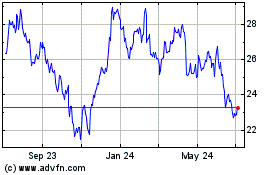

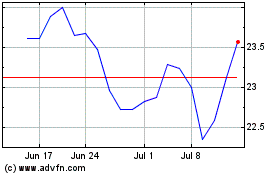

Luxembourg, August 1, 2019 - ArcelorMittal

(referred to as “ArcelorMittal” or the “Company”) (MT (New York,

Amsterdam, Paris, Luxembourg), MTS (Madrid)), the world’s leading

integrated steel and mining company, today announced results1 for

the three-month and six-month periods ended June 30, 2019.

Highlights:

- Health and safety: LTIF rate2 of 1.26x in 2Q 2019 and 1.19x in

1H 2019

- Operating loss of $0.2bn in 2Q 2019 including $0.9bn of

impairments ($0.3bn related to the remedy asset sales for the

ArcelorMittal Italia acquisition and $0.6bn impairment of the fixed

assets of ArcelorMittal USA following a sharp decline in steel

prices and high raw material costs); 1H 2019 operating income of

$0.6bn including $1.1bn of impairments3

- EBITDA of $1.6bn in 2Q 2019; 1H 2019 EBITDA of $3.2bn, -42.6%

lower YoY reflecting a negative price-cost effect

- Net loss of $0.4bn in 2Q 2019 (including $0.9bn of

impairments3); 1H 2019 net loss of $33 million (including $1.1bn of

impairments3)

- Steel shipments of 22.8Mt in 2Q 2019, up 4.3% vs. 1Q 2019 and

up 4.8% vs. 2Q 2018; 1H 2019 steel shipments of 44.6Mt, up 3.5% YoY

largely reflecting the impact of the ArcelorMittal Italia

acquisition

- 2Q 2019 iron ore shipments of 15.5Mt (+6.1% YoY), of which

9.9Mt shipped at market prices (-1.0% YoY); 1H 2019 iron ore

shipments of 29.3Mt (+3.0% YoY), of which 19.1Mt shipped at market

prices (-0.4% YoY)

- Gross debt of $13.8bn as of June 30, 2019 as compared to

$13.4bn as of March 31, 2019. Net debt decreased by $1.0bn during

the quarter to $10.2bn as of June 30, 2019, due in part to M&A

proceeds and working capital release ($0.4bn) (despite higher raw

materials costs and higher steel shipments). Excluding IFRS 16

impact4, net debt as of June 30, 2019 was $1.5bn lower YoY

Strategic actions:

- Given weak demand and high import levels in Europe, the Company

has taken steps to align its European production levels to the

current market demand. As a result of previously announced European

production curtailments, approximately 4.2Mt of annualized

production curtailment is scheduled for 2H 2019

- Further temporary cost initiatives undertaken to navigate the

current weak market backdrop

- Excluding IFRS 16 impact, net debt at the end of June 30, 2019

was the lowest level achieved since the ArcelorMittal merger.

Deleveraging remains the Group’s priority.

- Cash needs of the business for 2019 have been reduced by $1.0bn

to $5.4bn, due to lower expected capex and tax and others

- To complement the expected deleveraging through FCF generation,

the Company has identified opportunities to unlock up to $2bn of

value from its asset portfolio over the next two years

Outlook:

- The Company now expects global steel demand in 2019 to grow

+0.5% to +1.5% (ex-China steel demand growth of +0.5% to +1.0%; US

+0% to +1.0%; and Europe to contract by between -2.0% to

-1.0%)

- Against this backdrop and considering scope changes

(ArcelorMittal Italia acquisition, remedy asset sales and European

production curtailments) steel shipments are still expected to

increase YoY, which should provide support for the Group's Action

2020 program

Financial highlights (on the basis of

IFRS1):

|

(USDm) unless otherwise shown |

2Q 19 |

1Q 19 |

2Q 18 |

1H 19 |

1H 18 |

| Sales |

19,279 |

|

19,188 |

|

19,998 |

|

38,467 |

|

39,184 |

|

|

Operating (loss)/income |

(158 |

) |

769 |

|

2,361 |

|

611 |

|

3,930 |

|

|

Net (loss)/income attributable to equity holders of the parent |

(447 |

) |

414 |

|

1,865 |

|

(33 |

) |

3,057 |

|

|

Basic (loss) / earnings per common share (US$) |

(0.44 |

) |

0.41 |

|

1.84 |

|

(0.03 |

) |

3.01 |

|

|

|

|

|

|

|

|

|

Operating (loss) / income/ tonne (US$/t) |

(7 |

) |

35 |

|

109 |

|

14 |

|

91 |

|

|

EBITDA |

1,555 |

|

1,652 |

|

3,073 |

|

3,207 |

|

5,585 |

|

|

EBITDA/ tonne (US$/t) |

68 |

|

76 |

|

141 |

|

72 |

|

130 |

|

|

Steel-only EBITDA/ tonne (US$/t) |

43 |

|

56 |

|

127 |

|

50 |

|

114 |

|

|

|

|

|

|

|

|

|

Crude steel production (Mt) |

23.8 |

24.1 |

23.2 |

47.8 |

46.5 |

|

Steel shipments (Mt) |

22.8 |

21.8 |

21.8 |

44.6 |

43.1 |

|

Own iron ore production (Mt) |

14.6 |

14.1 |

14.5 |

28.7 |

29.1 |

|

Iron ore shipped at market price (Mt) |

9.9 |

9.2 |

10.0 |

19.1 |

19.1 |

Commenting, Mr. Lakshmi N. Mittal,

ArcelorMittal Chairman and CEO, said:

"After a strong 2018, market conditions in the first half of

2019 have been very tough, with the profitability of our steel

segments suffering due to lower steel prices combined with higher

raw material costs. This has been only partially offset by improved

profitability from our mining segment, but I am pleased that we

have generated healthy free cash flow demonstrating the improved

robustness of the business thanks to our Action 2020 plan.

Global overcapacity remains a clear challenge. We have reduced

capacity in Europe in response to the current weak demand

environment, which has also impacted the turnaround of the ex-Ilva

facilities in Italy. Further action needs to be taken to address

the increasing level of imports entering the continent due to

ineffective safeguard measures and we continue to engage with the

European Commission to create a level playing field for the sector.

A supportive regulatory and funding environment is also crucial to

our ambition to significantly reduce our emissions as announced in

our recent Climate Action report.

We are taking further actions to adapt and strengthen the

Company, ensuring we make continued progress towards our net debt

target and increase returns to shareholders. Despite the current

challenges, the Company is well positioned to benefit from any

improvement in market conditions and the current very low spread

environment".

Sustainable development and safety

performance

Health and safety - Own personnel and

contractors lost time injury frequency rate

Health and safety performance (inclusive of ArcelorMittal Italia

(previously known as Ilva)), based on own personnel figures and

contractors lost time injury frequency (LTIF) rate was 1.26x in

second quarter of 2019 ("2Q 2019") as compared to 1.14x in the

first quarter of 2019 (“1Q 2019”). Health and safety performance

(inclusive of ArcelorMittal Italia) in the first six months of 2019

(“1H 2019”) was 1.19x.

Excluding the impact of ArcelorMittal Italia, the LTIF was 0.68x

for 2Q 2019 as compared to 0.66x for 1Q 2019 and 0.71x for the

second quarter of 2018 (“2Q 2018”). Health and safety

performance (excluding the impact of ArcelorMittal Italia) improved

to 0.66x in 1H 2019 as compared to 0.67x for the first six months

of 2018 (“1H 2018”).

The Company’s efforts to improve its Health and Safety record

remain focused on both further reducing the rate of severe injuries

and preventing fatalities.

