UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 40-F

|

|

|

|

|

|

¨

|

REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

OR

|

|

x

|

ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

|

For the fiscal year ended June 30, 2019

|

Commission File Number: 001-38691

|

AURORA CANNABIS INC.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

British Columbia, Canada

|

|

2833

|

|

N/A

|

|

(Province or Other Jurisdiction of Incorporation or Organization)

|

|

(Primary Standard Industrial Classification Code)

|

|

(I.R.S. Employer

Identification No.)

|

Suite 500 – 10355 Jasper Avenue

Edmonton, Alberta

Canada T5J 1Y6

Tel: 1-844-928-7672

(Address and telephone number of Registrant’s principal executive offices)

CORPORATION SERVICE COMPANY

251 Little Falls Drive

County of New Castle

Wilmington, Delaware 19808

Tel: 1-800-927-9800

(Name, address (including zip code) and telephone number (including

area code) of agent for service in the United States)

Securities registered or to be registered pursuant to section 12(b) of the Act:

|

|

|

|

|

|

Title of Each Class

|

Name of Each Exchange on Which Registered:

|

|

Common Shares, no par value

Rights to purchase Common Shares, without par value

|

New York Stock Exchange

|

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

For annual reports, indicate by check mark the information filed with this Form:

|

|

|

|

|

|

|

|

x

|

Annual Information Form

|

x

|

Audited Annual Financial Statements

|

Indicate the number of outstanding shares of each of the Registrant’s classes of capital or common stock as of the close of the period covered by the annual report: 1,017,438,744

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the Registrant was required to submit and post such files).

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company x

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ¨

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

INTRODUCTORY INFORMATION

Aurora Cannabis Inc. (the “Company” or “Aurora”) is a “foreign private issuer” as defined in Rule 3b-4 under Securities Exchange Act of 1934, as amended (the “Exchange Act”), and is a Canadian issuer eligible to file its annual report pursuant to Section 13 of the Exchange on Form 40-F pursuant to the multi-jurisdictional disclosure system (the “MJDS”) adopted by the United States Securities and Exchange Commission (the “SEC”). The Company’s common shares are listed on the Toronto Stock Exchange and the New York Stock Exchange under the trading symbol “ACB”.

In this annual report, references to “we”, “our”, “us”, the “Company” or “Aurora”, mean Aurora Cannabis Inc. and our wholly-owned subsidiaries, unless the context suggests otherwise.

Unless otherwise indicated, all amounts in this annual report are in Canadian dollars and all references to “$” mean Canadian dollar and references to “U.S. dollars” or “US$” are to United States dollars.

AUDITED FINANCIAL STATEMENTS, MANAGEMENT'S DISCUSSION AND ANALYSIS

AND ANNUAL INFORMATION FORM

The following principal documents are filed as exhibits to, and incorporated by reference into, this Annual Report:

|

|

|

|

|

|

Document

|

Exhibit No.

|

|

Audited consolidated financial statements of the Company and notes thereto as at and for the year ended June 30, 2019, together with the report thereon of the independent registered public accounting firm

|

99.5

|

|

Management’s Discussion and Analysis of the Company for the year ended June 30, 2019 (the “MD&A”)

|

99.6

|

|

Annual Information Form of the Company for the year ended June 30, 2019 (the “AIF”)

|

99.7

|

FORWARD-LOOKING STATEMENTS

This Annual Report includes or incorporates by reference certain statements that constitute “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 (collectively, “forward-looking statements” or “FLS”). These forward-looking statements are made as of the date of this Annual Report and the Company does not intend, and does not assume any obligation, to update these FLS, except as required under applicable securities legislation. FLS relate to future events or future performance and reflect Company management’s expectations or beliefs regarding future events. In certain cases, FLS can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved” or the negative of these terms or comparable terminology. In this document, certain forward-looking statements are identified by words including “may”, “future”, “expected”, “intends” and “estimates”. By their very nature FLS involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the FLS. The Company provides no assurance that FLS will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on FLS. Certain FLS in this Annual Report and the documents incorporated by reference include, but are not limited to the following:

