Apollo and Belstar to Form Private Credit Joint Venture in Korea

August 04 2022 - 6:00PM

Apollo (NYSE: APO) and Belstar Group announced they have agreed to

establish a 50/50 joint venture in Korea to provide a wide range of

private credit solutions, bringing together the capabilities of

Apollo’s global credit platform with Belstar’s longstanding

expertise in investing and partnering with corporates and

institutions in Korea.

The joint venture intends to provide large

corporations, mid-sized enterprises and sponsors in Korea with

asset-backed capital solutions, corporate lending and acquisition

financing. In providing private lending solutions, in addition to

the traditional financing sources in place today, the joint venture

will look to address a liquidity gap borrowers face in the market.

The joint venture is a strategic extension of Apollo’s credit

investment franchise in the Asia Pacific region and will support

Apollo’s recently established Asia Pacific Credit Strategy. The

investment program in Korea will be anchored by Apollo’s funds and

its internal and affiliated insurance balance sheets, focusing on

providing flexible and differentiated capital across the yield and

duration spectrums.

Matt Michelini, Partner and Head of Asia Pacific

at Apollo, commented, “We have been exploring the market

opportunity in Korea with a heightened degree of interest for

several years, and are delighted to partner with Belstar to address

the market need for alternative forms of liquidity and credit in

Korea. We are optimistic this joint venture will serve as a

starting point for Apollo's long-term presence in Korea.”

“Together with Apollo, we are helping Korea

transition from a primarily bank-financed market to a market with

alternative sources of credit enabled by the 2021 amendments to the

Capital Markets Act,” said Daniel Yun, Chairman and Managing

Partner of Belstar. “We are pleased to partner with Apollo and

deliver their leading credit expertise to further develop the

capital markets in Korea.”

Apollo has more than $10 billion1 of assets

under management invested in the Asia Pacific region and a growing

team of nearly 60 investment professionals. Last year, Apollo

appointed Partner Matt Michelini as Head of Asia Pacific, now based

in Singapore, and Partner Anthony Hermann as Head of Asia Pacific

Credit, among other key additions. Globally, Apollo has

approximately $376 billion of yield assets under management and

total assets under management of approximately $515 billion, as of

June 30, 2022.

Belstar is a credit-oriented alternative

investment manager, primarily investing on behalf of institutional

investors based in Korea, with a 15-year track record in global

corporate and structured credit markets. Belstar has a unique

history of delivering advanced investment propositions,

including establishing one of the first foreign funds to

register with the Financial Supervisory Services of Korea.

About ApolloApollo is a

high-growth, global alternative asset manager. In our asset

management business, we seek to provide our clients excess return

at every point along the risk-reward spectrum from investment grade

to private equity with a focus on three investing strategies:

yield, hybrid, and equity. For more than three decades, our

investing expertise across our fully integrated platform has served

the financial return needs of our clients and provided businesses

with innovative capital solutions for growth. Through Athene, our

retirement services business, we specialize in helping clients

achieve financial security by providing a suite of retirement

savings products and acting as a solutions provider to

institutions. Our patient, creative, and knowledgeable approach to

investing aligns our clients, businesses we invest in, our

employees, and the communities we impact, to expand opportunity and

achieve positive outcomes. As of June 30, 2022, Apollo had

approximately $515 billion of assets under management. To learn

more, please visit www.apollo.com.

About Belstar GroupSince 1998,

Belstar and EMP Belstar have specialized in credit and private

equity investments. Belstar Management Company is an SEC registered

Investment Advisor. Currently, Belstar has over $2 billion in

assets under management. Historically, Belstar has raised and

invested over $4 billion of credit-dedicated capital. Belstar’s

corporate offices are located in New York, Seoul, and Singapore. To

learn more, please visit www.empbelstar.com.

Apollo ContactsNoah GunnGlobal

Head of Investor RelationsApollo Global Management, Inc.(212)

822-0540IR@apollo.com

Joanna RoseGlobal Head of Corporate

CommunicationsApollo Global Management, Inc.(212)

822-0491Communications@apollo.com

1 APAC-based assets as of 3/31/22 with pro forma inclusion of

commitment to Mumbai International Airport Ltd.

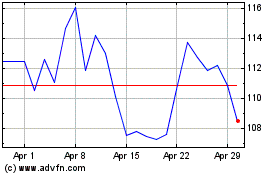

Apollo Global Management (NYSE:APO)

Historical Stock Chart

From Mar 2024 to Apr 2024

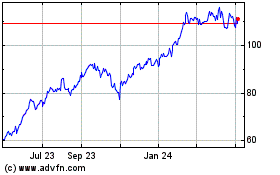

Apollo Global Management (NYSE:APO)

Historical Stock Chart

From Apr 2023 to Apr 2024