Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

December 28 2020 - 6:51AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of December, 2020

Commission File Number 1-15250

BANCO BRADESCO S.A.

(Exact name of registrant as specified in

its charter)

BANK BRADESCO

(Translation of Registrant's name into English)

Cidade de Deus, s/n, Vila Yara

06029-900 - Osasco - SP

Federative Republic of Brazil

(Address of principal executive office)

Indicate by check

mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form

20-F ___X___ Form 40-F _______

Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

.

Publicly-Held Company

Corporate Taxpayer’s

ID No. 60.746.948/0001-12

Notice to the Market

Banco Bradesco S.A. ("Bradesco")

announces the issuance of its first bond linked to ESG (environmental, social and governance) criteria. Reaching an amount of over

R$ 1.2 billion, it is the largest issuance of a sustainability-labelled bond ever made by a Brazilian private bank.

The private offering was registered

under a Financial Note (Letra Financeira), maturing in 30 months and priced at a yield to investor of CDI+0.60% per annum.

The resources will fund new and

existing projects and assets in areas that contribute to the transition to a low-carbon economy, such as energy and operational

efficiency, renewable energy, clean transport and green buildings.

Bradesco’s Climate Finance

Framework (available at www.bradescosustentabilidade.com.br) will guide the investment and management of the proceeds. The consultancy

Sitawi has reviewed the Framework and has confirmed in their Second Party Opinion that it is aligned with main international references

for sustainable financial instruments.

The disbursements and positive

impacts generated by the invested assets, mainly in terms of avoided carbon emissions, will be monitored and annually disclosed

by Bradesco.

Cidade de Deus, Osasco,

SP, December, 23, 2020

Banco Bradesco S.A.

Leandro de Miranda

Araujo

Executive Deputy Officer

and

Investor Relations Officer

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

Date: December 23, 2020

|

BANCO BRADESCO S.A.

|

|

|

|

By:

|

|

/S/Leandro de Miranda Araujo

|

|

|

|

Leandro de Miranda Araujo

Executive Deputy Officer and

Investor Relations Officer.

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates of future

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

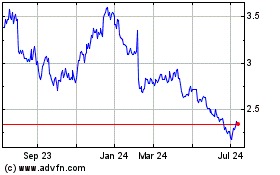

Banco Bradesco (NYSE:BBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Banco Bradesco (NYSE:BBD)

Historical Stock Chart

From Apr 2023 to Apr 2024