UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 11-K

______________________

[X] ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES AND EXCHANGE ACT OF 1934

For the year ended December 31, 2021

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to ______________

Commission File Number 1 - 12777

A. Full title of the plan and the address of the plan, if different from that of the issuer named below:

AZZ Inc. Employee Benefit Plan and Trust

B. Name of issuer of the securities held pursuant to the plan and the address of its principal executive office:

AZZ Inc.

One Museum Place

3100 West 7th Street, Suite 500

Fort Worth, Texas 76107

AZZ Inc. Employee Benefit Plan and Trust

Financial Statements and Supplemental Schedules

Years Ended December 31, 2021 and December 31, 2020

Table of Contents

| | | | | | | | |

| | PAGE |

| Report of Independent Registered Public Accounting Firm | |

| Report of Independent Registered Public Accounting Firm | |

| Financial Statements: | |

| Statements of Net Assets Available for Benefits | |

| Statements of Changes in Net Assets Available for Benefits | |

| Notes to Financial Statements | |

| Supplemental Schedules: | |

| Form 5500, Schedule H, line 4a - Schedule of Delinquent Participant Contributions | |

| Form 5500, Schedule H, line 4i - Schedule of Assets (Held at End of Year) | |

| Signatures | |

| Exhibit Index | |

NOTE: All other schedules required by the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 have been omitted since they are either not applicable or the information required therein has been included in the financial statements or notes thereto.

Report of Independent Registered Public Accounting Firm

Plan Administrator and Plan Participants

AZZ Inc. Employee Benefit Plan and Trust

Opinion on the financial statements

We have audited the accompanying statement of net assets available for benefits of AZZ Inc. Employee Benefit Plan and Trust (the “Plan”) as of December 31, 2021, the related statement of changes in net assets available for benefits for the year ended December 31, 2021, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2021, and the changes in net assets available for benefits for the year ended December 31, 2021 in conformity with accounting principles generally accepted in the United States of America.

Basis for opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audit we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audit also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable basis for our opinion.

Supplemental information

The schedules of delinquent participant contributions for the year ended December 31, 2021 and assets (held at end of year) as of December 31, 2021 (“supplemental information”) have been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The supplemental information is the responsibility of the Plan’s management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information, we evaluated whether the supplemental information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ GRANT THORNTON LLP

We have served as the Plan’s auditor since 2022.

St. Louis, MO

July 11, 2022

Report of Independent Registered Public Accounting Firm

To the Plan Administrator and Plan Participants of the AZZ Inc. Employee Benefit Plan and Trust

Opinion on the Financial Statements

We have audited the accompanying statement of net assets available for benefits of the AZZ Inc. Employee Benefit Plan and Trust (the Plan) as of December 31, 2020 and the related statement of changes in net assets available for benefits for the year then ended, and the related notes and schedules (collectively referred to as the financial statements). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2020, and the changes in net assets available for benefits for the year then ended, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of Plan management. Our responsibility is to express an opinion on these financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As a part of our audits, we are required to obtain an understanding of internal control over financial reporting, but not for purposes of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplementary Information

The supplementary information in the accompanying schedule of Schedule H, Line 4a – Schedule of Delinquent Participant Contributions for the year ended December 31, 2020 and Schedule H, Line 4i – Schedule of Assets (Held at End of Year) as of December 31, 2020 have been subjected to audit procedures performed in conjunction with the audit of the Plan's financial statements. The supplementary information is the responsibility of Plan management. Our audit procedures included determining whether the supplemental information reconciles to the financial statements or the underlying accounting and other records, as applicable and performing procedures to test the completeness and accuracy of the information presented in the supplemental information. In forming our opinion on the supplemental information in the accompanying schedules, we evaluated whether the supplementary information, including its form and content, is presented in conformity with the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental information in the accompanying schedules is fairly stated in all material respects in relation to the financial statements as a whole.

WEAVER AND TIDWELL, L.L.P.

Dallas, Texas

We have served as the Plan’s auditor since 2010.