Own personnel and contractors -

Frequency rate

|

Lost time injury frequency rate |

2Q 19 |

1Q 19 |

2Q 18 |

1H 19 |

1H 18 |

|

Mining |

0.64 |

|

0.38 |

|

0.62 |

|

0.51 |

|

0.53 |

|

|

NAFTA |

0.46 |

|

0.58 |

|

0.64 |

|

0.50 |

|

0.52 |

|

|

Brazil |

0.43 |

|

0.48 |

|

0.35 |

|

0.45 |

|

0.36 |

|

|

Europe |

1.00 |

|

0.85 |

|

1.02 |

|

0.91 |

|

0.92 |

|

|

ACIS |

0.58 |

|

0.75 |

|

0.52 |

|

0.66 |

|

0.64 |

|

|

Total Steel |

0.69 |

|

0.71 |

|

0.72 |

|

0.69 |

|

0.69 |

|

|

Total (Steel and Mining) |

0.68 |

|

0.66 |

|

0.71 |

|

0.66 |

|

0.67 |

|

|

ArcelorMittal Italia |

13.73 |

11.05 |

- |

12.35 |

- |

|

Total (Steel and Mining) including ArcelorMittal

Italia |

1.26 |

1.14 |

- |

1.19 |

- |

Key sustainable development highlights

for 2Q 2019:

- ArcelorMittal published its first Climate Action report with a

stated ambition to significantly reduce its carbon footprint by

2050; ArcelorMittal's European business specifically targets to be

carbon neutral by 2050.

- ArcelorMittal has become a member of the Energy Transition

Commission.

- ArcelorMittal hosted a consultation at the ArcelorMittal Orbit

in London on the draft ResponsibleSteel™ standard - the steel

industry’s first, multi-stakeholder standard for the entire

‘mine-to-metal’ steel value chain. The standard is due to

launch to the market at the end of 2019.

- ArcelorMittal won Fiat Chrysler Automobiles' best raw material

supplier award, recognizing our commitment to deliver value through

innovation, quality and competitiveness.

- ArcelorMittal was named Steel Sustainability Champion by the

World Steel Association for the second consecutive year.

Analysis of results for the six months

ended June 30, 2019 versus results for the six months ended June

30, 2018

Total steel shipments for 1H 2019 were 44.6 million metric

tonnes representing an increase of 3.5% as compared to 1H

2018,primarily due to higher steel shipments in Europe (+10.1%) due

to the impact of ArcelorMittal Italia (following its consolidation

from November 1, 2018) and in Brazil (+6.6%), offset in part by

lower shipments in ACIS (-4.0%) and NAFTA (-5.3%). Excluding the

impact of ArcelorMittal Italia and Votorantim, steel shipments in

1H 2019 were 1.9% lower as compared to 1H 2018.

Sales for 1H 2019 decreased by 1.8% to $38.5 billion as compared

with $39.2 billion for 1H 2018, primarily due to lower average

steel selling prices (-6.1%) offset in part by higher steel

shipments (+3.5%).

Depreciation of $1.5 billion for 1H 2019 was higher as compared

with $1.4 billion in 1H 2018. Depreciation charges for 2019 include

the depreciation of right-of-use assets recognized in property,

plant and equipment under IFRS 16 lease accounting, which were

previously recorded in cost of sales and selling, general and

administrative expenses. FY 2019 depreciation is expected to be

approximately $3.1 billion (based on current exchange rates).

Impairment charges for 1H 2019 were $1.1 billion related to the

remedy asset sales for the ArcelorMittal Italia acquisition ($0.5

billion) and impairment of the fixed assets of ArcelorMittal USA

($0.6 billion) following a sharp decline in steel prices and high

raw material costs. Impairment charges for 1H 2018 were $86 million

related to the agreed remedy package required for the approval of

the Votorantim acquisition5.

Exceptional items for 1H 2019 were nil. Exceptional charges for

1H 2018 were $146 million related to a provision taken in respect

of a case that has been settled6.

Operating income for 1H 2019 was lower at $0.6 billion as

compared to $3.9 billion in 1H 2018 primarily driven by impairments

as discussed above, as well as weaker operating conditions

(negative price-cost effect in steel segments) reflecting both the

impact of the decline in steel prices since 4Q 2018 and higher raw

material costs offset in part by improved mining segment

performance.

Income from associates, joint ventures and other investments for

1H 2019 was higher at $302 million as compared to $242 million for

1H 2018. Performance of Calvert and Chinese investee weakened in 1H

2019 as compared to 1H 2018, whilst 1H 2018 was negatively impacted

by $132 million impairment of ArcelorMittal’s investment in

Macsteel (South Africa) following the announced sale of its 50%

stake in May 2018. Income from investments in associates, joint

ventures and other investments in 1H 2019 and 1H 2018 include the

annual dividend income from Erdemir of $93 million and $87 million,

respectively.

Net interest expense in 1H 2019 was slightly lower at $315

million as compared to $323 million in 1H 2018. The Company expects

full year 2019 net interest expense to be approximately $650

million.

Foreign exchange and other net financing losses were $404

million for 1H 2019 as compared to $564 million for 1H 2018.

Foreign exchange losses for 1H 2019 were $14 million as compared to

foreign exchange losses of $237 million in 1H 2018.

ArcelorMittal recorded an income tax expense of $149 million for

1H 2019 as compared to $184 million for 1H 2018. The deferred tax

benefit of $340 million in 1H 2018 is the result of recording a

deferred tax asset primarily due to the expectation of higher

future profits mainly in Luxembourg, following the share capital

conversion.

ArcelorMittal’s net loss for 1H 2019 was $33 million, or $0.03

basic loss per common share, as compared to a net income in 1H 2018

of $3.1 billion, or $3.01 basic earnings per common share.

Analysis of results for 2Q 2019 versus

1Q 2019 and 2Q 2018Total steel shipments in 2Q 2019 were

4.3% higher at 22.8Mt as compared with 21.8Mt for 1Q 2019 primarily

due to higher steel shipments in ACIS (+19.5%) due to normalization

of production in Temirtau (Kazakhstan), seasonally higher shipments

in Europe (+2.2%), higher shipments in NAFTA (+2.2%), primarily due

to ramp up of the blast furnace in Mexico, offset by lower

shipments in Brazil (-3.3%) due to weaker export conditions.

Total steel shipments in 2Q 2019 were 4.8% higher as compared

with 21.8Mt for 2Q 2018 primarily due to higher steel shipments in

Europe (+12.3%) due to the acquisition of ArcelorMittal Italia,

ACIS (+4.1%) due to operational issues in Ukraine last year offset

by lower steel shipments in NAFTA (-6.3%) and in Brazil (-1.6%).

Excluding the impact of the ArcelorMittal Italia acquisition, steel

shipments were -0.7% lower as compared to 2Q 2018.

Sales in 2Q 2019 were 0.5% higher at $19.3 billion as compared

to $19.2 billion for 1Q 2019 primarily due to higher steel

shipments (+4.3%) offset in part by lower average steel selling

prices (-3.9%). Sales in 2Q 2019 were 3.6% lower as compared to $20

billion for 2Q 2018 primarily due to lower average steel selling

prices (-8.8%), partially offset by higher steel shipments

(+4.8%).

Depreciation for 2Q 2019 was higher at $766 million as compared

to $733 million for 1Q 2019. 2Q 2019 depreciation expense was

higher than $712 million in 2Q 2018 primarily due to the impact of

IFRS 16.

Impairment charges for 2Q 2019 were $947 million related to the

remedy asset sales for the ArcelorMittal Italia acquisition ($347

million) and impairment of the fixed assets of ArcelorMittal USA

($600 million) following a sharp decline in steel prices and high

raw material costs. Impairment charges for 1Q 2019 of $150 million

related to the remedy asset sales for the ArcelorMittal Italia

acquisition. Impairment charges for 2Q 2018 were nil.

Operating loss for 2Q 2019 was $0.2 billion as compared to an

operating income of $0.8 billion in 1Q 2019 and an operating income

of $2.4 billion in 2Q 2018 primarily driven by impairments as

discussed above, as well as weaker operating conditions (negative

price-cost effect in the steel segments) reflecting both the impact

of the decline in steel prices since 1Q 2019 and higher raw

material prices, offset in part by the impact of higher seaborne

iron ore reference prices.

Income from associates, joint ventures and other investments for

2Q 2019 was $94 million as compared to $208 million for 1Q 2019 and

$30 million for 2Q 2018. 2Q 2019 was impacted by weaker Chinese and

Calvert investee performances. 1Q 2019 was positively impacted by

the annual dividend declared by Erdemir ($93 million). 2Q 2018 was

impacted by $132 million impairment of ArcelorMittal’s investment

in Macsteel (South Africa) following the announced sale of its 50%

stake in May 2018.

Net interest expense in 2Q 2019 was $154 million as compared to

$161 million in 1Q 2019 and lower than $159 million in 2Q

2018.

Foreign exchange and other net financing losses in 2Q 2019 were

$173 million as compared to $231 million for 1Q 2019 and $390

million in 2Q 2018. Foreign exchange gain for 2Q 2019 was $34

million as compared to foreign exchange losses of $48 million and

$309 million, in 1Q 2019 and 2Q 2018, respectively. 2Q 2019

includes non-cash mark-to-market losses of $55 million related to

the mandatory convertible bonds call option as compared to losses

of $6 million in 1Q 2019 and gains of $91 million in 2Q 2018.

