Filed by

Amcor plc

Pursuant to Rule 425 of the Securities Act of 1933 and

deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Berry Global Group, Inc.

Commission File No.: 001-35672

Explanatory Note: The following is a

transcript of the joint investor conference call and webcast held on November 19, 2024.

Amcor

and Berry Merger Call

| Company Participants |

| ● |

Kevin J. Kwilinski, Chief Executive Officer |

| ● |

Michael Casamento, Executive Vice President and Chief Financial Officer |

| ● |

Peter

Konieczny, Chief Executive Officer |

| ● |

Tracey Whitehead, Global Head of Investor Relations |

| Other Participants |

| ● |

Andrew Scott, Analyst, Morgan Stanley |

| ● |

Anthony Pettinari, Analyst, Citigroup |

| ● |

Arun Viswanathan, Analyst, RBC Capital Markets |

| ● |

Daniel Kang, Analyst, CLSA |

| ● |

George Staphos, Analyst, Bank of America |

| ● |

Ghansham Panjabi, Analyst, Baird |

| ● |

Joshua Spector, Analyst, UBS |

| ● |

Keith Chau, Analyst, MST Marquee |

| ● |

Michael Roxland, Analyst, Truist Securities |

| ● |

Philip Ng, Analyst, Jefferies |

Presentation

Operator

Thank you for standing by. My name is

Geene, and I will be your conference operator today. At this time, I would like to welcome everyone to the Amcor-Berry Combination

Investor Call. All lines have been placed on mute to prevent any background noise. After the speakers' remarks, there will be a question-and-answer

session. (Operator Instructions) Thank you.

I would now like to turn the conference

over to Tracey Whitehead, Global Head of Investor Relations at Amcor. You may begin.

Tracey Whitehead

Thank you, operator,

and welcome, everyone. We appreciate you joining today on short notice to discuss our announced combination between Amcor and Berry.

Shortly, I'll turn the call over to management to provide prepared remarks with a question-and-answer session to follow.

Prepared remarks today will address

the combination only. Separately, Berry has posted on its website a presentation and prepared remarks covering their fourth quarter and

fiscal year 2024 earnings results. Our presentation outlining the compelling rationale behind this combination has been posted to the

Investor Relations section of both companies' websites. In addition, a replay of today's call will be available on our respective websites

later on.

Slide 2 provides some important disclaimers.

Statements related to our expectations, plans, estimates, and views regarding future performance and events related to the combination

of Amcor and Berry constitute forward-looking statements. These statements are based on currently available information and are subject

to various risks and uncertainties that could cause actual results to differ materially from the company's present expectations.

Further information regarding these risks and uncertainties is contained in the company's periodic filings with the SEC.

Turning to Slide 3, on the call today

are Peter Konieczny, Amcor's CEO; Kevin Kwilinski, Berry's CEO; Michael Casamento, Amcor's CFO; and Mark Miles, Berry's CFO.

With that, I'll turn the call over

to PK.

Peter Konieczny

Thank you, Tracey. Welcome to everyone

and thank you for joining us to discuss this exciting combination of Amcor and Berry. This is a highly complementary and financially

compelling combination that will deliver significant and immediate value for our collective customers and shareholders.

As outlined on our earnings call last

month, we have carefully been thinking about how to build a better business for the future. Amcor has an excellent opportunity to become

a stronger company by accelerating volume-driven organic growth through an unwavering focus on our customers, on sustainability, and

on our portfolio. The combination announced today delivers on that strategy. It creates a consumer and healthcare packaging industry

leader with a broader product offering in attractive categories and more innovation capabilities to drive more sustainable solutions.

In addition, this combination delivers significant immediate and long-term value for both companies' shareholders.

Before getting into more detail, I

want to start with a broader perspective. This combination will allow us to make a positive and meaningful impact on the lives of customers,

and the environment we live in, in a way no other packaging company can. Referring to Slide 4, a more sustainable future is something

our customers and our partners are striving for. We're here to enable that future, to anticipate their demands, to make it possible.

We're elevating brands, shaping lives, and protecting Earth with every solution we make.

On Slide 5, we're transforming the way

the world thinks about packaging. We're accelerating our innovation, and pushing boundaries, not on the horizon, not tomorrow, but right

now. And that's our commitment, to act today while we work towards an ideal future.

On Slide 6, this is a fundamental shift

in how we think and act. We're bringing unprecedented innovation expertise and investment to solve the most challenging technical problems

we face. We're proving that circular packaging is possible at scale and we're driving demand for recycled materials. Right now, we begin

to accelerate towards a brighter, more sustainable future by bringing these two companies together. We will have unique opportunities

to accelerate the possible. On Slide 7. Elevating brands, shaping live, and protecting Earth. It's an opportunity and responsibility

we embrace and I'm confident we'll deliver value in many forms.

Now moving to Slide 8 and transitioning

to key terms. Berry shareholders will receive 7.25 Amcor shares for each Berry share held at close and will own approximately 37% of

the combined company. The identified synergy opportunity unlocked by combining these two companies is a substantial $650 million, and

annual cash flow increases to more than $3 billion, which Michael will take -- talk more about shortly. With combined revenues of more

than $24 billion and $180 million of R&D spend every year, Amcor will be the go-to partner of choice for sustainable packaging solutions.

Slide 9 outlines the highly attractive

financial profile created through this combination. On a combined basis for the last 12 months, EBITDA margins expand to 18% with $4.3

billion in EBITDA, including full-rate -- run-rate synergies. Relative to Amcor's last 12-month standalone EPS, adjusted EPS accretion

including combined earnings on all synergies is expected to over 35% and we expect to generate more than $3 billion in annual cash flow.

Slide 10 summarizes the highly compelling

rationale for this combination. Amcor will be a better and stronger business with greater capabilities, broader scale in our chosen categories,

and more flexibility. We're adding scale and flexibles, and strengthening healthcare, transforming our containers business, and building

a global closures and dispensing business. This is all in line with our long-term strategy. We will grow faster by bringing together

highly complementary product portfolios with participation in attractive categories and innovation platforms in a range of formats and

materials and we will unlock new commercial opportunities that neither business could access independently.

We will enable customers to transform

their portfolio through technology-driven innovation, and passionate sustainability leadership. And we are creating significant value

that matters for all stakeholders. We will speak to each of these four points further as we move through the presentation.

At this point, I'm going to turn

over to Kevin to discuss how this combination creates a meaningfully better and stronger business. Kevin?

Kevin J. Kwilinski

Thank you, PK. And let me start by also

sharing my enthusiasm for this combination and my confidence in the extraordinary value we are creating.

