UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Under § 240.14a-12 |

| Apartment Investment and Management

Company |

(Name of Registrant as Specified In Its Charter)

|

| |

LAND &

BUILDINGS CAPITAL GROWTH FUND, LP

LAND &

BUILDINGS GP LP

L&B OPPORTUNITY

FUND, LLC

L&B TOTAL

RETURN FUND LLC

L&B MEGATREND

FUND

L&B Secular

Growth

LAND &

BUILDINGS INVESTMENT MANAGEMENT, LLC

JONATHAN LITT

Michelle Applebaum

James P. Sullivan

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

PRELIMINARY COPY SUBJECT TO COMPLETION

DATED SEPTEMBER 30, 2022

2022 ANNUAL MEETING OF STOCKHOLDERS

OF

APARTMENT INVESTMENT AND MANAGEMENT COMPANY

_________________________

PROXY STATEMENT

OF

Land & buildings capital growth fund, lp

_________________________

PLEASE SIGN, DATE AND MAIL THE ENCLOSED BLUE UNIVERSAL PROXY CARD TODAY

Land & Buildings Capital Growth Fund, LP (“L&B

Capital”), L&B Opportunity Fund, LLC (“L&B Opportunity”), Land & Buildings GP LP (“L&B GP”),

L&B Total Return Fund LLC (“L&B Total Return”), L&B Megatrend Fund (“L&B Megatrend”), L&B

Secular Growth (“L&B Secular”), Land & Buildings Investment Management, LLC (“L&B Management”), Jonathan

Litt and Corey Lorinsky (collectively, “Land & Buildings” or “we”) are investors in Apartment Investment

and Management Company, a Maryland corporation (“Aimco”, “AIV” or the “Company”), which beneficially

own an aggregate of 7,341,223 shares of Class A Common Stock (the “Common Stock”) of the Company, representing approximately

4.8% of the outstanding shares of Common Stock, and certain of such parties have also entered into certain notional principal amount

derivative agreements in the form of cash settled swaps with respect to an aggregate of 4,281,061 shares of Common Stock, giving Land

& Buildings a collective aggregate economic interest in approximately 7.6% of the outstanding shares of Common Stock. We believe

that the Board of Directors of the Company (the “Board”) requires the addition of new independent directors who have strong,

relevant backgrounds and who are committed to maximizing stockholder value. We are seeking your support at the annual meeting of stockholders

scheduled to be held at [_:__ _.m.], Mountain Time, on December 16, 2022, at 4582 South Ulster Street, Suite 1450, Denver, CO 80237 (including

any adjournments or postponements thereof and any meeting called in lieu thereof, the “Annual Meeting”), for the following:

| 1. | To elect our two director nominees, Michelle Applebaum and James P. Sullivan

(each, a “Land & Buildings Nominee” and, together, the “Land & Buildings Nominees”), for a term of two

years each, to serve until the 2024 annual meeting of stockholders (the “2024 Annual Meeting”) and until their successors

are duly elected and qualified; |

| 2. | To ratify the selection of Ernst & Young LLP, to serve as independent registered public accounting

firm for the Company for the fiscal year ending December 31, 2022; |

| 3. | To conduct an advisory vote on executive compensation; and |

| 4. | To transact such other business as may properly come before the Annual Meeting or any adjournment(s) thereof. |

This Proxy Statement and

the enclosed BLUE universal proxy card are first being mailed to stockholders on or about [__________], 2022.

The Company has a classified

Board, which is currently divided into three classes. The terms of three Class II directors expire at the Annual Meeting. Through the

attached Proxy Statement and enclosed BLUE universal proxy card, we are soliciting proxies to elect not only the two Land &

Buildings Nominees, but also one of the Company’s nominees whose election we do not oppose, [____] (the “Unopposed Company

Nominee”). Land & Buildings and Aimco will each be using a universal proxy card for voting on the election of directors at the

Annual Meeting, which will include the names of all nominees for election to the Board. Stockholders will have the ability to vote for

up to three nominees on Land & Buildings’ enclosed BLUE universal proxy card. Any stockholder who wishes to vote for

one Company nominee in addition to the Land & Buildings Nominees may do so on Land & Buildings’ BLUE universal proxy

card. There is no need to use the Company’s white proxy card or voting instruction form, regardless of how you wish to vote.

Your vote to elect the

Land & Buildings Nominees will have the legal effect of replacing two incumbent directors. If elected, the Land & Buildings Nominees,

subject to their fiduciary duties as directors, will seek to work with the other members of the Board to position Aimco to maximize stockholder

value. However, the Land & Buildings Nominees will constitute a minority on the Board and there can be no guarantee that they will

be able to implement the actions that they believe are necessary to do so. There is no assurance that any of the Company’s nominees

will serve as directors if all or some of the Land & Buildings Nominees are elected. The names, background and qualifications of the

Company’s nominees, and other information about them, can be found in the Company’s proxy statement.

Stockholders are permitted

to vote for less than three nominees or for any combination (up to three total) of the Land & Buildings Nominees and the Company’s

nominees on the BLUE universal proxy card. However, if stockholders choose to vote for any of the Company’s nominees, we

recommend that stockholders vote in favor of the Unopposed Company Nominee, who we believe is sufficiently qualified to serve as a director,

to help achieve a Board composition that we believe is in the best interest of all stockholders. We believe the best opportunity for both

of the Land & Buildings Nominees to be elected is by voting on the BLUE universal proxy card. Land & Buildings therefore

urges stockholders using our BLUE universal proxy card to vote “FOR” both of the Land & Buildings Nominees

and “FOR” the Unopposed Company Nominee. IMPORTANTLY, IF YOU MARK MORE THAN THREE “FOR” AND/OR “WITHHOLD”

BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS, ALL OF YOUR VOTES FOR THE ELECTION OF DIRECTORS WILL BE DEEMED INVALID.

The Company has set the

close of business on October 26, 2022 as the record date for determining stockholders entitled to notice of and to vote at the Annual

Meeting (the “Record Date”). Each outstanding share of Common Stock is entitled to one vote on each matter to be voted upon

at the Annual Meeting. Stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting.

According to the Company, as of the Record Date, there were approximately [______] shares of Common Stock outstanding and entitled to

vote at the Annual Meeting. The mailing address of the principal executive offices of the Company is 4582 South Ulster Street, Suite 1450,

Denver, Colorado 80237.

As of the date hereof,

the members of Land & Buildings and the other Participants (as defined below) in this solicitation collectively own an aggregate of

7,346,723 shares of Common Stock (the “Land & Buildings Group Shares”). The Participants intend to vote the Land &

Buildings Group Shares “FOR” the Land & Buildings Nominees and the Unopposed Company Nominee, “FOR”

the ratification of Ernst & Young LLP as the Company’s independent registered public accounting firm for the 2022 fiscal year,

and [“FOR”/“AGAINST”] the non-binding advisory resolution on the compensation of the Company’s named

executive officers.