ArcelorMittal recorded an income tax expense of $14 million in

2Q 2019 as compared to an income tax expense of $135 million for 1Q

2019 and an income tax benefit of $19 million for 2Q 2018.

Income attributable to non-controlling interests was $42 million

for 2Q 2019 as compared to $36 million for 1Q 2019 and losses

attributable to non-controlling interests of $4 million in 2Q

2018.

ArcelorMittal recorded a net loss for 2Q 2019 of $0.4 billion,

or $0.44 basic loss per common share, as compared to net income for

1Q 2019 of $0.4 billion, or $0.41 basic earnings per common share,

and a net income for 2Q 2018 of $1.9 billion, or $1.84 basic

earnings per common share.

Analysis of segment operations

NAFTA

|

(USDm) unless otherwise shown |

2Q 19 |

1Q 19 |

2Q 18 |

1H 19 |

1H 18 |

|

Sales |

5,055 |

|

5,085 |

|

5,356 |

|

10,140 |

|

10,108 |

|

|

Operating (loss) / income |

(539 |

) |

216 |

|

660 |

|

(323 |

) |

968 |

|

|

Depreciation |

(137 |

) |

(134 |

) |

(131 |

) |

(271 |

) |

(263 |

) |

|

Impairments |

(600 |

) |

— |

|

— |

|

(600 |

) |

— |

|

|

EBITDA |

198 |

|

350 |

|

791 |

|

548 |

|

1,231 |

|

|

Crude steel production (kt) |

5,590 |

|

5,388 |

|

5,946 |

|

10,978 |

|

11,810 |

|

|

Steel shipments (kt) |

5,438 |

|

5,319 |

|

5,803 |

|

10,757 |

|

11,362 |

|

|

Average steel selling price (US$/t) |

836 |

|

874 |

|

853 |

|

855 |

|

817 |

|

NAFTA segment crude steel production increased by 3.7% to 5.6Mt

in 2Q 2019 as compared to 5.4Mt in 1Q 2019. This increase was

primarily due to ramp up of the blast furnace in Mexico (which had

suffered delays following scheduled maintenance in 3Q 2018).

Steel shipments in 2Q 2019 increased by 2.2% to 5.4Mt as

compared to 5.3Mt in 1Q 2019 primarily due to a 21.1% improvement

in the long product shipments (mainly in Mexico as discussed

above).

Sales in 2Q 2019 were stable at $5.1 billion as compared to 1Q

2019, primarily due to higher steel shipments (+2.2%) offset by a

4.3% decline in average steel selling prices (with both flat and

long products down 3.6% and 5.7%, respectively). US prices have

deteriorated through 2Q 2019 reflecting weaker demand exacerbated

by prolonged customer destocking and increased domestic supply with

prices well below import parity.

Impairment charges for 2Q 2019 were $600 million related to

impairment of the fixed assets of ArcelorMittal USA following a

sharp decline in steel prices and high raw material costs. As a

result, there was an operating loss in 2Q 2019 of $539 million as

compared to operating income of $216 million in 1Q 2019 and $660

million in 2Q 2018.

EBITDA in 2Q 2019 decreased by 43.4% to $198 million as compared

to $350 million in 1Q 2019 primarily due to negative price-cost

effect offset in part by higher steel shipment volumes. EBITDA in

2Q 2019 decreased by 75.0% as compared to $791 million in 2Q 2018

primarily due to a negative price-cost effect and lower steel

shipments (-6.3%).

Brazil

|

(USDm) unless otherwise shown |

2Q 19 |

1Q 19 |

2Q 18 |

1H 19 |

1H 18 |

| Sales |

2,126 |

|

2,156 |

|

2,191 |

|

4,282 |

|

4,179 |

|

|

Operating income |

234 |

|

239 |

|

369 |

|

473 |

|

584 |

|

|

Depreciation |

(79 |

) |

(70 |

) |

(74 |

) |

(149 |

) |

(143 |

) |

|

Impairment |

— |

|

— |

|

— |

|

— |

|

(86 |

) |

|

EBITDA |

313 |

|

309 |

|

443 |

|

622 |

|

813 |

|

|

Crude steel production (kt) |

2,830 |

|

3,013 |

|

3,114 |

|

5,843 |

|

5,915 |

|

|

Steel shipments (kt) |

2,785 |

|

2,880 |

|

2,831 |

|

5,665 |

|

5,314 |

|

|

Average steel selling price (US$/t) |

705 |

|

704 |

|

728 |

|

705 |

|

739 |

|

Brazil segment crude steel production decreased by 6.1% to 2.8Mt

in 2Q 2019 as compared to 3.0Mt for 1Q 2019, due in part to the

decision to stop ArcelorMittal Tubarão's blast furnace #2 in June,

two months earlier than its initial maintenance schedule due to

deteriorating export market conditions, as well as lower production

in the long business.

Steel shipments in 2Q 2019 decreased by 3.3% to 2.8Mt as

compared to 2.9Mt in 1Q 2019, due to a decrease in flat products

(-8.0%) primarily due to lower exports.

Sales in 2Q 2019 decreased by 1.4% to $2.1 billion as compared

to $2.2 billion in 1Q 2019, primarily due to lower steel shipments

as discussed above. Average steel selling prices remained stable as

increases in local currency sales prices were offset by currency

depreciation.

Operating income in 2Q 2019 marginally declined to $234 million

as compared to $239 million in 1Q 2019 and was lower than $369

million in 2Q 2018.

EBITDA in 2Q 2019 increased by 1.2% to $313 million as compared

to $309 million in 1Q 2019. EBITDA in 2Q 2019 was 29.3% lower as

compared to $443 million in 2Q 2018 primarily due to negative

price-cost effect and foreign exchange translation impact.

Europe

|

(USDm) unless otherwise shown |

2Q 19 |

1Q 19 |

2Q 18 |

1H 19 |

1H 18 |

| Sales |

10,396 |

|

10,494 |

|

10,527 |

|

20,890 |

|

21,168 |

|

|

Operating (loss) / income |

(301 |

) |

11 |

|

853 |

|

(290 |

) |

1,433 |

|

|

Depreciation |

(313 |

) |

(309 |

) |

(292 |

) |

(622 |

) |

(610 |

) |

|

Impairment |

(347 |

) |

(150 |

) |

— |

|

(497 |

) |

— |

|

|

Exceptional charges |

— |

|

— |

|

— |

|

— |

|

(146 |

) |

|

EBITDA |

359 |

|

470 |

|

1,145 |

|

829 |

|

2,189 |

|

|

Crude steel production (kt) |

12,079 |

|

12,372 |

|

11,026 |

|

24,451 |

|

22,272 |

|

|

Steel shipments (kt) |

11,811 |

|

11,553 |

|

10,516 |

|

23,364 |

|

21,213 |

|

|

Average steel selling price (US$/t) |

704 |

|

729 |

|

800 |

|

716 |

|

800 |

|

Europe segment crude steel production decreased by 2.4% to

12.1Mt in 2Q 2019 as compared to 12.4Mt in 1Q 2019, primarily due

to weaker than expected market conditions.

Steel shipments in 2Q 2019 seasonally increased by 2.2% to

11.8Mt as compared to 11.6Mt in 1Q 2019, whilst they were 12.3%

higher than 2Q 2018 (due to the scope impact from the ArcelorMittal

Italia acquisition which was consolidated from November 1, 2018),

the impact of floods in Asturias, Spain and the impact of rail

strikes in France in 2Q 2018.

Sales in 2Q 2019 were $10.4 billion, -0.9% lower as compared to

$10.5 billion in 1Q 2019, with lower average steel selling prices

-3.5% (with both flat and long products declining 3.5% and 3.7%,

respectively) offset in part by higher steel shipments, as

discussed above.

Impairment charges for 2Q 2019 and 1Q 2019 were $347 million and

$150 million, respectively, related to remedy asset sales related

to ArcelorMittal Italia. Impairment charges for 2Q 2018 were

nil.

Operating loss in 2Q 2019 was $301 million as compared to

operating income of $11 million in 1Q 2019 and $853 million in 2Q

2018. Operating results were impacted by impairment charges as

discussed above.

