UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of March, 2021

Commission File Number 001-36671

Atento S.A.

(Translation of Registrant's name into

English)

1 rue Hildegard Von Bingen

L-1282, Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F: x Form

40-F: o

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes: o No: x

Note: Regulation S-T Rule 101(b)(1) only permits

the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes: o No: x

Note: Regulation S-T Rule 101(b)(7)

only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign

private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled

or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which

the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to

be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been

the subject of a Form 6-K submission or other Commission filing on EDGAR.

Atento Reports

Fiscal 2020 Fourth Quarter and Full Year Results

Solid Q4 and FY 2020

with increased profitability and strong cash flow generation;

Debt refinancing concluded

in Q1 2021;

Confidence in growing

opportunities and improving future results

NEW

YORK, March 3, 2021 – Atento S.A. (NYSE: ATTO) (“Atento” or the “Company”), the largest

provider of customer relationship management and business-process outsourcing services in Latin America, and among the top five

providers globally, today announced its fourth quarter and full-year operating and financial results for the period ending December

31, 2020. All comparisons in this announcement are year-over-year (YoY) and in constant-currency (CCY), unless noted otherwise.

Solid

Q4 and FY 2020 with increased profitability and strong cash flow generation

|

|

•

|

Q4 revenues grew 1.6%

on a CCY basis with consistent growth in Multisector across all regions driven by Next Generation Services primarily to Brazilian

and US clients

|

|

|

•

|

Strong Q4 2020 EBITDA

growth, with Consolidated EBITDA margin of 14.5%

|

|

|

•

|

Brazil:

18.4%; Americas:

14.7%; EMEA:

16.1%

|

|

|

•

|

FY Multisector revenues

increased 4.9%, reaching 68.2% of total revenues, 3.4 percentage points higher than FY 2019

|

|

|

•

|

FY 2020 Consolidated

EBITDA growth of 23.1% on a CCY basis, and 5.1% on a reported basis, despite the pandemic and a 30% BRL devaluation in the period

|

|

|

•

|

Solid improvement in

Operating Cash Flow during the year, leading to FCF generation of $40 million in 2020

|

Enhancing

operational efficiencies

|

|

•

|

Continued transformation

of the cost structure, with approximately $60 million carry forward effect to 2021

|

|

|

•

|

Delivering operational

excellence: Everest star performer and leader in 2021 Gartner Magic Quadrant

|

Successful

debt refinancing and healthy balance sheet

|

|

•

|

Healthy balance sheet

with solid cash position of $209 million

|

|

|

•

|

Net debt reduction of

13% versus Dec 2019, with leverage decreasing 70 basis points to 3.2x

|

|

|

•

|

Successfully concluded

debt refinancing in Q1 2021, extending average debt life to 4.5 years

|

Innovation

driving growth

|

|

•

|

First company in sector

globally to be awarded with ISO 56002 Innovation certification

|

|

|

•

|

First company in sector

globally to launch a startup accelerator (Atento Next) aimed at creating and developing new capabilities and enriching product

portfolio

|

Introducing

Fiscal 2021 Guidance

|

|

•

|

Revenue growth of Mid-Single

Digit, with EBITDA Margin between 12.5% to 13.5%

|

|

|

•

|

Leverage improvement

to 2.5x - 3.0x range

|

Summarized Consolidated

Financials

|

($ in millions except EPS)

|

Q4 2020

|

Q4 2019

|

CCY

Growth (1)

|

FY 2020

|

FY 2019

|

CCY

Growth (1)

|

|

Income Statement (6)

|

|

|

|

|

|

|

|

Revenue

|

369.6

|

417.2

|

1.6%

|

1,412.3

|

1,707.3

|

-2.8%

|

|

EBITDA (2)

|

53.5

|

20.7

|

148.6%

|

161.2

|

153.4

|

23.1%

|

|

EBITDA Margin

|

14.5%

|

5.0%

|

9.5 p.p.

|

11.4%

|

9.0%

|

2.4 p.p.

|

|

Net Income (3)

|

(7.9)

|

(29.6)

|

-68.6%

|

(46.8)

|

(80.7)

|

-35.6%

|

|

Recurring Net Income (2)

|

4.5

|

(13.5)

|

N.M.

|

(10.1)

|

(23.9)

|

-65.0%

|

|

Earnings Per Share in the reverse split basis (2) (3) (5)

|

($0.57)

|

($2.13)

|

-68.8%

|

($3.32)

|

($5.59)

|

-33.9%

|

|

Recurring EPS in the reverse split basis (2) (5)

|

0.32

|

(0.97)

|

N.M.

|

(0.72)

|

(1.65)

|

-64.1%

|

|

Cash Flow, Debt and Leverage

|

|

|

|

|

|

|

|

Net Cash Used In Operating Activities

|

60.1

|

49.2

|

|

128.2

|

46.5

|

|

|

Cash and Cash Equivalents

|

209.0

|

124.7

|

|

|

|

|

|

Net Debt (4)

|

517.6

|

595.6

|

|

|

|

|

|

Net Leverage (4)

|

3.2x

|

3.9x

|

|

|

|

|

(1) Unless otherwise noted, all results are

for Q4 and FY 2020; all revenue growth rates are on a constant currency basis, year-over-year; (2) EBITDA, Recurring Net Income/Recurring

Earnings per Share (EPS) are Non-GAAP measures; (3) Reported Net Income and Earnings per Share (EPS) include the impact of non-cash

foreign exchange gains/losses on intercompany balances; (4) Includes IFRS 16 impact in Net Debt and Leverage; (5) Earnings per

share and Recurring Earnings per share in the reverse split basis is calculated by applying the ratio of conversion of 5.027090466672970

used in the reverse split into the previous weighted average number of ordinary shares outstanding. (6) The following selected

financial information are preliminary, unaudited and are based on management's initial review of operations for the fourth quarter

and year ended December 31, 2020 and remain subject to the completion of the Company's customary annual closing and review procedures.

Final adjustments and other material developments may arise between the date hereof and the filing of the Company's Annual Report

on Form 20-F.

Message from

the CEO and CFO

We are pleased to report

that 2020 marked the consolidation of Atento’s Three Horizon Plan, which is based on substantially improving our operational

efficiency, promoting our next generation services and driving new avenues of growth, even amid the challenging environment imposed

by the pandemic. We are incredibly proud of and thankful to our employees who worked very hard to help us overcome the numerous

complex challenges arising from the pandemic, allowing us to continue growing and leading Next Generation CX in Latin America.

We are happy to report

that our EBITDA grew 23.1% in the year, reaching 11.4% in EBITDA Margin, a 2.4 percentage point increase from 2019 despite the

global environment, and a 30% BRL devaluation. We also reported an EBITDA margin of 14.5% in Q4, as our revenue mix continued to

improve not only on higher Multisector sales, but also on the roll-out of efficient and innovative services across our markets,

including in the US. We continued reshaping our relationship with Telefonica, with new wins in early 2021 which will positively

impact the first half of 2021, as we reinforced our leadership in their share of wallet for CX services. Next Generation Services

sales represented half of all new sales in 2020, compared to 40% in 2019, as we continue attracting fast-growing customers, such

as born-digital, tech and media, that favor digital and tech-enabled CX solutions developed by our new innovation hub.

On the cost side, we

executed a series of initiatives that led to increased operational efficiencies, enabling us to operate with even greater financial

discipline. At the end of the year, approximately $85 million in annualized cost savings had been implemented, out of which $60

million in structural opex reduction will be carried forward to 2021. Efficiency initiatives implemented during the year included

rightsizing operations, stricter cost control, adoption and expansion of the Atento@home operating model, and the implementation

of Zero-Based Budgeting and shared services, among other initiatives to reduce costs.