|

|

|

|

•

|

pro forma measures including revenue, registered medical patients and grams produced;

|

|

|

|

|

•

|

the completion of construction of production facilities, associated costs, and receipt of licenses from Health Canada to produce and sell cannabis and cannabis related products from these facilities;

|

|

|

|

|

•

|

the successful integration of CanniMed and MedReleaf and other subsidiaries into Aurora’s operations;

|

|

|

|

|

•

|

strategic investments and capital expenditures, and related benefits;

|

|

|

|

|

•

|

future growth expansion plans;

|

|

|

|

|

•

|

expectations regarding production capacity, costs and yields; and

|

|

|

|

|

•

|

product sales expectations and corresponding forecasted increases in revenues.

|

The above and other aspects of the Company’s anticipated future operations are forward-looking in nature and, as a result, are subject to certain risks and uncertainties. Although the Company believes that the expectations reflected in these FLS are reasonable, undue reliance should not be placed on them as actual results may differ materially from the forward-looking statements. Such FLS are estimates reflecting the Company’s best judgment based upon current information and involve a number of risks and uncertainties,

and there can be no assurance that other factors will not affect the accuracy of such forward-looking statements. These risks include, but are not limited to, the ability to retain key personnel, the ability to continue investing in infrastructure to support growth, the ability to obtain financing on acceptable terms, the continued quality of our products, customer experience and retention, the development of third party government and non-government consumer sales channels, management’s estimates of consumer demand in Canada and in jurisdictions where the Company exports, expectations of future results and expenses, the availability of additional capital to complete construction projects and improvements to facilities, the risk of unsuccessful integration of acquired business and operations, management’s estimation that selling, general and administrative expense will grow only in proportion to revenue growth, the ability to expand and maintain distribution capabilities, the impact of competition, the general impact of financial market conditions, the yield from cannabis growing operations, product demand, changes in prices of required commodities, competition, and the possibility of changes in laws, rules, and regulations in the industry as well as updates provided herein. See also “Description of the Business - Risk Factors” in the AIF.

This discussion, and the discussion of risk factors contained in the AIF and MD&A incorporated by reference herein, are not exhaustive of the factors that may affect any of forward-looking statements or information concerning the Company.

NOTE TO UNITED STATES READERS:

DIFFERENCES IN UNITED STATES AND CANADIAN REPORTING PRACTICES

The Company is permitted to prepare this Annual Report in accordance with Canadian disclosure requirements, which are different from those of the United States. The Company has historically prepared its consolidated financial statements in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards Board, which differ in certain respects from United States generally accepted accounting principles (“US GAAP”) and from practices prescribed by the SEC. Therefore, the Company’s financial statements incorporated by reference in this Annual Report may not be comparable to financial statements prepared in accordance with U.S. GAAP.

CURRENCY

Unless otherwise indicated, all dollar amounts in this Annual Report are in Canadian dollars. The exchange rate of Canadian dollars into United States dollars, on June 28, 2019 based upon the daily exchange rate as quoted by the Bank of Canada was U.S.$1.00 = Cdn.$1.3087.

CONTROLS AND PROCEDURES

Disclosure Controls and Procedures

Disclosure controls and procedures are defined in Rule 13a-15(e) and 15d-15(e) under the Exchange Act to mean controls and other procedures of an issuer that are designed to ensure that information required to be disclosed by the issuer in the reports that it files or submits under the Exchange Act is recorded, processed, summarized, and reported, within the time periods specified in the SEC’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under the Exchange Act is accumulated and communicated to the issuer’s management, including principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.

As of the end of the period covered by this report, our management carried out an evaluation, under the supervision of our Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”), of the effectiveness of the Company’s disclosure controls and procedures. Based upon that evaluation, our CEO and CFO concluded that, as of the end of the period covered by this report, the Company’s disclosure controls and procedures were effective in providing reasonable assurance that the information required to be disclosed by the Company in reports that we file or submit to the SEC under the Exchange Act is:

|

|

|

|

•

|

recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms, and

|

|

|

|

|

•

|

accumulated and communicated to our management, including our CEO and CFO, as appropriate, to allow timely decisions regarding required disclosure.

|

It should be noted that while our CEO and CFO believe that the Company's disclosure controls and procedures provide a reasonable level of assurance that they are effective, they do not expect that the Company's disclosure controls and procedures or internal control over financial reporting will prevent all errors and fraud. A control system, no matter how well conceived or operated, can provide only reasonable, not absolute, assurance that the objectives of the control system will be met.