We urge you to carefully

consider the information contained in the Proxy Statement and then support our efforts by signing, dating and returning the enclosed BLUE

universal proxy card today.

THIS SOLICITATION IS BEING

MADE BY LAND & BUILDINGS AND NOT ON BEHALF OF THE BOARD OR MANAGEMENT OF THE COMPANY. LAND & BUILDINGS IS NOT AWARE OF ANY OTHER

MATTERS TO BE BROUGHT BEFORE THE ANNUAL MEETING OTHER THAN AS DESCRIBED HEREIN. SHOULD OTHER MATTERS, WHICH LAND & BUILDINGS IS NOT

AWARE OF A REASONABLE TIME BEFORE THIS SOLICITATION, BE BROUGHT BEFORE THE ANNUAL MEETING, THE PERSONS NAMED AS PROXIES IN THE ENCLOSED

BLUE UNIVERSAL PROXY CARD WILL VOTE ON SUCH MATTERS IN THEIR DISCRETION.

LAND & BUILDINGS URGES

YOU TO VOTE “FOR” THE LAND & BUILDINGS NOMINEES VIA THE INTERNET OR TELEPHONE BY FOLLOWING THE INSTRUCTIONS ON

THE ENCLOSED BLUE UNIVERSAL PROXY CARD TODAY.

IF YOU DO NOT HAVE ACCESS

TO THE INTERNET OR A TOUCH-TONE TELEPHONE, PLEASE SIGN, DATE AND RETURN THE BLUE UNIVERSAL PROXY CARD VOTING “FOR”

THE ELECTION OF THE LAND & BUILDINGS NOMINEES.

IF YOU HAVE ALREADY SENT

A PROXY CARD FURNISHED BY COMPANY MANAGEMENT OR THE BOARD, YOU MAY REVOKE THAT PROXY AND VOTE ON EACH OF THE PROPOSALS DESCRIBED IN THIS

PROXY STATEMENT VIA THE INTERNET OR TELEPHONE BY FOLLOWING THE INSTRUCTIONS ON THE ENCLOSED BLUE UNIVERSAL PROXY CARD, OR IF YOU

DO NOT HAVE ACCESS TO THE INTERNET OR A TOUCH-TONE TELEPHONE, BY SIGNING, DATING AND RETURNING THE ENCLOSED BLUE UNIVERSAL PROXY

CARD. THE LATEST DATED PROXY IS THE ONLY ONE THAT WILL BE COUNTED. ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO THE ANNUAL MEETING BY

DELIVERING A WRITTEN NOTICE OF REVOCATION OR A LATER DATED PROXY FOR THE ANNUAL MEETING OR BY VOTING IN PERSON AT THE ANNUAL MEETING.

Important Notice Regarding the Availability

of Proxy Materials for the Annual Meeting—

This Proxy Statement and our BLUE universal proxy card are available at

www.___________.com

IMPORTANT

Your vote is important,

no matter how many shares of Common Stock you own. We urge you to sign, date, and return the enclosed BLUE universal proxy card today

to vote FOR the election of the Land & Buildings Nominees and in accordance with Land & Buildings’ recommendations on the

other proposals on the agenda for the Annual Meeting.

| · | If your shares of Common Stock are registered in your own name, please sign and date the enclosed BLUE

universal proxy card and return it to Land & Buildings c/o Saratoga Proxy Consulting LLC (“Saratoga”) in the enclosed

envelope today. |

| · | If your shares of Common Stock are held in a brokerage account, you are considered the beneficial owner

of the shares of Common Stock, and these proxy materials, together with a BLUE voting form, are being forwarded to you by your

broker. As a beneficial owner, if you wish to vote, you must instruct your broker how to vote. Your broker cannot vote your shares of

Common Stock on your behalf without your instructions. |

| · | Depending upon your broker, you may be able to vote either by toll-free telephone or by the Internet.

Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning

the enclosed voting form. |

As Land & Buildings

is using a “universal” proxy card containing both of the Land & Buildings Nominees as well as the Company’s nominees,

there is no need to use any other proxy card regardless of how you intend to vote. Land & Buildings strongly urges you NOT to sign

or return any white proxy cards or voting instruction forms that you may receive from Aimco. Even if you return the white management

proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously

sent to us.

|

If you have any questions, require assistance in

voting your BLUE universal proxy card,

or need additional copies of Land and Buildings’

proxy materials,

please contact Saratoga at the phone numbers listed

below.

520 8th Avenue, 14th Floor

New York, NY 10018

(212) 257-1311

Stockholders call toll free at (888) 368-0379

Email: info@saratogaproxy.com |

BACKGROUND OF THE SOLICITATION

The following is a chronology of events leading up to this proxy

solicitation:

| · | On September 14, 2020, the Company announced its plan to separate its business into two, separate and

distinct, publicly traded companies, Apartment Income REIT Corp. (“AIR”) and Aimco, through a taxable reverse spin-off (the

“Spin-Off” or the “Spin”). |

| · | Following the announced Spin-Off, Land & Buildings’ Jonathan Litt and Corey Lorinsky engaged

in various communications with the Company’s then existing management team (“Aimco Management”) and Board of Directors

(“Aimco Board”) to express Land & Buildings’ concerns with the proposed Spin, including its belief that the transaction

was not the best way to maximize value for all stockholders. Land & Buildings called on the Aimco Board to put the proposed Spin-Off

to a stockholder vote so that Aimco stockholders would have the opportunity to have their voices heard on such a material transaction,

which was expected to close prior to the Company’s 2021 Annual Meeting of Stockholders. Land & Buildings also called on the

Aimco Board to explain to stockholders whether it truly explored all available strategies to maximize value, including a sale of the Company. |

| · | Given the Company’s lack of commitment to put the Spin to a vote, on September 29, 2020, Land &

Buildings filed a preliminary solicitation statement with the SEC seeking to call a special meeting of stockholders to hold an advisory

vote on the Spin-Off (the “Special Meeting”). Land & Buildings and Aimco thereafter engaged in various communications

regarding the Special Meeting, namely with respect to the record date for determining stockholders entitled to submit a written request

to call the Special Meeting (the “Special Meeting Record Date”), which Land & Buildings had requested that Aimco promptly

set. |

| · | On October 6, 2020, the Company delivered a letter to Land & Buildings stating that the Aimco Board

set November 4, 2020 as the Special Meeting Record Date. |

| · | Land & Buildings thereafter filed revised preliminary solicitation materials with the SEC and on October

