Digital Transformation Building Momentum with

Solid Subscriber Growth for bartleby® Suite of Services

Board of Directors Approves Engagement of

Financial Advisor to Assist in Review of Strategic Opportunities to

Accelerate Execution of Customer-Focused Initiatives and Enhance

Shareholder Value

Barnes & Noble Education, Inc. (NYSE:BNED), a leading

solutions provider for the education industry, today reported sales

and earnings for the second quarter of fiscal year 2020, which

ended on October 26, 2019.

Financial highlights for the second quarter 2020:

- Consolidated second quarter sales of $772.2 million decreased

5.2%, as compared to the prior year period; year to date

consolidated sales of $1,091.9 million decreased 5.2%, as compared

to the prior year period.

- Consolidated second quarter GAAP net income of $35.9 million,

compared to net income of $59.7 million in the prior year period;

year to date GAAP net income of $3.8 million, compared to $21.1

million in the prior year period.

- Consolidated second quarter non-GAAP Adjusted Earnings of $37.8

million, compared to $60.2 million in the prior year period; year

to date non-GAAP Adjusted Earnings of $7.8 million, compared to

$21.6 million in the prior year period.

- Consolidated second quarter non-GAAP Adjusted EBITDA of $74.5

million, compared to $95.5 million in the prior year period; year

to date non-GAAP Adjusted EBITDA of $49.4 million, compared to

$63.1 million in the prior year period.

Operational highlights for the second quarter 2020:

- Gained 100,000 subscribers for the bartleby® suite of services

year to date, including the month of November.

- Continued to enhance bartleby learn™, growing the number of

step-by-step solutions available in the content library to more

than two million.

- Announced new agreement with VitalSource®, part of Ingram

Content Group. Under the agreement, VitalSource’s technology will

power the BNC FirstDay™ inclusive access platform, bringing

together VitalSource’s advanced technology and the unparalleled

campus and publisher relationships of Barnes & Noble College

(BNC).

- Continued growth of FirstDay inclusive access program, with

revenue increasing by 93% year over year.

- Drove new business wins as a result of the Company’s unified

and expanded sales team and dynamic, new go-to-market

strategy.

- Continued improvements in the general merchandise business,

including successfully expanding the Company’s online product

assortment through drop ship capabilities. The Company also made

continued progress on its next generation e-commerce platform,

which is expected to launch in fiscal year 2021.

- Completed additional implementations of BNC Adoption &

Insights Portal, an innovative platform that allows faculty and

academic leadership to research, submit and monitor course material

selections, further driving affordability and student success.

Strategic Review

BNED also announced today that its Board recently approved the

engagement of a financial advisor to assist in a review of

strategic opportunities to accelerate the execution of

customer-focused strategic initiatives and enhance value for BNED

shareholders, including, but not limited to, continued execution of

the Company’s current business plan, new partnerships, joint

ventures and other potential opportunities.

“Our teams continued to execute on our strategic priorities in

the first half of fiscal 2020. We succeeded in scaling our bartleby

suite of services, enhancing and scaling our FirstDay platform,

strengthening our general merchandise business and further growing

our physical and virtual store footprint. Despite the rapidly

changing nature of the industry and the current downward pressure

on our operating results, we have been able to maintain a strong

financial position by being diligent in our allocation of capital

and cost management,” said Michael P. Huseby, Chief Executive

Officer and Chairman, BNED. “Over the last two years, we have made

significant strides in our ongoing efforts to position BNED for the

future by rapidly transforming to digital products, services and

delivery. Consistent with our commitment to enhance value for

shareholders, and in response to a number of unsolicited inquiries,

the BNED Board of Directors has approved the engagement of a

financial advisor to assist with the evaluation of a range of

potential strategic opportunities. This review will help position

BNED to be able to deliver more immediate benefits for the

institutions and students we serve, and allow for the exploration

of all strategic paths to enhance shareholder value.”

Second Quarter 2020 and Year to Date Results Results for

the 13 and 26 weeks of fiscal 2020 and fiscal 2019 are as

follows:

$ in millions

13 and 26 Weeks Selected Data

(unaudited)

13

Weeks Q2 2020

13

Weeks Q2 2019

26

Weeks 2020

26

Weeks 2019

Total Sales

$

772.2

$

814.8

$

1,091.9

$

1,152.3

Net Income

$

35.9

$

59.7

$

3.8

$

21.1

Non-GAAP(1)

Adjusted EBITDA

$

74.5

$

95.5

$

49.4

$

63.1

Adjusted Earnings

$

37.8

$

60.2

$

7.8

$

21.6

(1) These non-GAAP financial measures have

been reconciled in the attached schedules to the most directly

comparable GAAP measures as required under SEC rules regarding the

use of non-GAAP financial measures.