Despite seasonally higher steel shipments, EBITDA in 2Q 2019

decreased by -23.7% to $359 million as compared to $470 million in

1Q 2019 primarily due to a negative price-cost effect. EBITDA in 2Q

2019 decreased by -68.7% as compared to $1,145 million in 2Q 2018,

primarily due to negative price-cost effect, foreign exchange

impact, and continued losses of ArcelorMittal Italia. Assuming

existing market conditions and no ongoing license to operate

issues, an accelerated action plan has been implemented to

significantly reduce ArcelorMittal Italia losses by 4Q

2019.ACIS

|

(USDm) unless otherwise shown |

2Q 19 |

1Q 19 |

2Q 18 |

1H 19 |

1H 18 |

| Sales |

1,906 |

|

1,645 |

|

2,129 |

|

3,551 |

|

4,209 |

|

|

Operating income |

114 |

|

64 |

|

312 |

|

178 |

|

602 |

|

|

Depreciation |

(85 |

) |

(81 |

) |

(85 |

) |

(166 |

) |

(158 |

) |

|

EBITDA |

199 |

|

145 |

|

397 |

|

344 |

|

760 |

|

|

Crude steel production (kt) |

3,252 |

|

3,323 |

|

3,087 |

|

6,575 |

|

6,487 |

|

|

Steel shipments (kt) |

3,182 |

|

2,662 |

|

3,057 |

|

5,844 |

|

6,086 |

|

|

Average steel selling price (US$/t) |

536 |

|

541 |

|

621 |

|

538 |

|

616 |

|

ACIS segment crude steel production in 2Q 2019 was broadly

stable at 3.3Mt as compared to 1Q 2019 primarily due to

normalization of production in Temirtau (Kazakhstan) following an

explosion at a gas pipeline in 4Q 2018 offset by lower production

in Ukraine due to planned blast furnace repair and in South Africa

following a scheduled maintenance.

Steel shipments in 2Q 2019 increased by 19.5% to 3.2Mt as

compared to 2.7Mt as at 1Q 2019, primarily due to the improved

shipments in all three regions particularly in Kazakhstan.

Sales in 2Q 2019 increased by 15.8% to $1.9 billion as compared

to $1.6 billion in 1Q 2019 primarily due to higher steel

shipments.

Operating income in 2Q 2019 was higher at $114 million as

compared to $64 million in 1Q 2019 and lower as compared to $312

million in 2Q 2018.

EBITDA in 2Q 2019 increased by 37.5% to $199 million as compared

to $145 million in 1Q 2019 primarily due to higher steel shipment

volumes. EBITDA in 2Q 2019 was 49.7% lower as compared to $397

million in 2Q 2018, primarily due to negative price-cost effect

partially offset by higher shipments.

Mining

|

(USDm) unless otherwise shown |

2Q 19 |

1Q 19 |

2Q 18 |

1H 19 |

1H 18 |

| Sales |

1,423 |

|

1,127 |

|

1,065 |

|

2,550 |

|

2,089 |

|

|

Operating income |

457 |

|

313 |

|

198 |

|

770 |

|

440 |

|

|

Depreciation |

(113 |

) |

(107 |

) |

(107 |

) |

(220 |

) |

(214 |

) |

|

EBITDA |

570 |

|

420 |

|

305 |

|

990 |

|

654 |

|

|

|

|

|

|

|

|

|

Own iron ore production (Mt) |

14.6 |

|

14.1 |

|

14.5 |

|

28.7 |

|

29.1 |

|

|

Iron ore shipped externally and internally at market price (a)

(Mt) |

9.9 |

|

9.2 |

|

10.0 |

|

19.1 |

|

19.1 |

|

|

Iron ore shipment - cost plus basis (Mt) |

5.6 |

|

4.6 |

|

4.6 |

|

10.2 |

|

9.3 |

|

|

Own coal production (Mt) |

1.5 |

|

1.2 |

|

1.6 |

|

2.7 |

|

3.1 |

|

|

Coal shipped externally and internally at market price (a)

(Mt) |

0.7 |

|

0.7 |

|

0.7 |

|

1.4 |

|

1.1 |

|

|

Coal shipment - cost plus basis (Mt) |

0.7 |

|

0.7 |

|

0.9 |

|

1.4 |

|

1.8 |

|

(a) Iron ore and coal shipments of market-priced based

materials include the Company’s own mines and share of production

at other mines

Own iron ore production in 2Q 2019 increased by 4.0% to 14.6Mt

as compared to 14.1Mt in 1Q 2019, primarily due to seasonally

higher production in ArcelorMittal Mines Canada7 (AMMC). Own iron

ore production in 2Q 2019 increased by 1.2% as compared to 2Q 2018

primarily due to higher AMMC and Ukraine production offset in part

by lower production in Liberia and Kazakhstan and the Volcan mine

in Mexico which reached end of life in May 2019.

Market-priced iron ore shipments in 2Q 2019 increased by 7.7% to

9.9Mt as compared to 9.2Mt in 1Q 2019, primarily driven by

seasonally higher market-priced iron ore shipments in AMMC offset

in part by lower shipments in Liberia and at the Volcan mine in

Mexico (as discussed above). Market-priced iron ore shipments in 2Q

2019 were largely stable as compared to 2Q 2018 driven by higher

shipments in AMMC and Serra Azul offset by lower shipments in

Ukraine. Market-priced iron ore shipments for FY 2019 are expected

to be stable as compared to FY 2018 with increases in Liberia and

AMMC to be offset by lower volume at the Volcan mine.

Own coal production in 2Q 2019 increased by 18.1% to 1.5Mt as

compared to 1.2Mt in 1Q 2019 primarily due to higher production at

Princeton (US) and Temirtau (Kazakhstan). Own coal production in 2Q

2019 decreased by 9.0% as compared to 1.6Mt in 2Q 2018 due to lower

production at Temirtau (Kazakhstan).

Market-priced coal shipments in 2Q 2019 were stable at 0.7Mt as

compared to 1Q 2019 and 2Q 2018.

Operating income in 2Q 2019 increased by 46.2% to $457 million

as compared to $313 million in 1Q 2019 and $198 million in 2Q

2018.

EBITDA in 2Q 2019 increased by 35.8% to $570 million as compared

to $420 million in 1Q 2019, primarily due to the impact of higher

seaborne iron ore reference prices (+22.5%) and higher

market-priced iron ore shipments (+7.7%). EBITDA in 2Q 2019 was

86.7% higher as compared to $305 million in 2Q 2018, primarily due

to higher seaborne iron ore reference prices (+53.0%).

Liquidity and Capital Resources

For 2Q 2019 net cash provided by operating activities was $1,786

million as compared to $971 million in 1Q 2019 and $1,232 million

in 2Q 2018. The cash provided by operating activities during 2Q

2019 reflects in part a working capital release of $353 million as

compared to a working capital investment of $553 million in 1Q 2019

and a working capital investment of $1,232 million in 2Q 2018.

Due to a smaller than anticipated release in 4Q 2018, the Group

invested more in working capital than expected in 2018 ($4.4

billion versus guidance of $3.0-3.5 billion). The Group expects

this additional investment of approximately $1 billion to be

released in full over the course of 2019. The 1H 2019 working

capital investment of $0.2 billion was significantly less

pronounced than in previous years despite seasonally higher

shipments and higher raw material prices reflecting the Company’s

focus on the structural release of the excess working capital.

Given the 1H 2019 working capital investment of $0.2 billion this

implies a release of $1.2 billion in 2H 2019.

Net cash used in investing activities during 2Q 2019 was $564

million as compared to $693 million during 1Q 2019 and $556 million

in 2Q 2018. Capex decreased to $869 million in 2Q 2019 as compared

to $947 million in 1Q 2019 and increased as compared to $616

million in 2Q 2018. Whilst no significant delays to growth

investments are expected, the Company has reduced overall expected

capex across all segments in FY 2019 by $0.5 billion and now

expects FY 2019 capex to be $3.8 billion versus previous guidance

of $4.3 billion.

Net cash provided by other investing activities in 2Q 2019 of

$305 million primarily includes net proceeds from remedy asset

sales for the ArcelorMittal Italia acquisition of $0.5 billion,

offset by $0.1 billion partial reversal of the Indian rupee rolling

hedge (see below) and by the quarterly lease payment for the

ArcelorMittal Italia acquisition ($51 million). Net cash provided

by other investing activities in 1Q 2019 of $254 million primarily

includes $0.3 billion due to the rollover of the Indian rupee hedge

at market price which protects the dollar funds needed for the

Essar transaction as per the resolution plan approved by the

Committee of Creditors and the National Company Law Tribunal in

Ahmedabad, offset in part by the quarterly lease payment for the

ArcelorMittal Italia acquisition ($51 million).