Starting at Slide 11, which

illustrates the highly complementary nature of our two businesses. The values and culture of Amcor and Berry are incredibly

well-aligned. Safety is our shared first priority always, and we share an unrelenting passion to help our customers reach their

growth and sustainability aspirations. There is little overlap across our product portfolios, and together we are better able to

anticipate and exceed customers' needs and expectations as they evolve. Berry has undergone a significant transformation over the

past year, completing the spin of our HHNF business, enhancing our product mix, optimizing our portfolio, and reducing

cyclicality.

Berry's business has never been more

complementary to Amcor and this is the right time to combine these two companies to deliver more value to our customers and our shareholders.

As a combined business, our focus on optimizing the portfolio and investing in strategically attractive categories and geographies is

further enhanced. We are bringing together scaled material science and R&D platforms with specialized capabilities to create a company

that is positioned to deliver more to our customers today and in the future.

Slide 12 highlights the complementary

leadership positions each company brings. Each has been purposeful in selecting our targeted markets, and we have leadership positions

in the categories and geographies where we operate. Combined, more than 90% of sales will serve consumer and healthcare end-markets,

creating a resilient and highly strategic partner to our customers and for their brands. Our complementary portfolio offiers customers

broader, more complete, and highly differentiated solutions. For example, we will combine various expertise in thin wall thermoforming

with Amcor's innovative Calypso Lidding solutions. And we will offer a complete liquids dispensing solution through the combination

of Amcor's specialty containers utilizing Berry's advanced dispensing technology.

Slide 13 shows the significant scale

and geographic breadth the combined company will have.

With greater reach than any other packaging

company in the world, we will serve more than 20,000 customers in over 140 countries and employ 70,000 coworkers across 400 production

facilities. This enables us to stay closer to customers, offering flexibility across our platform and improving productivity. Our

expanded global footprint further strengthens Amcor's and Berry's existing role as a trusted partner, bringing global capabilities to

local brands and local access to global brands. We will be positioned to serve global customers anywhere they operate with a familiar

approach, deploying the best solutions used in the market while providing continuity and confidence within complex supply chain.

At the same time, we will offer

smaller local customers access to global capabilities, world-class innovation, and procurement efficiencies to support their geographic

expansion. Playing both these unique roles sets us up to be the best choice in packaging partners. Today, we take the next logical step

for our businesses. This is an incredibly exciting opportunity for each of us to leverage our complementary strengths, to do more, and

to grow faster together.

I'll turn over to PK to provide more

detail on how we can accelerate growth and value-creation.

Peter Konieczny

Thanks, Kevin. Continuing on Slide 14,

the combined entity will have a strong and differentiated platform across two strategically attractive consumer and healthcare-focused

categories. Flexibles and Containers and Closures will be large scale global businesses and there are significant leverageable synergies

across both in terms of multi-substrate expertise, technology, innovation and design capabilities, regulatory expertise, and supply-chain

flexibility.

An excellent example of how the offering

from our two companies comes together to provide synergy and enhance our customer value proposition is healthcare. Amcor's largely flexible

format offering will be combined with Berry's containers, closures, dispensing, and delivery systems to provide customers with a

complete product portfolio. In addition, our combined certified facilities worldwide, best-in-class technology, global regulatory and

compliance expertise lay the foundation to build on our $3 billion combined annual sales in this faster-growing high-value category.

Moving to Slide 15. Already, Amcor and

Berry serve a number of categories that have large addressable markets, higher-than-average growth rates, and a requirement for complex

packaging solutions. Think about high barriers to protect against moisture, light, and oxygen, in-package pasteurization and sterilization,

key set closures that meet regulatory requirements and prevent waste. In order to solve complex functionality requirements, we will leverage

our differentiated innovation and technologies, which will deliver more value for our customers and enhance our product mix. We

have scale in each of these attractive categories, which will represent almost $10 billion or approximately 40% of combined sales.

Slide 16 highlights how our combined

footprint unlocks growth through a strengthened emerging markets platform representing $5 billion or more than 20% of combined sales.

The complementary nature of this combination is clearly evident as Amcor is much larger in Asia and Latin America and Berry has greater

presence across Eastern Europe. Together, we have more scale and better geographic balance with more than 100 facilities across emerging

markets. We see a range of clear cross-selling opportunities with one example being the sale of Berry's containers and closure solutions

into Latin America using Amcor's footprint and regional expertise.

Slide 17 showcases the unmatched innovation,

R&D, and technology platform we will create to revolutionize product development for our customers. Together, annual R&D spend

is substantial at $180 million with 10 state-of-the-art innovation centers around the world, more than 1,500 R&D professionals, and

over 7,000 patents, registered designs and trademarks. We're already leveraging AI-enabled design, research, and technologies to enhance

the engineering of new packaging formats through increasing physical performance while delivering presence on the store shelf. And our

Catalyst program forms stronger and more dynamic and productive relationships with customers by directly connecting them with Amcor's

market, materials, process, and packaging experts.

Slide 18 highlights just a few of the

solutions Amcor and Berry offer our customers today, made possible by these strong capabilities. These include automatic dispensers,

high-performance pouches enabling the in-the-bag cooking, reusable and refillable containers, and high-performance pill bottles. We can

also eliminate non-recyclable materials with PVDC-free shrink bags for fresh meat and vinyl-free blister and lidding films. Again, there

are numerous examples of these leverageable high-performance products. All these solutions are recycle-ready and contain post-consumer

recycled material at various levels.

Moving to Slide 19, our R&D reach

will extend beyond our own efforts across a larger combined platform through our corporate venturing partnerships. These initiatives

give us the ability to access new and disruptive ideas in a few carefully selected areas that are highly relevant to our industry and

may give us access to new technologies that will help us solve some of the biggest challenges our customers face.

Which brings me to sustainability

on Slide 20. As I mentioned earlier, sustainability is deeply rooted in our purpose. We recognize the responsibility we have and the

critical role we can play in meeting consumer needs. We share an aspiration and determination to deliver complete circularity and

eliminate carbon emissions. We believe this is possible and achievable faster by combining our efforts. We will be able to free

up resources where there is overlap, allowing us to reallocate financial and human capital to think differently and do more

with sustainability, and do it faster than either company could standalone. This combination provides a unique opportunity to help

shape the agenda for suppliers, policymakers, and regulators to create and support efficient markets and drive circularity and

decarbonization to reduce environmental impact without compromising functionality.