Our final year as auditor was 2020.

Dallas, Texas

July 14, 2021

| | | | | | | | | | | | | | | | | | | | |

| AZZ Inc. Employee Benefit Plan and Trust |

| | | | | | |

| Statements of Net Assets Available for Benefits |

| | | | | | |

| | | | | | |

| | | | |

| | | | December 31, 2021 | | December 31, 2020 |

| Assets | | | |

| Investments, at fair value: | | | |

| Registered investment companies | $ | 52,589,658 | | | $ | 44,655,043 | |

| Common collective trusts | 92,473,913 | | | 79,749,892 | |

| Pooled separate accounts | 28,631,649 | | | 26,732,512 | |

| AZZ Inc. common stock | 568,500 | | | 539,311 | |

| Total investments at fair value | 174,263,720 | | | 151,676,758 | |

| | | | | | |

| Fully benefit-responsive investment contract, at contract value | 10,983,488 | | | 11,163,126 | |

| | | | | | |

| Receivables: | | | |

| Employer contributions | 100,875 | | | 95,421 | |

| Participant contributions | 253,679 | | | 196,301 | |

| Notes receivable from participants | 4,868,024 | | | 4,936,368 | |

| | | | |

| Total receivables | 5,222,578 | | | 5,228,090 | |

| | | | | | |

| Total assets | 190,469,786 | | | 168,067,974 | |

| | | | | | |

| Liabilities | | | |

| Excess contributions payable | 203,331 | | | — | |

| | | | | | |

| Net Assets Available for Benefits | $ | 190,266,455 | | | $ | 168,067,974 | |

| | | | | | |

See accompanying notes to financial statements.

| | | | | | | | | | | | | | | | | |

| AZZ Inc. Employee Benefit Plan and Trust |

| | | | | |

| Statements of Changes in Net Assets Available for Benefits |

| | | | | |

| | | | | |

| | | | | |

| | | Year Ended |

| | | December 31, 2021 | | December 31, 2020 |

| Additions to Net Assets Attributed to: | | | |

| Investment income: | | | |

| Dividend income | $ | 677,785 | | | $ | 684,572 | |

| Net realized and unrealized gain | 23,409,181 | | | 21,204,425 | |

| Total investment income | 24,086,966 | | | 21,888,997 | |

| | | | | |

| Contributions received or receivable: | | | |

| Employer | 5,005,610 | | | 5,539,206 | |

| Participants | 10,634,180 | | | 11,547,290 | |

| Rollovers | 1,102,531 | | | 458,588 | |

| | | | |

| Total contributions | 16,742,321 | | | 17,545,084 | |

| | | | | |

| Interest income on notes receivable from participants | 237,736 | | | 311,198 | |

| | | |

| Total additions | 41,067,023 | | | 39,745,279 | |

| | | | | |

| Deductions from Net Assets Attributed to: | | | |

| Benefits paid to participants | 18,352,506 | | | 37,474,629 | |

| | | |

| Other fees and Plan expenses | 516,036 | | | 464,612 | |

| Total deductions | 18,868,542 | | | 37,939,241 | |

| | | | | |

| | | |

| | | | | |

| | | |

| | | | | |

Net increase in net assets available for benefits | 22,198,481 | | | 1,806,038 | |

| | | | | |

| Net assets available for benefits at beginning of year | 168,067,974 | | | 166,261,936 | |

| | | | | |

| Net assets available for benefits at end of year | $ | 190,266,455 | | | $ | 168,067,974 | |

See accompanying notes to financial statements.

1.Description of the Plan

The following description of the AZZ Inc. Employee Benefit Plan and Trust (the “Plan”) provides only general information. The Plan is sponsored by AZZ Inc. (the “Company” or "Employer"), which trades in the NYSE under the ticker symbol “AZZ”. Participants should refer to the Plan document for a more complete description of the Plan’s provisions.

General

The Plan is a defined contribution plan covering substantially all U.S. employees of the Company and its affiliates who have completed 30 days of service and attained 18 years of age, and excludes certain employees participating in unions who are covered in plans not associated with the AZZ Inc. Employee Benefit Plan and Trust.