The Company has three reportable segments: Retail, Wholesale and

Digital Student Solutions (DSS). Unallocated shared-service costs,

which include various corporate level expenses and other governance

functions, continue to be presented as Corporate Services. All

material intercompany accounts and transactions have been

eliminated in consolidation.

Retail Segment Results

Retail sales in the second quarter decreased

by $42.1 million, or 5.4%, as compared to the prior year period.

Comparable store sales in the Retail segment decreased 5.9% for the

quarter representing approximately $45.5 million in revenue.

General merchandise sales decreased 0.1% for the quarter, primarily

due to increased promotions.

Retail non-GAAP Adjusted EBITDA for the

quarter decreased by $15.6 million to $62.6 million, as compared to

$78.2 million in the prior year period. The decrease is primarily

due to lower textbook sales, a shift to lower margin digital

products and lower margin rates due to higher markdowns, partially

offset by lower selling and administrative expenses.

Wholesale Segment Results

Wholesale total sales of $40.2 million for

the quarter decreased by $0.6 million, or 1.5%, as compared to

$40.8 million in the prior year period. The decrease is primarily

due to a decrease in supply and a decrease in customer demand,

including the Company’s Retail segment.

Wholesale non-GAAP Adjusted EBITDA for the

quarter was $7.9 million, as compared to $8.9 million in the prior

year period. This decrease was primarily driven by lower sales and

lower gross margins, partially offset by lower selling and

administrative expenses.

DSS Segment Results

DSS sales of $5.2 million for the quarter

increased by $0.3 million, or 5.7%, as compared to $4.9 million in

the prior year period. The increase is primarily due to an increase

in sales of bartleby subscriptions.

DSS non-GAAP Adjusted EBITDA was $0.3 million

for the quarter, as compared to $1.4 million in the prior year

period. The decrease is primarily due to higher content

amortization costs and investments in the development, marketing

and selling of bartleby.

Other

Expenses for Corporate Services, which

includes unallocated shared-service costs, such as various

corporate level expenses and other governance functions, were $5.7

million for the quarter as compared to $6.0 million in the prior

period.

Intercompany gross margin eliminations of

$9.3 million reflected in Adjusted EBITDA, compared to $13.0

million in the prior year period, are lower due to a decrease in

inter-segment sales from Wholesale to Retail.

Outlook

For fiscal year 2020, the Company expects consolidated Adjusted

EBITDA to be between $80 million to $85 million. Capital

expenditures are expected to be in a range of $40 million to $50

million. The Company expects free cash flow to be between $25

million to $35 million, as compared to $39.7 million in fiscal year

2019. The Company defines free cash flow as Adjusted EBITDA less

capital expenditures, cash interest and cash taxes.

Conference Call

A conference call with Barnes & Noble Education, Inc. senior

management will be webcast at 10:00 a.m. Eastern Time on Wednesday,

December 4, 2019 and can be accessed at the Barnes & Noble

Education corporate website at investor.bned.com or

www.bned.com.

Barnes & Noble Education expects to report fiscal 2020 third

quarter results on or about March 3, 2020.

ABOUT BARNES & NOBLE EDUCATION, INC.

Barnes & Noble Education, Inc. (NYSE:BNED) is a

leading solutions provider for the education industry, driving

affordability, access and achievement at hundreds of academic

institutions nationwide and ensuring millions of students are

equipped for success in the classroom and beyond. Through its

family of brands, BNED offers campus retail services and academic

solutions, a digital direct-to-student learning ecosystem,

wholesale capabilities and more. BNED is a company serving all who

work to elevate their lives through education, supporting students,

faculty and institutions as they make tomorrow a better, more

inclusive and smarter world. For more information, visit

www.bned.com.

