were as follows ($ in millions):

| | | | | | | | | | | | | | | |

| | | | | July 30, 2022 | | January 29, 2022 | | July 31, 2021 |

Domestic | | | | | $ | 14,272 | | | $ | 16,016 | | | $ | 17,296 | |

International | | | | | | 1,147 | | | | 1,488 | | | | 1,283 | |

Total assets | | | | | $ | 15,419 | | | $ | 17,504 | | | $ | 18,579 | |

Item 2.Management's Discussion and Analysis of Financial Condition and Results of Operations

Unless the context otherwise requires, the use of the terms “Best Buy,” “we,” “us” and “our” refers to Best Buy Co., Inc. and its consolidated subsidiaries. Any references to our website addresses do not constitute incorporation by reference of the information contained on the websites.

Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is intended to provide a reader of our financial statements with a narrative from the perspective of our management on our financial condition, results of operations, liquidity and certain other factors that may affect our future results. Unless otherwise noted, transactions and other factors significantly impacting our financial condition, results of operations and liquidity are discussed in order of magnitude. Our MD&A should be read in conjunction with our Annual Report on Form 10-K for the fiscal year ended January 29, 2022 (including the information presented therein under Risk Factors), as well as our other reports on Forms 10-Q and 8-K and other publicly available information. All amounts herein are unaudited.

Overview

We are driven by our purpose to enrich lives through technology and our vision to personalize and humanize technology solutions for every stage of life. We accomplish this by leveraging our combination of technology and a human touch to meet our customers’ everyday needs, whether they come to us online, visit our stores or invite us into their homes.

We have two reportable segments: Domestic and International. The Domestic segment is comprised of our operations in all states, districts and territories of the U.S. and our Best Buy Health business. All of our former stores in Mexico were closed as of the end of the first quarter of fiscal 2022, and our International segment is now comprised of all our operations in Canada.

Our fiscal year ends on the Saturday nearest the end of January. Our business, like that of many retailers, is seasonal. A large proportion of our revenue and earnings is generated in the fiscal fourth quarter, which includes the majority of the holiday shopping season.

Comparable Sales

Throughout this MD&A, we refer to comparable sales. Comparable sales is a metric used by management to evaluate the performance of our existing stores, websites and call centers by measuring the change in net sales for a particular period over the comparable prior-period of equivalent length. Comparable sales includes revenue from stores, websites and call centers operating for at least 14 full months. Revenue from online sales is included in comparable sales and represents sales initiated on a website or app, regardless of whether customers choose to pick up product in store, curbside, at an alternative pick-up location or take delivery direct to their homes. Revenue from acquisitions is included in comparable sales beginning with the first full quarter following the first anniversary of the date of the acquisition. Comparable sales also includes credit card revenue, gift card breakage, commercial sales and sales of merchandise to wholesalers and dealers, as applicable. Revenue from stores closed more than 14 days, including but not limited to relocated, remodeled, expanded and downsized stores, or stores impacted by natural disasters, is excluded from comparable sales until at least 14 full months after reopening. Comparable sales excludes the impact of revenue from discontinued operations and the effect of fluctuations in foreign currency exchange rates (applicable to our International segment only). All periods presented apply this methodology consistently.

On November 2, 2021, we acquired all outstanding shares of Current Health Ltd. (“Current Health”). On November 4, 2021, we acquired all outstanding shares of Two Peaks, LLC d/b/a Yardbird Furniture (“Yardbird”). Consistent with our comparable sales policy, the results of Current Health and Yardbird are excluded from our comparable sales calculation until the first quarter of fiscal 2024.

We believe comparable sales is a meaningful supplemental metric for investors to evaluate revenue performance resulting from growth in existing stores, websites and call centers versus the portion resulting from opening new stores or closing existing stores. The method of calculating comparable sales varies across the retail industry. As a result, our method of calculating comparable sales may not be the same as other retailers’ methods.

Non-GAAP Financial Measures

This MD&A includes financial information prepared in accordance with accounting principles generally accepted in the U.S. (“GAAP”), as well as certain adjusted or non-GAAP financial measures, such as constant currency, non-GAAP operating income, non-GAAP effective tax rate and non-GAAP diluted earnings per share (“EPS”). We believe that non-GAAP financial measures, when reviewed in conjunction with GAAP financial measures, provide additional useful information for evaluating current period performance and assessing future performance. For these reasons, internal management reporting, including budgets and forecasts, and financial targets used for short-term incentives are based on non-GAAP financial measures. Generally, our non-GAAP financial measures include adjustments for items such as restructuring charges, goodwill and intangible impairments, price-fixing settlements, gains and losses on certain investments, intangible asset amortization, certain acquisition-related costs and the tax effect of all such items. In addition, certain other items may be excluded from non-GAAP financial measures when we believe doing so provides greater clarity to management and our investors. We provide reconciliations of the most comparable financial measures presented in accordance with GAAP to presented non-GAAP financial measures that enable investors to understand the adjustments made in arriving at the non-GAAP financial measures and to evaluate performance using the same metrics as management. These non-GAAP financial measures should be considered in addition to, and not superior to or as a substitute for, GAAP financial measures. We strongly encourage investors and shareholders to review our financial statements and publicly-filed reports in their entirety and not to rely on any single financial measure. Non-GAAP financial measures may be calculated differently from similarly titled measures used by other companies, thereby limiting their usefulness for comparative purposes.

In our discussions of the operating results of our consolidated business and our International segment, we sometimes refer to the impact of changes in foreign currency exchange rates or the impact of foreign currency exchange rate fluctuations, which are references to the differences between the foreign currency exchange rates we use to convert the International segment’s operating results from local currencies into U.S. dollars for reporting purposes. We also may use the term “constant currency,” which represents results adjusted to exclude foreign currency impacts. We calculate those impacts as the difference between the current period results translated using the current period currency exchange rates and using the comparable prior period currency exchange rates. We believe the disclosure of revenue changes in constant currency provides useful supplementary information to investors in light of significant fluctuations in currency rates.