The combination of improved

revenue mix, operational efficiencies and an enhanced collections effort in the first half of 2020, drove a $40 million FCF generation

in 2020, an increase of over $100 million compared to the negative $65 million in 2019.

The year also marked

the resolution of the uncertainty related to our shareholder structure, with HPS, GIC and Farallon independently investing in our

company and consequently transforming Atento into a Corporation. This was an important milestone as our Board is now comprised

mostly of independent members, solidifying our governance and strengthening the diversity of knowledge and expertise of our Board.

Another key milestone

was achieved in February 2021, when we successfully completed our debt refinancing. The new $500 million Senior Secured Notes matures

in February 2026, extending the average life of our debt to 4.5 years from 1.5 years. The refinancing affords us greater financial

flexibility to further penetrate high-growth verticals with Atento’s innovative next-generation CXM and BPO services. We

will continue to seek ways to improve Atento’s capital structure as another means to drive shareholder value, and we remain

committed to achieving our 2022 net debt-to-EBITDA target of 2.0 to 2.5 times. We believe this is one of the key elements to unlock

value, creating a strong alignment between all stakeholders.

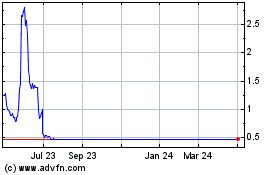

We are happy to see that

the market has recognized our evolution. Our shares multiplied by over 6 times since April 2020, when uncertainties related to

potential impacts from the pandemic peaked, while our bond price increased by roughly 80%. Having a highly oversubscribed book

in our refinancing process and strong share re-rating is a testament that investors recognize the results we have already delivered

as part of the turnaround process we initiated in 2019, and the strong results we have delivered despite the challenging pandemic

environment. On top of the financial market recognition, we were also recognized by industry experts. We have been acknowledged

by Everest as a star performer and by Gartner, which placed us at the top of the leaders group in its Magic Quadrant. But the most

important recognition came from our clients, rewarding us with record high marks in customer satisfaction, as measured by our 44.8

NPS score in 2020 vs. 30.8 a year earlier.

We expect for 2021 that

global and local brands will continue using new digital channels to improve relationships with end-customers, speeding up the transformation

of the industry into the digital age. We also believe that the shift to more digital experiences as a consequence of the pandemic

are here to stay, which presents a great opportunity for us to power more and more businesses in the regions where we operate.

We are confident in our

ability to continue delivering improved results in 2021. In parallel, we see significant opportunities to continue evolving our

value offering into more tech-oriented products, increasing penetration with fast growing verticals and expanding in geographies

with higher underlying profitability. While we acknowledge that the recent performance of our shares partially reflects our delivery

and evolution, we believe they remain undervalued and we expect that as we continue to deliver, our share price will follow.

|

Carlos López-Abadía

|

José Azevedo

|

|

Chief Executive Officer

|

Chief

Financial Officer

|

Fourth Quarter and Full-Year 2020

Consolidated Financial Results

In the fourth quarter, Atento’s

revenue increased 1.6% YoY to $369.6 million, mainly driven by a 6.2% growth in Multisector sales, which expanded across all regions,

reflecting the company’s effort to continue improving revenue mix into fast-growing and more profitable verticals. Telefónica

revenues declined 7.3% in the quarter, still reflecting the discontinuation of unprofitable programs that were phased out throughout

Q4 2019 in Brazil and lower volumes in Peru due to a stricter lockdown compared to other LatAm countries. On a sequential basis,

Telefónica revenues increased 1.4%. In FY 2020, despite a strong impact from the pandemic in Q2 2020, consolidated revenues

were down only 2.8%. Revenues from Multisector clients increased by 4.9%, while revenues from Telefónica decreased 15.9%.

Multisector revenues reached

68.2% of total sales, up from 64.7% at year-end 2019 and from 61.0% two years ago, as a result of higher sales of Next Generation

services, such as high-value voice, integrated multichannel and automated back office services, which were up nearly 40% YoY and

already represented half of all new sales in the year.

Consolidated EBITDA increased

148.6% to $53.5 million, while the corresponding margin reached 14.5%, the highest since the inception of the Three Horizon Plan,

due to a better revenue mix of Multisector clients and Next Generation services as well as improved operational efficiencies and

stricter cost control. For the year, EBITDA rose 23.1% on a CCY basis, and by 5.1% on a reported basis to $161.2 million, with

the margin expanding 240 basis points to 11.4% on a CCY basis, despite the pandemic and a 30% BRL devaluation in the period.

Atento continued to maintain

a comfortable level of financial liquidity at year-end, with net debt decreasing 13.1% to $517.6 million, mainly as a result of

the $39.8 million free cash flow generation in 2020. The strong increase of over $100 million in free cash flow generation when

compared to 2019 was due to the higher EBITDA combined with better cash conversion as a result of the collections efforts that

substantially improved working capital. The Company ended the year with a cash balance of $209 million, which includes $60 million

of drawn revolver credit facilities.

Segment

Reporting

Brazil

|

($ in millions)

|

Q4 2020

|

Q4 2019

|

CCY growth

|

FY 2020

|

FY 2019

|

CCY growth

|

|

Brazil Region

|

|

|

|

|

|

|

|

Revenue

|

156.9

|

194.8

|

5.5%

|

609.4

|

827.3

|

-4.4%

|

|

Adjusted EBITDA

|

28.9

|

29.8

|

26.6%

|

81.8

|

111.7

|

-4.8%

|

|

Adjusted EBITDA Margin

|

18.4%

|

15.3%

|

3.1 p.p.

|

13.4%

|

13.5%

|

-0.1 p.p.

|

|

Profit/(loss) for the period

|

(0.1)

|

(4.7)

|

-96.4%

|

(21.5)

|

(18.0)

|

52.2%

|

|

Brazil Revenue Mix

|

2020

|

2019

|

Notes:

|

|

§

|

Y-o-Y changes are in constant currency

|

Revenue

in Brazil, Atento’s flagship operation, increased 5.5% during the quarter to $156.9 million, fueled by a 13.0% multisector

growth. This growth reflects the company’s focus on continuing to sell Next Generation Services and further penetrating fast-growing

verticals such as born-digital, tech and media. FY 2020 revenues from Multisector grew 3.4%, reaching 78.0% of Brazil’s 2020

total revenue versus 72.6% in the prior year. Revenues from Telefónica decreased 15.4% in Q4 2020, still reflecting the

discontinuation of unprofitable programs that were phased out throughout Q4 2019. It is important to highlight that we have been

gaining new contracts with Telefónica in Brazil in the first months of the year and expect this to be reflected in 1H21

revenues.

The

better revenue mix combined with higher efficiencies boosted EBITDA by 26.6% versus Q4 2019, with EBITDA margin expanding 310 basis

points to 18.4%. On FY 2020, EBITDA Margin was flat, reflecting the impact of the pandemic mainly in Q2 2020.