Net cash provided by financing activities in 2Q 2019 was $180

million as compared to net cash used in financing activities of

$344 million in 1Q 2019 and net cash provided by financing

activities in 2Q 2018 of $352 million.

In 2Q 2019, net cash provided by financing activities included a

net inflow of $0.5 billion for new bank financing. In 1Q 2019, net

outflow of debt repayments and issuances of $136 million includes

$1 billion repayment of amounts borrowed in connection with the

purchase of the Uttam Galva and KSS Petron debts, $0.9 billion

repayment of the €750 million 5-year, 3% bond at maturity; and

offset in part by $1.6 billion cash received from the issuance of

two new bonds (€750 million 2.25% notes due 2024 and $750 million

4.55% notes due 2026) and $0.2 billion commercial paper issuance.

Net cash provided by financing activities in 2Q 2018 of $352

million primarily includes proceeds from a $1 billion short-term

loan facility entered into on May 14, 2018 offset by repayment of a

€400 million ($491 million) bond at maturity on April 9, 2018.

During 2Q 2019, the Company paid dividends of $204 million

mainly to ArcelorMittal shareholders. During 1Q 2019, the Company

paid dividends of $46 million to minority shareholders in AMMC

(Canada). During 2Q 2018, the Company paid dividends of $101

million to ArcelorMittal shareholders. During 1Q 2019, the Company

completed its share buyback programme having repurchased 4 million

shares for a total value of $90 million (€80 million) at an

approximate average price per share of $22.42 (€19.89 per

share).

Outflows from lease principal payments and other financing

activities (net) were $84 million in 2Q 2019 as compared $72

million in 1Q 2019 and $21 million in 2Q 2018. The increase is as a

result of the first-time application of IFRS 16 effective from

January 1, 2019, as the repayments of the principal portion of the

operating leases are presented under financing activities

(previously reported under operating activities).

As of June 30, 2019, the Company’s cash and cash equivalents

amounted to $3.7 billion as compared to $2.2 billion at March 31,

2019 and $2.4 billion at December 31, 2018.

Gross debt increased to $13.8 billion as of June 30, 2019, as

compared to $13.4 billion at March 31, 2019 and $12.6 billion in

December 31, 2018. As of June 30, 2019, net debt decreased by $1.0

billion to $10.2 billion as compared to $11.2 billion as of March

31, 2019. Net debt as of December 31, 2018, was $10.2 billion.

As of June 30, 2019, the Company had liquidity of $9.2 billion,

consisting of cash and cash equivalents of $3.7 billion and $5.5

billion of available credit lines8. The $5.5 billion credit

facility contains a financial covenant not to exceed 4.25x Net debt

/ LTM EBITDA (as defined in the facility). As of June 30, 2019, the

average debt maturity was 4.7 years.

Key recent developments

- On May 6, 2019, ArcelorMittal announced its intention to

temporarily reduce annualized European primary steelmaking

production by 3Mt in the 2H 2019. These measures included

temporarily idling production at its steelmaking facilities in

Kraków, Poland and reduce production in Asturias, Spain as well as

the slow down at ArcelorMittal Italia following a decision to

optimise cost and quality over volume in this environment.

Furthermore, on May 29, 2019, the Company announced additional

steps to adjust its European production levels to the current

market demand by a further 1.2Mt to take total annualized

productions cuts to 4.2Mt in 2H 2019. These include:

- Reduce primary steelmaking production at its facilities in

Dunkirk, France and Eisenhüttenstadt, Germany;

- Reduce primary steelmaking production at its facility in

Bremen, Germany in the fourth quarter of this year, where a planned

blast furnace stoppage for repair works will be extended;

- Extend the stoppage planned in the fourth quarter of this year

to repair a blast furnace at its plant in Asturias, Spain.

ArcelorMittal stated that these

actions were taken in light of difficult operating conditions in

Europe with a combination of weakening demand, rising imports, high

energy costs and rising carbon costs.

- On May 29, 2019, ArcelorMittal published its first Climate

Action report in which it announced its ambition to significantly

reduce CO2 emissions globally and be carbon neutral in Europe by

2050. To achieve this goal the Company is building a strategic

roadmap linked to the evolution of public policy and developments

in low-emissions steelmaking technologies. A target to 2030 will be

launched in 2020, replacing the Company’s current target of an 8%

carbon footprint reduction by 2020, against a 2007 baseline. The

report explains in greater detail the future challenges and

opportunities for the steel industry, the plausible technology

pathways the Company is exploring as well as its views on the

policy environment required for the steel industry to succeed in

meeting the targets of the Paris Agreement.

- In June 2017, ArcelorMittal signed an agreement for the lease

(for a period up to August 2023) and subsequent acquisition of

Ilva’s business assets, providing for total maximum payments of EUR

1.8 billion. The lease period started on November 1, 2018.

According to the legal framework in force at the time of signing

and closing of the lease agreement, Ilva’s insolvency trustees, as

well as the lessee and purchaser of Ilva’s assets, were granted

protection from criminal liability related to environmental, health

and safety, and workplace security issues at Ilva’s Taranto plant,

pending the timely implementation of the EUR 1.15 billion

environmental investment program approved by the Italian Government

in September 2017. In September 2017 and then August 2018 the

Italian State Solicitor-General issued an opinion confirming that

the term of the protection coincided with the term of the Company’s

environmental plan, namely to August 23, 2023. On June 28, 2019,

however, the Italian Parliament ratified a law decree enacted by

the Government, which has removed the protection for criminal

liability related to public health and safety, and workplace

security matters and, as from September 7, 2019, will also remove

such protection as it relates to environmental matters.

ArcelorMittal considers that the removal of this protection could

impair any operator’s ability to operate the Taranto plant while

implementing the environmental plan. ArcelorMittal remains in

discussions with the Italian authorities on this matter, in view of

reaching before September 7, 2019 an appropriate solution

compatible with the continued operation of the Taranto plant. No

assurance can be given at this stage as to the outcome of such

discussions.In addition, on July 9, 2019 the public prosecutor of

Taranto ordered the shutdown of blast furnace No. 2 of the Taranto

plant. The order was in the context of a procedure dating from a

fatality in 2015, as a result of which the blast furnace was put

under seizure and improvements were required to be undertaken by

the Special Commissioners as a condition to the continued operation

of the blast furnace. The timeline of the shutdown of blast furnace

No. 2 remains to be determined and will be set forth in a plan the

judicial custodian appointed by the public prosecutor of Taranto is

currently preparing and whose implementation would take 60 days.

ArcelorMittal Italia is assessing technical aspects and is working

with the relevant authorities towards an acceptable solution so

that the blast furnace (which has an annual production target of

1.5 million tonnes) may remain operational.

- On July 1, 2019, ArcelorMittal announced the completion of the

sale to Liberty House Group (‘Liberty’) of several steelmaking

assets that form the divestment package the Company agreed with the

European Commission (‘EC’) during its merger control investigation

into the Company’s acquisition of Ilva S.p.A. The assets included

in the divestment package are: ArcelorMittal Ostrava (Czech

Republic), ArcelorMittal Galati (Romania), ArcelorMittal Skopje

(Macedonia), ArcelorMittal Piombino (Italy), ArcelorMittal

Dudelange (Luxembourg) and several finishing lines at ArcelorMittal

Liège (Belgium). The total net consideration (consisting of amounts

payable upon closing and subsequently in part contingent upon

certain criteria, net of EUR 110 million placed in escrow) for the

assets payable to ArcelorMittal is €740 million subject to

customary closing adjustments. Of this total amount, €610 million

was received on June 28, 2019. The Company has deposited €110

million in escrow to be used by Liberty for certain capital

expenditure projects to satisfy commitments given in the EC

approval process.

- On July 4, 2019, ArcelorMittal announced the completion of an

issuance of €250 million of its 2.250% notes due January 17, 2024

(the “Notes”), which will be consolidated and form a single series

with the existing €750 million 2.250 per cent. notes due January

17, 2024, originally issued on January 17, 2019. At the time of

pricing the “tap” issuance, the yield to maturity (representing the

actual annual cost of the issuance for ArcelorMittal) was 0.984%.

The issuance closed on July 4, 2019. The Notes were issued under

ArcelorMittal’s €10 billion wholesale Euro Medium Term Notes

Programme. The proceeds of the issuance will be used for general

corporate purposes.