Forward-Looking Statements

This press release contains certain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995 and information relating to us and our business that are

based on the beliefs of our management as well as assumptions made

by and information currently available to our management. When used

in this communication, the words “anticipate,” “believe,”

“estimate,” “expect,” “intend,” “plan,” “will,” “forecasts,”

“projections,” and similar expressions, as they relate to us or our

management, identify forward-looking statements. Moreover, we

operate in a very competitive and rapidly changing environment. New

risks emerge from time to time. It is not possible for our

management to predict all risks, nor can we assess the impact of

all factors on our business or the extent to which any factor, or

combination of factors, may cause actual results to differ

materially from those contained in any forward-looking statements

we may make. In light of these risks, uncertainties and

assumptions, the future events and trends discussed in this press

release may not occur and actual results could differ materially

and adversely from those anticipated or implied in the

forward-looking statements. Such statements reflect our current

views with respect to future events, the outcome of which is

subject to certain risks, including, among others: general

competitive conditions, including actions our competitors and

content providers may take to grow their businesses; a decline in

college enrollment or decreased funding available for students;

decisions by colleges and universities to outsource their physical

and/or online bookstore operations or change the operation of their

bookstores; implementation of our digital strategy may not result

in the expected growth in our digital sales and/or profitability;

risk that digital sales growth does not exceed the rate of

investment spend; the performance of our online, digital and other

initiatives, integration of and deployment of, additional products

and services including new digital channels, and enhancements to

higher education digital products, and the inability to achieve the

expected cost savings; the risk of price reduction or change in

format of course materials by publishers, which could negatively

impact revenues and margin; the general economic environment and

consumer spending patterns; decreased consumer demand for our

products, low growth or declining sales; the strategic objectives,

successful integration, anticipated synergies, and/or other

expected potential benefits of various acquisitions may not be

fully realized or may take longer than expected; the integration of

the operations of various acquisitions into our own may also

increase the risk of our internal controls being found ineffective;

changes to purchase or rental terms, payment terms, return

policies, the discount or margin on products or other terms with

our suppliers; our ability to successfully implement our strategic

initiatives including our ability to identify, compete for and

execute upon additional acquisitions and strategic investments;

risks associated with operation or performance of MBS Textbook

Exchange, LLC’s point-of-sales systems that are sold to college

bookstore customers; technological changes; risks associated with

counterfeit and piracy of digital and print materials; our

international operations could result in additional risks; our

ability to attract and retain employees; risks associated with data

privacy, information security and intellectual property; trends and

challenges to our business and in the locations in which we have

stores; non-renewal of managed bookstore, physical and/or online

store contracts and higher-than-anticipated store closings;

disruptions to our information technology systems, infrastructure

and data due to computer malware, viruses, hacking and phishing

attacks, resulting in harm to our business and results of

operations; disruption of or interference with third party web

service providers and our own proprietary technology; work

stoppages or increases in labor costs; possible increases in

shipping rates or interruptions in shipping service; product

shortages, including decreases in the used textbook inventory

supply associated with the implementation of publishers’ direct to

student textbook consignment rental programs, as well as risks

associated with merchandise sourced indirectly from outside the

United States; changes in domestic and international laws or

regulations, including U.S. tax reform, changes in tax rates, laws

and regulations, as well as related guidance; enactment of laws or

changes in enforcement practices which may restrict or prohibit our

use of texts, emails, interest based online advertising, recurring

billing or similar marketing and sales activities; the amount of

our indebtedness and ability to comply with covenants applicable to

any future debt financing; our ability to satisfy future capital

and liquidity requirements; our ability to access the credit and

capital markets at the times and in the amounts needed and on

acceptable terms; adverse results from litigation, governmental

investigations, tax-related proceedings, or audits; changes in

accounting standards; and the other risks and uncertainties

detailed in the section titled “Risk Factors” in Part I - Item 1A

in our Annual Report on Form 10-K for the year ended April 27,

2019. Should one or more of these risks or uncertainties

materialize, or should underlying assumptions prove incorrect,

actual results or outcomes may vary materially from those described

as anticipated, believed, estimated, expected, intended or planned.

Subsequent written and oral forward-looking statements attributable

to us or persons acting on our behalf are expressly qualified in

their entirety by the cautionary statements in this paragraph. We

undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise after the date of this press

release.