Americas

Region

|

($ in millions)

|

Q4 2020

|

Q4 2019

|

CCY growth

|

FY 2020

|

FY 2019

|

CCY growth

|

|

Americas Region

|

|

|

|

|

|

|

|

Revenue

|

156.1

|

167.0

|

0.6%

|

582.2

|

660.1

|

-1.4%

|

|

Adjusted EBITDA

|

23.0

|

(11.2)

|

N.M

|

66.8

|

32.4

|

35.2%

|

|

Adjusted EBITDA Margin

|

14.7%

|

-6.7%

|

N.M.

|

11.5%

|

4.9%

|

6.6 p.p.

|

|

Profit/(loss) for the period

|

(2.1)

|

(16.7)

|

-82.4%

|

(10.0)

|

(25.9)

|

-44.9%

|

|

Americas Revenue Mix

|

2020

|

2019

|

In

the Americas, revenue recorded a slight increase of 0.6% YoY to $156.1 million, with Multisector sales increasing 4.8% YoY, driven

mainly by the 43% expansion of US revenues and by over 60% increase on the US Nearshore countries. Telefónica revenues decreased

7.2% YoY, mainly in Peru where the lockdown effects were more severe in this country.

FY

2020 revenue decreased 1.4%, as a 13.0% decrease in TEF revenue more than offset a 5.7% increase in Multisector sales during the

year. The decline in the former category was due the pandemic’s impact in the second quarter of the year, mainly in Peru.

As a percentage of Americas 2020 revenue, Multisector revenue was 66.3% versus 63.2% in the previous year, a 310 basis point increase.

The

region’s Adjusted EBITDA was $23.0 million, with the corresponding margin at a solid 14.7%. For the year, Adjusted EBITDA

increased 35.2% to $66.8 million, with the margin expanding 660 basis points to 11.5%, due to an improved revenue mix, higher efficiencies

and a low comparison base due to the $30.9 million impact from the Argentina Impairment on Q4 2019.

EMEA Region

|

($ in millions)

|

Q4 2020

|

Q4 2019

|

CCY growth

|

FY 2020

|

FY 2019

|

CCY growth

|

|

EMEA Region

|

|

|

|

|

|

|

|

Revenue

|

66.2

|

57.4

|

7.1%

|

234.7

|

232.8

|

-0.9%

|

|

Adjusted EBITDA

|

10.7

|

4.1

|

N.M

|

21.3

|

21.8

|

-2.8%

|

|

Adjusted EBITDA Margin

|

16.1%

|

7.1%

|

9.0 p.p.

|

9.1%

|

9.4%

|

-0.2 p.p.

|

|

Profit/(loss) for the period

|

6.5

|

(22.3)

|

N.M

|

5.2

|

(22.2)

|

N.M

|

|

EMEA Revenue Mix

|

2020

|

2019

|

In EMEA,

an 11.7% increase in Multisector sales, driven by telco, utilities and public services, coupled with a 2.5% increase in TEF revenues,

led to a 7.1% increase in revenue during the quarter, totaling $66.2 million. For the year, revenues were slightly down as the

9.7% increase in Multisector revenues was offset by a 9.3% decline in TEF revenue, mainly reflecting impacts from the pandemic

in Q2 2020. Multisector sales accounted for 49.2% of the region’s total revenue in FY 2020 compared to 43.1% in FY 2019.

EMEA’s Adjusted

EBITDA more than doubled to $10.7 million, while the EBITDA margin expanded 900 basis points to 16.1%. The region’s profitability

improved as a result of better revenue mix, including Next Generation services, combined with higher operating efficiencies. On

an annual basis, Adjusted EBITDA decreased 2.8% to $21.3 million, mainly due to the impact of Covid-19, especially in Q2 2020.

Cash

Flow

|

Cashflow Statement ($ in millions)

|

Q4 2020

|

Q4 2019

|

FY 2020

|

FY 2019

|

|

Cash and cash equivalents at beginning of period

|

196.6

|

105.5

|

124.7

|

133.5

|

|

Net Cash from Operating activities

|

60.1

|

49.2

|

128.2

|

46.5

|

|

Net Cash used in Investing activities

|

(10.9)

|

(8.3)

|

(38.2)

|

(55.9)

|

|

Net Cash (used in)/ provided by Financing activities

|

(36.4)

|

(24.7)

|

(0.3)

|

5.0

|

|

Net (increase/decrease) in cash and cash equivalents

|

12.8

|

16.2

|

89.8

|

(4.4)

|

|

Effect of changes in exchanges rates

|

(0.4)

|

2.9

|

(5.5)

|

(4.5)

|

|

Cash and cash equivalents at end of period

|

209.0

|

124.7

|

209.0

|

124.7

|

Indirect Cash Flow

View – FY 2020 ($ in millions)

The combination of higher

EBITDA in the period with a positive impact from working capital as a result of the efforts to improve overdue collections was

responsible for the improvement in both Operating Cash Flow and Free Cash Flow generation. In 2020, Atento generated $39.8 million

in FCF, compared to negative $65.5 million in 2019.

Cash Capex was 2.7% of

revenues in 2020, compared to 2.4% in 2019. Going forward, we expect cash capex to be aligned with industry standards, close to

4% of revenues.

Indebtedness &

Capital Structure

|

US$MM

|

Maturity

|

Interest Rate

|

Outstanding Balance 4Q20

|

|

SSN (1) (USD)

|

2022

|

6.125%

|

505.6

|

|

Super Senior Credit Facility

|

2021

|

5.223%

|

30.0

|

|

Other Revolving Credit Facilities

|

2021

|

CDI + 4.50

|

32.3

|

|

Other Borrowings and Leases

|

2025

|

Variable

|

15.2

|

|

BNDES (BRL)

|

2022

|

TJLP + 2.0%

|

0.6

|

|

Debt with Third Parties

|

|

|

583.7

|

|

Leasing (IFRS 16)

|

|

|

142.9

|

|

Gross Debt (Debt with Third Parties + IFRS 16)

|

|

|

726.6

|

|

Cash and Cash Equivalents

|

|

|

209.0

|

|

Net Debt

|

|

|

517.6

|

(1) Cross currency

swaps cover 100% of coupon payments until maturity

Net Leverage

At year-end 2020, gross

debt was $726.6 million, which included $142.9 million in leasing obligations under IFRS 16. Atento finished the year with cash

and cash equivalents of $209.0 million, a sequential and YoY increase of $12.4 million (+6.3%) and $84.3 million (+67.6%), respectively,

including the $60 million of drawn revolving credit facilities. Net debt decreased 13.1% when compared to December 2019, reflecting

the strong FCF generation in 2020.

Net leverage as of Q4

2020 decreased 0.7x when compared to Q4 2019, as a result of higher EBITDA from better revenue mix and improved efficiencies, and

also the phase out of the impact of the impairment in Argentina during Q4 2019. Excluding the impact of the impairment in Argentina

during Q4 2019, net leverage remained flat in Q4 2020 YoY, which is a remarkable result considering the challenging environment

from the pandemic and the 30% BRL devaluation effect on EBITDA.

On February 19, 2021,

Atento successfully completed its $500M bond refinancing. The new $500 million Senior Secured Notes mature on February 10,

2026 and will pay interest at a rate of 8.0% per annum. With this transaction, the Company’s average debt life increased

from 1.5 years to 4.5 years.

The new notes are protected

by certain hedging instruments, with the coupons hedged through maturity, while the principal is hedged for a period of 3 years.

The instruments consist mainly of cross-currency swaps in BRL, PEN and Euro. As a reference, the BRL cost is approximately 180%

of CDI (equivalent to circa 3.5% p.a. with the current CDI).

Introducing Fiscal

2021 Guidance

|

|

2020 Reported

|

FY 2021

|

|

Revenue growth (in constant currency)

|

-2.8%

|

Mid-single digit

|

|

EBITDA margin

|

11.4%

|

12.5%-13.5%

|

|

Leverage (x)

|

3.2x

|

2.5x-3.0x

|

|

Cash Capex as % of Revenues

|

2.7%

|

4.0-4.5%

|

Share

Repurchase Program

In the quarter, the

Company repurchased 37,364 shares under its Share Repurchase Program, at a cost of $0.4 million, at an average price of $10.96.