There are a few key areas of focus you

will hear us talk more about in the future as we bring change, starting now. These are on Slide 21. We have both been redesigning our

portfolios to be 100% recycle-ready, reusable, or compostable by 2025. We do this with technological breakthroughs such as our AmSky

Blister System that eliminates PVC to enable compatibility with recycling streams. We will gain significantly increased capabilities

to expand the use of PCR, deliver more lightweighting across our combined portfolio, and increase our successful efforts to lower

the carbon footprint of our packaging. We're convinced this combination creates a stronger and better business with greater innovation

capabilities, the ability to really change the game in terms of sustainability, and more opportunities to accelerate growth.

I'll now turn over to Michael to highlight

the compelling financial rationale. Michael?

Michael Casamento

Thanks, PK, and hello, everyone. Well,

this is an exciting combination and a defining moment for our two companies. The near and long-term financial value we are creating for

all shareholders is game-changing. It's substantial, clear, deliverable, and sustainable.

Slide 22 outlines the significant value

created across several dimensions. One, we've identified $650 million of total synergies, which I'll come back to shortly, and an additional

$280 million of one-time cash benefits from working capital improvements. Two, as PK mentioned, there will be substantial EPS accretion

and returns well above our weighted average cost-of-capital. Three, we expect the combined business to deliver above-market growth rates,

accelerating by at least 100 basis points and we expect margins to expand as we continue to orient the portfolio toward higher-value,

higher-growth categories. We also see opportunities to continue to refine the portfolio, providing the potential for further accelerated

growth. Four, annual cash flow, net of interest and tax and before CapEx is expected to exceed $3 billion after synergies, supporting

our ability to fund reinvestment in the business and quickly bring leverage back below 3 times, maintaining our investment-grade balance

sheet. And five, we are committed to growing the annual dividend from Amcor's current annualized base of $0.51 per share. Finally, this

combination of enhanced revenue and earnings growth and a growing dividend means we will also deliver stronger annual value for our shareholders,

which resets the outcomes under our well-known long-term shareholder value-creation model, and I'll come back to that shortly.

Turning to Slide 23 and a closer look

at the $650 million of earnings synergies we've identified. Both companies have carefully evaluated the synergy potential and we've sought

third-party validation, giving us confidence in delivering the full run-rate. The largest component totaling $530 million relates to

cost synergies, which reflects a combination of procurement benefits, G&A savings, including eliminating duplicated overheads and

operational streamlining. The balance includes approximately $60 million of interest and tax or financial benefits and a further $60

million of EBITDA contribution from revenue synergies.

To date, we have identified several

sources of revenue synergies totaling $280 million by the end of year three, which includes examples like taking Berry's product offering

in Latin America, which was mentioned earlier, and rolling out Amcor's commercial capabilities across a greater scale platform. We expect

to be at the full $650 million run-rate of synergies in the third year post-close with 40% of our identified synergies realized in year

one, a further 40% in year two, and the balance in year three. The $280 million in one-time cash benefits offset an expected $280

million in one-time cash expenses required to achieve our synergy target. We have a strong track record of successfully executing on

large transactions and our teams have significant experience in integrating businesses. This gives us confidence we will execute well

and deliver on these synergy expectations within the timeframe I just mentioned.

This brings me to an important slide.

On Slide 24, this shows how this combination takes the outcomes under our shareholder value-creation model to a new level. As you've

heard through this presentation, new Amcor is much better positioned to serve our customers, which will accelerate our own growth and

increase cash generation to more than $3 billion, net of interest and tax and before capital expenditures. This means we'll have more

capital available to support faster organic growth. Annual CapEx is expected to be in the range of 4-5% of sales and we will continue

to prioritize investment in faster-growing higher-value categories. We will also have more than $1 billion of cash each year to supplement

organic growth through strategic value-accretive M&A and/or share repurchases.

With more cash to deploy and more opportunities

to invest in, the long-term EPS growth outcome under our shareholder value-creation model increases to 10-15%, which compares to Amcor's

historical 15-year average range of 5-10%. In addition, the strong and improved cash flows will continue to support a growing dividend

of Amcor's annualized base of $0.51 per share today, which brings total annual shareholder value-creation to a compelling 13% to 18%.

Finally from me on Slide 25. We believe

this combination will be seen as a truly defining moment within the global packaging industry. We are creating a leading provider of

sustainable consumer and healthcare packaging solutions and significant value for our shareholders.

Thank you. And with that, I'll

turn it back over to PK.

Peter Konieczny

Thanks, Michael. In summary, we're confident

this is a winning combination for all stakeholders.

Amcor will have a better and stronger

business, numerous and substantial opportunities to accelerate growth, significantly greater capacity to invest in technology and innovation

platforms, a sharper and elevated focus on sustainability, and a clear path to create significant value for customers, employees, and

shareholders.

Operator, we're ready to open the call

to questions.

Questions And Answers

Operator

Thank you. The floor is now open for

questions. (Operator Instructions) And your first question comes from the line of Ghansham Panjabi with Baird. Please go ahead.

Q - Ghansham Panjabi

Hey guys, good

morning. Congrats on the transaction. I guess for my one question, PK, if you look at the history of Berry, obviously, the company struggled

with delivering organic volume growth with consistency. How do you expect that to change with the combination? And then related to that,

what exactly is additive from a technology standpoint relative to the current Amcor portfolio? Thank you.

A- Peter Konieczny

Thanks, Ghansham. Ghansham, I'm

always surprised how you make it to the top of the list of the people that ask questions, but you have something figured out there. But

it's great questions that you're asking. Let me take you through the way how I look at the ability of a combined company to grow faster.

Okay? That was the first part of your question.

The first thing that you can take away

is that we feel pretty confident about realizing top-line synergies, growth synergies. We're actually mentioning that. If you compare

what we have done in the past when we made large acquisitions, we would have underwritten them solidly with cost synergies. In this case,

we have a very juicy part of cost synergies, which we feel very confident about. But we're also going out there and we're talking about

growth synergies. And where do those come from? We talked about healthcare and healthcare continues to be a gem, notwithstanding the

fact that right now because of the cycle, there may be some holdbacks. But it is a gem and we have cross-selling opportunities on the

healthcare side of business. We have Amcor that is -- has a strong flexibles exposure in healthcare. Berry has a strong bottles and closures,

dispensers base on the healthcare side. Putting that together creates a more comprehensive portfolio that we can bring to customers.

We talked about other system sales like

lids and seals on Berry's containers, the thin wall containers, particularly. Again, we talk about containers and dispensers. We talk

about the opportunities to bring Amcor's product like flexibles into areas where Berry is well-represented for example, in the food service

space. And we talked about regional opportunities where we can use the footprint that Amcor has well-established like in Latin America

in order to introduce Berry's products. So those are the global synergies, the growth synergies that we see, and we feel pretty good

about those.

The second one is, we talked about portfolio.