Refer to the Non-GAAP Financial Measures section below for detailed reconciliations of items impacting non-GAAP operating income, non-GAAP effective tax rate and non-GAAP diluted EPS in the presented periods.

Business Strategy Update

One of our greatest strengths is our ability to adapt to rapidly changing and challenging environments, whether due to changes in technology, macroeconomic trends or a pandemic. We are currently operating in an unpredictable consumer electronics industry. As previously stated, we assumed the consumer electronics industry would be lower following two years of elevated growth driven by unusually strong demand for technology products and services and fueled partly by stimulus dollars. In addition, we expected to see some impact on our business as customers broadly shifted their spending back into experience areas, such as travel and entertainment. We did not expect these impacts to be compounded by a changing macro environment where consumers are dealing with sustained and record high levels of inflation in some of the most fundamental parts of their daily lives, like food.

While these factors have led to an uneven sales environment, they have not deterred us from continuing to make progress on our initiatives. During the quarter we drove broad customer satisfaction improvements even compared to pre-pandemic levels, particularly in installation and repair. We signed up new Best Buy Totaltech members and increased our delivery speed, delivering almost one-third of customer online orders in one day. We also completed store remodels, opened new outlet stores and began implementing newly signed deals with healthcare companies.

In this environment, we are managing thoughtfully and carefully while still investing in our future. This includes managing our inventory levels and actively assessing further actions to evolve our operating model, manage profitability and iterate on our growth initiatives. We have proactively managed our inventory levels and believe they continue to reflect a healthy and evolving mix of products that enables us to positively react to ever-changing consumer needs. We are planning for lower store payroll expenses and reducing spending in discretionary areas by increasing our rigor around backfilling corporate roles, capital expenditures and travel. During the quarter, we also commenced an enterprise-wide restructuring initiative to better align our spending with critical strategies and operations, as well as to optimize our cost structure.

While we remain confident in our strategy, the current macroeconomic backdrop has changed in ways that we and many others were not expecting. We fundamentally believe that technology is more important than ever in our everyday lives, and as a result of the past few years, consumers have even more technology devices in their homes that will need to be updated, upgraded and supported over time. As our vendor partners continue to innovate and the world becomes increasingly more digital in all aspects, we will be there to uniquely help customers in our stores, online, virtually and directly in their homes.

Results of Operations

Consolidated Results

Selected consolidated financial data was as follows ($ in millions, except per share amounts):

| | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| July 30, 2022 | | July 31, 2021 | | July 30, 2022 | | July 31, 2021 |

Revenue | $ | 10,329 | | | $ | 11,849 | | | $ | 20,976 | | | $ | 23,486 | |

Revenue % change | | (12.8) | % | | | 19.6 | % | | | (10.7) | % | | | 27.1 | % |

Comparable sales % change | | (12.1) | % | | | 19.6 | % | | | (10.1) | % | | | 27.7 | % |

Gross profit | $ | 2,287 | | | $ | 2,810 | | | $ | 4,640 | | | $ | 5,525 | |

Gross profit as a % of revenue(1) | | 22.1 | % | | | 23.7 | % | | | 22.1 | % | | | 23.5 | % |

SG&A | $ | 1,882 | | | $ | 2,009 | | | $ | 3,772 | | | $ | 3,997 | |

SG&A as a % of revenue(1) | | 18.2 | % | | | 17.0 | % | | | 18.0 | % | | | 17.0 | % |

Restructuring charges | $ | 34 | | | $ | 4 | | | $ | 35 | | | $ | (38) | |

Operating income | $ | 371 | | | $ | 797 | | | $ | 833 | | | $ | 1,566 | |

Operating income as a % of revenue | | 3.6 | % | | | 6.7 | % | | | 4.0 | % | | | 6.7 | % |

Net earnings | $ | 306 | | | $ | 734 | | | $ | 647 | | | $ | 1,329 | |

Diluted earnings per share | $ | 1.35 | | | $ | 2.90 | | | $ | 2.85 | | | $ | 5.22 | |

(1)Because retailers vary in how they record costs of operating their supply chain between cost of sales and SG&A, our gross profit rate and SG&A rate may not be comparable to other retailers’ corresponding rates. For additional information regarding costs classified in cost of sales and SG&A, refer to Note 1, Summary of Significant Accounting Policies, of the Notes to Consolidated Financial Statements included in our Annual Report on Form 10-K for the fiscal year ended January 29, 2022.

In the second quarter and first six months of fiscal 2023, we generated $10.3 billion and $21.0 billion in revenue and our comparable sales decreased 12.1% and 10.1%, respectively, as we lapped strong comparable sales last year, which were driven by the timing of government stimulus payments, temporary store closures due to the COVID-19 pandemic and heightened demand for stay-at-home focused purchases. In addition, we faced macroeconomic pressures, including high inflation, that have resulted in overall softness in customer demand within the consumer electronics industry.

Revenue, gross profit rate, SG&A and operating income rate changes in the second quarter and first six months of fiscal 2023 were primarily driven by our Domestic segment. For further discussion of each segment’s rate changes, see Segment Performance Summary, below.

Income Tax Expense

Income tax expense decreased in the second quarter of fiscal 2023 primarily due to a decrease in pre-tax earnings, partially offset by the prior year resolution of certain discrete tax matters. Our effective tax rate (“ETR”) increased to 15.6% in the second quarter of fiscal 2023 compared to 8.0% in the second quarter of fiscal 2022, primarily due to the prior year resolution of certain discrete tax matters, partially offset by the impact of lower pre-tax earnings in the current year.