At the end of December 2020, Atento held 1,010,502 shares in treasury. On February 24, 2021, the Board of Directors approved the

extension of the current program for additional 12 months, with the new expiration date on March 10, 2022.

Conference

Call

The Company

will host a conference call and webcast on Thursday, March 4, 2021 at 10:00 am ET to discuss its financial results. The conference

call can be accessed by dialing: USA: +1 (866) 807-9684; UK: (+44) 20 3514 3188; Brazil: (+55) 11 4933-0682; or Spain: (+34) 91

414 9260. No passcode is required. Individuals who dial in will be asked to identify themselves and their affiliations The live

webcast of the conference call will be available on Atento's Investor Relations website at investors.atento.com (Click

here). A web-based archive of the conference call will also be available at the above website.

About

Atento

Atento is

the largest provider of customer relationship management and business process outsourcing (“CRM BPO”) services in Latin

America, and among the top five providers globally. Atento is also a leading provider of nearshoring CRM BPO services to companies

that carry out their activities in the United States. Since 1999, the company has developed its business model in 13 countries

where it employs approximately 139,800 people. Atento has over 400 clients to whom it offers a wide range of CRM BPO services through

multiple channels. Atento’s clients are mostly leading multinational corporations in sectors such as telecommunications,

banking and financial services, health, retail and public administrations, among others. Atento’s shares trade under the

symbol ATTO on the New York Stock Exchange (NYSE). In 2019, Atento was named one of the World’s 25 Best Multinational Workplaces

and one of the Best Multinationals to Work for in Latin America by Great Place to Work®. Also, in 2021 Everest named Atento

as a star performer Gartner named the company as a leader in the 2021 Gartner Magic Quadrant. For more information visit www.atento.com

Investor Relations

Shay Chor

+ 55 11 3293-5926

shay.chor@atento.com

|

Investor Relations

Fernando Schneider

+ 55 11 3779-8119

fernando.schneider@atento.com

|

Media Relations

Pablo Sánchez Pérez

+34 670031347

pablo.sanchez@atento.com

|

Forward-Looking

Statements

This

press release contains forward-looking statements. Forward-looking statements can be identified by the use of words such as "may,"

"should," "expects," "plans," "anticipates," "believes," "estimates,"

"predicts," "intends," "continue" or similar terminology. These statements reflect only Atento's

current expectations and are not guarantees of future performance or results. Forward-looking statements by their nature address

matters that are, to different degrees, uncertain, such as statements about the potential impacts of the Covid-19 pandemic on our

business operations, financial results and financial position and on the world economy. These statements are subject to risks and

uncertainties that could cause actual results to differ materially from those contained in the forward-looking statements. These

risks and uncertainties include, but are not limited to, competition in Atento's highly competitive industries; increases in the

cost of voice and data services or significant interruptions in these services; Atento's ability to keep pace with its clients'

needs for rapid technological change and systems availability; the continued deployment and adoption of emerging technologies;

the loss, financial difficulties or bankruptcy of any key clients; the effects of global economic trends on the businesses of Atento's

clients; the non-exclusive nature of Atento's client contracts and the absence of revenue commitments; security and privacy breaches

of the systems Atento uses to protect personal data; the cost of pending and future litigation; the cost of defending Atento against

intellectual property infringement claims; extensive regulation affecting many of Atento's businesses; Atento's ability to protect

its proprietary information or technology; service interruptions to Atento's data and operation centers; Atento's ability to retain

key personnel and attract a sufficient number of qualified employees; increases in labor costs and turnover rates; the political,

economic and other conditions in the countries where Atento operates; changes in foreign exchange rates; Atento's ability to complete

future acquisitions and integrate or achieve the objectives of its recent and future acquisitions; future impairments of our substantial

goodwill, intangible assets, or other long-lived assets; and Atento's ability to recover consumer receivables on behalf of its

clients. In addition, Atento is subject to risks related to its level of indebtedness. Such risks include Atento's ability to generate

sufficient cash to service its indebtedness and fund its other liquidity needs; Atento's ability to comply with covenants contained

in its debt instruments; the ability to obtain additional financing; the incurrence of significant additional indebtedness by Atento

and its subsidiaries; and the ability of Atento's lenders to fulfill their lending commitments. Atento is also subject to other

risk factors described in documents filed by the company with the United States Securities and Exchange Commission.

These

forward-looking statements speak only as of the date on which the statements were made. Atento undertakes no obligation to update

or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

SELECTED FINANCIAL DATA:

The

following selected financial information are preliminary, unaudited and are based on management's initial review of operations

for the fourth quarter and year ended December 31, 2020 and remain subject to the completion of the Company's customary annual

closing and review procedures. Final adjustments and other material developments may arise between the date hereof and the filing

of the Company's Annual Report on Form 20-F.

Consolidated Statements of Operations for the

Three Months and Year Ended December 31, 2019 and 2020

|

|

For the three months ended December 31

|

For the year ended December 31

|

|

($ in millions, except percentage changes)

|

2020

|

2019

|

Change (%)

|

Change excluding FX (%)

|

2020

|

2019

|

Change (%)

|

Change excluding FX (%)

|

|

|

(unaudited)

|

|

|

(unaudited)

|

|

|

|

Revenue

|

369.6

|

417.2

|

(11.4)

|

1.6

|

1,412.3

|

1,707.3

|

(17.3)

|

(2.8)

|

|

Other operating income

|

2.5

|

1.9

|

34.2

|

43.8

|

5.6

|

4.5

|

22.8

|

31.0

|

|

Other gains and own work capitalized

|

0.1

|

3.5

|

(98.4)

|

(98.5)

|

0.1

|

10.5

|

(99.1)

|

(99.1)

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

Supplies

|

(21.1)

|

(17.1)

|

23.1

|

42.6

|

(72.3)

|

(66.4)

|

8.8

|

27.5

|

|

Employee benefit expenses

|

(266.5)

|

(314.3)

|

(15.2)

|

(3.6)

|

(1,060.4)

|

(1,301.0)

|

(18.5)

|

(4.6)

|

|

Depreciation

|

(17.9)

|

(24.1)

|

(25.6)

|

(13.0)

|

(73.9)

|

(83.6)

|

(11.5)

|

4.7

|

|

Amortization

|

(12.8)

|

(17.3)

|

(25.9)

|

(16.9)

|

(47.0)

|

(57.2)

|

(17.9)

|

(4.3)

|

|

Changes in trade provisions

|

(1.8)

|

(0.3)

|

N.M.

|

N.M.

|

(5.3)

|

(3.7)

|

41.9

|

65.3

|

|

Impairment charges

|

-

|

(30.9)

|

(100.0)

|

(100.0)

|

-

|

(30.9)

|

(100.0)

|

(100.0)

|

|

Other operating expenses

|

(29.3)

|

(39.2)

|

(25.2)

|

(13.7)

|

(118.7)

|

(166.8)

|

(28.8)

|

(17.0)

|

|

Total operating expenses

|

(349.4)

|

(443.3)

|

(21.2)

|

(9.0)

|

(1,377.6)

|

(1,709.7)

|

(19.4)

|

(5.5)

|

|

Operating profit

|

22.7

|

(20.7)

|

N.M.

|

N.M.

|

40.3

|

12.6

|

N.M.

|

N.M.

|

|

Finance income

|

2.7

|

15.4

|

(82.7)

|

(75.9)

|

15.7

|

20.0

|

(21.8)

|

7.2

|

|

Finance costs

|

(18.3)

|

(14.0)

|

31.0

|

38.8

|

(69.9)

|

(68.1)

|

2.6

|

13.6

|

|

Net foreign exchange loss

|

(9.7)

|

(8.4)

|

16.0

|

72.5

|

(27.8)

|

(9.1)

|

N.M.