The combined companies have a strong exposure to higher-growth, higher-value categories. And on top of that, we have an emerging market

platform. We talked about -- that's significant in the emerging platforms -- emerging markets platform, we have $5 billion of sales combined

in the categories that we like because they're higher-growth, higher margins. We have about $10 billion sales. And we'll make our resources

in terms of people, and also capital available to drive growth in those places. We have lots of that between the two companies. So I

think that we can accelerate growth in those categories, which are well-chosen.

And then -- and the third and last point

that I will say is the platforms. We talked about innovation, we talked about sustainability where we can double-down making smart choices

on how we want to deploy the combined resources more effectively and more efficiently. We have certainly more capacity to invest

in growth. And all of that, you take that together leads to what we call like the shareholder value creation model 2.0. So we're evolving

that just on the back of having a lot more free cash flow available to put back into the business. So -- and I think it's really important

to take the time to go through that because it's one of the important things that we want to drive as we come together.

Second part of your question was about

what Berry brings to Amcor in terms of technologies and products and portfolio. I will say the most important thing is and this is the

way to think about this. This is very complementary. This combination is very complementary in that think about it this way, Amcor has

a very strong global flexibles business, whereas Berry has a scale flexibles business, but smaller and focused on North America and Europe.

So this is for us strengthening of Amcor's strong base in flexible.

Then when you move to Containers and

Closures, it's exactly opposite. Amcor has a regional scale business in the Americas with what we call the Rigid Packaging business.

Berry has a strong global franchise on the containers side, plus brings the scale global closures business to Amcor. And so there again,

we have a situation where we're very complementary. And I think that is -- that is the most important point that I want to make on that

question, it's really the product complementarity, notwithstanding, of course, that there is a lot of technology that goes along with

these products, which obviously is likewise complementary.

Q - Ghansham Panjabi

Thank you.

A - Tracey Whitehead

Next question please, operator.

Operator

Your next question comes from the line

of George Staphos with Bank of America. Please go ahead.

Q - George Staphos

Thanks very much, everyone. Good luck

with the transaction and congratulations on the news. My question is a good segue from what you were talking about with Ghansham. So

if we go back, I guess, five years or so ago, Amcor bought Bemis, there were roughly the similar number of synergies as I recall

in terms of sales. It was adding complementary technology. And certainly, you delivered on the synergies, but if we look at it from just

a pure shareholder standpoint aside from dividend the share price for Amcor has been relatively stable over this time, PK. So what do

you think is different about this transaction relative to that transaction, why it will in fact enable the growth? Because the individual

components that you're adding, I guess, Berry is complementary in some areas relative to Amcor's, nonetheless, the growth rates

themselves in those categories don't change. So why do you think this will be different and why in particular, do you think putting

the two together, the complementary business accelerates the growth? Thank you so much.

A - Peter Konieczny

Thanks, George. You referenced the Bemis

acquisition. Bemis was different. We did Bemis for different reasons also. Bemis bodes complementary but in a different

way. Bemis added to our flexibles business, which we already had a strong franchise in. Here, we have a complementary product portfolio,

which is again different versus the characteristics of Bemis. After Bemis we had a pretty tough market dislocation that we had to

go through. And at the same time, we were focusing very strongly on driving the top-line growth of the company, which is a hard thing

to do with the environment that we faced at the time.

I referenced in the last earnings call

that we feel we're pulling away from the difficult times that we've gone through, particularly calendar '23 was difficult for

us. And we're now seeing sequential volume improvements quarter-on-quarter. And when you think back to the last quarter, we said we saw

4% of volume growth versus prior year, which was -- which ended up being a pretty solid number when you look across the environment that

we've seen with our customers, and also with peers in the space. And now that 4%, I would qualify that to the point that I'll say

that broke out two areas which are a bit of a holdback for us, which were healthcare for the reasons of destocking in North American

beverage because of consumer demand.

So we are in a better spot. Our growth

rates aren't increasing, and we find ourselves better positioned to drive organic growth forward. And what this combination does with

Berry, it just gives us a different platform, and it gives us a combination of capabilities that will allow us to double down on

the growth efforts that we have. And we're very realistic in terms of not changing our assessments on the market and the intrinsic

growth of the market. That's going to be what it is. But we feel we're a lot better positioned to work with the combined forces of both

companies in order to make progress. And I do believe that -- we are feeling comfortable about that. And you should take the fact that

we're coming out there, we're actually committing to growth and top-line synergies. You should take that as a signal that we feel very

good about that.

A-Tracey Whitehead

Thank you. Operator, next question.

Operator

Your next question comes from the line

of Daniel Kang with CLSA. Please go ahead.

Q - Daniel Kang

Good morning, everyone, and congratulations

on the transaction. Just with regards to the potential to refine the portfolio, I realize that it's early days. But can you talk

us through the thought process behind that opportunity, and perhaps the timeframe of this potential? Thank you.

A - Peter Konieczny

Daniel, if I got the question right,

you're talking about the future view of portfolio?

Q - Daniel Kang

Yeah. That's correct.

A - Peter Konieczny

Yeah. Thank you. Thanks for the clarification.

Look, it is early days. It is early days. What I will tell you is and obviously, we have a much bigger platform to work with at this

point in time. And when I was speaking to our last quarter, which was also my first quarter sort of confirmed in the seat as Chief Executive

for Amcor, I said one of the things I want to do is I want to be more proactive in portfolio management of the company. Now we're

sitting here about two months later and I make a transformational acquisition for the company, which may come as a surprise, but obviously,

we have been working on this for a longer period of time. And again, this creates a different platform and it gives us the opportunity

to go across the participation that we have in the combined companies and to just rigorously go through it and assess the attractiveness

of our participations.

We generally want to play to win and

not play to participate. And I felt we can do better in our portfolio within Amcor at least, and now we're going to look at the combined

portfolio to simply focus on those things that are attractive, attractive from a growth perspective, and attractive from a margin perspective.

Now, that's what we're going to do. That's what the process is going to look like. I would just ask for a little more time for us to

take a step back, review, assess, and take well-thought-through and educated decisions on the portfolio. But it will go in both ways.

We have certainly an opportunity to

shed businesses that we think we can find better owners for. And on the other hand, we can also make acquisitions on the back of the

strong cash-flow generation of the company in order to continue to grow the portfolio in those areas where we want to be. So bear with

me, we'll definitely talk more about it as we go forward. But that's exactly what we want to do and fully aligned with what I spelled

out on the last earnings call.

A - Tracey Whitehead

Next question please, operator.

Operator

Your next question comes from the line

of Josh Spector with UBS. Please go ahead.

