Current Report Filing (8-k)

November 12 2020 - 6:27AM

Edgar (US Regulatory)

0000008947false00000089472020-11-102020-11-1000000089472020-04-222020-04-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

November 10, 2020

Date of Report (Date of earliest event reported)

AZZ Inc.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Texas

|

|

1-12777

|

|

75-0948250

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

One Museum Place, Suite 500

3100 West 7th Street

Fort Worth, Texas 76107

(Address of principal executive offices) (Zip Code)

(817) 810-0095

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

Common Stock

|

|

AZZ

|

|

New York Stock Exchange

|

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

AZZ Inc. (the "Company") has prepared presentation materials (the "Presentation Materials") that management intends to use from time to time on and after November 12, 2020 in presentations about the Company's performance and operations. The Company may use the Presentation Materials in presentations to current and potential investors, lenders, creditors, insurers, vendors, customers, employees and others with an interest in the Company and its business. A copy of the Presentation Materials is furnished as Exhibit 99.1 hereto and incorporated herein by reference into this Item 7.01.

The information in the Presentation Materials is summary information that should be considered within the context of the Company's filings with the Securities and Exchange Commission and other public announcements that the Company may make by press release or otherwise from time to time. The Presentation Materials speak as of the date of this Current Report on Form 8-K ("Current Report"). While the Company may elect to update the Presentation Materials in the future to reflect events and circumstances occurring or existing after the date of this Current Report, the Company specifically disclaims any obligation to do so.

The information in this Item 7.01 is being furnished and shall not be deemed "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information in this Item 7.01 shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

Item 8.01 Other Events.

On November 10, 2020, the Company's Board of Directors authorized a $100 million share repurchase program pursuant to which the Company may repurchase its issued and outstanding common stock, par value $1.00 per share (the “2020 Share Repurchase Program”). Repurchases under the 2020 Share Repurchase Program will be made through open market and/or private transactions, in accordance with applicable federal securities laws, and could include repurchases pursuant to Rule 10b5-1 trading plans, which allows stock repurchases when the Company might otherwise be precluded from doing so.

The 2020 Share Repurchase Program does not obligate the Company to acquire any particular amount of common stock or to acquire the shares during any particular timetable. The exact number of shares purchased and timing of such purchases, will be determined from time to time at the discretion of the Company. There can be no assurance of repurchases, as they depend upon a variety of factors including: changes in market conditions and economic circumstances; availability of acquisition opportunities; available funds in compliance with the Company’s financial covenants; the market price of the Company’s common stock; and the suspension or discontinuation of the 2020 Share Repurchase Program, among others.

On November 12, 2020, the Company issued a press release announcing the 2020 Share Repurchase Program, a copy of which is included as Exhibit 99.2 to this Current Report and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

The following exhibits are filed as part of this report.

|

|

|

|

|

|

|

|

Exhibit

|

Description

|

|

99.1

|

|

|

99.2

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

AZZ Inc.

|

|

Date: November 12, 2020

|

By: /s/ Tara D. Mackey

|

|

|

Tara D. Mackey

Chief Legal Officer and Secretary

|

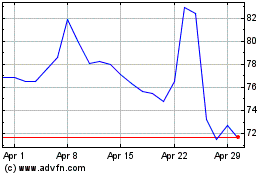

AZZ (NYSE:AZZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

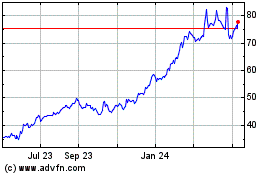

AZZ (NYSE:AZZ)

Historical Stock Chart

From Apr 2023 to Apr 2024