The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”).

Plan Amendments

Effective February 29, 2020, the Plan was amended to remove Nuclear Logistics Inc. as a participating employer in the Plan. The Company divested Nuclear Logistics Inc. as of February 28, 2020.

Effective July 1, 2020, the Plan was amended to (i) remove the Safe Harbor Match subsequent to July 1, 2020 and (ii) protect Safe Harbor Match amounts provided prior to July 1, 2020, (iii) implement a discretionary employer match based upon the employer’s formula determined on an annual basis, and (iv) include employee catch up contributions in the computation of the employer’s matching contributions.

Effective July 21, 2020, the Plan was amended to remove Reinforcing Services LLC as a participating employer in the Plan. The Company divested Reinforcing Services LLC in July 2020.

Effective October 26, 2020, the Plan was amended to remove AZZ SMS LLC as a participating employer in the Plan. The Company divested AZZ SMS LLC as of October 26, 2020.

Effective January 1, 2021, the Plan was amended to allow after-tax contributions (ROTH contributions).

Effective January 18, 2021, the Plan was amended to make Acme Galvanizing, Inc. a participating employer in the Plan. The Company purchased Acme Galvanizing, Inc. in January 2021.

Effective July 1, 2021, the Plan was amended to increase the automatic escalation from 6% to 10%. Participants are automatically enrolled in the Plan at 3% on the first of the month following 30 days of employment and the contribution will automatically increase by 1% annually up to a maximum of 10%.

Contributions

Participants may elect to contribute up to seventy-five percent (75%) of their eligible compensation, subject to Internal Revenue Service (“IRS”) limitations.

Participants are automatically enrolled in the Plan at 3% on the first of the month following 30 days of employment and the contribution will automatically increase by 1% annually up to a maximum of 6% until July 1, 2021, at which point the maximum was increased to 10%. Participants may change their contribution elections at any time.

Participants who are eligible to make salary deferral contributions under the Plan and who have attained

AZZ Inc. Employee Benefit Plan and Trust

Notes to Financial Statements

age 50 before the close of the Plan year may make catch-up contributions in accordance with, and subject to the limitations imposed by the Internal Revenue Code (the “Code”).

The Company currently makes a matching contribution equal to the first 1% of a participant’s compensation that is deferred to the plan, plus 50% of the next 5% of compensation deferred to the plan.

The plan also permits the Company to make a discretionary non-elective contribution for any year, for participants who have completed a year of service and who both completed 1,000 hours of service during the year and are employed on the last day of the year. No discretionary non-elective contributions were made in 2021 or 2020.

Participant Accounts

Each participant's account is credited with the participant's contributions, any employer contributions and an allocation of Plan earnings and losses. Allocations are based on the participant's account balance.

Forfeited Accounts

Forfeited balances of terminated participants’ non-vested accounts are used to offset employer contributions and may be used to pay plan expenses.

At December 31, 2020, net assets available for benefits included approximately $11,785 of unallocated forfeitures. Unallocated forfeiture amounts at December 31, 2020 were used during the 2021 Plan year.

In addition, $339,699 of current plan year forfeitures were used during 2021. At December 31, 2021, net assets available for benefits included approximately $10,695 of unallocated forfeitures.

Investment Options

Participants may direct contributions to their account in a variety of investment options, which vary in degree of risk, with the exception of AZZ Inc. common stock for which participants may only hold or sell existing shares. Participants may change their investment options at any time. Investments are held by Prudential Bank & Trust, FSB and are allocated by Prudential Retirement Insurance and Annuity Company ("Prudential"), record keeper. On April 2, 2022, Prudential was acquired by Empower.