EXPLANATORY NOTE

We have three reportable segments: Retail, Wholesale and DSS as

follows:

- The Retail Segment operates 1,436 college, university, and K-12

school bookstores, comprised of 772 physical bookstores and 664

virtual bookstores. Our bookstores typically operate under

agreements with the college, university, or K-12 schools to be the

official bookstore and the exclusive seller of course materials and

supplies, including physical and digital products. The majority of

the physical campus bookstores have school-branded e-commerce sites

which we operate and which offer students access to affordable

course materials and affinity products, including emblematic

apparel and gifts. The Retail Segment also offers inclusive access

programs, in which course materials, including e-content, are

offered at a reduced price through a course materials fee, and

delivered to students on or before the first day of class.

Additionally, the Retail Segment offers a suite of digital content

and services to colleges and universities, including a variety of

open educational resource-based courseware.

- The Wholesale Segment is comprised of our wholesale textbook

business and is one of the largest textbook wholesalers in the

country. The Wholesale Segment centrally sources, sells, and

distributes new and used textbooks to approximately 3,500 physical

bookstores (including our Retail Segment's 772 physical bookstores)

and sources and distributes new and used textbooks to our 664

virtual bookstores. Additionally, the Wholesale Segment sells

hardware and a software suite of applications that provides

inventory management and point-of-sale solutions to approximately

400 college bookstores.

- The Digital Student Solutions ("DSS") Segment includes

direct-to-student products and services to assist students to study

more effectively and improve academic performance. The DSS Segment

is comprised of the operations of Student Brands, LLC, a leading

direct-to-student subscription-based writing services business, and

bartleby®, a direct-to-student subscription-based offering

providing textbook solutions, expert questions and answers,

tutoring and test prep services.

Corporate Services represents unallocated shared-service costs

which include corporate level expenses and other governance

functions, including executive functions, such as accounting,

legal, treasury, information technology, and human resources.

All material intercompany accounts and transactions have been

eliminated in consolidation.

BARNES & NOBLE EDUCATION,

INC. AND SUBSIDIARIES

Condensed Consolidated

Statements of Operations

(In thousands, except per

share data)

(Unaudited)

13 weeks ended

26 weeks ended

October 26, 2019

October 27, 2018

October 26, 2019

October 27, 2018

Sales:

Product sales and other

$

718,543

$

756,173

$

1,020,770

$

1,074,018

Rental income

53,685

58,593

71,115

78,232

Total sales

772,228

814,766

1,091,885

1,152,250

Cost of sales: (a)

Product and other cost of sales

553,070

568,971

791,401

827,723

Rental cost of sales

32,208

35,035

41,877

47,157

Total cost of sales

585,278

604,006

833,278

874,880

Gross profit

186,950

210,760

258,607

277,370

Selling and administrative expenses

113,404

115,323

211,095

214,467

Depreciation and amortization expense

15,546

16,421

31,425

32,959

Impairment loss (non-cash) (a)

—

—

433

—

Restructuring and other charges (a)

1,569

—

3,035

—

Transaction costs (a)

—

537

—

537

Operating income

56,431

78,479

12,619

29,407

Interest expense, net

1,446

1,836

3,978

5,358

Income before income taxes

54,985

76,643

8,641

24,049

Income tax expense

19,054

16,946

4,865

2,974

Net income

$

35,931

$

59,697

$

3,776

$

21,075

Income per common share:

Basic

$

0.75

$

1.26

$

0.08

$

0.45

Diluted

$

0.74

$

1.25

$

0.08

$

0.44

Weighted average common shares

outstanding:

Basic

47,853

47,184

47,717

47,050

Diluted

48,758

47,824

48,412

47,689

(a) For additional information, see Note

(a) - (d) in the Non-GAAP disclosure information of this Press

Release.

13 weeks ended

26 weeks ended

October 26, 2019

October 27, 2018

October 26, 2019

October 27, 2018

Percentage of sales:

Sales:

Product sales and other

93.0%

92.8%

93.5%

93.2%

Rental income

7.0%

7.2%

6.5%

6.8%

Total sales

100.0%

100.0%

100.0%

100.0%

Cost of sales:

Product and other cost of sales (a)

77.0%

75.2%

77.5%

77.1%

Rental cost of sales (a)

60.0%

59.8%

58.9%

60.3%

Total cost of sales

75.8%

74.1%

76.3%

75.9%

Gross profit

24.2%

25.9%

23.7%

24.1%

Selling and administrative expenses

14.7%

14.2%

19.3%

18.6%

Depreciation and amortization expense

2.0%

2.0%

2.9%

2.9%

Impairment loss (non-cash)

—%

—%

—%

—%

Restructuring and other charges

0.2%

—%

0.3%

—%

Transaction costs

—%

—%

—%

—%

Operating income

7.3%

9.6%

1.2%

2.6%

Interest expense, net

0.2%

0.2%

0.4%

0.5%

Income before income taxes

7.1%

9.4%

0.8%

2.1%

Income tax expense

2.5%

2.1%

0.4%

0.3%

Net income

4.6%

7.3%

0.4%

1.8%

(a) Represents the percentage these costs

bear to the related sales, instead of total sales.