16, 2020, filed its definitive solicitation statement to call the Special Meeting. |

| · | Following the filing of its definitive solicitation statement, Land & Buildings’ issued various

public communications to Aimco stockholders urging them to join its efforts to call the Special Meeting and allow stockholders’

voices to be heard on the future of Aimco. Land & Buildings’ also expressed its belief that the Spin would not close the Company’s

substantial discount to stated NAV and that all options for maximizing value need to be considered. Land & Buildings’ also called

out Aimco for delaying the Special Meeting Record Date – 36 days after the filing of Land & Buildings’ preliminary proxy

materials for the Special Meeting – which Land & Buildings viewed as a desperate attempt to evade an advisory vote on the Spin

and prevent stockholder voices from being heard. Land & Buildings thereafter received the support of both leading proxy advisory firms,

Institutional Shareholder Services Inc. and Glass, Lewis & Co., LLC, recommending that Aimco stockholders support its efforts to call

the Special Meeting. |

| · | On November 12, 2020, Land & Buildings delivered written requests from

the holders of more than 43% of the Company’s then outstanding shares of common stock to call the Special Meeting, which satisfied

the prerequisite level (i.e. 25%) required under Aimco’s Amended and Restated Bylaws (the “Bylaws”) at such time. Following

delivery of the requisite written consents to call the Special Meeting, Land & Buildings’ called on Aimco to hold the Special

Meeting without delay. |

| · | On November 19, 2020, Aimco delivered a letter to Land & Buildings

stating that, under Aimco’s Bylaws, Land & Buildings was required to pay certain costs of preparing and mailing a notice of

the Special Meeting before Aimco was required to call the Special Meeting. However, in that same letter, the Company effectively conveyed

that it would not be holding the Special Meeting, stating that it planned to consummate the Spin “shortly” and that the Special

Meeting was “unlikely to occur prior to the consummation of the separation due to documentation preparation time, SEC review and

the notice requirements of the securities laws and NYSE requirements.” Land & Buildings thereafter publicized its grave concerns

with the Company’s determination to evade a clear stockholder mandate and called on Aimco to allow the Special Meeting to take place

prior to the Spin-Off per the will of Aimco stockholders. |

| · | On December 15, 2020, the Spin-Off was completed without the Special Meeting being called or held. |

| · | Following the Spin-Off, Land & Buildings continued to monitor the Company, particularly given its

serious governance concerns, including with respect to the Aimco Board’s decision to classify the new Board post-Spin. |

| · | On August 3, 2022, Mr. Litt reached out to Aimco’s CEO, Wes Powell, requesting a time to speak.

Mr. Powell and Mr. Litt had a telephone conversation that same day, during which Mr. Litt noted, among other things, that Land & Buildings

is a stockholder of Aimco and asked about the Company’s recent public announcements. Mr. Litt also requested a subsequent call with

management after the Company’s upcoming earnings release. |

| · | On August 5, 2022, Messrs. Litt and Lorinsky had a video conference call with Mr. Powell, Lynn Stanfield,

CFO, Jennifer Johnson, General Counsel, and Matt Foster, Head of Investor Relations, to further discuss the Company. Messrs. Litt and

Lorinsky discussed, among other things, their desire to work constructively with Aimco to help increase its trading price relative to

NAV. |

| · | During the course of August 2022, representatives of Aimco contacted Land & Buildings to schedule

a follow-up meeting. |

| · | On September 6, 2022, Messrs. Litt and Lorinsky had a video conference call with Mr. Powell, Ms. Stanfield,

Ms. Johnson, and Mr. Foster to discuss, among other things, Land & Buildings’ questions regarding Aimco’s business. Messrs.

Litt and Lorinsky further discussed their views on how the Company could improve its trading price. |

| · | On September 9, 2022, L&B Capital delivered a letter to Aimco notifying the Company of its intent

to nominate three highly-qualified individuals for election at the Annual Meeting. |

| · | On September 12, 2022, Land & Buildings delivered a letter to the Board, pursuant to which, among

other things, Land & Buildings expressed its concerns regarding Aimco’s troubling track record, including various actions relating

to the Spin and troubling governance practices. Land & Buildings also highlighted that the Company continues to trade at a substantially

deeper discount to NAV before the Spin and expressed its belief that a reconstituted Board, along with certain other improvements and

changes, is required in order to enhance Aimco’s governance and put the Company on a better path forward. Land & Buildings also

reiterated its desire to work amicably with the Company. |

| · | On September 14, 2022, Aimco reached out to Land & Buildings to set up a meeting with certain members

of the Board. |

| · | On September 20, 2022, Messrs. Litt and Lorinsky had a video conference call with Aimco directors Patricia

Gibson and Jay Leupp, along with Mr. Powell, Ms. Johnson, and Mr. Foster, to discuss, among other things, the concerns and recommendations

outlined by Land & Buildings in its September 12th letter to the Board. |

| · | On September 28, 2022, Mr. Litt received an email from Mr. Powell noting, among other things, that the

timing of the Annual Meeting compelled Aimco to file its preliminary proxy materials. Shortly thereafter, the Company filed its preliminary

proxy statement for the Annual Meeting. |

| · | On September 30, 2022, Land & Buildings delivered a letter to the Company notifying it of Land &

Buildings’ withdrawal of one of its three nominees for election at the Annual Meeting. |

| · | Also on September 30, 2022, Land & Buildings filed this preliminary proxy statement for the Annual

Meeting. |

REASONS FOR THE SOLICITATION

Land & Buildings has conducted

extensive due diligence on the Company, having monitored Aimco for decades. In doing so, we have carefully analyzed the Company’s

operating and financial performance as well as the competitive landscape in the real estate investment trust (“REIT”) industry

in which it operates.

Despite our sincere efforts to

engage constructively with the Board and management, both pre and post-Spin, regarding our concerns and the opportunities that we believe

are available to drive value, Aimco has been unwilling to address the level of change that we believe is required to put the Company on

a better path forward to maximize value for all stockholders.

We are therefore soliciting your

support to elect the Land & Buildings Nominees at the Annual Meeting, who we believe will collectively bring relevant industry, leadership,

financial, and corporate governance experience and expertise into the boardroom to help instill accountability and drive improved performance

and governance.

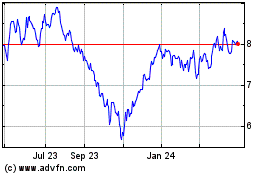

We Believe Aimco Has a Troubling History of Underperformance

and Poor Corporate Governance Practices

AIV has a long track record of

disappointing stockholder returns, slow earnings growth, and trading below its apartment REIT peers and below the value of its real estate.

In our view, this persistent underperformance and discounted valuation stems from decades of poor capital allocation, a lack of strategic

vision and inferior corporate governance.