Income tax expense decreased in the first six months of fiscal 2023 primarily due to a decrease in pre-tax earnings, partially offset by the prior year resolution of certain discrete tax matters. Our ETR increased to 20.5% in the first six months of fiscal 2023 compared to 15.1% in the first six months of fiscal 2022, primarily due to the prior year resolution of certain discrete tax matters, partially offset by the impact of lower pre-tax earnings in the current year. Refer to Note 10, Income Taxes, of the Notes to Condensed Consolidated Financial Statements, included in this Quarterly Report on Form 10-Q for additional information.

Our tax provision for interim periods is determined using an estimate of our annual ETR, adjusted for discrete items, if any, that are taken into account in the relevant period. We update our estimate of the annual ETR each quarter and we make a cumulative adjustment if our estimated tax rate changes. Our quarterly tax provision and our quarterly estimate of our annual ETR are subject to variation due to several factors, including our ability to accurately forecast our pre-tax and taxable income and loss by jurisdiction, tax audit developments, recognition of excess tax benefits or deficiencies related to stock-based compensation, foreign currency gains (losses), changes in laws or regulations, and expenses or losses for which tax benefits are not recognized. Our ETR can be more or less volatile based on the amount of pre-tax earnings. For example, the impact of discrete items and non-deductible losses on our ETR is greater when our pre-tax earnings are lower.

On August 16, 2022, the U.S. enacted the Inflation Reduction Act of 2022, which, among other things, implements a 15% minimum tax on book income of certain large corporations, a 1% excise tax on net stock repurchases and several tax incentives to promote clean energy. Based on our current analysis of the provisions, we do not believe this legislation will have a material impact on our consolidated financial statements.

Segment Performance Summary

Domestic Segment

Selected financial data for the Domestic segment was as follows ($ in millions):

| | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| July 30, 2022 | | July 31, 2021 | | July 30, 2022 | | July 31, 2021 |

Revenue | $ | 9,569 | | | $ | 11,011 | | | $ | 19,463 | | | $ | 21,852 | |

Revenue % change | | (13.1) | % | | | 20.6 | % | | | (10.9) | % | | | 28.2 | % |

Comparable sales % change(1) | | (12.7) | % | | | 20.8 | % | | | (10.6) | % | | | 28.7 | % |

Gross profit | $ | 2,109 | | | $ | 2,606 | | | $ | 4,279 | | | $ | 5,132 | |

Gross profit as a % of revenue | | 22.0 | % | | | 23.7 | % | | | 22.0 | % | | | 23.5 | % |

SG&A | $ | 1,732 | | | $ | 1,849 | | | $ | 3,473 | | | $ | 3,685 | |

SG&A as a % of revenue | | 18.1 | % | | | 16.8 | % | | | 17.8 | % | | | 16.9 | % |

Restructuring charges | $ | 34 | | | $ | - | | | $ | 34 | | | $ | (44) | |

Operating income | $ | 343 | | | $ | 757 | | | $ | 772 | | | $ | 1,491 | |

Operating income as a % of revenue | | 3.6 | % | | | 6.9 | % | | | 4.0 | % | | | 6.8 | % |

Selected Online Revenue Data | | | | | | | | | | | | | | | |

Total online revenue | $ | 2,975 | | | $ | 3,486 | | | $ | 6,034 | | | $ | 7,082 | |

Online revenue as a % of total segment revenue | | 31.0 | % | | | 31.7 | % | | | 31.0 | % | | | 32.4 | % |

Comparable online sales % change(1) | | (14.7) | % | | | (28.1) | % | | | (14.8) | % | | | (13.5) | % |

(1)Online sales are included in the comparable sales calculation.

The decrease in revenue in the second quarter and first six months of fiscal 2023 was primarily driven by comparable sales declines across most of our product categories, particularly computing and home theater. Online revenue of $3.0 billion and $6.0 billion in the second quarter and first six months of fiscal 2023 decreased 14.7% and 14.8% on a comparable basis, respectively. These decreases in revenue were primarily due to the reasons described above.

Domestic segment stores open at the beginning and end of the second quarters of fiscal 2023 and fiscal 2022 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal 2023 | | Fiscal 2022 |

| Total Stores at Beginning of Second Quarter | | Stores Opened | | Stores Closed | | Total Stores at End of Second Quarter | | Total Stores at Beginning of Second Quarter | | Stores Opened | | Stores Closed | | Total Stores at End of Second Quarter |

Best Buy | | 931 | | | | 1 | | | | (2) | | | | 930 | | | | 946 | | | | 2 | | | | (1) | | | | 947 | |

Outlet Centers | | 16 | | | | 2 | | | | - | | | | 18 | | | | 14 | | | | 1 | | | | - | | | | 15 | |

Pacific Sales | | 21 | | | | - | | | | - | | | | 21 | | | | 21 | | | | - | | | | - | | | | 21 | |

Yardbird | | 9 | | | | 4 | | | | - | | | | 13 | | | | - | | | | - | | | | - | | | | - | |

Total | | 977 | | | | 7 | | | | (2) | | | | 982 | | | | 981 | | | | 3 | | | | (1) | | | | 983 | |

We continuously monitor store performance as part of a market-driven, omnichannel strategy. As we approach the expiration of leases, we evaluate various options for each location, including whether a store should remain open. We currently expect to close approximately 15 to 20 Best Buy stores in fiscal 2023 and to increase the number of Outlet Centers to approximately 30 by the end of fiscal 2024.