Vesting

Participant contributions to the Plan plus actual earnings or losses thereon are fully vested at all times. Non-elective contributions and non-safe-harbor matching contributions held in the Plan vest in accordance with the following schedule:

| | | | | | | | |

| Years of Service | | Vesting

Percentage |

| | |

| Less than 1 year | | 0 | % |

| 1 year | | 20 | % |

| 2 years | | 40 | % |

| 3 years | | 60 | % |

| 4 years | | 80 | % |

| 5 years | | 100 | % |

Regular matching contributions vest in accordance with the following schedule:

AZZ Inc. Employee Benefit Plan and Trust

Notes to Financial Statements

| | | | | | | | |

| Years of Service | | Vesting

Percentage |

| | |

| Less than 2 years | | 0 | % |

| 2 years | | 100 | % |

Participants will vest 100% upon attainment of age 65, or in the event of death or disability while employed by the Company.

Notes Receivable from Participants

Participants may borrow from their account a minimum of $1,000 up to a maximum equal to the lesser of $50,000 or 50% of their vested account balance. Loans are not issued to participants who already have one note outstanding. Loan terms generally range from one year to five years, however the participant may repay eligible residential loans over fifteen (15) years. The loans are secured by a portion of the participant’s account and bear interest at prime plus 1% at the time of loan origination. Interest rates for loans at the end of 2021 ranged from 3.25% to 6.50%. Principal and interest are paid ratably through payroll deductions.

Participant Withdrawals

On termination of service, if a participant’s vested account is less than or equal to $5,000, the benefit is payable in a lump sum. If the vested account is greater than $5,000, the participant may elect to receive either a lump sum payment, partial withdrawals, or installments over a period not to exceed the life expectancy of the participant and the participant’s beneficiary. If no such election is made, the vested account will remain in the plan until the participant attains age 65.

Prior to termination of service, a participant who is age 59 ½ may elect to receive all or any portion of their vested benefit. Withdrawals are also available in the case of a participant’s hardship or during qualified military service. Non-safe-harbor match and certain non-elective contributions may also be withdrawn if the participant has completed five years of employment.

CARES Act

As a result of the Coronavirus Aid, Relief and Economic Security Act (the “CARES Act”) enacted on March 27, 2020, the Plan administrator implemented new CARES Act options including withdrawal provisions, loans, and temporary waiver of required minimum distributions. All provisions were effective between January 1, 2020 and December 31, 2020, and all were expired as of December 31, 2021.

2. Summary of Significant Accounting Policies

Basis of Accounting

The financial statements of the Plan are presented on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP").

Use of Estimates

The preparation of financial statements in conformity with U.S GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Accordingly, actual results may differ from these estimates.

AZZ Inc. Employee Benefit Plan and Trust

Notes to Financial Statements

Investment Valuation and Income Recognition

The investments of the Plan are stated at fair value (except the Fully Benefit-Responsive Investment Contract which is stated at contract value) as of the end of the Plan period.

Purchases and sales of securities are recorded on the trade dates. Dividends are recorded on the ex-dividend date. Gains or losses on sales of securities are calculated using the average cost of the securities sold. Interest income is recorded on the accrual basis.

All investments and un-invested cash were held by Prudential under a trust agreement. The Plan’s investments are generally subject to market or credit risks customarily associated with debt and equity investments. Investment-related expenses are included in net realized and unrealized gain on investments.

Notes Receivable from Participants

Notes receivable from participants are recorded at their unpaid principal balance plus any accrued but unpaid interest. Notes receivable are reported net of an allowance. Fees related to the administration of notes receivable from participants are charged directly to the participant's account. The balance of deemed loans at December 31, 2021 and 2020 was $233,115 and $216,948, respectively. No allowance for credit losses has been recorded as of December 31, 2021 or 2020.

On March 27, 2020, the CARES Act was enacted into law. The CARES Act allowed participants to borrow up to $100,000 from the total of their investment accounts for a maximum of five years with no repayments due until 2021. In accordance with the CARES Act, participants could elect to defer loan repayments during 2020. If such elections were made, the participant's note, including interest accrued during the deferral, was reamortized on January 1, 2021, and the loan repayment period extended by the length of time repayments were deferred. The elections were effective from January 1, 2020 through December 31, 2020, and are now expired.