Q - Joshua Spector

Yeah, hi, good morning. I just wanted

to ask on the synergy side. In Berry's separate release this morning, you guys flagged about $100 million, $150 million of cost-savings

by fiscal '27. Is that baked into the assumed combined cost-savings or is that a separate program that would be additive to what you're

presenting today? Thank you.

A - Peter Konieczny

Yeah. Let me take that first and then

I may ask Kevin to make a couple of comments. Look, both businesses have obviously managed themselves in a way to drive efficiency

and become more profitable going forward. That has been the case in the past and will continue to be the case as we go forward until

closing and then we'll do that as a combined entity under the new Amcor.

And the synergies that we have identified

are outside of that. And so when you've seen the earnings release, certain numbers in terms of cost reductions, those are exclusive of

the synergies that we've identified. Kevin, do you want to comment any further on this?

A - Kevin J . Kwilinski

No. We just -- we've got tremendous

traction in our lean transformation. So we're committing -- putting a marker down on those savings and those are really about improving

the productivity of existing Berry facilities as they stand today. And on the digital side, we've really been focused on using the customer

experience to help accelerate growth. And what we found is we have opportunity to take cost out and improve the customer experience at

the same time through much more effective IT platform. So we are often and running with that and it's just going to make the integration

easier and will be a really positive tailwind for growth.

A- Tracey Whitehead

Thank you. Operator, next question,

please.

Operator

Your next question comes from the line

of Mike Roxland with Truist Securities. Please go ahead.

Q - Michael Roxland

Congrats on the transaction, everybody,

and thank you for taking my question. Just wanted to follow up on the -- whether there should be any regulatory issues that we should

be mindful of. And you highlighted in the deck 50% from North America, I think 30% from Europe. When I look back at what you did

with Bemis, you were -- even though I think there was little overlap at Bemis, you were required to sell I think Bemis's European medical

packaging assets and also some US medical packaging assets. And so just wondering if there are any regulatory concerns that we should

be mindful of and where they will be coming from. Thank you.

A - Peter Konieczny

Yeah, Mike, it's a good question.

We have -- let me start off by saying, I'm not going to speculate here in any shape or form. But what I will tell you is

that, again, Bemis and Berry are completely different in that Berry is a complementary acquisition in terms of the products

that they bring to the -- to Amcor, to the old Amcor. And therefore, the overlap is actually very limited. In Bemis, you had a

flexibles business, we acquired a flexibles business. Amcor was in its core and the backbone of Amcor still is the flexibles

business. Now we're acquiring containers and closures -- we're not acquiring, we're combining -- the acquisition relates to Bemis.

In this case, we're combining ourselves with the containers and the closures business. Again, very little overlap. And therefore,

we're not seeing any particular exposure here to regulatory approvals.

A-Tracey Whitehead

Next question please, operator.

Operator

Your next question comes from the line

of Arun Viswanathan with RBC Capital Markets. Please go ahead.

Q - Arun Viswanathan

Great. Thanks for taking my question.

Congrats on the announcement. I guess I just wanted to go back to your points on market growth there. So it sounds like you expect a

deal to add about 1% to market growth, which the combined entity should grow above. So what is that market growth rate? Would you say

it's kind of in the 0-2% rate? And then as a related note, you noted that '23 was a little bit of a challenging year and you have seen

some improvements recently. So maybe you can just elaborate on what you're seeing there. Do you see customers promoting more -- a little

bit more and you expect greater volume growth or maybe just offer some perspective there? Thanks.

A - Peter Konieczny

Yeah. Thanks, Arun. First question was,

how do we -- how would we see market growth? I would say you're right about there. Right now, it sort of is low-single-digits. You referenced

0-2%. I think we would say the same thing. I'm looking across the table here to my colleagues from Berry and they're all nodding. So

we're aligned on that one. And yes, we have -- we're making a point here and we say through this combination and we definitely feel on

average, we can definitely increase our growth profile by 100 basis points, which if you think about it, I mean, it's not that we're

-- that we're becoming a high-growth company, but we're going to outperform market and we're pretty -- we're feeling pretty confident

about that.

Now the second part of your question

was going back to the recent developments that we've seen and I can speak to Amcor here and maybe Kevin wants to speak a bit about what

they've seen on the Berry side. From an Amcor perspective, and I alluded to that on an earlier question, we have seen sequential volume

improvements pretty much since the beginning of the calendar year. So quarter-by-quarter, we saw volumes improve and it's a pretty broad-based

improvement in terms of -- across the categories and across the regions. You would have expected at the beginning, more support from

emerging markets than the developed markets where we have strongholds in North America and Europe, obviously. But then as we walked through

this calendar year, we saw the developed markets also coming back, which was very encouraging. We saw growth in the developed markets.

While they are still held back by the continued destocking that we saw in the healthcare business and remember that is -- that the biggest

exposure that we have with healthcare is in the developed markets. So very encouraged by the developments that we've seen.

I will -- I've said it before, we're

very grounded and bolted people. I will also say that we do have weaker comps on a year-on-year basis. That's clear. But what we're seeing

is that when we dissect the whole thing, the growth performance into the drivers. We're seeing more green shoots of share gains, which

I would put in the category of us winning business back, but also winning new business and that capability, that muscle is becoming stronger

and stronger as we speak. So I'm pretty encouraged with that and would believe that that continues as we go forward. That's the Amcor

side. Do you want to add anything, Kevin?

A - Kevin J. Kwilinski

Sure. I mean, I'm just sitting

here thinking about it was just four short quarters ago that I joined Berry and we really came in with a thesis about how do we pivot

to growth. And we've done a lot of work on the portfolio and that was to position the company for growth. We've done a lot of work on

the operations, and that was to drive the customer experience for growth and we've done a lot of work on commercial excellence so that

our value selling model is better. Two quarters ago, we delivered positive growth. The quarter we just reported, we delivered positive

growth and the start to the current quarter is very encouraging.

A - Peter Konieczny

Thank you.

A - Tracey Whitehead

Thanks, operator. Next question, please.

Operator

Your next question comes from the line

of Anthony Pettinari with Citi. Please go ahead.

0-Anthony Pettinari

Good morning. With the $325 million

in procurement, I'm wondering if you could talk about the opportunity specifically in resin. I mean, it seems like the combined

company will be the largest global buyer of resin by far if I'm thinking about that the right way. Just wondering if you could talk about,

does this fundamentally transform how you buy resin? Maybe if you can remind us how much the combined company will buy, what kind of

grades? And I'm just wondering if you could kind of talk about that opportunity specifically.

