Current Report Filing (8-k)

June 27 2022 - 4:56PM

Edgar (US Regulatory)

6.244% Fixed-to-Floating Rate Normal Preferred Capital Securities of Mellon Capital IV (fully and unconditionally guaranteed by The Bank of New York false 0001390777 0001390777 2022-06-27 2022-06-27 0001390777 us-gaap:CommonStockMember 2022-06-27 2022-06-27 0001390777 us-gaap:PreferredStockMember 2022-06-27 2022-06-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 27, 2022

THE BANK OF NEW YORK MELLON CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-35651 |

|

13-2614959 |

| (State or other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| 240 Greenwich Street New York, New York |

|

10286 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (212) 495-1784

Not Applicable

(Former name or former address if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

|

BK |

|

New York Stock Exchange |

| 6.244% Fixed-to-Floating Rate Normal Preferred Capital Securities of Mellon Capital IV (fully and unconditionally guaranteed by The Bank of New York Mellon Corporation) |

|

BK/P |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 under the Securities Act (17 CFR 230.405) or Rule 12b-2 under the Exchange Act (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On June 27, 2022, The Bank of New York Mellon Corporation (the “Company”) announced that the Federal Reserve had notified the Company that its preliminary Stress Capital Buffer (“SCB”) requirement will remain 2.5%, equal to the regulatory floor. This SCB is expected to be effective from October 1, 2022 to September 30, 2023.

The Company also announced that it intends to increase its quarterly common stock cash dividend by 9% from $0.34 to $0.37 per share, commencing as early as the third quarter of 2022, subject to approval by its Board of Directors (the “Board”). The Company continues to be authorized to repurchase common shares under its existing share repurchase program approved by the Board, as announced in June 2021. The repurchases of common stock may be executed through open market purchases, in privately negotiated transactions or by other means, including through repurchase plans designed to comply with Rule 10b5-1 and through derivative, accelerated share repurchase and other structured transactions. The timing, manner and amount of repurchases are subject to various factors, including the Company’s capital position and prevailing market conditions.

The information presented in this Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements, which may be expressed in a variety of ways, including the use of future or present tense language, relate to, among other things, the Company’s repurchases of common stock, common stock dividends, capital base, performance and ability to meet regulatory requirements. These statements are based upon current beliefs and expectations and are subject to significant risks and uncertainties (some of which are beyond the Company’s control). Actual outcomes may differ materially from those expressed or implied as a result of risks and uncertainties, including, but not limited to, the factors identified above and the risk factors and other uncertainties set forth in the Company’s Annual Report on Form 10-K for the year ended Dec. 31, 2021, the Quarterly Report on Form 10-Q for the quarter ended March 31, 2022 and the Company’s other filings with the Securities and Exchange Commission. All statements in this Current Report on Form 8-K speak only as of the date of this filing and the Company undertakes no obligation to update the information to reflect events or circumstances that arise after that date or to reflect the occurrence of unanticipated events.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

The Bank of New York Mellon Corporation (Registrant) |

|

|

|

| Date: June 27, 2022 |

|

By: |

|

/s/ James J. Killerlane III |

|

|

Name: |

|

James J. Killerlane III |

|

|

Title: |

|

Secretary |

3

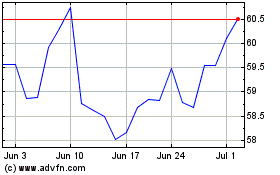

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024