|

N.M.

|

|

Net finance expense

|

(25.3)

|

(6.9)

|

N.M.

|

N.M.

|

(82.0)

|

(57.1)

|

43.6

|

80.2

|

|

Profit/(oss) before income tax

|

(2.6)

|

(27.6)

|

(90.5)

|

(88.3)

|

(41.7)

|

(44.5)

|

(6.3)

|

21.6

|

|

Income tax benefit/(expense)

|

(5.3)

|

(2.0)

|

N.M.

|

76.8

|

(5.1)

|

(36.2)

|

(85.9)

|

(86.7)

|

|

Profit/(loss) for the period

|

(7.9)

|

(29.6)

|

(73.2)

|

(68.6)

|

(46.8)

|

(80.7)

|

(42.0)

|

(35.6)

|

|

Profit/(loss) attributable to:

|

|

|

|

|

|

|

|

|

|

Owners of the parent

|

(7.9)

|

(29.6)

|

(73.2)

|

(68.6)

|

(46.8)

|

(81.3)

|

(42.4)

|

(36.0)

|

|

Non-controlling interest

|

|

|

|

|

-

|

0.6

|

(100.0)

|

(100.0)

|

|

Profit/(loss) for the period

|

(7.9)

|

(29.6)

|

(73.2)

|

(68.6)

|

(46.8)

|

(80.7)

|

(42.0)

|

(35.6)

|

|

Other financial data:

|

|

|

|

|

|

|

|

|

|

EBITDA (1) (unaudited)

|

53.5

|

20.7

|

N.M.

|

148.6

|

161.2

|

153.4

|

5.1

|

23.1

|

|

Adjusted EBITDA (1) (unaudited)

|

53.5

|

20.7

|

N.M.

|

148.6

|

161.2

|

153.4

|

5.1

|

23.1

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) For the reconciliation

of these non-GAAP measures to the closest comparable IFRS measure, see section "Summary Consolidated Historical Financial

Information - Reconciliation of EBITDA and Adjusted EBITDA to profit/(loss)".

N.M. means not meaningful

Consolidated Statements of Operations by Segment

for the Three Months and Year Ended December 31, 2019 and 2020

|

($ in millions, except percentage changes)

|

For the three months ended December 31,

|

Change (%)

|

Change Excluding FX (%)

|

For the year ended

December 31,

|

Change (%)

|

Change Excluding FX (%)

|

|

2020

|

2019

|

2020

|

2019

|

|

|

(unaudited)

|

|

Revenue:

|

|

|

|

|

|

|

|

|

|

Brazil

|

156.9

|

194.8

|

(19.4)

|

5.5

|

609.4

|

827.3

|

(26.3)

|

(4.4)

|

|

Americas

|

156.1

|

167.0

|

(6.6)

|

0.6

|

582.2

|

660.1

|

(11.8)

|

(1.4)

|

|

EMEA

|

66.2

|

57.4

|

15.3

|

7.1

|

234.7

|

232.8

|

0.8

|

(0.9)

|

|

Other and eliminations (1)

|

(9.6)

|

(2.0)

|

N.M.

|

N.M.

|

(14.0)

|

(12.9)

|

8.0

|

15.9

|

|

Total revenue

|

369.6

|

417.2

|

(11.4)

|

1.6

|

1,412.3

|

1,707.3

|

(17.3)

|

(2.8)

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

Brazil

|

(144.9)

|

(191.1)

|

(24.1)

|

(0.8)

|

(594.7)

|

(807.4)

|

(26.3)

|

(4.5)

|

|

Americas

|

(152.7)

|

(193.8)

|

(21.2)

|

(12.0)

|

(576.7)

|

(679.5)

|

(15.1)

|

(4.2)

|

|

EMEA

|

(63.8)

|

(64.5)

|

(1.0)

|

(8.3)

|

(235.1

|

(244.1)

|

(3.7)

|

(5.7)

|

|

Other and eliminations (1)

|

12.0

|

6.1

|

96.9

|

126.2

|

28.9

|

21.4

|

34.9

|

68.9

|

|

Total operating expenses

|

(349.4)

|

(443.3)

|

(21.2)

|

(9.0)

|

(1,377.6)

|

(1,709.7)

|

(19.4)

|

(5.5)

|

|

Operating profit/(loss):

|

|

|

|

|

|

|

|

|

|

Brazil

|

12.0

|

4.5

|

N.M.

|

N.M.

|

14.8

|

21.1

|

(29.7)

|

(5.9)

|

|

Americas

|

4.2

|

(26.4)

|

N.M.

|

N.M.

|

7.9

|

(18.2)

|

-143.3

|

N.M.

|

|

EMEA

|

4.1

|

(2.8)

|

N.M.

|

N.M.

|

2.8

|

1.2

|

133.9

|

N.M.

|

|

Other and eliminations (1)

|

2.4

|

4.0

|

(39.9)

|

(28.7)

|

14.8

|

8.6

|

73.0

|

N.M.

|

|

Total operating profit/(loss)

|

22.7

|

(20.7)

|

N.M.

|

N.M.

|

40.3

|

12.6

|

N.M.

|

N.M.

|

|

Net finance expense:

|

|

|

|

|

|

|

|

|

|

Brazil

|

(8.2)

|

(10.5)

|

(22.2)

|

2.0

|

(42.1)

|

(46.5)

|

(9.5)

|

17.9

|

|

Americas

|

(3.2)

|

8.9

|

N.M.

|

N.M.

|

(9.6)

|

(5.6)

|

71.2

|

88.3

|

|

EMEA

|

(1.8)

|

(0.6)

|

N.M.

|

N.M.

|

(1.3)

|

(1.4)

|

(10.9)

|

(10.9)

|

|

Other and eliminations (1)

|

(12.1)

|

(4.7)

|

N.M.

|

N.M.

|

(29.1)

|

(3.6)

|

N.M.

|

N.M.

|

|

Total net finance expense

|

(25.3)

|

(6.9)

|

N.M.

|

N.M.

|

(82.0)

|

(57.1)

|

43.6

|

80.2

|

|

Income tax benefit/(expense):

|

|

|

|

|

|

|

|

|

|

Brazil

|

(3.9)

|

1.3

|

N.M.

|

N.M.

|

5.7

|

7.4

|

(22.6)

|

(0.8)

|

|

Americas

|

(3.1)

|

0.7

|

N.M.

|

N.M.

|

(8.3)

|

(2.0)

|

N.M.

|

N.M.

|

|

EMEA

|

4.2

|

(18.8)

|

N.M.

|

N.M.

|

3.6

|

(22.0)

|

N.M.

|

N.M.

|

|

Other and eliminations (1)

|

(2.5)

|

14.7

|

N.M.

|

N.M.

|

(6.2)

|

(19.6)

|

(68.6)

|

(65.2)

|

|

Total income tax benefit/(expense)

|

(5.3)

|

(2.0)

|

N.M.

|

N.M.

|

(5.1)

|

(36.2)

|

(85.9)

|

(86.7)

|

|

Profit/(loss) for the period:

|

|

|

|

|

|

|

|

|

|

Brazil

|

(0.1)

|

(4.7)

|

(97.2)

|

(96.4)

|

(21.5)

|

(18.0)

|

19.5

|

52.2

|

|

Americas

|

(2.1)

|

(16.7)

|

(87.5)

|

(82.4)

|

(10.0)

|

(25.9)

|

(61.2)

|

(44.9)

|

|

EMEA

|

6.5

|

(22.3)

|

N.M.