- On July 4, 2019, the National Company Law Appellate Tribunal

(“NCLAT”) of India disposed of the various appeals pending before

it while approving the Company’s resolution plan for the

acquisition of Essar Steel India Limited (“ESIL”). Several appeals

have been filed before India’s Supreme Court challenging the

NCLAT’s order and on July 22, 2019, India’s Supreme Court further

stayed the implementation of the NCLAT’s order pending a hearing of

the appeals on August 7, 2019. The transaction closing is now

expected 3Q 2019.

- On July 11, 2019, ArcelorMittal completed the pricing of its

offering of US$750 million aggregate principal amount of its 3.600%

notes due 2024 (the “Series 2024 Notes”) and US$500 million

aggregate principal amount of its 4.250% notes due 2029 (the

“Series 2029 Notes”). The proceeds to ArcelorMittal (before

expenses), amounting to approximately $1.2 billion, will be used

for general corporate purposes including future repayment of

existing indebtedness and to partially pre-fund commitments under

the Essar acquisition financing facility. The issuance closed on

July 16, 2019.

- On July 30, 2019, ArcelorMittal announced that it has given

notice that it will redeem all of the outstanding 5.125% Notes due

June 1, 2020 and 5.250% Notes due August 5, 2020 on August 30,

2019. Following prior tender offers, there is currently the

following outstanding principal amount of 5.125% Notes and 5.250%

Notes, respectively: US$324,229,000 (original issuance of

US$500,000,000) and US$625,630,000 (original issuance of

US$1,000,000,000).

Outlook and guidanceBased on year-to-date

growth and the current economic outlook, ArcelorMittal expects

global apparent steel consumption (“ASC”) to grow further in 2019

by between +0.5% to +1.5% (slightly revised down from previous

expectation of +1.0% to +1.5% growth). By region:

ASC in US is expected to grow marginally by between +0.0% to

+1.0% in 2019, with healthy non-residential construction demand

offset by ongoing weakness in automotive demand and a slowdown in

machinery demand (a moderation of growth versus +0.5% to +1.5%

previous estimate). In Europe, ASC is expected to contract by

between -2.0% to -1.0% with ongoing automotive demand weakness

primarily due to lower exports (versus -1.0% to 0.0% previous

estimate). In Brazil, ASC growth in 2019 is forecasted in the

range of +1.5% to +2.5% (a moderation of growth versus +3.0% to

4.0% previous estimate) as domestic GDP has slowed, as well as

impacts of Argentinian recession and delayed growth in

infrastructure spend until pension reform is passed. In the CIS,

expected ASC growth is unchanged at +1.0% to +2.0% in 2019.

Overall, World ex-China ASC is expected to grow by approximately

+0.5% to +1.0% in 2019 (a moderation versus previous estimate of

+1.0% to +2.0%).In China, ASC growth forecast has increased to

between +0.5% to +1.5% in 2019 (versus previous estimate of +0.0%

to +1.0%) as real estate demand remains resilient.

The Group's steel shipments are expected to increase in 2019

versus 2018 due to these demand expectations, the positive scope

effect of the ArcelorMittal Italia and Votorantim acquisition (net

of the remedy assets sales for the ArcelorMittal Italia acquisition

now complete), the expectation that 2018 operational disruptions

(both controllable and uncontrollable) will not recur, offset in

part by European production curtailments.

Market-priced iron ore shipments for FY 2019 are expected to be

broadly stable as compared to FY 2018 with increases in Liberia and

AMMC to be offset by lower volume in Mexico (in part due to the end

of life of the Volcan mine).

The Company expects certain cash needs of the business

(including capex, interest, cash taxes, pensions and certain other

cash costs but excluding working capital movements) to be

approximately $5.4 billion in 2019 versus $6.4 billion previous

guidance. Whilst no significant delays to growth investments are

expected, the Company has reduced overall expected capex across all

segments in FY 2019 by $0.5 billion and now expects FY 2019 capex

to be $3.8 billion (versus previous guidance of $4.3 billion).

Interest expense in 2019 is expected to be $0.65 billion (no

change) while cash taxes, pensions and other cash costs are now

expected to be $1.0 billion (versus previous guidance of $1.5

billion).

As announced with the full year 2018 results in February 2019,

the $1 billion excess working capital accumulated in 2018 is

expected to be released in full over the course of 2019. Given the

1H 2019 working capital investment of $0.2 billion this implies a

release of $1.2 billion in 2H 2019.

The Company will continue to prioritize deleveraging and

believes that $7 billion (including impact of IFRS 16) is an

appropriate net debt target that will sustain investment grade

metrics even at the low point of the cycle.

ArcelorMittal intends to progressively increase the base

dividend paid to its shareholders, and, on attainment of the net

debt target, the Company is committed to returning a portion of

annual FCF to shareholders.