Against this backdrop, the December

2020 Spin-Off looks more like a thinly veiled attempt by Aimco Management and the Aimco Board to brush this decades-long track record

of failure under the rug, rather than a move taken to address any fundamental issues challenging the Company, in our view. The lack of

a compelling rationale for the Spin was reinforced by the immediate negative reaction from the market, with AIV shares trading as low

as $4.52 in the days following the announced Spin.

We also believe stockholder suspicion

regarding the Spin was evidenced by the support we received from approximately 43% of Aimco stockholders to call the Special Meeting to

hold an advisory vote on the Spin. Our efforts to allow stockholders’ voices to be heard on such a material transaction governing

the future of the Company was also supported by leading proxy voting advisory firms Institutional Shareholder Services Inc. and Glass,

Lewis & Co., LLC. Despite the clear support to hold the Special Meeting, the Company ignored the will of stockholders and effectuated

the Spin before holding the Special Meeting.

Now, in the two years since the

announcement of the Spin, the issues that have historically plagued Aimco have only been magnified, including:

| · | In a seeming attempt to further entrench itself in the face of public pressure, the Aimco Board put in

place a classified structure designed to suppress stockholder rights; |

| · | The Annual Meeting was delayed to December from its historical timing in April; |

| · | The Company has continued to trade at a substantially deeper discount to NAV than before the Spin-Off;

and |

| · | There is no analyst coverage, earnings conference calls, earnings guidance, or concerted investor outreach program. |

The Status Quo Will Not Suffice – We Believe

Change is Clearly Required

We believe change is clearly and

urgently required at the Company, which is why we have nominated two highly qualified candidates for election to the Board at the Annual

Meeting.

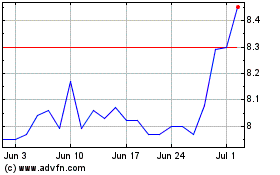

In addition to reconstituting

the Board, in order to overcome the aforementioned obstacles and put the Company on a better path forward, AIV needs a herculean effort

to earn a cost of capital from stockholders where it's business plan and external growth ambitions are feasible and likely to create stockholder

value. We believe the Company has badly missed the mark here, preferring to stay nearly invisible to the investment community and existing

as an orphan REIT with a distressed valuation for the better part of two years. We caution the Board not to be fooled by the recent run-up

in Aimco’s stock price. Vultures and value investors have bought large portions of the Company in hopes of seeing a path to realizing

the substantial value trapped in the shares, not as a validation of the business plan or of the performance of the management team and

Board, in our view.

We believe and recommended to

the Board that the Company immediately take the following steps to materially enhance corporate governance and begin earning the trust

of stockholders, including, among others:

| · | Immediately de-stagger the Board; |

| · | Refresh the Board with independent, stockholder-minded directors who have real credibility with the investment

community; |

| · | Move the Annual Meeting back to the Spring, consistent with best practices and its historical precedent;

and |

| · | Improve various other aspects of AIV’s troubling corporate governance, including by removing any

supermajority vote requirements from the Company’s governing documents, permitting stockholders to act by written consent (other

than by unanimous written consent), and lowering the ownership threshold required for stockholders to call a special meeting to 10%. |

We truly believe that improving

the Company’s governance profile to be in line with best-in-class governance practices will not only foster an improved boardroom

culture but will enhance accountability and drive improved performance.

Our sincere desire has been, and

continues to be, to work constructively with the Company to help right the ship, materially improve the Company’s corporate governance

and drive value for the benefit of all stockholders. We initially held out hope that history would not simply repeat itself and there

would be better faith engagement than we experienced from the Aimco Board in 2020. Unfortunately, since our private nomination of director

candidates there has been no clear indication that Aimco has a genuine desire to truly work collaboratively and we are once again left

with no choice but to take action for the benefit of all Aimco stockholders.

We Believe Our Exceptionally-Qualified Nominees

Are The Right Individuals to Help Maximize Stockholder Value and Realize AIV’s True Potential

Michelle Applebaum possesses 30+

years’ experience working in capital markets and advising CEOs, has significant leadership experience working at a senior level

in a large multinational company and has served as a public company director. If elected, we believe Ms. Applebaum would be ideally positioned

to help Aimco improve its corporate governance and regain credibility with the investment community.

| · | Has served as President of Corp Research Inc., a firm engaged in a variety of consulting and retail

businesses, since November 2016. |

| · | Previously built one of the first “independent” equity research and corporate advisory

boutiques, Michelle Applebaum Research Inc. (“MARI”). |

| · | Former equity analyst and Managing Director with Salomon Brothers (later Citigroup) and became ranked

number one in steel equity analysis for much of her career with the firm. |

| · | Previously, Ms. Applebaum served as a director of Northwest Pipe Company (NASDAQ: NWPX), the largest

manufacturer of engineered steel pipe water systems in North America, from September 2014 to June 2020. |

James P. Sullivan possesses extensive

expertise in the real estate industry and advising REITs, as well as significant investment, leadership and boardroom experience. If elected,

we believe Mr. Sullivan would be able to immediately help improve the Company’s investor outreach and capital allocation strategies.

| · | Most recently spent over twenty-five years at Green Street, an investment research firm that focuses

on commercial real estate, as Senior Advisor of Research and before that, as President of Green Street's Advisory Group. |

| · | Prior to Green Street, Mr. Sullivan worked as a real estate investment banker and construction lender

at Bank of America (NYSE: BAC), and Manufacturers Hanover Trust Company. |

| · | Currently serves as a member of the board of directors of The James Campbell Company, a private, Hawaii-based,

nationally diversified real estate company, since May 2022, where he serves as a member of the Compensation and Audit Committees. |

| · | Also serves as a director of Bixby Land Company, a privately owned real estate company, since 2016,

where he serves as Chairman of the Compensation Committee and a member of the Audit Committee. |

PROPOSAL ONE

ELECTION OF DIRECTORS

The Company currently has

a classified Board of ten (10) directors divided into three (3) classes. The directors in each class are elected for staggered terms such

that the term of office of one (1) class of directors expires at each annual meeting of stockholders. Beginning at the 2024 Annual Meeting,

however, the Board will no longer be classified and all directors will be elected for one year terms expiring at the next annual meeting

of stockholders. We believe that the terms of three (3) Class II directors expire at the Annual Meeting. We are seeking your support at

the Annual Meeting to elect our two Land & Buildings Nominees, Michelle Applebaum and James P. Sullivan, for terms ending at the 2024

Annual Meeting. Your vote to elect the Land & Buildings Nominees will have the legal effect of replacing two incumbent directors of

the Company with the Land & Buildings Nominees. If elected, the Land & Buildings Nominees will represent a minority of the members

of the Board, and therefore it is not guaranteed that they will be able to implement any actions that they may believe are necessary to

enhance stockholder value. However, we believe the election of the Land & Buildings Nominees is an important step in the right direction

for enhancing long-term value at the Company. There is no assurance that any incumbent director will serve as a director if our Land &

Buildings Nominees are elected to the Board. You should refer to the Company’s proxy statement for the names, background, qualifications

and other information concerning the Company’s nominees.

