|

Main Post Office, P.O. Box 751 |

www.asyousow.org |

Berkeley, CA 94701

|

BUILDING A SAFE, JUST, AND SUSTAINABLE WORLD SINCE 1992 |

Notice of Exempt Solicitation Pursuant to Rule 14a-103

Name of the Registrant: Berkshire Hathaway Inc. (BRK)

Name of persons relying on exemption: As You Sow

Address of persons relying on exemption: Main Post Office, P.O. Box 751, Berkeley, CA 94704

Written materials are submitted pursuant to Rule 14a-6(g)(1) promulgated

under the Securities Exchange Act of 1934. Submission is not required of this filer under the terms of the Rule, but is made voluntarily

in the interest of public disclosure and consideration of these important issues.

Berkshire Hathaway

Inc (BRK)

Vote Yes: Item #5 – Shareholder Proposal Requesting Report on Effectiveness of Diversity and Inclusion Efforts

Annual

Meeting: April 30, 2022

CONTACT: Meredith Benton, Benton@whistlestop.capital

THE RESOLUTION

Resolved: Shareholders request that Berkshire Hathaway or its

holding companies report to shareholders on the outcomes of their diversity, equity, and inclusion efforts by publishing quantitative

data on workforce composition, and recruitment, retention, and promotion rates of employees by gender, race, and ethnicity. The reporting

should be done at reasonable expense and exclude proprietary information,

Supporting Statement: Quantitative data is sought so investors

can assess, understand, and compare the effectiveness of companies' diversity, equity, and inclusion programs and apply this analysis

to investors' portfolio management and securities' selection process.

SUMMARY

The resolution requests Berkshire Hathaway publish an annual report

assessing the Company’s diversity, equity, and inclusion (DEI) efforts, the process that the Board follows for assessing the effectiveness

of its diversity and inclusion programs, and its assessment of program effectiveness as reflected in any goals, metrics, and trends related

to its promotion, recruitment, and retention of protected classes of employees.

The resolution explains that investors are seeking quantitative, comparable

data to understand the effectiveness of Berkshire Hathaway’s DEI programs. It cites concerns that Berkshire Hathaway is continuing

to be an outlier in its decision to withhold these data sets. It explains that recruitment data is important in understanding if diverse

applicants are being fairly considered, promotion data is important in understanding if diverse talent is being well nurtured at a company,

and retention data is important in assessing a company’s employee satisfaction.

|

2022

Proxy Memo

Berkshire Hathaway | Shareholder Proposal on Diversity

and Inclusion

|

RATIONALE FOR A YES

VOTE

| 1. | Companies benefit from diverse and inclusive workplaces. |

| 2. | Corporate policies that allow harassment and discrimination undermine business success. |

| 3. | Berkshire Hathaway companies have faced diversity and inclusion challenges |

| 4. | Berkshire Hathaway is isolated in its almost total lack of transparency |

DISCUSSION

| 1. | Companies benefit from diverse and inclusive workplaces |

Berkshire Hathaway wrote in last year’s proxy statement:

“Berkshire agrees that a diverse,

equitable and inclusive workforce has been and will continue to be an important aspect of the success and long-term sustainability of

companies.”

Multiple research reports agree with Berkshire Hathaway’s statement.

Research indicates that companies with diverse teams offer better management, have stronger long-term growth prospects, and improved share

value. These studies include:

| ● | BCG found that innovation revenue was 19 percent higher in companies with above-average leadership diversity. In addition, companies

with above-average diversity had EBIT margins nine percentage points higher.1 |

| ● | Credit Suisse, in a study of over 3,000 companies, found that companies with women representing more than 20 percent of managers have

had greater share price increases over the past decade than those companies with lower representations of women in management.2 |

| ● | A McKinsey study found that companies in the top quartile for gender diversity in corporate leadership had a 21 percent likelihood

of outperforming bottom-quartile industry peers on profitability. Similarly, leaders in racial and ethnic diversity were 33 percent more

likely to outperform peers on profitability.3 |

| ● | A 2019 study of the S&P 500 by the Wall Street Journal found that the 20 most diverse companies had an average annual five year

stock return that was 5.8 percent higher than the 20 least-diverse companies.4 |

_____________________________

1 https://www.bcg.com/en-us/publications/2018/how-diverse-leadership-teams-boost-innovation.aspx

2 https://www.americanbanker.com/diversity-&-inclusion-yields-strongest-returns

3 https://www.mckinsey.com/business-functions/organization/our-insights/delivering-through-diversity