Contributions

Participant and employer contributions are accrued in the period in which they are deducted in accordance with salary deferral agreements and as they become obligations of the Company, as determined by the Plan’s administrator.

Payment of Benefits

Benefits are recorded when paid.

Plan Expenses

The Plan pays some or all Plan related expenses except for a limited category of expenses, known as "settlor expenses," which the law requires the employer to pay. Generally, settlor expenses relate to the design, establishment or termination of the Plan. The expenses charged to the Plan may be charged pro rata to each participant in relation to the size of each participant's account balance or may be charged equally to each participant. In addition, some types of expenses may be charged only to some participants based upon their use of a Plan feature or receipt of a plan distribution. Finally, the Plan may charge expenses in a different manner as to participants who have terminated employment with the Employer versus those participants who remain employed with the Employer.

Excess Contributions Payable

AZZ Inc. Employee Benefit Plan and Trust

Notes to Financial Statements

Amounts payable to participants for contributions in excess of amounts allowed by the IRS are recorded as a liability with a corresponding reduction to contributions. The Plan distributed the 2021 excess contributions to the applicable participants prior to March 15, 2022.

Subsequent Events

The Plan's management has evaluated subsequent events through July 11, 2022 and there were no subsequent events requiring adjustments to the financial statements.

3. Risks and Uncertainties

The Plan invests in various investment securities. Investment securities are exposed to various risks such as interest rate, market, liquidity and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the fair value of certain investment securities will occur in the near term and that such changes could materially affect participants' account balances and the amounts reported in the statements of net assets available for benefits.

Coronavirus Pandemic

The Company is closely monitoring the global outbreak of the novel coronavirus (COVID-19). We are unable to determine the ultimate severity or duration of the outbreak or its effect on, among other things, the global, national or local economy. To date COVID-19 has not had a material adverse impact to the Company’s business or the Plan.

4. Fair Value Measurements

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. A three-tier hierarchy has been established that is used to identify assets and liabilities measured at fair value. The hierarchy focuses on the inputs used to measure fair value and requires that the lowest level input be used. The three levels are defined as follows:

- Level 1: Inputs are unadjusted, quoted prices in active markets for identical assets or liabilities as of the reporting date.

- Level 2: Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly.

- Level 3: Unobservable inputs that are not corroborated by market data.

A description of the methodologies used to measure the fair value of assets and liabilities follows. These methodologies were consistently applied to all assets carried as of December 31, 2021 and December 31, 2020. The methodology used to measure each major category of assets and liabilities is as follows:

- Mutual funds: Valued based on quoted market prices of the underlying assets provided by the trustee and are classified within Level 1 of the valuation hierarchy.

- Common stock: Valued at the closing price reported on the active market on which the individual securities are traded and classified within Level 1 of the valuation hierarchy.

- Pooled separate accounts: Pooled separate accounts are valued at the net asset value (“NAV”) or equivalent based on units of the pooled separate accounts. The NAV, as provided by the trustee, is used as a practical expedient to estimate fair value. The NAV is generally based on the fair

AZZ Inc. Employee Benefit Plan and Trust

Notes to Financial Statements

value of the underlying investments held by the pooled separate account less its liabilities. This practical expedient is not used when it is determined to be probable that the pooled separate account will sell the investment for an amount different than the reported NAV.

- Common collective trusts: Common collective trust accounts are valued at NAV of units at a bank collective trust. The NAV, as provided by the trustee, is used as a practical expedient to estimate fair value. Participant transactions (purchases and sales) may occur daily. Were the Plan to initiate a full redemption of the collective trust, the investment adviser reserves the right to temporarily delay withdrawal from the trust in order to ensure that securities liquidations will be carried out in an orderly business manner.