This Proxy Statement is

soliciting proxies to elect not only the two Land & Buildings Nominees, but also the Unopposed Company Nominee. We have provided the

required notice to the Company pursuant to the Universal Proxy Rules, including Rule 14a-19(a)(1) under the Securities Exchange Act of

1934, as amended (the “Exchange Act”), and intend to solicit the holders of Common Stock representing at least 67% of the

voting power of Common Stock entitled to vote on the election of directors in support of director nominees other than the Company’s

nominees.

THE LAND & BUILDINGS NOMINEES

The following information

sets forth the name, age, business address, present principal occupation, and employment and material occupations, positions, offices

or employments for the past five (5) years of the Land & Buildings Nominees. The nomination was made in a timely manner and in compliance

with the applicable provisions of the Company’s governing instruments. The specific experience, qualifications, attributes and skills

that led us to conclude that the Land & Buildings Nominees should serve as directors of the Company are also set forth below. This

information has been furnished to us by the Land & Buildings Nominees. Each of the Land & Buildings Nominees is a citizen of the

United States of America.

Michelle Applebaum,

age 65, has served as President of Corp Research Inc., a firm engaged in a variety of consulting and retail businesses, since November

2016. Previously, Ms. Applebaum served as a Senior Advisor to Republic Partners, a middle-market investment bank focusing on clients in

the industrial and logistics sectors, from September 2016 until October 2018. Prior to that, Ms. Applebaum built one of the first “independent”

equity research and corporate advisory boutiques, Michelle Applebaum Research Inc. (“MARI”), and also published an industry

newsletter and did industry consulting under the dba, Steel Market Intelligence (“SMI”), serving as Managing Partner, President

and CEO of MARI/SMI from 2003 until November 2016. Prior to establishing MARI/SMI, she was an equity analyst and Managing Director with

Salomon Brothers (later Citigroup) and became ranked number one in steel equity analysis in 1988 and retained that standing for most of

the remainder of her career with the firm. Ms. Applebaum also was a part of the Management Oversight Committee for the firm’s top-rated

equity research division, and sat on the Credit Committee for all steel business and on the firm’s Diversity Committee. Ms. Applebaum’s

steel equity research has won many accolades and awards, including repeated top ratings from Institutional Investor Magazine and Greenwich

Research Associates. Previously, Ms. Applebaum served as a director of Northwest Pipe Company (NASDAQ: NWPX), the largest manufacturer

of engineered steel pipe water systems in North America, from September 2014 to June 2020. Ms. Applebaum was also previously employed

by Lake Forest College as Adjunct Faculty from 2010 until 2014 and became trustee of the college in 2015. She has also been a frequent

contributor to Bloomberg, WSJ, CNBC, Washington Post and other financial news outlets. Ms. Applebaum has been a National Association of

Corporate Directors Board Leadership Fellow, has been profiled in Boardroom Insider magazine and is a frequent speaker at conferences

regarding stockholder engagement, disclosure and other matters relevant to public companies. Ms. Applebaum holds a Bachelor of Arts degree

in Economics from Northwestern University and an MBA in finance/accounting from the Kellogg School of Management at Northwestern University.

We believe that Ms. Applebaum’s

30+ years’ experience and expertise working in capital markets and advising CEOs, as well as her significant leadership experience

working at a senior level in a large multinational company, make her well-qualified to serve on the Board.

James P. Sullivan, age

61, most recently served as Senior Advisor of Research at Green Street Advisors, LLC (“Green Street”), an investment research

firm that focuses on commercial real estate, from January 2020 to December 2020, after having served as President of Green Street's Advisory

Group, which provided strategic advice to commercial real estate owners and investors around the globe, from 2014 to December 2019, Head

of North American REIT Research from 2010 to 2014, and Managing Director/Senior REIT Analyst from 1994 to 2009. Prior to Green Street,

Mr. Sullivan worked as a real estate investment banker and construction lender at Bank of America (NYSE: BAC), a multinational investment

bank and financial services holding company, and Manufacturers Hanover Trust Company, a former large New York-based bank. Mr. Sullivan

currently serves as a member of the board of directors of each of The James Campbell Company, a private, Hawaii-based, nationally diversified

real estate company, since May 2022, where he serves as a member of the Compensation and Audit Committees, and Bixby Land Company, a privately

owned real estate company, since 2016, where he serves as Chairman of the Compensation Committee and a member of the Audit Committee.

Mr. Sullivan earned an M.B.A. in Finance & Real Estate from Columbia University and a B.A. in Economics from Duke University.

We believe that Mr. Sullivan’s

extensive expertise and experience in the real estate industry and advising REITs, including through his over twenty-five years’

experience at Green Street, as well as his significant investment, leadership and boardroom experience, will make him a valuable addition

to the Board.

The principal business address

of Ms. Applebaum is 6362 E Amber Sun Drive, Scottsdale, Arizona 85266. The principal business address of Mr. Sullivan is 34 S Peak, Laguna

Niguel, California 92677.

As of the date hereof,

Mr. Sullivan does not own any securities of the Company and has not entered into any transactions in the securities of the Company during

the past two years.

As of the date hereof,

Ms. Applebaum directly beneficially owns 5,500 shares of Common Stock. For information regarding transactions in securities of the Company

during the past two years by Ms. Applebaum, please see Schedule I.

L&B Management has entered

into an indemnification letter agreement with each of the Land & Buildings Nominees, pursuant to which it has agreed to indemnify

each such Land & Buildings Nominee against claims arising from the solicitation of proxies from the Company’s stockholders in

connection with the Annual Meeting and any related transactions. For the avoidance of doubt, such indemnification does not apply to any

claims made against any such Land & Buildings Nominee in his or her capacity or service as a director of the Company, if so elected.

L&B Management has

entered into a compensation letter agreement with each of the Land & Buildings Nominees (collectively, the “Compensation Agreements”)

pursuant to which it has agreed to pay each Land & Buildings Nominee: (i) $10,000 in cash upon the submission by L&B Capital of

its nomination of such Land & Buildings Nominee to the Company and (ii) $10,000 in cash upon the filing by L&B Capital or its

affiliates of a definitive proxy statement with the SEC relating to the solicitation of proxies in favor of such Land & Buildings

Nominee’s election as a director of the Company, provided, however, that, at L&B Management’s sole discretion, it may

determine to compensate such Land & Buildings Nominee the $10,000 provided for under clause (ii) above at any date of its choosing,

including prior to the filing of a definitive proxy statement. The Compensation Agreements expire on the earliest to occur of (i) the

Company’s appointment or nomination of such Land & Buildings Nominee as a director of the Company, (ii) the date of any agreement

with the Company in furtherance of such Land & Buildings Nominee’s nomination or appointment as a director of the Company, (iii)

L&B Capital’s withdrawal of its nomination of such Land & Buildings Nominee for election as a director of the Company, and

(iv) the date of the Annual Meeting. For the avoidance of doubt, such compensation is not being paid in connection with any such Land

& Buildings Nominee’s capacity or service as a director of the Company, if so elected.