|

N.M.

|

5.2

|

(22.2)

|

N.M.

|

N.M.

|

|

Other and eliminations (1)

|

(12.3)

|

14.0

|

N.M.

|

N.M.

|

(20.4)

|

(14.6)

|

39.6

|

28.6

|

|

Profit/(loss) for the period

|

(7.9)

|

(29.6)

|

(73.2)

|

(68.6)

|

(46.8)

|

(80.7)

|

(42.0)

|

(35.6)

|

|

Profit/(loss) attributable to:

|

|

|

|

|

|

|

|

|

|

Owners of the parent

|

(7.9)

|

(29.6)

|

(73.2)

|

(68.6)

|

(46.8)

|

(81.3)

|

(42.4)

|

(36.0)

|

|

Non-controlling interest

|

-

|

-

|

N.M.

|

N.M.

|

-

|

0.6

|

N.M.

|

N.M.

|

|

Other financial data:

|

|

|

|

|

|

|

|

|

|

EBITDA (2):

|

|

|

|

|

|

|

|

|

|

Brazil

|

27.7

|

26.7

|

3.7

|

35.7

|

78.1

|

96.9

|

(19.4)

|

5.0

|

|

Americas

|

15.8

|

(13.1)

|

N.M.

|

N.M.

|

52.7

|

30.7

|

71.6

|

54.1

|

|

EMEA

|

7.5

|

3.1

|

142.7

|

134.6

|

15.3

|

17.0

|

(9.6)

|

(9.6)

|

|

Other and eliminations (1)

|

2.4

|

4.0

|

(39.4)

|

(28.3)

|

15.1

|

8.8

|

71.0

|

N.M.

|

|

Total EBITDA (unaudited)

|

53.5

|

20.7

|

N.M.

|

148.6

|

161.2

|

153.4

|

5.1

|

23.1

|

|

Adjusted EBITDA (2):

|

|

|

|

|

|

|

|

|

|

Brazil

|

28.9

|

29.8

|

(2.8)

|

26.6

|

81.8

|

111.7

|

(26.8)

|

(4.8)

|

|

Americas

|

23.0

|

(11.2)

|

N.M.

|

N.M.

|

66.8

|

32.4

|

105.8

|

35.2

|

|

EMEA

|

10.7

|

4.1

|

N.M.

|

N.M.

|

21.3

|

21.8

|

(2.3)

|

(2.8)

|

|

Other and eliminations (1)

|

(9.1)

|

(1.9)

|

N.M.

|

N.M.

|

(8.6)

|

(12.6)

|

(31.2)

|

(67.1)

|

|

Total Adjusted EBITDA (unaudited)

|

53.5

|

20.7

|

N.M.

|

148.6

|

161.2

|

153.4

|

5.1

|

23.1

|

(1)

Included revenue and expenses at the holding-company level (such as corporate expenses and acquisition related expenses), as applicable,

as well as consolidation adjustments.

(2)

For the reconciliation of these non-GAAP measures to the closest comparable IFRS measure, see section "Summary Consolidated

Historical Financial Information - Reconciliation of EBITDA and Adjusted EBITDA to profit/(loss)".

Balance Sheet ($ Thousands)

|

ASSETS

|

|

|

|

December 31,

|

December 31,

|

|

2020

|

2019

|

|

|

(unaudited)

|

(audited)

|

|

NON-CURRENT ASSETS

|

614,922

|

765,839

|

|

|

|

|

|

Intangible assets

|

105,929

|

160,041

|

|

Goodwill

|

103,014

|

119,902

|

|

Right-of-use assets

|

137,842

|

181,564

|

|

Property, plant and equipment

|

90,888

|

116,893

|

|

Non-current financial assets

|

70,275

|

82,158

|

|

Trade and other receivables

|

20,995

|

22,124

|

|

Other non-current financial assets

|

38,192

|

54,652

|

|

Derivative financial instruments

|

11,088

|

5,382

|

|

Other taxes receivable

|

4,815

|

5,650

|

|

Deferred tax assets

|

102,159

|

99,631

|

|

|

|

|

|

CURRENT ASSETS

|

571,802

|

538,772

|

|

|

|

|

|

Trade and other receivables

|

324,856

|

388,308

|

|

Trade and other receivables

|

299,092

|

359,599

|

|

Current income tax receivable

|

25,764

|

28,709

|

|

Other taxes receivable

|

36,794

|

24,664

|

|

Other current financial assets

|

1,158

|

1,094

|

|

Cash and cash equivalents

|

208,994

|

124,706

|

|

|

|

|

|

TOTAL ASSETS

|

1,186,724

|

1,304,611

|

|

|

|

|

|

EQUITY AND LIABILITIES

|

December 31,

|

December 31,

|

|

2020

|

2019

|

|

|

(unaudited)

|

(audited)

|

|

|

|

|

|

TOTAL EQUITY

|

119,092

|

207,020

|

|

EQUITY ATTRIBUTABLE TO:

|

|

|

|

OWNERS OF THE PARENT COMPANY

|

119,092

|

207,020

|

|

|

|

|

|

Share capital

|

49

|

49

|

|

Share premium

|

613,619

|

619,461

|

|

Treasury shares

|

(12,312)

|

(19,319)

|

|

Retained losses

|

(178,907)

|

(127,070)

|

|

Translation differences

|

(281,864)

|

(271,273)

|

|

Cash flow / Net investment Hedge

|

(37,360)

|

(8,872)

|

|

Stock-based compensation

|

15,867

|

14,044

|

|

|

|

|

|

NON-CURRENT LIABILITIES

|

662,895

|

718,989

|

|

|

|

|

|

Deferred tax liabilities

|

11,642

|

20,378

|

|

Debt with third parties

|

594,636

|

633,498

|

|

Derivative financial instruments

|

5,220

|

2,289

|

|

Provisions and contingencies

|

45,617

|

48,326

|

|

Non-trade payables

|

3,887

|

11,744

|

|

Other taxes payable

|

1,893

|

2,754

|

|

|

|

|

|

CURRENT LIABILITIES

|

404,737

|

378,602

|

|

|

|

|

|

Debt with third parties

|

131,943

|

87,117

|

|

Derivative financial instruments

|

-

|

167

|

|

Trade and other payables

|

250,835

|

272,547

|

|

Trade payables

|

60,527

|

71,676

|

|

Income tax payables

|

16,838

|

12,671

|

|

Other taxes payables

|

97,104

|

93,765

|

|

Other non-trade payables

|

76,366

|

94,435

|

|

Provisions and contingencies

|

21,959

|

18,771

|

|

TOTAL EQUITY AND LIABILITIES

|

1,186,724

|

1,304,611

|

Cash Flow ($ thousand)

|

|

For the three months ended December 31,

|

For the nine months ended December 31,

|

|

|

2020

|

2019

|

2020

|

2019

|

|

|

(unaudited)

|

|

Operating activities

|

|

|

|

|

|

Loss before income tax

|

(2.6)

|

(27.6)

|

(41.7)

|

(44.5)

|

|

Adjustments to reconcile loss before income tax to net cash flows:

|

|

|

|

|

|

Amortization and depreciation

|

30.7

|

41.4

|

120.9

|

140.8

|

|

Changes in trade provisions

|

1.8

|

0.3

|

5.3

|

3.7

|

|

Impairment losses

|

0.0

|

30.9

|

0.0

|

30.9

|

|

Share-based payment expense

|

1.2

|

2.2

|

4.3

|

5.2

|

|

Change in provisions

|

5.3

|

1.2

|

27.3

|

33.9

|

|

Grants released to income

|

(0.4)