4 https://www.wsj.com/articles/the-business-case-for-more-diversity-11572091200

|

2022

Proxy Memo

Berkshire Hathaway | Shareholder Proposal on Diversity

and Inclusion

|

| ● | Stanford Graduate School of Business researchers found that share prices increased when companies reported

better than anticipated gender diversity. This was particularly true when the company had better diversity than the industry leader.5 |

Given these benefits, investors are incentivized to ensure that the

companies they hold are proactive and intentional in addressing their workplace diversity and inclusion programs. Berkshire Hathaway’s

lack of transparent diversity and inclusion metrics undermines investors’ ability to assess and benchmark the company’s corporate

commitment to a diverse and inclusive workplace.

| 2. | Corporate policies that allow harassment and discrimination undermine business success |

Researchers have identified benefits of diverse

and inclusive teams including: access to top talent, better understanding of consumer preferences, a stronger mix of leadership skills,

informed strategy discussions, and improved risk management. Diversity, and the different perspectives it encourages, has also been shown

to encourage more creative and innovative workplace environments.6

In contrast, companies where harassment and discrimination exist may

experience reduced employee morale and productivity, increased absenteeism, challenges in attracting talent and difficulties in retaining

talent. Employees directly experiencing workplace discrimination are also more likely to experience anxiety and depression, potentially

hindering their ability to contribute in the workplace.7 The implications of a non-inclusive workplace go beyond directly impacted

employees. In a Deloitte study, 80 percent of surveyed full-time employees said that inclusion was an important factor in their employer

choice. Seventy-two percent said that they would consider leaving an employer for a more inclusive work environment.8

3. Berkshire Hathaway companies have faced diversity and inclusion

challenges

Berkshire Hathaway employs ~360,000 employees worldwide. Below is a

partial list of allegations, settlements, and lawsuits its companies have been involved in:

| - | Geico: In 2018, one of Geico’s attorneys sued the company over allegations of racial bias, discrimination and retaliation.9 |

| - | Dairy Queen: In January 2020, allegations of age discrimination resulted in the repayment of employee back wages. 10 |

| - | BH Media Group: In 2019, BH Media Group and Berkshire were both accused of failing to address sexual harassment claims and paying

their male advertising sales employees more than their female advertising sales employees. 11 |

_____________________________

5 https://www.bloomberg.com/news/articles/2019-09-17/when-companies-improve-their-diversity-stock-prices-get-a-boost

6 https://images.forbes.com/forbesinsights/StudyPDFs/Innovation_Through_Diversity.pdf

7 https://www.apa.org/news/press/releases/stress/2015/impact

8 https://www2.deloitte.com/us/en/pages/about-deloitte/articles/covering-in-the-workplace.html

9 https://www.propertycasualty360.com/2018/05/07/former-geico-lawyer-claims-racial-bias-in-new-laws/

10 https://fox17.com/news/local/bellevue-dairy-queen-owners-will-pay-back-wages-to-settle-age-discrimination-lawsuit

11 https://news.bloomberglaw.com/litigation/bh-media-berkshire-accused-of-sex-based-pay-bias-harassment?context=article-related

|

2022

Proxy Memo

Berkshire Hathaway | Shareholder Proposal on Diversity

and Inclusion

|

Shareholders are concerned that corporate’s lack of leadership

on workplace issues will leave Berkshire Hathaway and its companies at risk of being left behind in an evolving market.

4. Berkshire Hathaway is isolated in its almost total lack

of transparency

Below are statistics on the data sets Berkshire’s sixty-two subsidiary

companies, as listed on its website, release:

| - | Only seven companies have released any form of workforce demographic data on its employees. (11%) |

| - | Only one company has released any amount of recruitment data on its employees. (2%) |

| - | Only one company has released any level of promotion data on its employees. (2%) |

| - | None of Berkshire’s companies have released retention data on its employees. (0%) |

| - | Only one company has released its EEO-1 report. (2%)

|

Berkshire Hathaway and its companies significantly lag peers in the

disclosure and transparency it provides to investors. All members of the S&P 100, excluding Berkshire Hathaway, provide workplace

DEI data at some level. Eighty-seven of the S&P 100 release, or have committed to release, their consolidated EEO-1 forms, a best-practice

standard for workforce composition disclosure.

The release of workforce composition data is akin to a balance sheet,

detailing diversity at a single point in time. Just as a balance sheet would, by itself, be insufficient to identify the strength of a

company’s financials, so too is the EEO-1, by itself, insufficient in assessing the effectiveness of DEI programs. The Company’s

inclusion data – the hiring, retention and promotion rates of diverse employees – must also be shared for investors to have

a full understanding of the actual experience of Berkshire Hathaway’s employees and its subsidiaries. This data is needed for investors

to assess if a company is masking a toxic workplace culture having poor retention rates with high recruitment statistics, for example.