Other than as stated herein,

there are no arrangements or understandings among the members of Land & Buildings or any other person or persons pursuant to which

the nomination of the Land & Buildings Nominees described herein is to be made, other than the consent by each of the Land & Buildings

Nominees to be named as a nominee of L&B Capital in any proxy statement relating to the Annual Meeting and serving as a director of

the Company if elected as such at the Annual Meeting. Other than as stated herein, the Land & Buildings Nominees are not a party adverse

to the Company or any of its subsidiaries nor do the Land & Buildings Nominees have a material interest adverse to the Company or

any of its subsidiaries in any material pending legal proceeding.

We believe that each Land

& Buildings Nominee presently is, and if elected as a director of the Company, each of the Land & Buildings Nominees would qualify

as, an “independent director” within the meaning of (i) applicable New York Stock Exchange (“NYSE”) listing standards

applicable to board composition, including NYSE Listed Company Manual Section 303.A, and (ii) Section 301 of the Sarbanes-Oxley Act of

2002. Notwithstanding the foregoing, we acknowledge that no director of a NYSE listed company qualifies as “independent” under

the NYSE listing standards unless the board of directors affirmatively determines that such director is independent under such standards.

Accordingly, we acknowledge that if any Land & Buildings Nominee is elected, the determination of such Land & Buildings Nominee’s

independence under the NYSE listing standards ultimately rests with the judgment and discretion of the Board. No Land & Buildings

Nominee is a member of the Company’s compensation, nominating or audit committee that is not independent under any such committee’s

applicable independence standards.

Except as set forth in

this Proxy Statement (including the Schedules hereto), (i) during the past 10 years, no Land & Buildings Nominee has been convicted

in a criminal proceeding (excluding traffic violations or similar misdemeanors); (ii) no Land & Buildings Nominee directly or indirectly

beneficially owns any securities of the Company; (iii) no Land & Buildings Nominee owns any securities of the Company which are owned

of record but not beneficially; (iv) no Land & Buildings Nominee has purchased or sold any securities of the Company during the past

two years; (v) no part of the purchase price or market value of the securities of the Company owned by any Land & Buildings Nominee

is represented by funds borrowed or otherwise obtained for the purpose of acquiring or holding such securities; (vi) no Land & Buildings

Nominee is, or within the past year was, a party to any contract, arrangements or understandings with any person with respect to any securities

of the Company, including, but not limited to, joint ventures, loan or option arrangements, puts or calls, guarantees against loss or

guarantees of profit, division of losses or profits, or the giving or withholding of proxies; (vii) no associate of any Land & Buildings

Nominee owns beneficially, directly or indirectly, any securities of the Company; (viii) no Land & Buildings Nominee owns beneficially,

directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) no Land & Buildings Nominee or any of his

or her associates was a party to any transaction, or series of similar transactions, since the beginning of the Company’s last fiscal

year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its subsidiaries

was or is to be a party, in which the amount involved exceeds $120,000; (x) no Land & Buildings Nominee or any of his or her associates

has any arrangement or understanding with any person with respect to any future employment by the Company or its affiliates, or with respect

to any future transactions to which the Company or any of its affiliates will or may be a party; (xi) no Land & Buildings Nominee

has a substantial interest, direct or indirect, by securities holdings or otherwise in any matter to be acted on at the Annual Meeting;

(xii) no Land & Buildings Nominee holds any positions or offices with the Company; (xiii) no Land & Buildings Nominee has a family

relationship with any director, executive officer, or person nominated or chosen by the Company to become a director or executive officer;

and (xiv) no companies or organizations, with which any of the Land & Buildings Nominees has been employed in the past five years,

is a parent, subsidiary or other affiliate of the Company. There are no material proceedings to which any Land & Buildings Nominee

or any of his or her associates is a party adverse to the Company or any of its subsidiaries or has a material interest adverse to the

Company or any of its subsidiaries. With respect to each of the Land & Buildings Nominees, none of the events enumerated in Item 401(f)(1)-(8)

of Regulation S-K of the Exchange Act occurred during the past 10 years.

We do not expect that the

Land & Buildings Nominees will be unable to stand for election, but, in the event any Land & Buildings Nominee is unable to serve

or for good cause will not serve, the shares of Common Stock represented by the enclosed BLUE universal proxy card will be voted

for substitute nominee(s), to the extent this is not prohibited under the Bylaws and applicable law. In addition, we reserve the right

to nominate substitute person(s) if the Company makes or announces any changes to the Bylaws or takes or announces any other action that

has, or if consummated would have, the effect of disqualifying any Land & Buildings Nominee, to the extent this is not prohibited

under the Bylaws and applicable law. In any such case, we would identify and properly nominate such substitute nominee(s) in accordance

with the Bylaws and the shares of Common Stock represented by the enclosed BLUE universal proxy card will be voted for such substitute

nominee(s). We reserve the right to nominate additional person(s), to the extent this is not prohibited under the Bylaws and applicable

law, if the Company increases the size of the Board above its existing size or increases the number of directors whose terms expire at

the Annual Meeting.

Land & Buildings and

Aimco will each be using a universal proxy card for voting on the election of directors at the Annual Meeting, which will include the

names of all nominees for election to the Board. Each of the Land & Buildings Nominees has consented to being named as a nominee for

election as a director of the Company in any proxy statement relating to the Annual Meeting. Stockholders will have the ability to vote

for up to three nominees on Land & Buildings’ enclosed BLUE universal proxy card. Any stockholder who wishes to vote

for one of the Company nominees in addition to the Land & Buildings Nominees may do so on Land & Buildings’ BLUE

universal proxy card. There is no need to use the Company’s white proxy card or voting instruction form, regardless of how you

wish to vote.

The Company nominee that

Land & Buildings does not oppose and believes is sufficiently qualified to serve as a director with the Land & Buildings Nominees

is the Unopposed Company Nominee. Certain information about the Unopposed Company Nominee is set forth in the Company’s proxy statement.

Land & Buildings is not responsible for the accuracy of any information provided by or relating to Aimco or its nominees contained

in any proxy solicitation materials filed or disseminated by, or on behalf of, Aimco or any other statements that Aimco or its representatives

have made or may otherwise make.