Management's Report on Internal Control over Financial Reporting

This Annual Report does not include a report of management’s assessment regarding internal control over financial reporting due to a transition period established by rules of the SEC for newly established public companies.

No Auditor's Attestation Report

This Annual Report does not include an attestation report of the Company’s independent registered public accounting firm relating to the Company’s internal control over financial reporting due to a transition period established by rules of the SEC for newly public companies. In addition, as an “emerging growth company” (as such term is defined in Rule 12b-2 under the Exchange Act), the Company otherwise would not be required to provide such a report. The Company will be required to provide an attestation report when it no longer qualifies as an emerging growth company.

Changes in Internal Control over Financial Reporting

During the period covered by this Annual Report, no significant changes occurred in the Company’s internal controls over financial reporting that materially affected, or is reasonably likely to materially affect, the Company’s internal control over financial reporting. Given the fast pace of ongoing expansion of the business, management has also performed additional account reconciliations and other analytical and substantive procedures to ensure reliable financial reporting and the preparation of financial statements in accordance with IFRS.

CORPORATE GOVERNANCE

The Company’s Board of Directors (the “Board”) is responsible for the Company’s corporate governance and has the following separately-designated standing committees: the Nominating and Corporate Governance Committee, the Human Resources and Compensation Committee, the Audit Committee and the Science Committee. The charters of each committee can be viewed on the Company’s corporate website at https://investor.auroramj.com/about-aurora/corporate-governance/. In addition, the Company’s Audit Committee Charter is attached as Schedule “A” to the Annual Information Form, which is filed as Exhibit 99.7 to this Annual Report.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee (the “N&CG Committee”) is responsible for screening nominees to the Board. The N&CG Committee annually assesses the skills and qualifications of directors and nominees to ensure the members of the board of directors have the requisite skills and qualifications to meet the current needs of the Company. This N&CG Committee meets as required to review and make recommendations to the board of directors on all direct and indirect compensation, benefits and perquisites for senior management and directors of the Company. The N&CG Committee is comprised of Norma Beauchamp (Chair), Ronald Funk and Jason Dyck. The Board has determined that all three members of the N&CG Committee are independent, based on the criteria for independence prescribed by Section 303A.02 of the NYSE Listed Company Manual.

Human Resources and Compensation Committee

The Human Resources and Compensation Committee (the “HR&C Committee”) is responsible for (a) reviewing and approving directors’ and executive compensation based on the Company’s goals and objectives, (b) reviewing and approving the Company’s incentive compensation and equity-based plans and arrangements, and (c) reporting regularly to the Board on the activities of the HR&C Committee. To make its recommendation on directors’ and executive officer compensation, the HR&C Committee takes into account the types of compensation and the amounts paid to directors and executive officers of comparable publicly traded Canadian companies. The HR&C Committee is comprised of Adam Szweras (Chair), Norma Beauchamp and Ronald Funk. The Board has determined that all of the members of the HR&C Committee are independent, based on the criteria for independence prescribed by Section 303A.02 of the NYSE Listed Company Manual.

Science Committee

The Science Committee reviews all ongoing research initiatives, provides strategic advice and brings recommendations to the Board and management regarding all scientific matters involving the Company’s research and discovery science programs, including research progress, strategic research direction, research team governance, research priorities, the acquisition of potential product opportunities and new research team nominees. The Science Committee is comprised of Jason Dyck (Chair), Norma Beauchamp

and Margaret Shan Atkins. The Board has determined that all of the members of the Committee are independent, based on the criteria for independence prescribed by Section 303A.02 of the NYSE Listed Company Manual.

AUDIT COMMITTEE

Our Board has established a separately-standing Audit Committee in accordance with Section 3(a)(58)(A) of the Exchange Act and Section 303A.06 of the NYSE Listed Company Manual for the purpose of overseeing our accounting and financial reporting processes and the audit of our annual financial statements.