A - Peter Konieczny

I mean, Anthony, let me stay on a higher

level here, but I'll speak to procurement, obviously. It's a big driver of our synergy expectations as we combine the two companies,

and rightly so, I mean, you would expect that to be a big cost synergy driver of the combination. And we do have a significant spend

now between the two combined companies way above $10 billion and we have in that procurement spend, obviously direct material spend,

but we also have indirect material spend. I'd say for Amcor, typically it's the case, the procurement capabilities are a little more

matured on the direct material buy not so much on the indirect material buy. And we see lots of opportunities across the broad

range of our spend. So that's the first thing that I would say.

The second thing that you need to keep

in mind, again, this concept of being complementary comes through even here, even on the direct material side. It just so happens that

Berry is a big buyer in certain grades that Amcor is not such a big buyer of and vice-versa. And that gives us the confidence that we

can continue to leverage the opportunity and value from procurement, which is, by the way, an incredibly important competence in the

packaging industry generally. So if you don't procure well, you probably don't have a chance to be very successful. And this gives us

just an opportunity to double down one more time in partnership with our suppliers. But obviously, we all have the need to drive cost

out of the value chain and this is just one step that we need to continue to focus on.

A- Tracey Whitehead

Next question, please, operator.

Operator

Your next question comes from the line

of Andrew Scott with Morgan Stanley. Please go ahead.

Q-Andrew Scott

Thank you. Good morning, PK. PK, you've

increased the parameters around the value-creation model. If we look at that historically, the lower end of the model has been sort of

focused on buybacks and the high end has been when you've been able to bring acquisitions into the equation. If I look forward, you're

going to have multiple years now where presumably you've got your hands full integrating this acquisition, you'll have leverage towards

the top-end of that sort of 3 times sort of range. And then beyond that, it kind of gets harder to find an acquisition that, A, you'll

be able to do from a regulatory perspective, and, B, that can actually bring enough size to move the needle on what's now going to be

a much bigger earnings space. So I understand the higher cash flows, but how realistic is the top-end of that value-creation model near

term? And then longer-term, how long -- how realistic is it without a step-out into other substrates?

A - Peter Konieczny

Good morning, Andrew. I think it's also

a great question. I'll give you a couple of views here and then maybe ask Michael if he wants to add on. I think the way to think about

value creation going forward on the back of the combination is actually quite obvious. We will definitely be busy over the next couple

of years in order to integrate the business, capture the synergies, create a greater platform, a better platform going forward as we

have discussed. Now that doesn't come as a surprise because we have demonstrated that in many acquisitions that we've done in the past,

transformational acquisitions that were essentially fueled by delivering on the synergies. And we're pretty confident about the synergies,

both in terms of the quantum that we have identified here, but also in terms of our ability to capture the synergies as we go forward.

And we have demonstrated that.

In all honesty, the question that we

sometimes asked ourselves on the prior acquisitions is after the synergies have then been exploited, have we become a better company,

and have we been able to deliver an economic model that continues to drive sustained higher returns for shareholders? And we believe

in this case, we're able to do that, and that was exactly the work that we've done to develop the shareholder value-creation model and

2.0 if you want, which is all fueled by higher cash flow as an input and then translates into the way how we deploy capital between those

three buckets of dividends, of reinvestments into the business, and then going after M&A and/or share buybacks.

I'll hand it over to Michael in a second,

but in terms of the question of what other targets are out there, and we said -- we always said we're in the market, we're exploring

opportunities. I've had the question several times on my earnings calls, is there something out there, you would love to do greater things,

but there's fewer and fewer. And we sit here today and we just made probably the largest acquisition that the company has made in its

history. So there are opportunities out there. And I appreciate and I acknowledge the mere size of the company and potential limitations

to grow within our current space, but I see a lot of adjacencies that we can move into. Substrate is just one and healthcare would be

another one. There's many other opportunities that we will explore. With that said, Michael, do you want to take us through the dynamics

of the (inaudible)

A - Michael Casamento

Exactly. I think just to touch on it, I

mean we're -- you're seeing the annual cash flow now really increase $3 billion plus from this business, which means we can invest more

in capital to drive organic growth. And part of this combination in itself drives faster organic growth, which we've talked about in

the areas where we've got the focus categories with higher margins. So the business itself is going to be in better shape, higher growth,

higher margin, you've reduced the cost base through the synergies. So exiting that period of time, you're in a much better place from

an organic growth delivery, and that capital expenditure is going to be significant, 4% or 5% of sales, it's going to continue to drive

that organic growth, which we can then reinvest in the business.

So the underlying performance of the

business is going to be in that mid-to-high single-digit from an organic standpoint, and then you're left with significant cash flow

to reinvest in M&A and buybacks, which is how you get to that 10% to 15% range. And to PK's point, the marketplace is still fragmented.

I mean, there's opportunities on an M&A standpoint. With the scale of this business as well, we're going to have 400 plants around

the globe. Any M&A you can do, there's more potential to drive synergy from that just because of the scale that we have now and the

footprint and the ability to get benefit from that footprint.

So I think there's going to be significant

opportunities on the M&A side as we move forward.

And there's --

as we've touched on, they'll be in the priority categories areas, that's where we'll invest organically and inorganically. And then the

buybacks become a function of the cash flow and keeping that all predicated on the investment-grade balance sheet. So we feel pretty

good about the new model Amcor 2.0. I think it's going to drive a lot of value for shareholders over a long time.

A-Tracey Whitehead

Thank you. Operator, next question.

Operator

Your next question comes from the line

of Phil Ng with Jefferies. Please go ahead.

Q- Philip Ng

Hey, guys. This question is actually

for Kevin from a Berry shareholder perspective. So Kevin, the root of the question is, how did this deal come together? I mean, I

guess, was this the game plan from the get-go when you guys were spinning out HHNF? And since you guys came forward with a merger, where

these assets shop is -- was Berry shopped as well? I mean, certainly 10% premium is not insignificant and you're highlighting a lot of

synergies and the growth opportunity could be pretty impactful. But why was this the more obvious path versus being a standalone company?

A- Kevin J. Kwilinski

Yeah, I think as a -- I certainly

didn't have this in mind when we worked on improving the portfolio and the optimization. It was about taking the cyclicality out of the

business and pivoting us to growth, improving the overall value of Berry on a standalone basis. When we began to talk, when PK and I

began to talk, what became obvious is that we had an opportunity to grow -- accomplish the work I was trying to do with growth much faster

and we could create a company with the cash flow to invest to drive the circular economy that we've been both pushing for independently

and to invest in the business to grow organically faster through significant R&D and kind of where we were duplicating things, we

could bring those together to really get more from our investment dollars.

So the significance of the shareholder

value-creation for Berry as we look at the differential and how these companies traded on a multiple basis, when we look at the

delivery of the synergies, there was nothing that compared to the speed at which we could accrete value to Berry shareholders, so we

didn't do a shop, but we didn't need to do a shop because this was so compelling.