BARNES & NOBLE EDUCATION,

INC. AND SUBSIDIARIES

Condensed Consolidated Balance

Sheets

(In thousands, except per

share data)

(Unaudited)

October 26, 2019

October 27, 2018

ASSETS

Current assets:

Cash and cash equivalents

$

24,594

$

20,048

Receivables, net

162,538

138,048

Merchandise inventories, net

475,422

505,943

Textbook rental inventories

68,167

70,599

Prepaid expenses and other current

assets

18,494

16,554

Total current assets

749,215

751,192

Property and equipment, net

105,156

112,029

Operating lease right-of-use assets

(a)

289,722

—

Intangible assets, net

184,188

213,886

Goodwill

4,700

53,982

Deferred tax assets, net

8,039

—

Other noncurrent assets

39,235

41,632

Total assets

$

1,380,255

$

1,172,721

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities:

Accounts payable

$

387,704

$

443,319

Accrued liabilities

197,220

170,037

Current operating lease liabilities

(a)

107,721

—

Total current liabilities

692,645

613,356

Long-term deferred taxes, net

—

7,906

Long-term operating lease liabilities

(a)

179,613

—

Other long-term liabilities

50,677

59,419

Total liabilities

922,935

680,681

Commitments and contingencies

—

—

Stockholders' equity:

Preferred stock, $0.01 par value;

authorized, 5,000 shares; issued and outstanding, none

—

—

Common stock, $0.01 par value; authorized,

200,000 shares; issued, 52,139 and 51,026 shares, respectively;

outstanding, 48,298 and 47,561 shares, respectively

521

511

Additional paid-in-capital

730,501

722,286

Accumulated deficit

(240,801)

(199,128)

Treasury stock, at cost

(32,901)

(31,629)

Total stockholders' equity

457,320

492,040

Total liabilities and stockholders'

equity

$

1,380,255

$

1,172,721

(a) We adopted ASC 842 Leases accounting

guidance effective April 28, 2019 which requires that we recognize

a right-of-use asset and lease liability for leases with a term

greater than twelve months.

BARNES & NOBLE EDUCATION,

INC. AND SUBSIDIARIES

Sales Information

(Unaudited)

Total Sales

The components of the sales variances for

the 13 and 26 weeks period are as follows:

Dollars in millions

13 weeks ended

26 weeks ended

October 26, 2019

October 27, 2018

October 26, 2019

October 27, 2018

Retail Sales

New stores (a)

$

39.3

$

22.5

$

46.7

$

30.3

Closed stores (a)

(24.5)

(39.6)

(32.9)

(48.6)

Comparable stores (b)

(45.5)

(46.8)

(52.3)

(53.0)

Textbook rental deferral

1.5

3.8

2.3

3.6

Service revenue (c)

(2.0)

(0.8)

(2.5)

(0.9)

Other (d)

(10.9)

0.2

(15.9)

(2.3)

Retail Sales subtotal:

$

(42.1)

$

(60.7)

$

(54.6)

$

(70.9)

Wholesale Sales:

$

(0.6)

$

(6.7)

$

(18.3)

$

(9.2)

DSS Sales

$

0.3

$

0.4

$

—

$

6.1

Eliminations (e)

$

(0.1)

$

(5.1)

$

12.5

$

(16.3)

Total sales variance

$

(42.5)

$

(72.1)

$

(60.4)

$

(90.3)

(a) The following is a store count summary

for physical stores and virtual stores:

Number of Stores:

13 weeks ended

26 weeks ended

October 26, 2019

October 27, 2018

October 26, 2019

October 27, 2018

Physical Stores

Virtual Stores

Physical Stores

Virtual Stores

Physical Stores

Virtual Stores

Physical Stores

Virtual Stores

Number of stores at beginning of

period

777

714

753

684

772

676

768

676

Stores opened

2

9

21

9

40

55

34

26

Stores closed

7

59

1

16

40

67

29

25

Number of stores at end of period

772

664

773

677

772

664

773

677

(b) For Comparable Store Sales details,

see below.