The Audit Committee is comprised of Margaret Shan Atkins (Chair), Adam Szweras and Ronald Funk. Our Board has determined that the Audit Committee meets the composition requirements set forth by Section 303A.07 of the NYSE Listed Company Manual, and that each of the members of the Audit Committee is independent as determined under Rule 10A-3 of the Exchange Act and Section 303A.02 of the NYSE Listed Company Manual. All three members of the Audit Committee are financially literate, meaning they are able to read and understand the Company’s financial statements and to understand the breadth and level of complexity of the issues that can reasonably be expected to be raised in the Company’s financial statements.

Our Board has determined that Margaret Shan Atkins qualifies as an “audit committee financial expert” (as defined in paragraph (8)(b) of General Instruction B to Form 40-F), has financial management expertise (pursuant to section 303A.07 of the NYSE Listed Company Manual) and is independent (as determined under Exchange Act Rule 10A-3 and section 303A.02 of the NYSE Listed Company Manual).

PRE-APPROVAL OF AUDIT AND NON-AUDIT SERVICES PROVIDED BY

INDEPENDENT AUDITOR

The Audit Committee Charter sets out responsibilities regarding the provision of non-audit services by the Company’s external auditors and requires the Audit Committee to pre-approve all permitted non-audit services to be provided by the Company’s external auditors, in accordance with applicable law.

PRINCIPAL ACCOUNTING FEES AND SERVICES - INDEPENDENT AUDITORS

The following table sets forth information regarding amounts billed to us by our independent auditor for each of our last two fiscal years ended June 30 in Canadian dollars:

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Period Ending

|

Audit Fees ($)(1)

|

|

Audit Related Fees ($)(2)

|

|

Tax Fees ($)(3)

|

|

All Other Fees ($)(4)

|

|

|

2019

|

1,655,500

|

|

19,341

|

|

967,352

|

|

—

|

|

|

2018 (5)

|

890,000

|

|

—

|

|

15,345

|

|

—

|

|

Notes

|

|

|

|

(1)

|

“Audit Fees” includes fees for the performance of the annual audit and quarterly reviews of the financial statements, which includes the audit of significant transactions and matters.

|

|

|

|

|

(2)

|

“Audit-Related Fees” includes fees for assurance related services that have not been reflected under (1). This includes, but is not limited to, the review of the Annual Information Form, consultations on new accounting standards and matters and audit or attest services not required by legislation or regulation.

|

|

|

|

|

(3)

|

“Tax Fees” includes fees for tax compliance, tax planning, tax structuring and tax advice. The Company incurred $176,000 of tax compliance fees for the financial period ending June 30, 2019.

|

|

|

|

|

(4)

|

“All Other Fees” refers to fees for ad hoc projects, which include reviews of prospectus and financing documents.

|

|

|

|

|

(5)

|

MNP LLP, Chartered Professional Accountants (“MNP”), was the auditor of Aurora for Aurora’s financial year ended June 30, 2018. MNP resigned as the auditors of Aurora, effective July 1, 2018, the beginning of Aurora’s fiscal year 2019, to facilitate the appointment of KPMG. For more information, refer to the Notice of Change of Auditor dated September 25, 2018 filed under Aurora’s SEDAR profile on October 3, 2018. The 2018 external auditor fees were billed by MNP.

|

Audit Committee Pre-Approval Policies

From time to time, management of the Company recommends to, and requests approval from, the audit committee for audit and non-audit services to be provided by the Company's auditor.

The Audit Committee may delegate to one or more of its members the authority to pre-approve non-audit services to be provided to the Company or its subsidiaries by the Company’s external auditor. The pre-approval of non-audit services must be presented to the Audit Committee at its first scheduled meeting following such pre-approval.

The Audit Committee may satisfy its duty to pre-approve non-audit services by adopting specific policies and procedures for the engagement of the non-audit services, provided the policies and procedures are detailed as to the particular service, the Audit Committee is informed of each non-audit service and the procedures do not include delegation of the Audit Committee’s responsibilities to management.