Stockholders are permitted to

vote for less than three nominees or for any combination (up to three total) of the Land & Buildings Nominees and the Company’s

nominees on the BLUE universal proxy card. IMPORTANTLY, IF YOU MARK MORE THAN THREE “FOR” AND/OR “WITHHOLD”

BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS, ALL OF YOUR VOTES FOR THE ELECTION OF DIRECTORS WILL BE DEEMED INVALID.

WE STRONGLY URGE YOU TO

VOTE “FOR” THE ELECTION OF THE LAND & BUILDINGS NOMINEES ON THE ENCLOSED BLUE UNIVERSAL PROXY CARD.

PROPOSAL TWO

RATIFICATION

OF THE SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

As discussed in further

detail in the Company’s proxy statement, the Audit Committee of the Board has retained Ernst & Young LLP as the Company’s

independent registered public accounting firm for the fiscal year ending December 31, 2022, and the Board is requesting that stockholders

ratify such selection. Additional information regarding this proposal is contained in the Company’s proxy statement.

WE MAKE NO RECOMMENDATION

WITH RESPECT TO THIS PROPOSAL AND INTEND TO VOTE OUR SHARES “FOR” THIS PROPOSAL.

PROPOSAL THREE

ADVISORY VOTE ON EXECUTIVE COMPENSATION

As discussed in further detail

in the Company’s proxy statement, the Company is providing stockholders with the opportunity to cast an advisory, non-binding vote

on the compensation of the Company’s named executive officers as required by Section 14A of the Exchange Act and the Dodd-Frank

Wall Street Reform and Consumer Protection Act. This proposal, which is commonly referred to as “say-on-pay,” is not intended

to address any specific item of compensation, but rather the overall compensation of the Company’s named executive officers and

the philosophy, policies and practices described in the Company’s proxy statement. Accordingly, the Company is asking stockholders

to vote for the following resolution:

“RESOLVED, that the

compensation of the named executive officers, as disclosed in the Company’s Proxy Statement for the 2022 Annual Meeting of Stockholders

pursuant to Item 402 of SEC Regulation S-K, including the Compensation Discussion & Analysis, the 2021 Summary Compensation Table

and the other related tables and disclosure, is hereby APPROVED.”

According to the Company’s

proxy statement, the vote on this proposal is advisory, which means that the vote is not binding on the Company, the Board or the Audit

Committee. However, the Company further disclosed that to the extent there is any significant vote against the executive compensation

proposal, the Audit Committee will evaluate whether any actions are necessary to address the concerns of stockholders. Additional information

regarding this proposal is contained in the Company’s proxy statement.

[WE MAKE NO RECOMMENDATION WITH RESPECT TO

THIS PROPOSAL AND INTEND TO VOTE OUR SHARES [“FOR”/”AGAINST”] THIS PROPOSAL.]

VOTING AND PROXY PROCEDURES

Only stockholders of record

on the Record Date will be entitled to notice of and to vote at the Annual Meeting. Each share of Common Stock is entitled to one vote.

Stockholders who sell shares of Common Stock before the Record Date (or acquire them without voting rights after the Record Date) may

not vote such shares of Common Stock. Stockholders of record on the Record Date will retain their voting rights in connection with the

Annual Meeting even if they sell such shares of Common Stock after the Record Date. Based on publicly available information, we believe

that the only outstanding class of securities of the Company entitled to vote at the Annual Meeting is the shares of Common Stock.

Shares of Common Stock

represented by properly executed BLUE universal proxy cards will be voted at the Annual Meeting as marked and, in the absence of

specific instructions, will be voted FOR the election of the Land & Buildings Nominees and the Unopposed Company Nominee to

the Board, FOR the ratification of the selection of Ernst & Young LLP as the Company’s independent registered public

accounting firm for the fiscal year ending December 31, 2022, and [FOR/AGAINST] the non-binding advisory vote on executive compensation.

Land & Buildings and

Aimco will each be using a universal proxy card for voting on the election of directors at the Annual Meeting, which will include the

names of all nominees for election to the Board. Stockholders will have the ability to vote for up to three nominees on Land & Buildings’

enclosed BLUE universal proxy card. Any stockholder who wishes to vote for one of the Company’s nominees in addition to the

Land & Buildings Nominees may do so on Land & Buildings’ BLUE universal proxy card. There is no need to use the

Company’s white proxy card or voting instruction form, regardless of how you wish to vote.

The Company has a classified

Board, which is currently divided into three classes. The terms of three Class II directors expire at the Annual Meeting. Through the

attached Proxy Statement and enclosed BLUE universal proxy card, we are soliciting proxies to elect not only the two Land &

Buildings Nominees, but also one of the Company’s nominees whose election we do not oppose, the Unopposed Company Nominee.

Stockholders are permitted

to vote for less than three nominees or for any combination (up to three total) of the Land & Buildings Nominees and the Company’s

nominees on the BLUE universal proxy card. However, if stockholders choose to vote for any of the Company’s nominees, we

recommend that stockholders vote in favor of the Unopposed Company Nominee, who we believe is sufficiently qualified to serve as a director

to help achieve a Board composition that we believe is in the best interest of all stockholders. We believe the best opportunity for both

of the Land & Buildings Nominees to be elected is by voting on the BLUE universal proxy card. Land & Buildings therefore

urges stockholders using our BLUE universal proxy card to vote “FOR” both of the Land & Buildings Nominees

and “FOR” the Unopposed Company Nominee.

IMPORTANTLY, IF YOU

MARK MORE THAN THREE “FOR” AND/OR “WITHHOLD” BOXES WITH RESPECT TO THE ELECTION OF DIRECTORS, ALL OF YOUR VOTES

FOR THE ELECTION OF DIRECTORS WILL BE DEEMED INVALID.

Quorum; Broker Non-Votes; Discretionary Voting

A quorum is the minimum

number of shares of Common Stock that must be represented at a duly called meeting in person or by proxy in order to legally conduct business

at the meeting. The presence, in person or by proxy, of stockholders entitled to cast a majority of all the votes entitled to be cast

at the Annual Meeting constitutes a quorum.

Abstentions and shares

represented by “broker non-votes” will be treated as shares that are present and entitled to vote for purposes of determining

whether a quorum is present, but will not be counted as votes cast either in favor of or against a particular proposal. In addition, if

you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposal

on which your broker does not have discretionary authority to vote (a “broker non-vote”). Under applicable rules, your broker

will not have discretionary authority to vote your shares at the Annual Meeting on any of the proposals.

If you are a stockholder

of record, you may deliver your vote by mail, by telephone, or via the Internet, or attend the Annual Meeting in person, to be counted

in the determination of a quorum.

