Large custody bank faces pressure as depositors chase higher

interest rates

By Justin Baer

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (April 18, 2019).

Bank of New York Mellon Corp. delivered a grim reminder that

shifting Federal Reserve policies and softening long-term interest

rates are taking their toll on part of the finance industry.

Shares of BNY Mellon fell by nearly 10% Wednesday after the

custody bank reported quarterly earnings and revenue that fell

short of Wall Street's expectations.

BNY Mellon's disappointing results underline how sensitive

financial firms can be to the ebb and flow of interest rates,

particularly when increases in short-term rates aren't matched with

rising longer-term rates. Federal Reserve officials hiked rates

four times in 2018. Then, in January, they signaled they would

leave rates unchanged for some time, citing increasing risks to

economic growth. In March, the central bank indicated it was

unlikely to raise rates at all in 2019.

The policy reversal caused the yield on the benchmark 10-year

Treasury to drop to its lowest level in more than a year. Treasury

yields decline when bond prices rise and investors' outlook for the

economy darkens.

Last month, the 10-year yield fell below that of three-month

Treasurys for the first time since 2007 -- a so-called inverted

yield curve that may indicate a recession is lurking in the

economy's future.

"We're not getting help from interest rates now, which we had

for the last few years," said Jeffrey Harte, a bank analyst with

Sandler O'Neill + Partners. "That puts banks in a position where

interest income is now a function of volume. Can you grow

loans?"

For banks and other financial firms that fund themselves with

deposits and other short-term loans and put that money to work

through loans and longer-term investments, a flattening yield curve

can squeeze their interest margins and leave a mark on earnings. At

BNY Mellon, net interest revenue fell 8% to $841 million from a

year earlier.

"Rates across the entire yield curve declined versus our

assumptions, deposit balances declined, and we saw changes to the

mix between interest and noninterest-bearing deposits," Charles

Scharf, BNY Mellon's chairman and chief executive, said Wednesday

during a conference call with analysts. "We see significant

competitive pressure for deposits."

While Goldman Sachs Group Inc., Bank of America Corp. and other

big banks were able to sidestep the brunt of these effects,

custodians like BNY Mellon tend to lose clients' deposits faster as

rates go up. That is because commercial banks draw more of their

short-term funding from retail customers who are slower to pull

their money than big companies and institutions.

That is especially true for BNY Mellon, which tends to collect

more deposits that don't pay interest. As rates rose, more of BNY

Mellon's customers moved money out of the bank and into

interest-bearing deposits with a higher yield. That shift left BNY

Mellon with a bigger slice of their deposits drawing interest;

meantime, the average deposit rate rose from a year ago.

BNY Mellon and other custody banks don't have big lending

businesses, so a drop in deposits is usually with a decline in

securities holdings that generate interest income. So their revenue

from that interest was shrinking at the same time that their

interest margins were narrowing.

BNY Mellon "is suffering more than other firms now, and

certainly today is a stark reminder that there's an increasing

demand for yield," said Brennan Hawken, an analyst with UBS Group

AG. "You've got a double whammy on your hands."

BNY Mellon executives predicted in January that the bank's

net-interest revenue would be little-changed or slightly higher in

the first quarter from the last three months of 2018. Instead,

interest revenue fell 5%

On the conference call, BNY Mellon finance chief Michael

Santomassimo said the bank expected deposit rates would "inch up a

little bit" in the second quarter.

BNY Mellon reported net income of $946 million, or 94 cents a

share, in the first quarter, down 19% from a year earlier. Total

revenue slipped 6.7% to $3.9 billion.

Analysts polled by S&P Global Market Intelligence had

expected a profit of 96 cents a share, on revenue of $4

billion.

BNY Mellon said the fees it collects also fell, dropping 9% to

$3.03 billion.

The bank's results were also hurt by changes to currency

exchange rates and the flow of assets from its

investment-management division. The sale of several

asset-management businesses last year also affected the most-recent

quarter.

Assets under management dropped 1% from a year ago, to $1.84

trillion.

On the call, BNY Mellon executives said they were continuing to

look for ways to trim expenses even as they invest heavily in

technology initiatives they expect will boost growth.

Noninterest expenses fell 1% to $2.7 billion in the first

quarter from a year earlier.

Allison Prang contributed to this article.

Write to Justin Baer at justin.baer@wsj.com

(END) Dow Jones Newswires

April 18, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

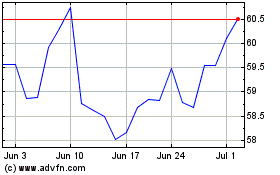

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bank of New York Mellon (NYSE:BK)

Historical Stock Chart

From Apr 2023 to Apr 2024