(c) Service revenue includes brand

partnerships, shipping and handling, digital content, software,

services, and revenue from other programs.

(d) Other includes inventory liquidation

sales to third parties, marketplace sales and certain accounting

adjusting items related to return reserves, agency sales and other

deferred items.

(e) Eliminates Wholesale sales and service

fees to Retail and Retail commissions earned from Wholesale.

Comparable Sales - Retail

Segment

Comparable store sales variances by

category for the 13 and 26 week periods are as follows:

Dollars in millions

13 weeks ended

26 weeks ended

October 26, 2019

October 27, 2018

October 26, 2019

October 27, 2018

Textbooks (Course Materials)

$

(43.9)

(7.7)%

$

(49.4)

(8.0)%

$

(55.4)

(8.0)%

$

(55.2)

(7.4)%

General Merchandise

(0.2)

(0.1)%

3.2

1.8%

5.7

1.9%

4.4

1.5%

Trade Books

(1.4)

(12.1)%

(0.6)

(4.7)%

(2.6)

(11.9)%

(2.2)

(8.8)%

Total Comparable Store Sales

$

(45.5)

(5.9)%

$

(46.8)

(5.8)%

$

(52.3)

(5.1)%

$

(53.0)

(5.0)%

Comparable store sales includes sales from physical stores that

have been open for an entire fiscal year period and virtual store

sales for the period, does not include sales from closed stores for

all periods presented, and digital agency sales are included on a

gross basis. We believe the current comparable store sales

calculation method reflects the manner in which management views

comparable sales, as well as the seasonal nature of our

business.

BARNES & NOBLE EDUCATION,

INC. AND SUBSIDIARIES

Consolidated Non-GAAP

Information

(In thousands)

(Unaudited)

Adjusted Earnings

13 weeks ended

26 weeks ended

October 26, 2019

October 27, 2018

October 26, 2019

October 27, 2018

Net income

$

35,931

$

59,697

$

3,776

$

21,075

Reconciling items, after-tax (below)

1,903

513

3,983

546

Adjusted Earnings (Non-GAAP)

$

37,834

$

60,210

$

7,759

$

21,621

Reconciling items, pre-tax

Impairment loss (non-cash) (a)

$

—

$

—

$

433

$

—

Content amortization (non-cash) (b)

998

104

1,909

148

Restructuring and other charges (c)

1,569

—

3,035

—

Transaction costs (d)

—

537

—

537

Reconciling items, pre-tax

2,567

641

5,377

685

Less: Pro forma income tax impact (e)

664

128

1,394

139

Reconciling items, after-tax

$

1,903

$

513

$

3,983

$

546

Adjusted EBITDA

13 weeks ended

26 weeks ended

October 26, 2019

October 27, 2018

October 26, 2019

October 27, 2018

Net income

$

35,931

$

59,697

$

3,776

$

21,075

Add:

Depreciation and amortization expense

15,546

16,421

31,425

32,959

Interest expense, net

1,446

1,836

3,978

5,358

Income tax expense

19,054

16,946

4,865

2,974

Impairment loss (non-cash) (a)

—

—

433

—

Content amortization (non-cash) (b)

998

104

1,909

148

Restructuring and other charges (c)

1,569

—

3,035

—

Transaction costs (d)

—

537

—

537

Adjusted EBITDA (Non-GAAP)

$

74,544

$

95,541

$

49,421

$

63,051

(a) During the 26 weeks ended October 26,

2019, we recognized an impairment loss (non-cash) of $433 in the

Retail Segment related to net capitalized development costs for a

project which are not recoverable.

(b) Represents amortization of content

development costs (non-cash) recorded in cost of goods sold in the

consolidated financial statements.

(c) During the 26 weeks ended October 26,

2019, we recognized restructuring and other charges totaling

$3,035, comprised primarily of severance and other employee

termination and benefit costs associated with several management

changes and the elimination of various positions as part of cost

reduction objectives, and professional service costs for

restructuring, process improvements, and shareholder activist

activities.

(d) Transaction costs are costs incurred

for business development and acquisitions.

(e) Represents the income tax effects of

the non-GAAP items.