OFF-BALANCE SHEET ARRANGEMENTS

The Company has not entered into any “off-balance sheet arrangements”, as defined in General Instruction B(11) to Form 40-F, that have or are reasonably likely to have a current or future effect on the Company's financial condition, changes in financial condition, revenues, expenses, results of operations, liquidity, capital expenditures or capital resources that are material to investors.

CODE OF ETHICS

We have adopted a Code of Business Conduct and Ethics (the “Code”) that applies to our officers (including without limitation, the CEO, CFO and other high-ranking financial officers), employees and directors of the Company and its subsidiaries and promotes, among other things, honest and ethical conduct. The Code meets the requirements for a “code of ethics” within the meaning of that term under Form 40-F. The Code of Ethics was reviewed and approved by the Company’s Board of Directors on October 11, 2018. The Code is available under the Company’s profile on www.SEDAR.com and on the Company's website at https://investor.auroramj.com/about-aurora/corporate-governance/.

No substantive amendments were made to the Code during the fiscal year ended June 30, 2019, and no waivers of the Code were granted to any principal officer of the Company or any person performing similar functions during the fiscal year ended June 30, 2019.

TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS

The following table lists, as of June 30, 2019, information with respect to the Company’s known contractual obligations (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payments due by period

|

|

|

Total

($)

|

Less than one year

($)

|

1 - 3

years

($)

|

3 - 5

years

($)

|

More than 5 years

($)

|

|

Long-Term Debt Obligations

|

737,780

|

|

50,427

|

|

186,186

|

|

501,167

|

|

—

|

|

|

Capital (Finance) Lease Obligations

|

1,529

|

|

449

|

|

763

|

|

317

|

|

—

|

|

|

Operating Lease Obligations

|

92,591

|

|

11,348

|

|

20,399

|

|

19,188

|

|

41,656

|

|

|

Contingent Consideration (1)

|

60,769

|

|

53,512

|

|

7,257

|

|

—

|

|

—

|

|

|

Purchase Obligations (2)

|

387,561

|

|

249,658

|

|

38,097

|

|

41,779

|

|

58,027

|

|

|

Provisions

|

4,200

|

|

4,200

|

|

—

|

|

—

|

|

—

|

|

|

Other long-term liabilities reflected on Aurora’s balance sheet (3)

|

269,281

|

|

—

|

|

—

|

|

177,395

|

|

91,886

|

|

|

Total

|

1,553,711

|

|

369,594

|

|

252,702

|

|

739,846

|

|

191,569

|

|

Notes:

|

|

|

|

(1)

|

Contingent consideration represents the gross amount estimated to be paid out on achievement of future performance milestones related to acquisitions.

|

|

|

|

|

(2)

|

Purchase obligations include capital commitments, licensing and sponsorship fees.

|

|

|

|

|

(3)

|

Other long-term liabilities reflected on the balance sheet as at June 30, 2019, includes derivative liabilities and deferred tax liabilities.

|

NOTICES PURSUANT TO REGULATION BTR

There were no notices required by Rule 104 of Regulation BTR that the Company sent during the year ended June 30, 2019 concerning any equity security subject to a blackout period under Rule 101 of Regulation BTR.

NYSE CORPORATE GOVERNANCE

The Company complies with corporate governance requirements of both the TSX and the NYSE. As a foreign private issuer the Company is not required to comply with all of the corporate governance requirements of the NYSE; however, the Company adopts best practices consistent with domestic NYSE listed companies when appropriate to its circumstances.

The Company has reviewed the NYSE corporate governance requirements and confirms that, except as described below, the Company is in compliance with the NYSE corporate governance standards in all significant respects:

Shareholder Meeting Quorum Requirement: The NYSE is of the opinion that the quorum required for any meeting of shareholders should be sufficiently high to ensure a representative vote. The Company’s quorum requirement is set forth in its Articles. A quorum for a meeting of shareholders of the Company is present if there are two persons who are, or who represent by proxy, one or more shareholders who, in the aggregate, hold at least five percent of the issued common shares. This is consistent with the laws, customs and practices in Canada.