Domestic segment revenue mix percentages and comparable sales percentage changes by revenue category were as follows:

| | | | | | | | | | | | | | | |

| | Revenue Mix | | | | Comparable Sales | |

| | Three Months Ended | | | | Three Months Ended | |

| July 30, 2022 | | July 31, 2021 | | July 30, 2022 | | July 31, 2021 |

Computing and Mobile Phones | | 42 | % | | | 43 | % | | | (16.6) | % | | | 11.4 | % |

Consumer Electronics | | 30 | % | | | 31 | % | | | (14.7) | % | | | 27.4 | % |

Appliances | | 17 | % | | | 16 | % | | | (1.2) | % | | | 31.1 | % |

Entertainment | | 5 | % | | | 5 | % | | | (9.2) | % | | | 36.4 | % |

Services | | 5 | % | | | 5 | % | | | (8.5) | % | | | 23.6 | % |

Other | | 1 | % | | | - | % | | | 15.6 | % | | | N/A | |

Total | | 100 | % | | | 100 | % | | | (12.7) | % | | | 20.8 | % |

Notable comparable sales changes by revenue category were as follows:

Computing and Mobile Phones: The 16.6% comparable sales decline was driven primarily by computing, tablets and wearables.

Consumer Electronics: The 14.7% comparable sales decline was driven primarily by home theater, headphones and portable speakers.

Appliances: The 1.2% comparable sales decline was driven primarily by large appliances.

Entertainment: The 9.2% comparable sales decline was driven primarily by gaming.

Services: The 8.5% comparable sales decline was driven primarily by the launch of our Totaltech membership offering that includes benefits that were previously stand-alone revenue-generating services, such as warranty.

Our gross profit rates decreased in the second quarter and first six months of fiscal 2023, primarily due to lower services margin rates, which resulted in approximately 100 basis points of margin pressure on a weighted basis in both the second quarter and first six months of fiscal 2023. Our Totaltech membership offering was the primary driver of the lower services margin rates, which is primarily due to incremental customer benefits, and associated costs, compared to our previous Total Tech Support offer. Lower product margin rates, including increased promotions, and higher supply chain costs also contributed to the decreases in our gross profit rates. These decreases were partially offset by higher profit-sharing revenue from our private label and co-branded credit card arrangement in the second quarter and first six months of fiscal 2023.

Our SG&A decreased in the second quarter and first six months of fiscal 2023, primarily due to lower incentive compensation expense of approximately $135 million and $265 million, respectively, compared to prior-year periods. We currently expect to be below required financial thresholds for short-term incentive compensation performance metrics in the current year while lapping short-term incentive payments near maximum levels in the prior year.

The restructuring charges incurred in the second quarter and first six months of fiscal 2023 primarily related to termination benefits related to an enterprise-wide restructuring initiative that commenced in the second quarter of fiscal 2023 to better align our spending with critical strategies and operations, as well as to optimize our cost structure. Refer to Note 2, Restructuring, of the Notes to Condensed Consolidated Financial Statements, included in this Quarterly Report on Form 10-Q for additional information.

Our operating income rates decreased in the second quarter and first six months of fiscal 2023, primarily due to the unfavorable gross profit rates and decreased leverage from lower sales volume on our fixed expenses, which resulted in unfavorable SG&A rates.

International Segment

Selected financial data for the International segment was as follows ($ in millions):

| | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| July 30, 2022 | | July 31, 2021 | | July 30, 2022 | | July 31, 2021 |

Revenue | $ | 760 | | | $ | 838 | | | $ | 1,513 | | | $ | 1,634 | |

Revenue % change | | (9.3) | % | | | 7.2 | % | | | (7.4) | % | | | 14.3 | % |

Comparable sales % change | | (4.2) | % | | | 5.0 | % | | | (2.8) | % | | | 15.0 | % |

Gross profit | $ | 178 | | | $ | 204 | | | $ | 361 | | | $ | 393 | |

Gross profit as a % of revenue | | 23.4 | % | | | 24.3 | % | | | 23.9 | % | | | 24.1 | % |

SG&A | $ | 150 | | | $ | 160 | | | $ | 299 | | | $ | 312 | |

SG&A as a % of revenue | | 19.7 | % | | | 19.1 | % | | | 19.8 | % | | | 19.1 | % |

Restructuring charges | $ | - | | | $ | 4 | | | $ | 1 | | | $ | 6 | |

Operating income | $ | 28 | | | $ | 40 | | | $ | 61 | | | $ | 75 | |

Operating income as a % of revenue | | 3.7 | % | | | 4.8 | % | | | 4.0 | % | | | 4.6 | % |

The decreases in revenue in the second quarter and first six months of fiscal 2023 were primarily driven by comparable sales declines of 4.2% and 2.8%, respectively, in Canada and the negative impact from unfavorable foreign currency exchange rates. The decrease in revenue in the first six months of fiscal 2023 was also driven by lower revenue in Mexico as a result of our decision in fiscal 2021 to exit operations.

International segment stores open at the beginning and end of the second quarters of fiscal 2023 and fiscal 2022 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fiscal 2023 | | Fiscal 2022 |

| Total Stores at Beginning of Second Quarter | | Stores Opened | | Stores Closed | | Total Stores at End of Second Quarter | | Total Stores at Beginning of Second Quarter | | Stores Opened | | Stores Closed | | Total Stores at End of Second Quarter |

Canada | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Best Buy | | 127 | | | | - | | | | - | | | | 127 | | | | 130 | | | | - | | | | (1) | | | | 129 | |

Best Buy Mobile | | 33 | | | | - | | | | - | | | | 33 | | | | 33 | | | | - | | | | - | | | | 33 | |

Total | | 160 | | | | - | | | | - | | | | 160 | | | | 163 | | | | - | | | | (1) | | | | 162 | |

International segment revenue mix percentages and comparable sales percentage changes by revenue category were as follows:

| | | | | | | | | | | | | | | |

| Revenue Mix | | Comparable Sales |

| Three Months Ended | | Three Months Ended |

| July 30, 2022 | | July 31, 2021 | | July 30, 2022 | | July 31, 2021 |

Computing and Mobile Phones | | 43 | % | | | 44 | % | | | (7.6) | % | | | (1.6) | % |