A - Tracey Whitehead

Thank you. Operator, next question,

please.

Operator

And due to time constraints, this will

be the final question and it does come from the line of Keith Chau with MST. Please go ahead.

Q - Keith Chau

Good morning, everybody. Thanks for

taking my question. Just a follow-up on the revenue or the growth profiles of both companies. At the last quarterly result for Amcor,

you talked about obviously delivering some volume growth in that flexibles business around 3% for the last couple of quarters. In large

part that's been due to, I guess, the non-recurrence of destocking.

And I think you mentioned at the last

result that the underlying demand profile is flat, not slightly soft. Just wondering if you could confirm that, that is still the case.

And maybe, Kevin, is that what you're seeing in the Berry business as well? Is growth a function of the non-recurrence of destocking

or are you saying green shoots as well for the Berry business? Thank you.

A - Peter Konieczny

Thanks, Keith. I'll start and then I'll

hand off to Kevin. Keith, I think our assessment of the underlying sort of consumer demand has not changed. We would believe

that is flat to low-single-digits maybe. And we would not hang our hat on an assumption of that getting better quickly any -- in the

near future. So that's the first thing. We typically dissect our growth performance into four buckets, okay?

The first one is the consumer performance

that I just commented on. The second one is the question, how do our customers do? And we have a certain customer exposure, obviously,

and we have exposure to large customers too as we have exposure to smaller customers. But what we have said and what is still the case

is that our customers are becoming a little more and have become a little more agile to drive volume performance coming forward because

they were the ones that have protected margins, expanded margins even through aggressive price management. And they had to give a little

volume and they are now coming around to say they want to rebalance that a bit and they're driving volume again, and we're benefiting

from that. So our customers are doing better.

The third one is the destocking that

we've seen over the past quarters and we have said that's over. And we're -- we can't wait for it to be over also in the healthcare space,

which has shown signs of improvement. We talked about medical essentially being out of the weeds when it came to destocking and that's

the only category, by the way. Healthcare was the only category that was still showing signs of destocking. Again, medical already came

out of it and pharma, we're still seeing some, but it's improving. And then the final point is, again, our ability to win in the marketplace.

And two quarters ago, I would have said green shoots, now the last quarter, I said it's a little more than that. I'm still

being very careful about it. But I think we're going to see more. I think we're going to see more as we go forward. So that's sort of

the picture on the growth side that I'm seeing and that's how we look at it in Amcor. Kevin, do you want to say something about Berry?

A - Kevin J. Kwilinski

Yeah, kind of three points that I would

make. One is the category where we saw destocking really was healthcare-related and that is the part of the business that was in nonwoven.

So that really went with the spin. But at the time of the spin, we had really seen that destocking out of the picture and we saw growth

already happening in the spin. So that's a positive. The second point I would make is that we have a really good balance of sales of

products that go into restaurants and into grocery. So when we see consumer behavior changing, we tend to have a very resilient business.

We might lose on one side, but we pick it up on the other side. And then the third point I would make is that our win rate and success

has really increased over the last four quarters, at the same time, we've seen market stabilize and start to show some signs of improvement.

So that makes me feel very positive about where we stand in the current quarter, and as we look out through the balance of our fiscal

'25.

A - Peter Konieczny

Definitely much better positioned today

than a couple of quarters ago. I think that was the last question. Look, thank you everyone for the time. The only thing I want to leave

you with is we're very confident that this is a compelling and significant value-creating combination of two companies -- two great companies

for all stakeholders of Amcor and Berry. And we definitely look forward to the opportunity to meet with many of you over the coming months.

And that concludes the call. Thank you very much.

A - Tracey Whitehead

Thank you, operator.

Operator

This concludes today's conference call.

Thank you all for joining. You may now disconnect.

Important Information for Investors

and Shareholders

This communication

does not constitute an offer to sell or the solicitation of an offer to buy or exchange any securities or a solicitation of any vote

or approval in any jurisdiction, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. It

does not constitute a prospectus or prospectus equivalent document. No offering or sale of securities shall be made except by means of

a prospectus meeting the requirements of Section 10 of the US Securities Act of 1933, as amended, and otherwise in accordance with

applicable law.

In connection with

the proposed transaction between Amcor plc (“Amcor”) and Berry Global Group, Inc. (“Berry”), Amcor and Berry

intend to file relevant materials with the Securities and Exchange Commission (the “SEC”), including, among other filings,

an Amcor registration statement on Form S-4 that will include a joint proxy statement of Amcor and Berry that also constitutes a

prospectus of Amcor with respect to

Amcor’s ordinary

shares to be issued in the proposed transaction, and a definitive joint proxy statement/prospectus, which will be mailed to shareholders

of Amcor and Berry (the “Joint Proxy Statement/Prospectus”). Amcor and Berry may also file other documents with the SEC regarding

the proposed transaction. This document is not a substitute for the Joint Proxy Statement/Prospectus or any other document which Amcor

or Berry may file with the SEC. INVESTORS AND SECURITY HOLDERS OF AMCOR AND BERRY ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS

AND ANY OTHER DOCUMENTS THAT WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN

THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED

MATTERS. Investors and security holders will be able to obtain free copies of the registration statement and the Joint Proxy Statement/Prospectus

(when available) and other documents filed with the SEC by Amcor or Berry through the website maintained by the SEC at http://www.sec.gov.

Copies of the documents filed with the SEC by Amcor will be available free of charge on Amcor’s website at amcor.com under the

tab “Investors” and under the heading “Financial Information” and subheading “SEC Filings.” Copies

of the documents filed with the SEC by Berry will be available free of charge on Berry’s website at berryglobal.com under the tab

“Investors” and under the heading “Financials” and subheading “SEC Filings.”

Certain Information Regarding Participants

Amcor, Berry, and

their respective directors and executive officers may be considered participants in the solicitation of proxies from the shareholders

of Amcor and Berry in connection with the proposed transaction. Information about the directors and executive officers of Amcor is set

forth in its Annual Report on Form 10-K for the year ended June 30, 2024, which was filed with the SEC on August 16, 2024

and its proxy statement for its 2024 annual meeting, which was filed with the SEC on September 24, 2024. Information about the directors

and executive officers of Berry is set forth in its Annual Report on Form 10-K for the year ended September 30, 2023, which

was filed with the SEC on November 17, 2023, its proxy statement for its 2024 annual meeting, which was filed with the SEC on January 4,

2024, and its Current Reports on Form 8-K, which were filed with the SEC on February 12, 2024, April 11, 2024, September 6,

2024 and November 4, 2024. To the extent holdings of Amcor’s or Berry’s securities by its directors or executive officers

have changed since the amounts set forth in such filings, such changes have been or will be reflected on Initial Statements of Beneficial

Ownership on Form 3 or Statements of Beneficial Ownership on Form 4 filed with the SEC. Information about the directors and

executive officers of Amcor and Berry, including a description of their direct or indirect interests, by security holdings or otherwise,

and other information regarding the potential participants in the proxy solicitations, which may be different than those of Amcor’s

shareholders and Berry’s stockholders generally, will be contained in the Joint Proxy Statement/Prospectus and other relevant materials

to be filed with the SEC regarding the proposed transaction. You may obtain these documents (when they become available) free of charge

through the website maintained by the SEC at http://www.sec.gov and from Amcor’s or Berry’s website as described above.