Proxy Delivery Requirement: The NYSE requires the solicitation of proxies and delivery of proxy statements for all shareholder meetings and requires that these proxies shall be solicited pursuant to a proxy statement that conforms to SEC proxy rules. The Company is a “foreign private issuer” as defined in Rule 3b-4 under the Exchange Act, and the equity securities of the Company are accordingly exempt from the proxy rules set forth in Sections 14(a), 14(b), 14(c) and 14(f) of the Exchange Act. The Company solicits proxies in accordance with applicable rules and regulations in Canada.

Shareholder Approval Requirement: The NYSE requires shareholder approval for issuances of common shares, or any securities convertible or exercisable into common shares:

|

|

|

|

(a)

|

to directors, officers or substantial security holders of the Company (each, a “Related Party”), a subsidiary, affiliate or other closely-related person of a Related Party or any company or entity in which a Related Party has a substantial interest, where the number of common shares, or the number of common shares into which the securities are convertible or exercisable, exceeds either (i) 1% of the outstanding common shares before the issuance; or (ii) 1% of the voting power of the outstanding common shares before the issuance, in either case except for substantial security holders paying cash and full book and market value for less than 5% of the number of common shares and voting power outstanding before the issuance;

|

|

|

|

|

(b)

|

the common shares, or the number of common shares into which the securities are convertible or exercisable, constitute at least (i) 20% of the voting power of the outstanding common shares before the issuance; or (ii) 20% of the outstanding common shares before the issuance, in either case except for public offerings of common shares for cash and private financings involving sales of common shares at a price, or securities convertible or exercisable into common shares with a conversion or exercise price, of at least the market values of the common shares; and

|

|

|

|

|

(c)

|

where the issuance would result in a change of control of the Company.

|

The Company will follow TSX rules for shareholder approval of new issuances of its common shares, in lieu of the foregoing requirements of the NYSE. Following TSX rules, shareholder approval is required for certain issuances of shares that: (i) materially affect control of the listed issuer; or (ii) provide consideration to insiders in aggregate of 10% or greater of the market capitalization of the listed issuer, during any six-month period, and has not been negotiated at arm's length. Shareholder approval is also required, pursuant to TSX rules, in the case of private placements: (a) for an aggregate number of listed securities issuable greater than 25% of the number of securities of the listed issuer which are outstanding, on a non-diluted basis, prior to the date of closing of the transaction if the price per security is less than the market price; or (b) that during any six month period are to insiders for listed securities or options, rights or other entitlements to listed securities greater than 10% of the number of securities of the listed issuer which are outstanding, on a non-diluted basis, prior to the date of the closing of the first private placement to an insider during the six month period. The rules of the TSX also require shareholder approval in connection with an acquisition by a listed issuer where the number of securities issued or issuable in payment of the purchase price for the acquisition exceeds 25% of the number of securities of the listed issuer that are outstanding, on a non-diluted basis.

Equity Compensation Plans: The NYSE also requires shareholder approval of all plans or other arrangements that provide for equity securities as compensation to employees, directors or service providers, and any material revisions to such plans or arrangements, except for certain plans and arrangements, including:

|

|

|

|

(a)

|

those plans or arrangements allowing employees, directors or service providers to buy such securities on the open market or from the Company for current fair market value;

|

|

|

|

|

(b)

|

grants of options or other equity-based compensation as a material inducement upon hiring or to new employees in connection with a merger or acquisition; and

|

|

|

|

|

(c)

|

conversions, replacements or adjustments of outstanding options or other equity compensation awards to reflect a merger or acquisition.

|

The TSX requires shareholder approval of all security based compensation arrangements, and any material amendments to such arrangements, except for arrangements used as an inducement to persons or companies not previously employed by and not previously an insider of the listed issuer, provided that: (i) such persons or companies enter into a contract of full time employment as an officer of the listed issuer; and (ii) the number of securities made issuable to such persons or companies during any twelve month period does not exceed in aggregate 2% of the number of securities of the listed issuer which are outstanding, on a non-diluted basis, prior to the date the exemption is first used during such twelve month period. Such shareholder approval is required when the security-based arrangement is instituted and every three years thereafter if the arrangement does not have a fixed maximum aggregate of securities issuable. The TSX considers a security-based compensation arrangement to be any compensation or incentive mechanism involving the issuance from treasury or potential issuance from treasury of securities of a listed issuer.