Consumer Electronics | | 29 | % | | | 30 | % | | | (4.8) | % | | | 11.8 | % |

Appliances | | 14 | % | | | 12 | % | | | 6.8 | % | | | 11.6 | % |

Entertainment | | 7 | % | | | 7 | % | | | (5.8) | % | | | 13.7 | % |

Services | | 5 | % | | | 5 | % | | | (0.4) | % | | | 2.2 | % |

Other | | 2 | % | | | 2 | % | | | 12.6 | % | | | 10.8 | % |

Total | | 100 | % | | | 100 | % | | | (4.2) | % | | | 5.0 | % |

Notable comparable sales changes by revenue category were as follows:

Computing and Mobile Phones: The 7.6% comparable sales decline was driven primarily by computing, partially offset by comparable sales growth in mobile phones.

Consumer Electronics: The 4.8% comparable sales decline was driven primarily by home theater.

Appliances: The 6.8% comparable sales growth was driven primarily by small appliances.

Entertainment: The 5.8% comparable sales decline was driven primarily by gaming.

Services: The 0.4% comparable sales decline was driven primarily by warranty services.

Other: The 12.6% comparable sales growth was driven primarily by sporting goods.

The decrease in our gross profit rate in the second quarter of fiscal 2023 was primarily driven by lower product margin rates. In the first six months of fiscal 2023, the decrease in our gross profit rate was primarily driven by lower product margin rates and a $6 million benefit in the first six months of fiscal 2022 associated with more-favorable-than-expected inventory markdowns related to our decision to exit operations in Mexico. The decrease in the first six months of fiscal 2023 was partially offset by a larger percentage of revenue from the higher margin services category in Canada.

Our SG&A decreased in the second quarter and first six months of fiscal 2023, primarily due to lower incentive compensation expense and the favorable impact of foreign currency exchange rates, partially offset by higher store payroll expense.

Our operating income rates decreased in the second quarter and first six months of fiscal 2023, primarily due to the unfavorable gross profit rates and decreased leverage from lower sales volume on our fixed expenses, which resulted in unfavorable SG&A rates.

Consolidated Non-GAAP Financial Measures

Reconciliations of operating income, effective tax rate and diluted EPS (GAAP financial measures) to non-GAAP operating income, non-GAAP effective tax rate and non-GAAP diluted EPS (non-GAAP financial measures) were as follows ($ in millions, except per share amounts):

| | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| July 30, 2022 | | July 31, 2021 | | July 30, 2022 | | July 31, 2021 |

Operating income | $ | 371 | | | $ | 797 | | | $ | 833 | | | $ | 1,566 | |

% of revenue | | 3.6 | % | | | 6.7 | % | | | 4.0 | % | | | 6.7 | % |

Intangible asset amortization(1) | | 22 | | | | 20 | | | | 44 | | | | 40 | |

Restructuring charges(2) | | 34 | | | | 4 | | | | 35 | | | | (38) | |

Restructuring - inventory markdowns(3) | | - | | | | - | | | | - | | | | (6) | |

Non-GAAP operating income | $ | 427 | | | $ | 821 | | | $ | 912 | | | $ | 1,562 | |

% of revenue | | 4.1 | % | | | 6.9 | % | | | 4.3 | % | | | 6.7 | % |

| | | | | | | | | | | | | | | |

Effective tax rate | | 15.6 | % | | | 8.0 | % | | | 20.5 | % | | | 15.1 | % |

Intangible asset amortization(1) | | 0.4 | % | | | 0.4 | % | | | 0.2 | % | | | 0.3 | % |

Restructuring charges(2) | | 0.7 | % | | | - | % | | | 0.1 | % | | | (0.3) | % |

Non-GAAP effective tax rate | | 16.7 | % | | | 8.4 | % | | | 20.8 | % | | | 15.1 | % |

| | | | | | | | | | | | | | | |

Diluted EPS | $ | 1.35 | | | $ | 2.90 | | | $ | 2.85 | | | $ | 5.22 | |

Intangible asset amortization(1) | | 0.10 | | | | 0.08 | | | | 0.19 | | | | 0.16 | |

Restructuring charges(2) | | 0.15 | | | | 0.02 | | | | 0.15 | | | | (0.15) | |

Restructuring - inventory markdowns(3) | | - | | | | - | | | | - | | | | (0.02) | |

Income tax impact of non-GAAP adjustments(4) | | (0.06) | | | | (0.02) | | | | (0.08) | | | | - | |

Non-GAAP diluted EPS | $ | 1.54 | | | $ | 2.98 | | | $ | 3.11 | | | $ | 5.21 | |

(1)Represents the non-cash amortization of definite-lived intangible assets associated with acquisitions, including customer relationships, tradenames and developed technology assets.

(2)Represents charges primarily related to termination benefits in the Domestic segment for the periods ended July 30, 2022, associated with an enterprise-wide initiative that commenced in the second quarter of fiscal 2023 to better align our spending with critical strategies and operations, as well as to optimize our cost structure. Represents adjustments to previously planned organizational changes and higher-than-expected retention rates in the Domestic segment and charges associated with the exit from operations in Mexico in the International segment for the periods ended July 31, 2021.

(3)Represents inventory markdown adjustments recorded within cost of sales associated with the exit from operations in Mexico.

(4)The non-GAAP adjustments primarily relate to the U.S., the UK and Mexico. As such, the income tax charge is calculated using the statutory tax rate of 24.5% for all U.S. non-GAAP items for all periods presented. There is no income tax charge for the UK and Mexico non-GAAP items, as there was no tax benefit recognized on these expenses in the calculation of GAAP income tax expense.