ArcelorMittal Condensed Consolidated Statement of

Financial Position1

|

In millions of U.S. dollars |

Jun 30,2019 |

Mar 31,2019 |

Dec 31,2018 |

| ASSETS |

|

|

|

| Cash and

cash equivalents |

3,656 |

|

2,246 |

|

2,354 |

|

| Trade

accounts receivable and other |

5,048 |

|

5,131 |

|

4,432 |

|

|

Inventories |

20,550 |

|

20,583 |

|

20,744 |

|

| Prepaid

expenses and other current assets |

3,123 |

|

3,000 |

|

2,834 |

|

| Assets

held for sale9 |

122 |

|

1,950 |

|

2,111 |

|

|

Total Current Assets |

32,499 |

|

32,910 |

|

32,475 |

|

|

|

|

|

|

| Goodwill

and intangible assets |

5,480 |

|

5,549 |

|

5,728 |

|

| Property,

plant and equipment |

36,725 |

|

36,647 |

|

35,638 |

|

|

Investments in associates and joint ventures |

5,026 |

|

5,000 |

|

4,906 |

|

| Deferred

tax assets |

8,412 |

|

8,318 |

|

8,287 |

|

| Other

assets |

4,224 |

|

4,236 |

|

4,215 |

|

|

Total Assets |

92,366 |

|

92,660 |

|

91,249 |

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

|

Short-term debt and current portion of long-term debt |

3,107 |

|

2,739 |

|

3,167 |

|

| Trade

accounts payable and other |

14,418 |

|

14,232 |

|

13,981 |

|

| Accrued

expenses and other current liabilities |

5,549 |

|

5,699 |

|

5,486 |

|

|

Liabilities held for sale9 |

35 |

|

828 |

|

821 |

|

|

Total Current Liabilities |

23,109 |

|

23,498 |

|

23,455 |

|

|

|

|

|

|

| Long-term

debt, net of current portion |

10,723 |

|

10,591 |

|

9,316 |

|

| Deferred

tax liabilities |

2,284 |

|

2,337 |

|

2,374 |

|

| Other

long-term liabilities |

12,139 |

|

11,945 |

|

11,996 |

|

|

Total Liabilities |

48,255 |

|

48,371 |

|

47,141 |

|

|

|

|

|

|

| Equity

attributable to the equity holders of the parent |

42,033 |

|

42,286 |

|

42,086 |

|

|

Non-controlling interests |

2,078 |

|

2,003 |

|

2,022 |

|

|

Total Equity |

44,111 |

|

44,289 |

|

44,108 |

|

|

Total Liabilities and Shareholders’ Equity |

92,366 |

|

92,660 |

|

91,249 |

|

ArcelorMittal Condensed Consolidated Statement of

Operations1

|

|

Three months ended |

Six months ended |

|

In millions of U.S. dollars unless otherwise

shown |

Jun 30,2019 |

Mar 31,2019 |

Jun 30,2018 |

Jun 30,2019 |

Jun 30,2018 |

| Sales |

19,279 |

|

19,188 |

|

19,998 |

|

38,467 |

|

39,184 |

|

| Depreciation

(B) |

(766 |

) |

(733 |

) |

(712 |

) |

(1,499 |

) |

(1,423 |

) |

| Impairments

(B) |

(947 |

) |

(150 |

) |

— |

|

(1,097 |

) |

(86 |

) |

| Exceptional

items6 (B) |

— |

|

— |

|

— |

|

— |

|

(146 |

) |

|

Operating (loss) / income (A) |

(158 |

) |

769 |

|

2,361 |

|

611 |

|

3,930 |

|

| Operating

margin % |

(0.8 |

)% |

4.0 |

% |

11.8 |

% |

1.6 |

% |

10.0 |

% |

| |

|

|

|

|

|

| Income from

associates, joint ventures and other investments |

94 |

|

208 |

|

30 |

|

302 |

|

242 |

|

| Net interest

expense |

(154 |

) |

(161 |

) |

(159 |

) |

(315 |

) |

(323 |

) |

| Foreign

exchange and other net financing loss |

(173 |

) |

(231 |

) |

(390 |

) |

(404 |

) |

(564 |

) |

|

(Loss) / income before taxes and non-controlling

interests |

(391 |

) |

585 |

|

1,842 |

|

194 |

|

3,285 |

|

|

Current tax expense |

(225 |

) |

(180 |

) |

(240 |

) |

(405 |

) |

(524 |

) |

|

Deferred tax benefit |

211 |

|

45 |

|

259 |

|

256 |

|

340 |

|

| Income tax

(expense) / benefit |

(14 |

) |

(135 |

) |

19 |

|

(149 |

) |

(184 |

) |

|

(Loss) / income including non-controlling

interests |

(405 |

) |

450 |

|

1,861 |

|

45 |

|

3,101 |

|

|

Non-controlling interests (income) / loss |

(42 |

) |

(36 |

) |

4 |

|

(78 |

) |

(44 |

) |

| Net

(loss) / income attributable to equity holders of the

parent |

(447 |

) |

414 |

|

1,865 |

|

(33 |

) |

3,057 |

|

|

|

|

|

|

|

|

|

Basic (loss) / earnings per common share ($) |

(0.44 |

) |

0.41 |

|

1.84 |

|

(0.03 |

) |

3.01 |

|

|

Diluted (loss) / earnings per common share ($) |

(0.44 |

) |

0.41 |

|

1.83 |

|

(0.03 |

) |

2.99 |

|

| |

|

|

|

|

|

|

Weighted average common shares outstanding (in millions) |

1,014 |

|

1,014 |

|

1,013 |

|

1,013 |

|

1,016 |

|

|

Diluted weighted average common shares outstanding (in

millions) |

1,014 |

|

1,017 |

|

1,018 |

|

1,013 |

|

1,021 |

|

|

|

|

|

|

|

|

|

OTHER INFORMATION |

|

|

|

|

|

| EBITDA (C =

A-B) |

1,555 |

|

1,652 |

|

3,073 |

|

3,207 |

|

5,585 |

|

| EBITDA

Margin % |

8.1 |

% |

8.6 |

% |

15.4 |

% |

8.3 |

% |

14.3 |

% |

|

|

|

|

|

|

|

| Own iron ore

production (Mt) |

14.6 |

|

14.1 |

|

14.5 |

|

28.7 |

|

29.1 |

|

| Crude steel

production (Mt) |

23.8 |

|

24.1 |

|

23.2 |

|

47.8 |

|

46.5 |

|

|

Steel shipments (Mt) |

22.8 |

|

21.8 |

|

21.8 |

|

44.6 |

|

43.1 |

|

ArcelorMittal Condensed Consolidated Statement of Cash

flows1

|

|

Three months ended |

Six months ended |

|

In millions of U.S. dollars |

Jun 30,2019 |

Mar 31,2019 |

Jun 30,2018 |

Jun 30,2019 |

Jun 30,2018 |

| Operating

activities: |

|

|

|

|

|

|

(Loss)/income attributable to equity holders of the parent |

(447 |

) |

414 |

|

1,865 |

|

(33 |

) |

3,057 |

|

|

Adjustments to reconcile net income to net cash provided by

operations: |

|

|

|

|

|

|

Non-controlling interests income/ (loss) |

42 |

|

36 |

|

(4 |

) |

78 |

|

44 |

|

|

Depreciation and impairments |

1,713 |

|

883 |

|

712 |

|

2,596 |

|

1,509 |

|

|

Exceptional items6 |

— |

|

— |

|

— |

|

— |

|

146 |

|

| Income

from associates, joint ventures and other investments |

(94 |

) |

(208 |

) |

(30 |

) |

(302 |

) |

(242 |

) |

| Deferred

tax benefit |

(211 |

) |

(45 |

) |

(259 |

) |

(256 |

) |

(340 |

) |

| Change in

working capital |

353 |

|

(553 |

) |

(1,232 |

) |

(200 |

) |

(3,101 |

) |

| Other

operating activities (net) |

430 |

|

444 |

|

180 |

|

874 |

|

319 |

|

|

Net cash provided by operating activities (A) |

1,786 |

|

971 |

|

1,232 |

|

2,757 |

|

1,392 |

|

|

Investing activities: |

|

|

|

|

|

| Purchase

of property, plant and equipment and intangibles (B) |

(869 |

) |

(947 |

) |

(616 |

) |

(1,816 |

) |

(1,368 |

) |

| Other

investing activities (net) |

305 |

|

254 |

|

60 |

|

559 |

|

136 |

|

|

Net cash used in investing activities |

(564 |

) |

(693 |

) |

(556 |

) |

(1,257 |

) |

(1,232 |

) |

|

Financing activities: |

|

|

|

|

|

| Net

proceeds / (payments) relating to payable to banks and long-term

debt |

468 |

|

(136 |

) |

474 |

|

332 |

|

737 |

|

| Dividends

paid |

(204 |

) |

(46 |

) |

(101 |

) |

(250 |

) |

(151 |

) |

| Share

buyback |

— |

|

(90 |

) |

— |

|

(90 |

) |

(226 |

) |

| Lease

payments and other financing activities (net) |

(84 |

) |

(72 |

) |

(21 |

) |

(156 |

) |

(41 |

) |

|

Net cash provided by / (used in) financing

activities |

180 |

|

(344 |

) |

352 |

|

(164 |

) |

319 |

|

| Net

increase / (decrease) in cash and cash equivalents |

1,402 |

|

(66 |

) |

1,028 |

|

1,336 |

|

479 |

|

| Cash and

cash equivalents transferred from/(to) assets held for sale |

21 |

|

(11 |

) |

(23 |

) |

10 |

|

(23 |

) |

|

Effect of exchange rate changes on cash |

17 |

|

(15 |

) |

(104 |

) |

2 |

|

(87 |

) |

|

Change in cash and cash equivalents |

1,440 |

|

(92 |

) |

901 |

|

1,348 |

|

369 |

|

| |

|

|

|

|

|

|

Free cash flow (C=A+B) |

917 |

|

24 |

|

616 |

|

941 |

|

24 |

|

Appendix 1: Product shipments by region

|

(000'kt) |

2Q 19 |

1Q 19 |

2Q 18 |

1H 19 |

1H 18 |

| Flat |

4,732 |

|

4,750 |

|

5,011 |

|

9,482 |

|

9,822 |

|

| Long |

873 |

|

721 |

|

969 |

|

1,594 |

|

1,890 |

|

|

NAFTA |

5,438 |

|

5,319 |

|

5,803 |

|

10,757 |

|

11,362 |

|

| Flat |

1,563 |

|

1,699 |

|

1,494 |

|

3,262 |

|

2,894 |

|

| Long |

1,236 |

|

1,194 |

|

1,345 |

|

2,430 |

|

2,440 |

|

|

Brazil |

2,785 |

|

2,880 |

|

2,831 |

|

5,665 |

|

5,314 |

|

| Flat |

8,824 |

|

8,647 |

|

7,553 |

|

17,471 |

|

15,257 |

|

| Long |

2,883 |

|

2,821 |

|

2,942 |

|

5,704 |

|

5,903 |

|

|

Europe |

11,811 |

|

11,553 |

|

10,516 |

|

23,364 |

|

21,213 |

|

| CIS |

2,064 |

|

1,617 |

|

1,861 |

|

3,681 |

|

3,727 |

|

| Africa |

1,113 |

|

1,049 |

|

1,199 |

|

2,162 |

|

2,366 |

|

|

ACIS |

3,182 |

|

2,662 |

|

3,057 |

|

5,844 |

|

6,086 |

|

Note: “Others and eliminations” are not presented in the

table

Appendix 2a: Capital expenditures

|

(USDm) |

2Q 19 |

1Q 19 |

2Q 18 |

1H 19 |

1H 18 |

| NAFTA |

144 |

|

182 |

|

110 |

|

326 |

|

270 |

|

|

Brazil |

80 |

|

84 |

|

36 |

|

164 |

|

83 |

|

|

Europe |

337 |

|

353 |

|

226 |

|

690 |

|

539 |

|

|

ACIS |

115 |

|

137 |

|

117 |

|

252 |

|

234 |

|

|

Mining |

125 |

|

115 |

|

119 |

|

240 |

|

226 |

|

|

Total |

869 |

|

947 |

|

616 |

|

1,816 |

|

1,368 |

|

Note: “Others” are not presented in the table

Appendix 2b: Capital expenditure projects

The following tables summarize the Company’s principal growth

and optimization projects involving significant capex.