Insiders of a listed issuer that are entitled to receive a benefit under a security-based compensation arrangement are not eligible to vote their securities in respect of the shareholder approval required by the TSX unless such security-based compensation arrangement contains an “insider participation limit”. An “insider participation limit” is a provision typically found in security-based compensation arrangements which limits the number of a listed issuer’s securities: (i) issued to insiders of the listed issuer, within any one-year period; and (ii) issuable to insiders of the listed issuer at any time, to 10% of the listed issuer’s total issued and outstanding securities.

For the purposes of security-based compensation arrangements, the definition of “insider” would include the CEO, CFO, all directors of the listed issuer and its major subsidiaries, any person responsible for a principal business unit, division or function, and any shareholder that has beneficial ownership or control or direction over, more than 10% of the issued and outstanding common shares of the listed issuer. The Company obtains shareholder approval of its equity compensation plans in accordance with applicable rules and regulations of the TSX.

Compensation and Corporate Governance Committee Independence Requirement: The NYSE requires listed companies to have a compensation committee and a nominating/corporate governance committee, each of which must be composed entirely of independent directors, as determined using the criteria prescribed by Section 303A.02 of the NYSE Listed Company Manual. The NYSE rules permit listed companies to allocate the responsibilities of the compensation and nominating/corporate governance committees to committees of their own denomination provided that the committees are composed entirely of independent directors.

The Company has a separately-designated standing Nominating and Corporate Governance Committee, and a separately-designated standing Human Resources and Compensation Committee. The Board of Directors has determined that all three members of the Nominating and Corporate Governance Committee (Norma Beauchamp (Chair), Ronald Funk and Jason Dyck) are independent, and all three members of the Human Resources and Compensation Committee (Adam Szweras (Chair), Norma Beauchamp and Ron Funk) are independent.

The foregoing is consistent with the laws, customs and practices in Canada.

MINE SAFETY DISCLOSURE

Not applicable.

UNDERTAKING

The Company undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered

pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

CONSENT TO SERVICE OF PROCESS

The Company has previously filed with the SEC a written consent to service of process on Form F-X. Any change to the name or address of the Company’s agent for service shall be communicated promptly to the SEC by amendment to the Form F-X referencing the file number of the Company.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Company certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this annual report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

Date: September 11, 2019

|

AURORA CANNABIS INC.

|

|

|

|

By:

|

/s/ Terry Booth

|

|

|

|

|

Terry Booth

Chief Executive Officer

|

|

EXHIBIT INDEX

|

|

|

|

|

|

Exhibit Number

|

Exhibit Description

|

|

|

|

|

99.1

|

|

|

99.2

|

|

|

99.3

|

|

|

99.4

|

|

|

99.5

|

|

|

99.6

|

|

|

99.7

|

|

|

99.8

|

|

|

101.INS

|

XBRL Instance

|

|

101.SCH

|

XBRL Taxonomy Extension Schema

|

|

101.CAL

|

XBRL Taxonomy Extension Calculation Linkbase

|

|

101.DEF

|

XBRL Taxonomy Extension Definition Linkbase

|

|

101.LAB

|

XBRL Taxonomy Extension Label Linkbase

|

|

101.PRE

|

XBRL Taxonomy Extension Presentation Linkbase

|

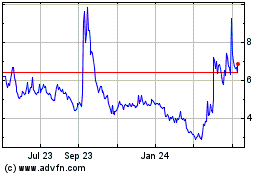

Aurora Cannabis (NASDAQ:ACB)

Historical Stock Chart

From Mar 2024 to Apr 2024

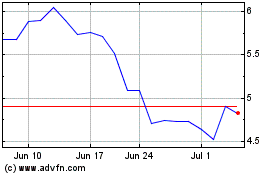

Aurora Cannabis (NASDAQ:ACB)

Historical Stock Chart

From Apr 2023 to Apr 2024