Our non-GAAP operating income rate decreased in the second quarter and first six months of fiscal 2023, primarily driven by our Domestic segment’s lower gross profit rates and decreased leverage from lower sales volume on our fixed expenses, which resulted in unfavorable SG&A rates.

Our non-GAAP effective tax rate increased in the second quarter and first six months of fiscal 2023, primarily due to the prior year resolution of certain discrete tax matters, partially offset by the impact of lower pre-tax earnings in the current year. Refer to Note 10, Income Taxes, of the Notes to Condensed Consolidated Financial Statements, included in this Quarterly Report on Form 10-Q for additional information.

Our non-GAAP diluted EPS decreased in the second quarter and first six months of fiscal 2023, primarily driven by the decreases in non-GAAP operating income.

Liquidity and Capital Resources

We closely manage our liquidity and capital resources. Our liquidity requirements depend on key variables, including the level of investment required to support our business strategies, the performance of our business, capital expenditures, credit facilities, short-term borrowing arrangements and working capital management. We modify our approach to managing these variables as changes in our operating environment arise. For example, capital expenditures and share repurchases are a component of our cash flow and capital management strategy, which, to a large extent, we can adjust in response to economic and other changes in our business environment. We have a disciplined approach to capital allocation, which focuses on investing in key priorities that support our strategy.

Cash and cash equivalents were as follows ($ in millions):

| | | | | | | | | | | | | | | | |

| | | | | | July 30, 2022 | | January 29, 2022 | | July 31, 2021 |

Cash and cash equivalents | | | | | | $ | 840 | | | $ | 2,936 | | | $ | 4,340 | |

The decrease in cash and cash equivalents from January 29, 2022, was primarily due to lower inventory turnover and the timing and volume of inventory purchases and payments, higher incentive compensation payments in fiscal 2023 as a result of strong fiscal 2022 results, share repurchases, capital expenditures and dividend payments, partially offset by earnings.

The decrease in cash and cash equivalents from July 31, 2021, was primarily due to share repurchases, lower inventory turnover and the timing and volume of inventory purchases and payments, capital expenditures, dividend payments and acquisitions, partially offset by earnings.

Cash Flows

Cash flows were as follows ($ in millions):

| | | | | | | | | | | | | | | |

| | | | | | | | | Six Months Ended |

| | | | | | | | | July 30, 2022 | | July 31, 2021 |

Total cash provided by (used in): | | | | | | | | | | | | | | | |

Operating activities | | | | | | | | | $ | (709) | | | $ | 864 | |

Investing activities | | | | | | | | | | (484) | | | | (358) | |

Financing activities | | | | | | | | | | (861) | | | | (1,662) | |

Effect of exchange rate changes on cash | | | | | | | | | | 1 | | | | 5 | |

Decrease in cash, cash equivalents and restricted cash | | | | | | | $ | (2,053) | | | $ | (1,151) | |

Operating Activities

The increase in cash used in operating activities in the first six months of fiscal 2023 was primarily driven by lower earnings in the current year period, lower inventory turnover and the timing and volume of inventory purchases and payments, which resulted in a higher proportion of inventory purchases having been paid for compared to the first six months of fiscal 2022. The increase in cash used in operating activities was also due to higher incentive compensation payments in the first six months of fiscal 2023 as a result of strong fiscal 2022 results.

Investing Activities

The increase in cash used in investing activities in the first six months of fiscal 2023 was primarily driven by increased capital spending for initiatives to support our business.

Financing Activities

The decrease in cash used in financing activities in the first six months of fiscal 2023 was primarily driven by lower share repurchases.

Sources of Liquidity

Funds generated by operating activities, available cash and cash equivalents, our credit facilities and other debt arrangements are our most significant sources of liquidity. We believe our sources of liquidity will be sufficient to fund operations and anticipated capital expenditures, share repurchases, dividends and strategic initiatives, including business combinations. However, in the event our liquidity is insufficient, we may be required to limit our spending. There can be no assurance that we will continue to generate cash flows at or above current levels or that we will be able to maintain our ability to borrow under our existing credit facilities or obtain additional financing, if necessary, on favorable terms.

We have a $1.25 billion, five year senior unsecured revolving credit facility agreement (the “Five-Year Facility Agreement”) with a syndicate of banks. The Five-Year Facility Agreement permits borrowings of up to $1.25 billion and expires in May 2026. There were no borrowings outstanding under the Five-Year Facility Agreement as of July 30, 2022, January 29, 2022, or July 31, 2021.

Our credit ratings and outlook as of September 6, 2022, remained unchanged from those disclosed in our Annual Report on Form 10-K for the fiscal year ended January 29, 2022, and are summarized below.

| | | | | | | | | | | |

Rating Agency | | | | | Rating | | Outlook |

Standard & Poor's | | | | | | BBB+ | | | | Stable | |

Moody's | | | | | A3 | | Stable |

Credit rating agencies review their ratings periodically, and, therefore, the credit rating assigned to us by each agency may be subject to revision at any time. Factors that can affect our credit ratings include changes in our operating performance, the economic environment, conditions in the retail and consumer electronics industries, our financial position and changes in our business strategy. If changes in our credit ratings were to occur, they could impact, among other things, interest costs for certain of our credit facilities, our future borrowing costs, access to capital markets, vendor financing terms and future new-store leasing costs.

Restricted Cash

Our liquidity is also affected by restricted cash balances that are primarily restricted to cover product protection plans provided under our Totaltech membership offering and self-insurance liabilities. Restricted cash, which is included in Other current assets on our Condensed Consolidated Balance Sheets, was $312 million, $269 million and $134 million at July 30, 2022, January 29, 2022, and July 31, 2021, respectively. The increases in restricted cash from January 29, 2022, and July 31, 2021, were primarily due to the national launch of our Totaltech membership offering in October 2021 and growth in the membership base, partially offset by a decrease in restricted cash for self-insurance liabilities.