Below are examples of inclusion factor data that Berkshire Hathaway’s

peers are disclosing, or have committed to disclose, as of March 13, 2022 :

| - | Forty-two percent of the S&P 100 release, or have committed to release, one or more recruitment statistic related to gender. |

| - | Forty-one percent of the S&P 100 release or have committed to release, one or more recruitment statistic related to race/ethnicity.. |

| - | Twenty-three percent of the S&P 100 release or have committed to release, one or more promotion statistic related to gender. |

| - | Twenty-two percent of the S&P 100 release or have committed to release, one or more promotion statistic related to race/ethnicity |

| - | Twenty percent of the S&P 100 release or have committed to release, one or more retention statistic related to gender. |

| - | Thirty-five percent of the S&P 100 release or have committed to release, one or more retention statistic related to race or ethnicity. |

|

2022

Proxy Memo

Berkshire Hathaway | Shareholder Proposal on Diversity

and Inclusion

|

Investor desire for promotion, recruitment, and retention data is a

topic area that has grown at great speed within the last year. Between September 2020 and September 2021, the number of S&P 100 companies

releasing recruitment rate data by gender, race and ethnicity increased by 234 percent, companies releasing retention rate data increased

by 79 percent, and companies releasing promotion rate data increased by 379 percent.12

RESPONSE

TO BERKSHIRE HATHAWAY’S STATEMENT IN OPPOSITION

In its statement in opposition to the resolution, the Board states:

| 1. | “Berkshire's operating companies continue to show their commitment to diversity, equity and inclusion through a number of actions,

including, at certain companies, the creation of senior level positions and/or employee-driven committees to support these efforts at

their respective organizations.” |

Investors have no indication that Berkshire’s companies have

strong human capital management programs as it relates to workplace equity.

| 2. | In addition, in its statement in opposition to the resolution, the Board writes: |

“Berkshire manages its operating

businesses on an unusually decentralized basis and has minimal involvement in these businesses' day-to-day activities.”

This decentralization does not prohibit Berkshire from asking for,

and receiving, key data sets from its companies. Nor does a decentralized structure prohibit Berkshire’s leadership from communicating

expectations and priorities, or sharing resources, to its companies relative to their diversity, equity and inclusion programs.

CONCLUSION

A “Yes” vote is warranted. The Board has released insufficient

information to assure investors that it is providing effective oversight of diversity, equity, and inclusion programs at Berkshire Hathaway

or its holding companies. The resistance to providing investors with metrics supporting the company’s and its subsidiaries’

diversity commitments is concerning.

Vote “Yes” on this Shareholder Proposal

#5.

_____________________________

12 https://www.asyousow.org/our-work/social-justice/workplace-equity/

|

2022

Proxy Memo

Berkshire Hathaway | Shareholder Proposal on Diversity

and Inclusion

|

For questions regarding Proposal #5 at Berkshire Hathaway, please

contact Meredith Benton, As You Sow Workplace Equity Program Manager and Principal at Whistle Stop Capital, benton@whistlestop.capital,

(415) 384-9895.

THE FOREGOING INFORMATION MAY BE DISSEMINATED TO SHAREHOLDERS VIA TELEPHONE,

U.S. MAIL, E-MAIL, CERTAIN WEBSITES AND CERTAIN SOCIAL MEDIA VENUES, AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE OR AS A SOLICITATION

OF AUTHORITY TO VOTE YOUR PROXY. THE COST OF DISSEMINATING THE FOREGOING INFORMATION TO SHAREHOLDERS IS BEING BORNE ENTIRELY BY ONE OR

MORE OF THE CO-FILERS. PROXY CARDS WILL NOT BE ACCEPTED BY ANY CO-FILER. PLEASE DO NOT SEND YOUR PROXY TO ANY CO-FILER. TO VOTE YOUR PROXY,

PLEASE FOLLOW THE INSTRUCTIONS ON YOUR PROXY CARD.

6

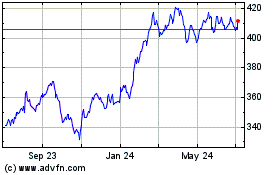

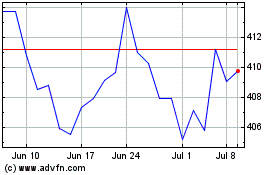

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Apr 2023 to Apr 2024