BARNES & NOBLE EDUCATION,

INC. AND SUBSIDIARIES

Consolidated Non-GAAP

Information

(In thousands)

(Unaudited)

Free Cash Flow (non-GAAP)

13 weeks ended

26 weeks ended

October 26, 2019

October 27, 2018

October 26, 2019

October 27, 2018

Adjusted EBITDA (non-GAAP)

$

74,544

$

95,541

$

49,421

$

63,051

Less:

Capital expenditures (a)

10,946

14,912

19,255

23,152

Cash interest paid

2,419

2,271

4,029

5,185

Cash taxes (refund) paid

721

1,272

(5,877)

2,649

Free Cash Flow (non-GAAP)

$

60,458

$

77,086

$

32,014

$

32,065

(a) Purchases of property and equipment

are also referred to as capital expenditures. Our investing

activities consist principally of capital expenditures for

contractual capital investments associated with renewing existing

contracts, new store construction, digital initiatives and

enhancements to internal systems and our website. The following

table provides the components of total purchases of property and

equipment:

Capital Expenditures

13 weeks ended

26 weeks ended

October 26, 2019

October 27, 2018

October 26, 2019

October 27, 2018

Physical store capital expenditures

$

4,599

$

8,314

$

8,117

$

12,523

Product and system development

4,102

3,190

7,444

5,210

Content development costs

1,548

2,501

2,233

4,225

Other

697

907

1,461

1,194

Total Capital Expenditures

$

10,946

$

14,912

$

19,255

$

23,152

BARNES & NOBLE EDUCATION,

INC. AND SUBSIDIARIES

Segment Information

(In thousands, except

percentages)

(Unaudited)

Segment Information (a)

13 weeks ended

26 weeks ended

October 26, 2019

October 27, 2018

October 26, 2019

October 27, 2018

Sales

Retail

$

741,769

$

783,906

$

1,016,425

$

1,070,991

Wholesale

40,210

40,830

112,519

130,774

DSS

5,215

4,934

10,589

10,611

Eliminations

(14,966)

(14,904)

(47,648)

(60,126)

Total

$

772,228

$

814,766

$

1,091,885

$

1,152,250

Gross profit

Retail (b)

$

161,150

$

178,805

$

223,473

$

235,370

Wholesale

12,535

14,275

27,453

33,820

DSS (b)

4,929

4,789

10,070

10,343

Eliminations

9,334

12,995

(480)

(2,015)

Total

$

187,948

$

210,864

$

260,516

$

277,518

Selling and administrative expenses

Retail

$

98,578

$

100,595

$

182,393

$

185,830

Wholesale

4,593

5,364

9,352

11,003

DSS

4,615

3,387

8,728

6,166

Corporate Services

5,668

6,016

10,675

11,509

Eliminations

(50)

(39)

(53)

(41)

Total

$

113,404

$

115,323

$

211,095

$

214,467

Adjusted EBITDA (Non-GAAP) (c)

Retail

$

62,572

$

78,210

$

41,080

$

49,540

Wholesale

7,942

8,911

18,101

22,817

DSS

314

1,402

1,342

4,177

Corporate Services

(5,668)

(6,016)

(10,675)

(11,509)

Eliminations

9,384

13,034

(427)

(1,974)

Total

$

74,544

$

95,541

$

49,421

$

63,051

(a) See Explanatory Note in this Press

Release for Segment descriptions.

(b) For the 13 and 26 weeks ended October

26, 2019, the Retail Segment gross margin excludes $210 and $394,

respectively, of amortization expense (non-cash) related to content

development costs. For the 13 and 26 weeks ended October 26, 2019,

the DSS Segment gross margin excludes $788 and $1,515,

respectively, of amortization expense (non-cash) related to content

development costs.

For the 13 and 26 weeks ended October 27,

2018, the Retail Segment gross margin excludes $104 and $148,

respectively, of amortization expense (non-cash) related to content

development costs.

(c) For additional information, see "Use

of Non-GAAP Financial Information" in the Non-GAAP disclosure

information of this Press Release.