Debt and Capital

As of July 30, 2022, we had $500 million principal amount of notes due October 1, 2028, and $650 million principal amount of notes due October 1, 2030. Refer to Note 6, Debt, of the Notes to Condensed Consolidated Financial Statements, included in this Quarterly Report on Form 10-Q, and Note 8, Debt, of the Notes to Consolidated Financial Statements included in our Annual Report on Form 10-K for the fiscal year ended January 29, 2022, for additional information about our outstanding debt.

Share Repurchases and Dividends

We repurchase our common stock and pay dividends pursuant to programs approved by our Board of Directors (“Board”). The payment of cash dividends is also subject to customary legal and contractual restrictions. Our long-term capital allocation strategy is to first fund operations and investments in growth and then return excess cash over time to shareholders through dividends and share repurchases while maintaining investment-grade credit metrics.

On February 28, 2022, our Board approved a new $5.0 billion share repurchase program, which replaced the $5.0 billion share repurchase program authorized on February 16, 2021. There is no expiration date governing the period over which we can repurchase shares under this authorization. Share repurchases were paused during the second quarter of fiscal 2023.

Share repurchase and dividend activity was as follows ($ and shares in millions, except per share amounts):

| | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| July 30, 2022 | | July 31, 2021 | | July 30, 2022 | | July 31, 2021 |

Total cost of shares repurchased | $ | 10 | | | $ | 416 | | | $ | 452 | | | $ | 1,331 | |

Average price per share | $ | 83.71 | | | $ | 112.75 | | | $ | 96.83 | | | $ | 109.92 | |

Number of shares repurchased | | 0.1 | | | | 3.7 | | | | 4.6 | | | | 12.1 | |

Regular quarterly cash dividend per share | $ | 0.88 | | | $ | 0.70 | | | $ | 1.76 | | | $ | 1.40 | |

Cash dividends declared and paid | $ | 198 | | | $ | 175 | | | $ | 397 | | | $ | 350 | |

The total cost of shares repurchased decreased in the second quarter and first six months of fiscal 2023, primarily due to decreases in the volume of repurchases. Cash dividends declared and paid increased in the second quarter and first six months of fiscal 2023, primarily due to increases in the regular quarterly cash dividend per share.

Other Financial Measures

Our current ratio, calculated as current assets divided by current liabilities, was 1.0 as of July 30, 2022, and January 29, 2022, and 1.2 as of July 31, 2021. The decrease from July 31, 2021, was primarily driven by lower cash and cash equivalents.

Our debt to earnings ratio, calculated as total debt (including current portion) divided by net earnings over the trailing twelve months increased to 0.7 as of July 30, 2022, compared to 0.5 as of January 29, 2022, and July 31, 2021, primarily due to lower net earnings.

Off-Balance-Sheet Arrangements and Contractual Obligations

Our liquidity is not dependent on the use of off-balance-sheet financing arrangements other than in connection with our $1.25 billion in undrawn capacity on our Five-Year Facility Agreement as of July 30, 2022, which, if drawn upon, would be included in either short-term or long-term debt on our Condensed Consolidated Balance Sheets.

There has been no material change in our contractual obligations other than in the ordinary course of business since the end of fiscal 2022. See our Annual Report on Form 10-K for the fiscal year ended January 29, 2022, for additional information regarding our off-balance-sheet arrangements and contractual obligations.

Significant Accounting Policies and Estimates

We describe our significant accounting policies in Note 1, Summary of Significant Accounting Policies, of the Notes to Consolidated Financial Statements, and our critical accounting estimates in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, in our Annual Report on Form 10-K for the fiscal year ended January 29, 2022. There have been no significant changes in our significant accounting policies or critical accounting estimates since the end of fiscal 2022.

New Accounting Pronouncements

We do not expect any recently issued accounting pronouncements to have a material effect on our financial statements.

Safe Harbor Statement Under the Private Securities Litigation Reform Act

Section 27A of the Securities Act of 1933, as amended (“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (“Exchange Act”), provide a “safe harbor” for forward-looking statements to encourage companies to provide prospective information about their companies. With the exception of historical information, the matters discussed in this Quarterly Report on Form 10-Q are forward-looking statements and may be identified by the use of words such as “anticipate,” “assume,” “believe,” “estimate,” “expect,” “guidance,” “intend,” “outlook,” “plan,” “project” and other words and terms of similar meaning. Such statements reflect our current views and estimates with respect to future market conditions, company performance and financial results, operational investments, business prospects, new strategies, the competitive environment and other events. These statements are subject to certain risks and uncertainties that could cause actual results to differ materially from the potential results discussed in such forward-looking statements. Readers should review Item 1A, Risk Factors, of our Annual Report on Form 10-K for the fiscal year ended January 29, 2022, for a description of important factors that could cause our actual results to differ materially from those contemplated by the forward-looking statements made in this Quarterly Report on Form 10-Q. Among the factors that could cause actual results and outcomes to differ materially from those contained in such forward-looking statements are the following: levels of consumer confidence; macroeconomic pressures in the markets in which we operate (including but not limited to the effects of COVID-19; increased inflation rates; increased levels of inventory loss due to organized crime, petty theft or otherwise, fluctuations in housing prices, energy markets, and jobless rates and those related to the conflict in Ukraine); supply chain issues; any material disruption in our relationship with or the services of third-party vendors, risks related to our exclusive brand products and risks associated with vendors that source products outside of the U.S.; the duration and scope of the COVID-19 pandemic and its resurgences and the impact on demand for our products and services; catastrophic events, health crises and pandemics; susceptibility of our products to technological advancements, product life cycles and launches; conditions in the industries and categories in which we operate; changes in consumer preferences, spending and debt; competition (including from multi-channel retailers, e-commerce business, technology service providers, traditional store-based retailers, vendors and mobile network carriers); our ability to attract and retain qualified employees; changes in market compensation rates; our expansion strategies; our focus on services as a strategic priority; our reliance on key vendors and mobile network carriers (including product availability); our ability to maintain positive brand perception and recognition; our company transformation; our mix of products and services; our ability to effectively manage strategic ventures, alliances or acquisitions; our ability to effectively manage our real estate portfolio; trade restrictions or changes in the costs of imports (including existing or new tariffs or duties and changes in the amount of any such tariffs or duties); our reliance on our information technology systems; our dependence on internet and telecommunications access and capabilities; our ability to prevent or effectively respond to a cyber-attack, privacy or security breach; product safety and quality concerns; changes to labor or employment laws or regulations; risks arising from statutory, regulatory and legal developments (including tax statutes and regulations); risks arising from our international activities (including those related to the conflict in Ukraine); failure to effectively manage our costs; our dependence on cash flows and net earnings generated during the fourth fiscal quarter; pricing investments and promotional activity; economic or regulatory developments that might affect our ability to provide attractive promotional financing; constraints in the capital markets; changes to our vendor credit terms; changes in our credit ratings; and general economic uncertainty in key global markets and worsening of global economic conditions or low levels of economic growth. We caution that the foregoing list of important factors is not complete. Any forward-looking statements speak only as of the date they are made and we assume no obligation to update any forward-looking statement that we may make.