|

(0.3)

|

(0.9)

|

(1.2)

|

|

Losses on disposal of property, plant and equipment

|

0.2

|

0.1

|

0.3

|

0.2

|

|

Finance income

|

(2.7)

|

(15.4)

|

(15.7)

|

(20.0)

|

|

Finance costs

|

18.3

|

14.0

|

69.9

|

68.1

|

|

Net foreign exchange differences

|

9.7

|

8.4

|

27.8

|

9.1

|

|

Change in other (gains)/ losses and own work capitalized

|

(0.1)

|

(4.1)

|

(0.2)

|

(23.0)

|

|

|

64.0

|

78.6

|

239.0

|

247.7

|

|

Changes in working capital:

|

|

|

|

|

|

Changes in trade and other receivables

|

15.3

|

55.2

|

2.2

|

(55.7)

|

|

Changes in trade and other payables

|

(4.7)

|

(32.3)

|

2.7

|

-

|

|

Other assets/(payables)

|

1.6

|

(14.3)

|

(14.1)

|

(4.8)

|

|

|

12.2

|

8.7

|

(9.2)

|

(60.5)

|

|

|

|

|

|

|

|

Interest paid

|

(3.8)

|

(3.4)

|

(46.2)

|

(48.7)

|

|

Interest received

|

0.1

|

0.1

|

11.8

|

1.4

|

|

Income tax paid

|

(3.9)

|

2.0

|

(11.2)

|

(31.3)

|

|

Other payments

|

(5.9)

|

(9.3)

|

(14.3)

|

(17.6)

|

|

|

(13.5)

|

(10.5)

|

(59.9)

|

(96.2)

|

|

Net cash flows from operating activities

|

60.1

|

49.2

|

128.2

|

46.5

|

|

Investing activities

|

|

|

|

|

|

Payments for acquisition of intangible assets

|

(1.6)

|

(6.2)

|

(6.9)

|

(18.7)

|

|

Payments for acquisition of property, plant and equipment

|

(9.3)

|

(2.1)

|

(31.3)

|

(21.4)

|

|

Acquisition of subsidiaries, net of cash acquired

|

0.0

|

0.0

|

0.0

|

(15.8)

|

|

Net cash flows used in investing activities

|

(10.9)

|

(8.3)

|

(38.2)

|

(55.9)

|

|

Financing activities

|

|

|

|

|

|

Proceeds from borrowing from third parties

|

12.1

|

0.8

|

121.8

|

173.7

|

|

Repayment of borrowing from third parties

|

(29.5)

|

(7.4)

|

(70.5)

|

(101.5)

|

|

Payments of lease liabilities

|

(18.7)

|

(14.6)

|

(50.2)

|

-56.1

|

|

Acquisition of treasury shares

|

(0.4)

|

(3.5)

|

(1.3)

|

(11.1)

|

|

Net cash flows provided by/(used in) financing activities

|

(36.4)

|

(24.7)

|

(0.3)

|

5.0

|

|

Net (decrease)/increase in cash and cash equivalents

|

12.8

|

16.2

|

89.8

|

-4.4

|

|

Foreign exchange differences

|

(0.4_

|

2.9

|

(5.5)

|

(4.5)

|

|

Cash and cash equivalents at beginning of period

|

196.6

|

105.5

|

124.7

|

133.5

|

|

Cash and cash equivalents at end of period

|

209.0

|

124.7

|

209.0

|

124.7

|

Adjustments to EBITDA by

Quarter

|

|

Fiscal 2018

|

Fiscal 2019

|

Fiscal 2020

|

|

($ in millions)

|

Q1

|

Q2

|

Q3

|

Q4

|

FY

|

Q1

|

Q2

|

Q3

|

Q4

|

FY

|

Q1

|

Q2

|

Q3

|

Q4

|

FY

|

|

Profit/(loss) for the period

|

(1.7)

|

4.0

|

3.1

|

15.0

|

20.5

|

(45.6)

|

(6.6)

|

1.3

|

(29.6)

|

(80.7)

|

(7.4)

|

(18.3)

|

(13.1)

|

(7.9)

|

(46.8)

|

|

Net finance expense

|

19.6

|

21.9

|

18.3

|

(4.2)

|

55.6

|

17.3

|

19.1

|

13.8

|

6.9

|

57.1

|

16.9

|

14.2

|

25.6

|

25.3

|

82.0

|

|

Income tax expense

|

5.5

|

(0.5)

|

3.8

|

4.6

|

13.4

|

(2.9)

|

(3.1)

|

2.3

|

2.0

|

36.2

|

(0.2)

|

(2.4)

|

2.3

|

5.3

|

5.1

|

|

Write-off of deferred tax assets

|

-

|

-

|

-

|

-

|

-

|

37.8

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

Depreciation and amortization

|

26.3

|

23.6

|

21.8

|

23.6

|

95.2

|

35.3

|

33.2

|

30.8

|

41.4

|

140.8

|

31.5

|

28.7

|

30.0

|

30.7

|

120.9

|

|

EBITDA (non-GAAP) (unaudited)

|

49.8

|

49.1

|

46.9

|

39.0

|

184.8

|

42.0

|

42.6

|

48.1

|

20.7

|

153.4

|

40.8

|

22.2

|

44.8

|

53.5

|

161.2

|

|

Adjusted EBITDA Margins

|

10.1%

|

10.4%

|

10.9%

|

9.2%

|

10.2%

|

9.6%

|

9.6%

|

11.7

|

5.0%

|

9.0%

|

10.9%

|

7.1%

|

12.7%

|

14.5%

|

11.4%

|

IFRS 16 Effect

|

IFRS 16: Effect

|

FY 2020

|

FY 2019

|

|

Revenue

|

0.0

|

0.0

|

|

EBITDA

|

47.8

|

52.4

|

|

Depreciation & Amortization

|

(44.0)

|

(49.3)

|

|

Operating Profit

|

3.8

|

3.1

|

|

Finance costs

|

(14.4)

|

(17.5)

|

|

(Loss)/profit before income tax

|

(10.6)

|

(14.4)

|

|

Income tax expense

|

0.0

|

0.4

|

|

(Loss)/profit after income tax

|

(10.6)

|

(14.1)

|

Add-Backs to Net Income

by Quarter

|

|

Fiscal 2018

|

Fiscal 2019

|

Fiscal 2020

|

|

($ in millions, except percentage changes)

|

Q1

|

Q2

|

Q3

|

Q4

|

FY

|

Q1

|

Q2

|

Q3

|

Q4

|

FY

|

Q1

|

Q2

|

Q3

|

Q4

|

FY

|

|

Profit/(Loss) attributable to equity holders of the parent

|

(1.7)

|

4.0

|

3.1

|

15.0

|

20.5

|

(45.6)

|

(6.6)

|

1.3

|

(29.6)

|

(80.7)

|

(7.4)

|

(18.3)

|

(13.1)

|

(7.9)

|

(46.8)

|

|

Amortization of Acquisition related Intangible assets

|

5.7

|

5.3

|

5.1

|

5.1

|

21.2

|

5.1

|

5.0

|

4.9

|

5.5

|

20.6

|

5.0

|

4.3

|

4.5

|

4.5

|

18.3

|

|

Net foreign exchange gain on financial instruments

|

3.1

|

(9.0)

|

5.9

|

-

|

0.0

|

-

|

-

|

-

|

-

|

|

-

|

|

|

|

|

|

Net foreign exchange impacts

|

2.8

|

19.0

|

9.3

|

(2.3)