| | | | | | | | | | | | | | | | | | | | | | | |

| Fair Value Measurements at December 31, 2021 |

| Total Carrying Value as of December 31, 2021 | | Quoted Prices in Active Markets for Identical Assets (Level 1) | | Significant Observable Inputs (Level 2) | | Unobservable Inputs (Level 3) |

| Mutual Funds | $ | 52,589,658 | | | $ | 52,589,658 | | | $ | — | | | $ | — | |

| AZZ Stock | 568,500 | | 568,500 | | — | | | — | |

| Total | $ | 53,158,158 | | | $ | 53,158,158 | | | $ | — | | | $ | — | |

| | | | | | | |

| Investments Measured at Net Asset Value | | | | | | |

| Pooled Separate Accounts | $ | 28,631,649 | | | | | | | |

| Common Collective Trusts | 92,473,913 | | | | | | | |

| Total Investments at Fair Value | $ | 174,263,720 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Fair Value Measurements at December 31, 2020 |

| Total Carrying Value as of December 31, 2020 | | Quoted Prices in Active Markets for Identical Assets (Level 1) | | Significant Observable Inputs (Level 2) | | Unobservable Inputs (Level 3) |

| Mutual Funds | $ | 44,655,043 | | | $ | 44,655,043 | | | $ | — | | | $ | — | |

| AZZ Stock | 539,311 | | | 539,311 | | | — | | | — | |

| Total | $ | 45,194,354 | | | $ | 45,194,354 | | | $ | — | | | $ | — | |

| | | | | | | |

| Investments Measured at Net Asset Value | | | | | | |

| Pool Separate Accounts | $ | 26,732,512 | | | | | | | |

| Common Collective Trusts | 79,749,892 | | | | | | | |

| Total Investments at Fair Value | $ | 151,676,758 | | | | | | | |

Gains and losses (both realized and unrealized) included in changes in net assets for the period above are reported in "Net realized and unrealized gain" in the statements of changes in net assets available for benefits.

The following table summarizes investments measured at fair value based on NAV per share as of December 31, 2021 and 2020, respectively.

AZZ Inc. Employee Benefit Plan and Trust

Notes to Financial Statements

| | | | | | | | | | | |

| Fair Value of Investments in Entities that Use NAV |

| 2021 | | 2020 |

| Pooled Separate Accounts | | | |

| Fair value | $28,631,649 | | $26,732,512 |

| Unfunded commitment | None | | None |

| Redemption frequency | Daily | | Daily |

| Other redemption restrictions | None | | None |

| Redemption notice period | None | | None |

| | | |

Common Collective Trusts(1) | | | |

| Fair value | $92,473,913 | | $79,749,892 |

| Unfunded commitment | None | | None |

| Redemption frequency | Daily | | Daily |

| Other redemption restrictions | None | | None |

| Redemption notice period | None | | None |

1.Common collective trust funds: The Trust seeks to provide the highest total return over time, consistent with an emphasis on both capital growth and income. The Trust invests in a diversified portfolio of other T. Rowe Price stock and bond trusts that represent various asset classes and sectors. The Trust's allocation between T. Rowe Price stock and bond trusts will change over time in relation to its target retirement date.

5. Fully Benefit- Responsive Investment Contract

The Mass Mutual Retirement Services (“MMRS”) SAGIC is a market value separate account investment option with a general investment account guarantee that provides a stated rate of return and insulates participants’ accounts from daily fluctuations in the market. Under the terms of the SAGIC group annuity contract participants may direct permitted withdrawal and/or transfer transactions of all or a portion of their balance in the SAGIC investment option at Contract Value. Contract Value is the relevant measure attributable to fully benefit-responsive investment contracts because contract value is the amount participants would receive if they were to initiate permitted transactions under the terms of the Plan. Contract Value represents contributions plus credited interest less participant withdrawals and fees.

The MMRS considers the SAGIC to be fully benefit responsive notwithstanding the market value events under SAGIC contract that limit the ability of the Plan to transact at Contract Value.

The average yield earned is calculated by dividing the annual interest credited to the plan during the Plan year by the average annual fair value (applicable for those plans that have been in-force with MMRS for more than one year). The average interest rate credited to participants is calculated by dividing the annual interest credited to the participants during the plan year by the average annual fair value (applicable for those plans that have been in-force with MMRS for more than one year). The average yield earned by the Plan and the average interest rate credited to the participants is the same, therefore, no adjustment is needed.