Item 3.Quantitative and Qualitative Disclosures About Market Risk

As disclosed in our Annual Report on Form 10-K for the fiscal year ended January 29, 2022, in addition to the risks inherent in our operations, we are exposed to certain market risks.

Interest Rate Risk

We are exposed to changes in short-term market interest rates and these changes in rates will impact our net interest expense. Our cash, cash equivalents and restricted cash generate interest income that will vary based on changes in short-term interest rates. In addition, we have swapped a portion of our fixed-rate debt to floating rate such that the interest expense on this debt will vary with short-term interest rates. Refer to Note 1, Summary of Significant Accounting Policies, of the Notes to Consolidated Financial Statements included in our Annual Report on Form 10-K for the fiscal year ended January 29, 2022, for further information regarding our interest rate swaps.

As of July 30, 2022, we had $1.15 billion of cash, cash equivalents and restricted cash and $0.5 billion of debt that has been swapped to floating rate, and therefore the net balance exposed to interest rate changes was $0.65 billion. As of July 30, 2022, a 50-basis point increase in short-term interest rates would have led to an estimated $3 million reduction in net interest expense, and conversely a 50-basis point decrease in short-term interest rates would have led to an estimated $3 million increase in net interest expense.

Foreign Currency Exchange Rate Risk

We have market risk arising from changes in foreign currency exchange rates related to operations in our International segment. Refer to Note 1, Summary of Significant Accounting Policies, of the Notes to Consolidated Financial Statements included in our Annual Report on Form 10-K for the fiscal year ended January 29, 2022, for additional information regarding these instruments.

In the second quarter and first six months of fiscal 2023, foreign currency exchange rate fluctuations were primarily driven by the strength of the U.S. dollar compared to the Canadian dollar compared to the prior-year period, which had a negative overall impact on our revenue as this foreign currency revenue translated into less U.S. dollars. We estimate that foreign currency exchange rate fluctuations had an unfavorable impact on our revenue of approximately $35 million and $40 million in the second quarter and first six months of fiscal 2023, respectively. The impact of foreign exchange rate fluctuations on our net earnings in the second quarter and first six months of fiscal 2023 was not significant.

Item 4.Controls and Procedures

We maintain disclosure controls and procedures that are designed to ensure that information required to be disclosed in the reports we file or submit under the Exchange Act is recorded, processed, summarized and reported within the time periods specified in the U.S. Securities and Exchange Commission’s (“SEC”) rules and forms, and that such information is accumulated and communicated to our management, including our Chief Executive Officer (principal executive officer) and Chief Financial Officer (principal financial officer), to allow timely decisions regarding required disclosure. We have established a Disclosure Committee, consisting of certain members of management, to assist in this evaluation. The Disclosure Committee meets on a regular quarterly basis and more often if necessary.

Our management, including our Chief Executive Officer and Chief Financial Officer, evaluated the effectiveness of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) promulgated under the Exchange Act), at July 30, 2022. Based on that evaluation, our Chief Executive Officer and Chief Financial Officer concluded that, at July 30, 2022, our disclosure controls and procedures were effective.

There were no changes in internal control over financial reporting during the fiscal quarter ended July 30, 2022, that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

PART II — OTHER INFORMATION

Item 1.Legal Proceedings

For information about our legal proceedings, see Note 11, Contingencies, of the Notes to Condensed Consolidated Financial Statements, included in this Quarterly Report on Form 10-Q.

Item 2.Unregistered Sales of Equity Securities and Use of Proceeds

(c) Stock Repurchases

On February 28, 2022, our Board approved a new $5.0 billion share repurchase program. For additional information, see Note 9, Repurchase of Common Stock, of the Notes to the Condensed Consolidated Financial Statements included in this Quarterly Report on Form 10-Q.

| | | | | | | | | | | | | | | |

Fiscal Period | | Total Number of

Shares Purchased | | Average Price Paid

per Share | | Total Number of Shares Purchased as Part of Publicly Announced Program | | Approximate Dollar Value of Shares that May Yet Be Purchased Under the Program |

May 1, 2022 through May 28, 2022 | | 119,460 | | | $ | 83.71 | | | | 119,460 | | | $ | 4,674,000,000 | |