|

28.8

|

1.6

|

1.4

|

(2.3)

|

8.4

|

9.1

|

3.5

|

5.8

|

8.8

|

9.7

|

27.8

|

|

Tax effect

|

(2.4)

|

(3.7)

|

(4.6)

|

(1.6)

|

(11.3)

|

34.6

|

(6.8)

|

(2.2)

|

2.2

|

27.7

|

(4.5)

|

(2.0)

|

(1.4)

|

(1.7)

|

(9.4)

|

|

Other

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

|

|

|

|

|

|

Adjusted Earnings (non-GAAP) (unaudited)

|

7.5

|

15.1

|

15.7

|

16.2

|

59.1

|

(4.3)

|

(6.9)

|

1.6

|

(13.5)

|

(23.2)

|

(3.4)

|

(10.2)

|

(1.2)

|

4.5

|

(10.1)

|

|

Adjusted Earnings per share (in U.S. dollars) in the reverse split basis

|

0.51

|

1.01

|

1.27

|

1.11

|

4.03

|

(0.29)

|

(0.47)

|

0.11

|

(0.97)

|

(1.61)

|

(0.24)

|

(0.70)

|

(0.09)

|

0.32

|

(0.72)

|

|

Adjusted Earnings attributable to Owners of the parent (non-GAAP) (unaudited)

|

7.8

|

14.3

|

18.4

|

15.7

|

57.2

|

(4.7)

|

(7.2)

|

1.6

|

(13.5)

|

(23.9)

|

(3.4)

|

(10.2)

|

(1.2)

|

4.5

|

(10.1)

|

|

Adjusted Earnings attributable to Owners of the parent (in U.S. dollars) in the reverse split basis

|

0.53

|

0.96

|

1.25

|

1.06

|

3.89

|

(0.32)

|

(0.49)

|

0.11

|

(0.97)

|

(1.65)

|

(0.24)

|

(0.70)

|

(0.09)

|

0.32

|

(0.72)

|

|

|

(*)

|

We define non-recurring items as items that are limited in number,

clearly identifiable, unusual, are unlikely to be repeated in the near future in the ordinary course of business and that have

a material impact on the consolidated results of operations. Non-recurring items can be summarized as demonstrated below:

|

|

|

(a)

|

Amortization of acquisition related intangible

assets represents the amortization expense of customer base, recorded as intangible assets. This customer base represents the fair

value (within the business combination involving the acquisition of control of Atento Group) of the intangible assets arising from

service agreements (tacit or explicitly formulated in contracts) with Telefónica Group and with other customers.

|

|

|

(b)

|

Since April 1, 2015, the Company designated

the foreign currency risk on certain of its subsidiaries as net investment hedges using financial instruments as the hedging items.

As a consequence, any gain or loss on the hedging instrument, related to the effective portion of the hedge is recognized in other

comprehensive income (equity) as from that date. The gains or losses related to the ineffective portion are recognized in the statements

of operations and for comparability, and those adjustments are added back to calculate Adjusted Earnings.

|

|

(**)

|

Adjusted Earnings per share is calculated based on weighted average number of ordinary shares outstanding

of 13,903,439 and 14,004,490 for the three months ended December 31, 2019 and 2020, respectively.

|

|

(***)

|

Adjusted Earnings per share in the reverse split basis is calculated by applying the ratio of conversion of 5.027090466672970

used in the reverse split into the previous weighted average number of ordinary shares outstanding

|

Effective Tax Rate

|

($ in millions, except percentage changes)

|

Fiscal 2018

|

Fiscal 2019

|

Fiscal 2020

|

Q1 2018

|

Q2 2018

|

Q3 2018

|

Q4 2018

|

Q1 2019

|

Q2 2019

|

Q3 2019

|

Q4 2019

|

Q1 2020

|

Q2 2020

|

Q3 2020

|

Q4 2020

|

|

Profit/(loss) before tax1

|

33.9

|

(44.5)

|

(41.7)

|

3.9

|

3.6

|

6.9

|

19.6

|

(10.6)

|

(9.7)

|

3.5

|

(27.6)

|

(7.6)

|

(20.7)

|

(10.8)

|

(2.6)

|

|

(+) Total Add-backs to Net Income (excluding tax effect)

|

50.0

|

29.7

|

46.1

|

11.5

|

15.3

|

20.3

|

2.8

|

6.7

|

6.5

|

2.6

|

13.9

|

8.5

|

10.1

|

13.3

|

14.2

|

|

Amortization of Acquisition related Intangible assets

|

21.2

|

20.6

|

18.3

|

5.7

|

5.3

|

5.1

|

5.1

|

5.1

|

5.0

|

4.9

|

5.5

|

5.0

|

4.3

|

4.5

|

4.5

|

|

Net foreign exchange gain on financial instruments

|

0.0

|

-

|

-

|

3.1

|

(9.0)

|

5.9

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

-

|

|

Net foreign exchange impacts

|

28.8

|

9.1

|

27.8

|

2.8

|

19.0

|

9.3

|

(2.3)

|

1.6

|

1.4

|

(2.3)

|

8.4

|

3.5

|

5.8

|

8.8

|

9.7

|

|

= Recurring Profit/(loss) before tax (non-GAAP) (unaudited)

|

83.9

|

(14.8)

|

4.4

|

15.4

|

18.9

|

27.2

|

22.4

|

(3.9)

|

(3.2)

|

6.1

|

(13.7)

|

0.9

|

(10.6)

|

2.5

|

11.6

|

|

(-) Recurring Tax

|

(24.8)

|

(8.5)

|

(14.5)

|

(7.9)

|

(3.2)

|

(8.4)

|

(6.2)

|

(0.4)

|

(3.7)

|

(4.5)

|

0.1

|

(4.3)

|

0.4

|

(3.7)

|

(7.1)

|

|

Income tax expense (reported)

|

(13.4)

|

(36.2)

|

(5.1)

|

(5.5)

|

0.5

|

(3.8)

|

(4.6)

|

(35.0)

|

3.1

|

(2.3)

|

(2.0)

|

0.2

|

2.4

|

(2.3)

|

(5.3)

|

|

Tax effect (non-recurring)

|

(11.3)

|

27.7

|

(9.4)

|

(2.4)

|

(3.7)

|

(4.6)

|

(1.6)

|

34.6

|

(6.8)

|

(2.2)

|

2.2

|

(4.5)

|

(2.0)

|

(1.4)

|

(1.7)

|

|

= Adjusted Earnings (non-GAAP) (unaudited)

|

59.1

|

(23.2)

|

(10.1)

|

7.5

|

15.7

|

18.7

|

16.2

|

(4.3)

|

(6.9)

|

1.6

|

(13.5)

|

(3.4)

|

(10.2)

|

(1.2)

|

4.5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Recurring ETR

|

30.5%

|

57.4%

|

N.M.

|

51.3%

|

17.7%

|

31.1%

|

31.4%

|

9.8%

|

N.M.

|

74.1%

|

0.8%

|

N.M.

|

3.8%

|

N.M.

|

61.0%

|

(1) Profit/(loss) before income tax from continuing

operations

Financing Arrangements

Net debt with third parties

as of December 31, 2019 and 2020 is as follow:

|

($ in millions, except Net Debt/Adj. EBITDA LTM)

|

On December 31, 2020

|

On December 31, 2019

|

|

Cash and cash equivalents

|

209.0

|

124.7

|

|

Debt:

|

|

|

|

Senior Secured Notes

|

505.6

|

501.9

|

|

Super Senior Credit Facility

|

30.0

|

-

|

|

BNDES

|

0.6

|