Certain events may limit the ability of the Plan to transact at Contract Value. Such events include, but may not be limited to, the following: (1) the complete or partial termination of the Plan; and (2) the establishment or activation of, or material change in any Plan investment fund, or an amendment to the Plan or a change in the administration or operation of the Plan, including the removal of a group of employees from Plan coverage as a result of the sale or liquidation of a subsidiary or a division or as a result of group layoffs or early retirement programs.

6. Plan Termination

AZZ Inc. Employee Benefit Plan and Trust

Notes to Financial Statements

Although it has not expressed any intent to do so, the Company has the right under the Plan to discontinue its contributions at any time and to terminate the Plan subject to the provisions of ERISA. In the event of Plan termination, participants will become 100% vested in their accounts.

7. Income Tax Status

The Plan uses a prototype plan sponsored by Prudential, and obtained its latest opinion letter on April 29, 2014, in which the IRS stated that the prototype Plan, as then designed, was in compliance with the applicable requirements of the IRC. The Plan has been amended since receiving the determination letter. However, the Plan administrator and the plan’s tax counsel believe that the plan is designed to be in compliance with the applicable requirements of the Internal Revenue Code.

U.S. GAAP requires Plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. The Plan administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2021 and December 31, 2020, there were no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) and believes the Plan is being operated in compliance with the applicable requirements of the Code and, therefore, believes that the Plan is qualified and the related trust continues to be tax exempt. Therefore, no provision for income taxes has been included in the Plan’s financial statements. The Plan is subject to routine audits by taxing jurisdictions. However, there are currently no audits for any tax periods in progress.

8. Related Party and Party-In-Interest Transactions

Certain investments of the Plan include shares of common stock of AZZ Inc. ("Plan Sponsor"). Transactions in the stock, as well as the notes receivable from participants, qualify as party-in-interest transactions. At December 31, 2021 and 2020, the Plan held 10,282 shares and 11,368 shares, respectively, of AZZ Inc. common stock. For the years ended December 31, 2021 and December 31, 2020, the Plan recorded investment gains on the AZZ Inc. stock of $82,598 and $15,844, respectively.

9. Delinquent Participant Contributions

The contributions for the year ended December 31, 2021, that were not segregated and remitted in a timely manner totaled $177,396, all of which was remitted during the year ended December 31, 2021.

The contributions for the year ended December 31, 2020, that were not segregated and remitted in a timely manner totaled $169,446, all of which was remitted during the year ending December 31, 2020.

Plan management intends to fully correct these late remittances by contributing lost earnings to participant accounts in 2022.

SUPPLEMENTAL SCHEDULES

SUPPLEMENTARY INFORMATION

AZZ Inc.

Employee Benefit Plan and Trust

Plan 001, EIN 75-0948250

Form 5500, Schedule H, Line 4a – Schedule of Delinquent Participant Contributions

For the Year Ended December 31, 2021

| | | | | | | | | | | | | | | | | |

| Participant Contributions Transferred Late to Plan | Total that Constitute Nonexempt Prohibited Transactions | Total Fully Corrected Under VFCP and PTE 2002-51 |

| Check Here if Late Participant Loan Repayments are included: | Contributions Not Corrected | Contributions Corrected Outside VFCP | Contributions Pending Correction in VFCP |

| 2020 | X | $ | 169,446 | | $ | — | | $ | — | | $ | — | |

| 2021 | X | $ | 177,396 | | $ | — | | $ | — | | $ | — | |

SUPPLEMENTARY INFORMATION

AZZ Inc.