Cautionary Statement Regarding Forward-Looking

Statements

This

communication contains certain statements that are “forward-looking statements” within the meaning of Section 27A

of the Securities Act and Section 21E of the Exchange Act. Some of these forward-looking statements can be identified by words

like “anticipate,” “approximately,” “believe,” “continue,” “could,”

“estimate,” “expect,” “forecast,” “intend,” “may,”

“outlook,” “plan,” “potential,” “possible,” “predict,”

“project,” “target,” “seek,” “should,” “will,” or “would,”

the negative of these words, other terms of similar meaning or the use of future dates. Such statements, including projections as to

the anticipated benefits of the proposed transaction, the impact of the proposed transaction on Amcor’s and Berry’s

business and future financial and operating results and prospects, the amount and timing of synergies from the proposed transaction,

the terms and scope of the expected financing in connection with the proposed transaction, the aggregate amount of indebtedness of

the combined company following the closing of the proposed transaction and the closing date for the proposed transaction, are based

on the current estimates, assumptions and projections of the management of Amcor and Berry, and are qualified by the inherent risks

and uncertainties surrounding future expectations generally, all of which are subject to change. Actual results could differ

materially from those currently anticipated due to a number of risks and uncertainties, many of which are beyond Amcor’s and

Berry’s control. None of Amcor, Berry or any of their respective directors, executive officers, or advisors, provide any

representation, assurance or guarantee that the occurrence of the events expressed or implied in any forward-looking statements will

actually occur, or if any of them do occur, what impact they will have on the business, results of operations or financial condition

of Amcor or Berry. Should any risks and uncertainties develop into actual events, these developments could have a material adverse

effect on Amcor’s and Berry’s businesses, the proposed transaction and the ability to successfully complete the proposed

transaction and realize its expected benefits. Risks and uncertainties that could cause results to differ from expectations include,

but are not limited to, the occurrence of any event, change or other circumstance that could give rise to the termination of the

merger agreement; the risk that the conditions to the completion of the proposed transaction (including shareholder and regulatory

approvals) are not satisfied in a timely manner or at all; the risks arising from the integration of the Amcor and Berry businesses;

the risk that the anticipated benefits of the proposed transaction may not be realized when expected or at all; the risk of

unexpected costs or expenses resulting from the proposed transaction; the risk of litigation related to the proposed transaction;

the risks related to disruption of management’s time from ongoing business operations as a result of the proposed transaction;

the risk that the proposed transaction may have an adverse effect on the ability of Amcor and Berry to retain key personnel and

customers; general economic, market and social developments and conditions; the evolving legal, regulatory and tax regimes under

which Amcor and Berry operate; potential business uncertainty, including changes to existing business relationships, during the

pendency of the proposed transaction that could affect Amcor’s and/or Berry’s financial performance; and other risks and

uncertainties identified from time to time in Amcor’s and Berry’s respective filings with the SEC, including the Joint

Proxy Statement/Prospectus to be filed with the SEC in connection with the proposed transaction. While the list of risks presented

here is, and the list of risks presented in the Joint Proxy Statement/Prospectus will be, considered representative, no such list

should be considered to be a complete statement of all potential risks and uncertainties, and other risks may present significant

additional obstacles to the realization of forward-looking statements. Forward-looking statements included herein are made only as

of the date hereof and neither Amcor nor Berry undertakes any obligation to update any forward-looking statements, or any other

information in this communication, as a result of new information, future developments or otherwise, or to correct any inaccuracies

or omissions in them which become apparent. All forward-looking statements in this communication are qualified in their entirety by

this cautionary statement.

Note Regarding Use of Non-GAAP Financial

Measures

In addition to

the financial measures presented in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”), this

communication includes certain non-GAAP financial measures (collectively, the “Non-GAAP Measures”), such as EBIT,

EBITDA, Adjusted EBITDA, free cash flow and return on investment.

These Non-GAAP

Measures should not be used in isolation or as a substitute or alternative to results determined in accordance with U.S. GAAP. In addition,

Amcor’s and Berry’s definitions of these Non-GAAP Measures may not be comparable to similarly titled non-GAAP financial measures

reported by other companies.

It should also

be noted that projected financial information for the combined businesses of Amcor and Berry is based on management’s estimates,

assumptions and projections and has not been prepared in conformance with the applicable accounting requirements of Regulation S-X relating

to pro forma financial information, and the required pro forma adjustments have not been applied and are not reflected therein. These

measures are provided for illustrative purposes, are based on an arithmetic sum of the relevant historical financial measures of Amcor

and Berry and do not reflect pro forma adjustments. None of this information should be considered in isolation from, or as a substitute

for, the historical financial statements of Amcor or Berry. Important risk factors could cause actual future results and other future

events to differ materially from those currently estimated by management, including, but not limited to, the risks that: a condition

to the closing of the proposed transaction may not be satisfied; a regulatory approval that may be required for the proposed transaction

is delayed, is not obtained or is obtained subject to conditions that are not anticipated; Amcor is unable to achieve the synergies and

value creation contemplated by the proposed transaction; Amcor is unable to promptly and effectively integrate Berry’s businesses;

management’s time and attention is diverted on transaction related issues; disruption from the transaction makes it more difficult

to maintain business, contractual and operational relationships; the credit ratings of the combined company declines following the proposed

transaction; legal proceedings are instituted against Amcor, Berry or the combined company; Amcor, Berry or the combined company is unable

to retain key personnel; and the announcement or the consummation of the proposed transaction has a negative effect on the market price

of the capital stock of Amcor and Berry or on Amcor’s and Berry’s operating results.

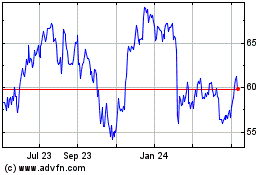

Berry Global (NYSE:BERY)

Historical Stock Chart

From Oct 2024 to Nov 2024

Berry Global (NYSE:BERY)

Historical Stock Chart

From Nov 2023 to Nov 2024