Investors in Auto-Parts Retailers Are Tapping the Brakes -- Update

August 13 2019 - 5:07PM

Dow Jones News

By Jessica Menton

Shares of auto-parts retailers are tapping the brakes a bit

after ramping higher than the broader market for the past year.

Two big sellers of replacement parts have posted disappointing

sales of late, worrying some investors. Advance Auto Parts Inc. cut

its sales outlook for the year on Tuesday while reporting mixed

second-quarter earnings. Shares ticked up less than 0.1% after

sliding as much as 9.3% in premarket trading. O'Reilly Auto Parts

Inc. also reported mixed earnings last month and gave

weaker-than-expected profit guidance for the year.

Since the end of July, shares of Advance, O'Reilly and AutoZone

Inc. are down 5.6%, 1.9% and 3.7%, falling more than the S&P

500's 1.8% decline. AutoZone is expected to report earnings next

month.

Some investors don't expect these companies to thrive with a

backdrop of a slowing global economy, said Brian Sterz, portfolio

manager at Miracle Mile Advisors, which has $1.7 billion in assets

under management.

"The consumer has been resilient, but that looks like the last

leg standing as we begin to see some signs of strain with

credit-card and mortgage defaults beginning to tick up," Mr. Sterz

said. "With record unemployment in the U.S., it's hard to see how

it gets better from here."

Those declines are largely a reversal from how parts sellers

have performed over the past year. They have marched higher,

largely able to avoid the steep declines suffered by traditional

bricks-and-mortar retailers. O'Reilly and AutoZone are up 19% and

48%, respectively, over the past 12 months, outperforming the

S&P 500's 3.7% rise. Advance has fallen 1.8%.

One reason parts sellers have done well over the past year,

analysts say, is because Americans are keeping their cars longer,

which has helped service shops and parts makers. The average age of

cars and light trucks in 2019 rose to 11.8 years old, according to

IHS Markit. The firm, which collects vehicle-registration data,

estimates a record level of more than 278 million light vehicles

are in operation.

"People are owning their cars longer and that's going to lead to

a trend of self maintenance, whereas new cars are typically handled

through dealers," Mr. Sterz said.

Write to Jessica Menton at Jessica.Menton@wsj.com

(END) Dow Jones Newswires

August 13, 2019 16:52 ET (20:52 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

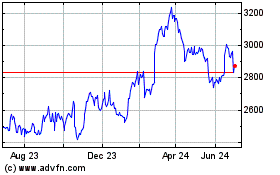

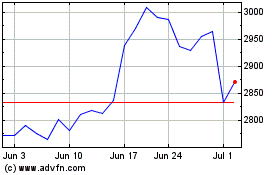

AutoZone (NYSE:AZO)

Historical Stock Chart

From Mar 2024 to Apr 2024

AutoZone (NYSE:AZO)

Historical Stock Chart

From Apr 2023 to Apr 2024