Percentage of Segment Sales

13 weeks ended

26 weeks ended

October 26, 2019

October 27, 2018

October 26, 2019

October 27, 2018

Gross margin

Retail

21.7%

22.8%

22.0%

22.0%

Wholesale

31.2%

35.0%

24.4%

25.9%

DSS

94.5%

97.1%

95.1%

97.5%

Elimination

(62.4)%

(108.4)%

1.0%

3.4%

Total gross margin

24.3%

25.9%

23.9%

24.1%

Selling and administrative expenses

Retail

13.3%

12.8%

17.9%

17.4%

Wholesale

11.4%

13.1%

8.3%

8.4%

DSS

88.5%

68.6%

82.4%

58.1%

Corporate Services

N/A

N/A

N/A

N/A

Elimination

N/A

N/A

N/A

N/A

Total selling and administrative

expenses

14.7%

14.2%

19.3%

18.6%

Use of Non-GAAP Financial Information - Adjusted Earnings,

Adjusted EBITDA and Free Cash Flow

To supplement the Company’s consolidated financial statements

presented in accordance with generally accepted accounting

principles (“GAAP”), in the Press Release attached hereto as

Exhibit 99.1, the Company uses the non-GAAP financial measures of

Adjusted Earnings (defined as net income adjusted for certain

reconciling items), Adjusted EBITDA (defined by the Company as

earnings before interest, taxes, depreciation and amortization, as

adjusted for additional items subtracted from or added to net

income) and Free Cash Flow (defined by the Company as Adjusted

EBITDA less capital expenditures, cash interest and cash

taxes).

These non-GAAP financial measures are not intended as

substitutes for and should not be considered superior to measures

of financial performance prepared in accordance with GAAP. In

addition, the Company's use of these non-GAAP financial measures

may be different from similarly named measures used by other

companies, limiting their usefulness for comparison purposes.

The Company's management reviews these non-GAAP financial

measures as internal measures to evaluate the Company's performance

and manage the Company's operations. The Company's management

believes that these measures are useful performance measures which

are used by the Company to facilitate a comparison of on-going

operating performance on a consistent basis from period-to-period.

The Company's management believes that these non-GAAP financial

measures provide for a more complete understanding of factors and

trends affecting the Company's business than measures under GAAP

can provide alone, as it excludes certain items that do not reflect

the ordinary earnings of its operations. The Company's Board of

Directors and management also use Adjusted EBITDA as one of the

primary methods for planning and forecasting overall expected

performance, for evaluating on a quarterly and annual basis actual

results against such expectations, and as a measure for performance

incentive plans. The Company's management believes that the

inclusion of Adjusted EBITDA and Adjusted Earnings results provides

investors useful and important information regarding the Company's

operating results. The Company believes that Free Cash Flow

provides useful additional information concerning cash flow

available to meet future debt service obligations and working

capital requirements and assists investors in their understanding

of the Company’s operating profitability and liquidity as the

Company manages to the business to maximize margin and

cashflow.

The non-GAAP measures included in the Press Release attached

hereto as Exhibit 99.1 has been reconciled to the comparable GAAP

measures as required under Securities and Exchange Commission (the

“SEC”) rules regarding the use of non-GAAP financial measures. All

of the items included in the reconciliations below are either (i)

non-cash items or (ii) items that management does not consider in

assessing the Company's on-going operating performance. The Company

urges investors to carefully review the GAAP financial information

included as part of the Company’s Form 10-K dated April 27, 2019

filed with the SEC on June 25, 2019, which includes consolidated

financial statements for each of the three years for the period

ended April 27, 2019 (Fiscal 2019, Fiscal 2018, and Fiscal 2017)

and the Company's Quarterly Report on Form 10-Q for the period

ended July 28, 2018 filed with the SEC on August 27, 2019

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191204005163/en/

Media: Carolyn J. Brown

Senior Vice President Corporate Communications and Public Affairs

Barnes & Noble Education, Inc. (908) 991-2967

cbrown@bned.com

Investors: Thomas D. Donohue

Executive Vice President Chief Financial Officer Barnes & Noble

Education, Inc. (908) 991-2966 tdonohue@bned.com

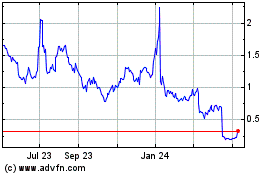

Barnes and Noble Education (NYSE:BNED)

Historical Stock Chart

From Mar 2024 to Apr 2024

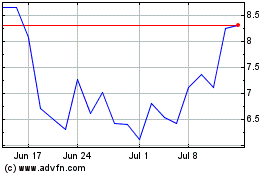

Barnes and Noble Education (NYSE:BNED)

Historical Stock Chart

From Apr 2023 to Apr 2024