Completed projects in most recent

quarter

|

Segment |

Site

/ unit |

Project |

Capacity / details |

Actual completion |

|

NAFTA |

Indiana Harbor (US) |

Indiana Harbor “footprint optimization project” |

Restoration of 80” HSM and upgrades at Indiana Harbor

finishing |

4Q 2018 (a) |

Ongoing projects

|

Segment |

Site / unit |

Project |

Capacity / details |

Forecasted completion |

| ACIS |

ArcelorMittal

Kryvyi Rih (Ukraine) |

New LF&CC

2&3 |

Facilities

upgrade to switch from ingot to continuous caster route. Additional

billets of up to 290kt over ingot route through yield increase |

2019 |

|

Europe |

Sosnowiec (Poland) |

Modernization of Wire Rod Mill |

Upgrade rolling technology improving the mix of HAV products and

increase volume by 90kt |

2019 |

|

NAFTA |

Mexico |

New Hot strip mill |

Production capacity of 2.5Mt/year |

2020(b) |

|

NAFTA |

ArcelorMittal Dofasco (Canada) |

Hot Strip Mill Modernization |

Replace existing three end of life coilers with two states of the

art coilers and new runout tables |

2021(c) |

|

NAFTA |

Burns Harbor (US) |

New Walking Beam Furnaces |

Two new walking beam reheat furnaces bringing benefits on

productivity, quality and operational cost |

2021 |

|

Brazil |

ArcelorMittal Vega Do Sul |

Expansion project |

Increase hot dipped / cold rolled coil capacity and construction of

a new 700kt continuous annealing line (CAL) and continuous

galvanising line (CGL) combiline |

2021(d) |

|

Brazil |

Juiz de Fora |

Melt shop expansion |

Increase in meltshop capacity by 0.2Mt/year |

On hold(e) |

|

Brazil |

Monlevade |

Sinter plant, blast furnace and melt shop |

Increase in liquid steel capacity by 1.2Mt/year;Sinter feed

capacity of 2.3Mt/year |

On hold(e) |

|

Mining |

Liberia |

Phase 2 expansion project |

Increase production capacity to 15Mt/year |

Under review(f) |

- In support of the Company’s Action 2020 program, the footprint

optimization project at ArcelorMittal Indiana Harbor is now

complete, which has resulted in structural changes required to

improve asset and cost optimization. The plan involved idling

redundant operations including the #1 aluminize line, 84” hot strip

mill (HSM), and #5 continuous galvanizing line (CGL) and No.2 steel

shop (idled in 2Q 2017) whilst making further planned investments

totalling approximately $200 million including a new caster at No.3

steel shop (completed in 4Q 2016), restoration of the 80” hot strip

mill and Indiana Harbor finishing. The full project scope was

completed in 4Q 2018.

- On September 28, 2017, ArcelorMittal announced a major US$1

billion, three-year investment programme at its Mexican operations,

which is focussed on building ArcelorMittal Mexico’s downstream

capabilities, sustaining the competitiveness of its mining

operations and modernising its existing asset base. The programme

is designed to enable ArcelorMittal Mexico to meet the anticipated

increased demand requirements from domestic customers, realise in

full ArcelorMittal Mexico’s production capacity of 5.3 million

tonnes and significantly enhance the proportion of higher

added-value products in its product mix, in-line with the Company’s

Action 2020 plan. The main investment will be the construction of a

new hot strip mill. Upon completion, the project will enable

ArcelorMittal Mexico to produce c. 2.5 million tonnes of flat

rolled steel, long steel c. 1.8 million tonnes and the remainder

made up of semi-finished slabs. Coils from the new hot strip mill

will be supplied to domestic, non-auto, general industry customers.

The project commenced late 4Q 2017 and is expected to be completed

in 2020. Deep foundation essentially complete. Building erection

ongoing. Working with EPC consortium on productivity

improvements.

- Investment in ArcelorMittal Dofasco (Canada) to modernise the

hot strip mill. The project is to install two new state of the art

coilers and runout tables to replace three end of life coilers. The

strip cooling system will be upgraded and include innovative power

cooling technology to improve product capability. Engineering and

equipment manufacturing is complete. Construction activities for

coiler are on track. Runout table installation work originally

scheduled for April 2019 will be effectively carried out during

April 2020 shut down due to change in design and delay in

manufacturing. The project is expected to be completed in

2021.

- In August 2018, ArcelorMittal announced the resumption of the

Vega Do Sul expansion to provide an additional 700kt of cold-rolled

annealed and galvanised capacity to serve the growing domestic

market. The three-year ~$0.3 billion investment programme to

increase rolling capacity with construction of a new continuous

annealing line and CGL combiline (and the option to add a ca. 100kt

organic coating line to serve construction and appliance segments),

and upon completion, will strengthen ArcelorMittal’s position in

the fast growing automotive and industry markets through Advanced

High Strength Steel products. The investments will look to

facilitate a wide range of products and applications whilst further

optimizing current ArcelorMittal Vega facilities to maximize site

capacity and its competitiveness, considering comprehensive digital

and automation technology.

- Although the Monlevade wire rod expansion project and Juiz de

Fora rebar expansion were completed in 2015, both projects are

currently on hold and are expected to be completed upon Brazil

domestic market recovery.

- ArcelorMittal had previously announced a Phase 2 project that

envisaged the construction of 15 million tonnes of concentrate

sinter fines capacity and associated infrastructure. The Phase 2

project was initially delayed due to the declaration of force

majeure by contractors in August 2014 due to the Ebola virus

outbreak in West Africa, and then reassessed following rapid iron

ore price declines over the ensuing period. ArcelorMittal Liberia

is currently conducting detailed engineering following the

feasibility study in order to be ready to progress to the next

stage of the project. The investment case will be assessed in 2H

2019.

Appendix 3: Debt repayment schedule as of June 30,

2019

|

(USD billion) |

2019 |

2020 |

2021 |

2022 |

2023 |

≥2024 |

Total |

|

Bonds |

— |

|

1.8 |

|

1.3 |

|

1.5 |

|

0.6 |

|

3.3 |

|

8.5 |

|

|

Commercial paper |

1.3 |

|

0.2 |

|

— |

|

— |

|

— |

|

— |

|

1.5 |

|

|

Other loans |

0.6 |

|

1.0 |

|

0.7 |

|

0.5 |

|

0.4 |

|

0.6 |

|

3.8 |

|

|

Total gross debt |

1.9 |

|

3.0 |

|

2.0 |

|

2.0 |

|

1.0 |

|

3.9 |

|

13.8 |

|

Appendix 4: Reconciliation of gross debt to net

debt

|

(USD million) |

Jun 30, 2019 |

Mar 31, 2019 |

Dec 31, 2018 |

| Gross

debt (excluding that held as part of the liabilities held for

sale) |

13,830 |

|

13,330 |

|

12,483 |

|

|

Gross debt held as part of the liabilities held for sale |

— |

|

96 |

|

77 |

|

|

Gross debt |

13,830 |

|

13,426 |

|

12,560 |

|

|

Less: |

|

|

|

|

Cash and cash equivalents |

(3,656 |

) |

(2,246 |

) |

(2,354 |

) |

|

Cash and cash equivalents held as part of the assets held for

sale |

— |

|

(21 |

) |

(10 |

) |

|

Net debt (including that held as part of the assets and the

liabilities held for sale) |

10,174 |

|

11,159 |

|

10,196 |

|

|

|

|

|

|

|

Net debt / LTM EBITDA |

— |

|

— |

|

1.0 |

|

Appendix 5: Terms and definitionsUnless

indicated otherwise, or the context otherwise requires, references

in this earnings release report to the following terms have the

meanings set out next to them below:

Apparent steel consumption: calculated as the

sum of production plus imports minus exports.Average steel

selling prices: calculated as steel sales divided by steel

shipments.Cash and cash equivalents: represents

cash and cash equivalents, restricted cash and short-term

investments.Capex: represents the purchase of

property, plant and equipment and intangibles.Crude steel

production: steel in the first solid state after melting,

suitable for further processing or for