Employee Benefit Plan and Trust

Plan 001, EIN 75-0948250

Form 5500, Schedule H, Line 4i – Schedule of Assets (Held at End of Year)

As of December 31, 2021

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | | (b)

Identity of issue, borrower,

lessor or similar party | | (c)

Description of investment including maturity date, rate of interest, collateral, par or maturity value | | (d)

Cost | | (e)

Current Value |

| | | | | | | | |

| | Mass Mutual Stable Value | | GIC | | ** | | $ | 10,983,488 | |

| | American Funds America Mutual R6 | | Intl/Global Large Growth | | ** | | 10,111,361 | |

| | American Funds New World R6 Fund | | Emerging Market Equity Fund | | ** | | 638,231 | |

| | T. Rowe Price | | Large Cap Growth I | | ** | | 19,868,967 | |

| | PGIM High Yield | | Mid Cap Growth | | ** | | 692,182 | |

| | Metwest Core Plus Bond Fund | | Intermediate Term Bond | | ** | | 8,762,682 | |

| | Fid Adv Intl App I | | Large Cap Value | | ** | | 8,053,958 | |

| | T. Rowe Price | | Retirement 2005 Fund | | ** | | 254,754 | |

| | T. Rowe Price | | Retirement 2010 Fund | | ** | | 168,815 | |

| | T. Rowe Price | | Retirement 2015 Fund | | ** | | 1,254,727 | |

| | T. Rowe Price | | Retirement 2020 Fund | | ** | | 6,566,513 | |

| | T. Rowe Price | | Retirement 2025 Fund | | ** | | 14,588,454 | |

| | T. Rowe Price | | Retirement 2030 Fund | | ** | | 18,343,293 | |

| | T. Rowe Price | | Retirement 2035 Fund | | ** | | 14,278,617 | |

| | T. Rowe Price | | Retirement 2040 Fund | | ** | | 10,096,346 | |

| | T. Rowe Price | | Retirement 2045 Fund | | ** | | 11,527,135 | |

| | T. Rowe Price | | Retirement 2050 Fund | | ** | | 7,843,167 | |

| | T. Rowe Price | | Retirement 2055 Fund | | ** | | 4,503,750 | |

| | T. Rowe Price | | Retirement 2060 Fund | | ** | | 2,772,887 | |

| | T. Rowe Price | | Retirement Balanced I | | ** | | 275,455 | |

| | Vanguard FTSE World Index Admiral | | Int/Global Large Core | | ** | | 960,730 | |

| | Vanguard Total Bond Market Index | | Intermediate Term Bond | | ** | | 2,152,972 | |

| | Vanguard 500 Index Admiral Fund | | Large Cap Core | | ** | | 15,855,677 | |

| | Vanguard Mid Cap Index Fund | | Mid Cap Core | | ** | | 8,239,161 | |

| | Vanguard RE IDX Admiral | | REIT | | ** | | 1,241,411 | |

| | Vanguard Small Cap Index Admiral Fund | | Small Cap Core | | ** | | 4,643,845 | |

| * | | AZZ Inc. | | AZZ Inc. common stock | | ** | | 568,500 | |

| | Prudential Mutual Funds | | AP Fund | | ** | | 130 | |

| * | | Participant Notes Receivable | | Interest rates ranging from 3.25% to 6.50% | | | | 4,868,024 | |

| | | | | | | | $ | 190,115,232 | |

| | | | | | | | |

| * | | Represents a party-in-interest to the Plan. | | | | |

| ** | Cost omitted for participant directed investments. | | | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | AZZ Inc. Employee Benefit Plan and Trust |

| | |

| | |

DATE: July 11, 2022 | By: | /s/ Philip A. Schlom |

| | Philip A. Schlom |

| | Chief Financial Officer |

EXHIBIT INDEX

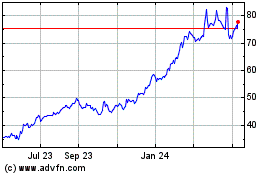

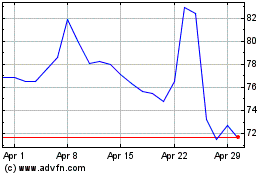

AZZ (NYSE:AZZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

AZZ (NYSE:AZZ)

Historical Stock Chart

From Apr 2023 to Apr 2024