Best Buy Rides Web to Lift Sales

May 23 2019 - 4:42PM

Dow Jones News

By Khadeeja Safdar and Aisha Al-Muslim

Best Buy Co.'s profit rose in the latest quarter as growing

online sales of appliances and electronics offset flat sales in its

stores.

The company said Thursday comparable sales increased 1.1% in the

first quarter ended May 4, slower than previous periods but the

ninth consecutive quarter of growth.

Best Buy Chief Executive Hubert Joly said the results reflect

the success of the strategy that was put in place after he joined

in 2012. "We're still in the midst of this multiyear

transformation, but we like where we are and where we're going," he

said on his final earnings call as CEO.

Mr. Joly recently announced he would step aside and hand over

the CEO job to finance chief Corie Barry in June, making her one of

the youngest CEOs of an S&P 500 company and one of the few

women. He will serve as executive chairman and sit in an office

across the hall from her to offer input on matters like strategy

and acquisitions.

Best Buy shares on Thursday fell 3% to $66.80 in early trading.

The stock was down 9% in the previous 12 months.

Results from retailers have been mixed so far this spring.

Amazon.com Inc. and Target Corp. posted strong sales in the recent

quarter, while Kohl's Corp. and J.C. Penney Co. clouded the outlook

for the sector. Many retailers are also bracing for an increase in

tariffs on goods imported from China.

Mr. Joly reassured investors about Best Buy's ability to

mitigate the impact of the tariffs and said the company plans to

press the Trump administration to limit the inclusion of consumer

products on the next list of tariffs on Chinese imports. So far

many electronics, from Apple Inc.'s smartwatches to Lenovo

computers, have been largely spared.

"While we understand the list as proposed is comprised of many

consumer items, including many electronics, we think it's premature

to speculate on the impact of further tariffs," he said.

Best Buy has undergone a striking turnaround in the past five

years, defying the fate that has befallen Circuit City, Sports

Authority, Toys "R" Us and other so-called category killers. When

Mr. Joly joined in 2012, the electronics retailer was struggling

with plunging sales and dwindling profit as consumers browsed at

bricks-and-mortar stores but made purchases on Amazon.com and other

websites.

He matched prices, added services to reduce the company's

reliance on new product releases and used its stores to fulfill

online orders. More recently, he struck a partnership with Amazon

to sell smart TVs and acquired GreatCall Inc., the maker of

senior-focused devices.

On Thursday, Mr. Joly said the company has been expanding

GreatCall and acquired a senior-focused health services company

called Critical Signal Technologies. "Our focus is to enable

seniors to live longer in their homes and help reduce their health

care cost," he said.

He also said the company expanded a program that allows shoppers

to pay for products in installments. The goal is to attract people

who might not otherwise be able to buy computers and other

big-ticket items.

In the latest quarter, growth in appliances, wearables and

tablets offset weak demand in the entertainment category. Best Buy

has been gaining share in some categories because of closures at

Sears Holdings Corp. and other retailers.

Domestic online revenue increased 15% to $1.31 billion due to

larger orders and higher traffic. The company has been investing in

its supply chain to speed up delivery times.

Total revenue was flat at $9.14 billion. Revenue from GreatCall

partially offset the loss of sales from the closure of Best Buy's

smaller mobile-phone stores and a dozen large-format stores in the

past year.

The retailer said profit in the quarter was $265 million, up

from $208 million a year ago. Adjusted earnings were $1.02 a share,

above the 86 cents a share analysts polled by Refinitiv were

looking for.

For fiscal 2020, Best Buy reaffirmed its financial outlook,

which includes the impact of the recent tariffs. The company said

it still expects comparable sales to grow 0.5% to 2.5% for the full

year. The retailer estimates adjusted per-share earnings of $5.45

to $5.65.

Write to Khadeeja Safdar at khadeeja.safdar@wsj.com and Aisha

Al-Muslim at aisha.al-muslim@wsj.com

(END) Dow Jones Newswires

May 23, 2019 16:27 ET (20:27 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

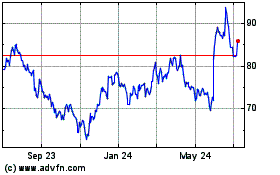

Best Buy (NYSE:BBY)

Historical Stock Chart

From Mar 2024 to Apr 2024

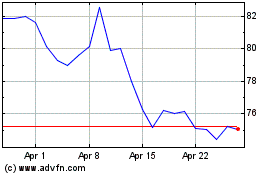

Best Buy (NYSE:BBY)

Historical Stock Chart

From Apr 2023 to Apr 2024