BellRing Brands Announces Stockholder Approval of Transactions in Connection with the Anticipated Completion of the Spin-off of Post’s Interest in BellRing

March 08 2022 - 4:15PM

BellRing Brands, Inc. (NYSE:BRBR) (“BellRing”) today announced

that, at its stockholders meeting held today, BellRing stockholders

voted to adopt the transaction agreement and plan of merger in

connection with Post Holdings, Inc.’s (“Post”) anticipated spin-off

and distribution of 80.1% of Post’s interest in BellRing to Post

shareholders, including a vote of a majority of the shares held by

BellRing’s stockholders other than Post, BellRing Distribution, LLC

and their respective affiliates, satisfying one of the closing

conditions of the transaction.

As previously announced by Post, the distribution and merger are

expected to occur after market close on March 10, 2022, subject to

the satisfaction or waiver of remaining closing conditions.

Forward-Looking Statements

Certain matters discussed in this press release are

forward-looking statements. These forward-looking statements are

made based on known events and circumstances at the time of

release, and as such, are subject to uncertainty and changes in

circumstances. These forward-looking statements include statements

regarding Post’s proposed distribution of a significant portion of

its interest in BellRing to Post shareholders, including the amount

of New BellRing equity Post intends to distribute, the form of the

distribution and the expected timing of the completion of the

proposed transaction. There is no assurance that the proposed

distribution will be completed as anticipated or at all, and there

are a number of risks, uncertainties and assumptions that could

cause actual results to differ materially from the forward-looking

statements made herein, including risks relating to unanticipated

developments that prevent, delay or negatively impact the proposed

distribution, the ongoing conflict in Ukraine, the rapidly changing

situation related to the COVID-19 pandemic and other financial,

operational and legal risks and uncertainties described in

BellRing’s filings with the Securities and Exchange Commission (the

“SEC”). These forward-looking statements represent BellRing’s

judgment as of the date of this release. BellRing disclaims,

however, any intent or obligation to update these forward-looking

statements.

Additional Information and Where to Find It

This release does not constitute an offer to sell, the

solicitation of an offer to sell or the solicitation of an offer to

buy any securities, nor shall there be any sale of securities in

any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offer of securities

shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as

amended. In connection with the proposed transaction, New BellRing

(as BellRing Distribution, LLC) has filed a registration statement

of New BellRing on Form S-4 (File No. 333-261741) with the SEC,

which contains a prospectus of New BellRing and a definitive proxy

statement of BellRing, dated February 3, 2022, and a registration

statement of New BellRing on Form S-4/S-1 (File No. 333-261873)

with the SEC, which contains a prospectus of New BellRing, dated

February 14, 2022. INVESTORS AND SECURITYHOLDERS ARE URGED TO READ

THE REGISTRATION STATEMENTS/ PROSPECTUSES, PROXY STATEMENT AND ANY

DOCUMENTS INCORPORATED BY REFERENCE THEREIN, ANY AMENDMENTS OR

SUPPLEMENTS TO THESE FILINGS, AND ANY OTHER RELEVANT DOCUMENTS WHEN

THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT NEW BELLRING, BELLRING AND THE PROPOSED

TRANSACTION. The registration statements were declared effective by

the SEC on February 3, 2022, and a definitive proxy

statement/prospectus was mailed on or about February 3, 2022 to

stockholders of BellRing seeking that such stockholders adopt the

definitive agreement for the proposed transaction. Investors and

security holders will be able to obtain these materials (when they

are available) and other documents filed with the SEC free of

charge from the SEC’s website, www.sec.gov, BellRing’s website,

www.bellring.com, or Post’s website, www.postholdings.com.

The transaction and distribution of this release may be

restricted by law in certain jurisdictions and persons who come

into possession of any document or other information referred to

herein should inform themselves about and observe any such

restrictions. Any failure to comply with these restrictions may

constitute a violation of the securities laws of any such

jurisdiction. No offering of securities will be made, directly or

indirectly, in or into any jurisdiction where to do so would be

inconsistent with the laws of such jurisdiction.

About BellRing Brands, Inc.

BellRing Brands, Inc. is a rapidly growing leader in the global

convenient nutrition category offering ready-to-drink shake and

powder protein products. Its primary brands, Premier Protein® and

Dymatize®, appeal to a broad range of consumers and are distributed

across a diverse network of channels including club, food, drug,

mass, eCommerce, specialty and convenience. BellRing’s commitment

to consumers is to strive to make highly effective products that

deliver best-in-class nutritionals and superior taste. For more

information, visit www.bellring.com.

Contact:Investor RelationsJennifer

Meyerjennifer.meyer@postholdings.com(314) 644-7665

Media RelationsLisa Hanlylisa.hanly@postholdings.com(314)

665-3180

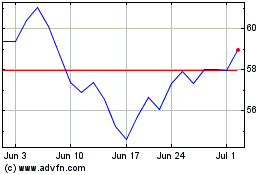

BellRing Brands (NYSE:BRBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

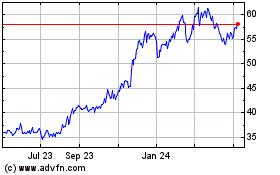

BellRing Brands (NYSE:BRBR)

Historical Stock Chart

From Apr 2023 to Apr 2024