If you are a beneficial owner,

your broker will vote your shares pursuant to your instructions, and those shares will count in the determination of a quorum. Brokers

do not have discretionary authority to vote on any of the proposals at the Annual Meeting. Accordingly, unless you vote via proxy card

or provide instructions to your broker, your shares of Common Stock will count for purposes of attaining a quorum, but will not be voted

on those proposals. Accordingly, we encourage you to vote promptly, even if you plan to attend the Annual Meeting.

Votes Required for Approval

Proposal 1: Election

of Directors ─ According to the Company’s proxy statement, directors are elected by a plurality vote. As a result, the

three director nominees receiving the highest number of “FOR” votes will be elected as directors. With respect to the election

of directors, only votes cast “FOR” a nominee will be counted. Proxy cards specifying that votes should be withheld with respect

to one or more nominees will result in those nominees receiving fewer votes but will not count as a vote against the nominees. Neither

an abstention nor a broker non-vote will count as a vote cast “FOR” or “AGAINST” a director nominee. Therefore,

abstentions and broker non-votes will have no direct effect on the outcome of the election of directors.

Proposal 2: Ratification

of Independent Registered Public Accounting Firm ─ According to the Company’s proxy statement, the affirmative vote of

the holders of a majority of shares present in person or represented by proxy and entitled to vote on the proposal is required to ratify

the selection of Ernst & Young LLP. The Company has indicated that abstentions will be counted as votes “AGAINST” this

proposal. Broker-non-votes will not be counted as votes cast and will have no effect on the result of the vote on this proposal.

Proposal 3: Advisory

Vote on Executive Compensation ─ According to the Company’s proxy statement, with respect to the advisory vote on executive

compensation, in order to be approved, this proposal must receive the affirmative vote of the holders of a majority of shares present

in person or represented by proxy and entitled to vote. The Company has indicated that abstentions will be counted as votes “AGAINST”

this proposal. Broker-non-votes will not be counted as votes cast and will have no effect on the result of the vote on this proposal.

If you sign and submit

your BLUE universal proxy card without specifying how you would like your shares voted, your shares will be voted as specified

above and in accordance with the discretion of the persons named on the BLUE universal proxy card with respect to any other matters

that may be voted upon at the Annual Meeting.

Revocation of Proxies

Stockholders of the Company

may revoke their proxies at any time prior to exercise by attending the Annual Meeting and voting in person (although attendance at the

Annual Meeting will not in and of itself constitute revocation of a proxy), by voting again by telephone or through the Internet, by delivering

a written notice of revocation, or by signing and delivering a subsequently dated proxy which is properly completed. The latest dated

proxy is the only one that will be counted. The revocation may be delivered either to Land & Buildings in care of Saratoga at the

address set forth on the back cover of this Proxy Statement or to the Company at 4582 S. Ulster Street, Suite 1450, Denver, Colorado 80237,

or any other address provided by the Company. Although a revocation is effective if delivered to the Company, Land & Buildings requests

that either the original or photostatic copies of all revocations be mailed to Land & Buildings in care of Saratoga at the address

set forth on the back cover of this Proxy Statement so that we will be aware of all revocations and can more accurately determine if and

when proxies have been received from the holders of record on the Record Date of a majority of the outstanding shares of Common Stock.

Additionally, Saratoga may use this information to contact stockholders who have revoked their proxies in order to solicit later dated

proxies for the election of the Land & Buildings Nominees.

IF YOU WISH TO VOTE FOR THE LAND & BUILDINGS

NOMINEES, PLEASE FOLLOW THE INSTRUCTIONS TO VOTE BY INTERNET OR BY TELEPHONE ON THE ENCLOSED BLUE UNIVERSAL PROXY CARD. ALTERNATIVELY,

IF YOU DO NOT HAVE ACCESS TO THE INTERNET OR A TOUCH-TONE TELEPHONE, PLEASE SIGN, DATE AND RETURN THE ENCLOSED BLUE UNIVERSAL PROXY CARD

TODAY IN THE POSTAGE-PAID ENVELOPE PROVIDED.

SOLICITATION OF PROXIES

The solicitation of proxies

pursuant to this Proxy Statement is being made by Land & Buildings. Proxies may be solicited by mail, facsimile, telephone, Internet,

in person and by advertisements. Solicitations may be made by certain of the respective directors, officers, members and employees of

Land & Buildings, none of whom will, except as described elsewhere in this Proxy Statement, receive additional compensation for such

solicitation. The Land & Buildings Nominees may make solicitations of proxies but, except as described herein, will not receive compensation

for acting as director nominees.

Land & Buildings has

entered into an agreement with Saratoga for solicitation and advisory services in connection with this solicitation, for which Saratoga

will receive a fee not to exceed $[______], together with reimbursement for its reasonable out-of-pocket expenses, and will be indemnified

against certain liabilities and expenses, including certain liabilities under the federal securities laws. Saratoga will solicit proxies

from individuals, brokers, banks, bank nominees and other institutional holders. Land & Buildings has requested banks, brokerage houses

and other custodians, nominees and fiduciaries to forward all solicitation materials to the beneficial owners of the shares of Common

Stock they hold of record. Land & Buildings will reimburse these record holders for their reasonable out-of-pocket expenses in so

doing. It is anticipated that Saratoga will employ approximately [__] persons to solicit the Company’s stockholders for the Annual

Meeting.

The entire expense of soliciting

proxies is being borne Land & Buildings. Costs of this solicitation of proxies are currently estimated to be approximately $[_______].

Land & Buildings estimates that through the date hereof, its expenses in connection with this solicitation are approximately $[_______].

Land & Buildings intends to seek reimbursement from the Company of all expenses it incurs in connection with the solicitation of proxies

for the election of the Land & Buildings Nominees to the Board at the Annual Meeting. If such reimbursement is approved by the Board,

Land & Buildings does not intend to submit the question of such reimbursement to a vote of security holders of the Company.

ADDITIONAL PARTICIPANT INFORMATION

The participants in the

solicitation are anticipated to be L&B Capital, a Delaware limited partnership, L&B GP, a Delaware limited partnership, L&B

Opportunity, a Delaware limited liability company, L&B Total Return, a Delaware limited liability company, L&B Megatrend, a Cayman

Islands company, L&B Secular, a Cayman Islands company, L&B Management, a Delaware limited liability company, Jonathan Litt and

Corey Lorinsky, each a citizen of the United States of America, and the Land & Buildings Nominees (each, a “Participant”

and collectively, the “Participants”).

The principal business

address of each member of Land & Buildings is 1 Landmark Square, 17th Floor, Stamford, Connecticut 06901.

The principal business

of each of L&B Capital, L&B Opportunity, L&B Total Return, L&B Megatrend and L&B Secular is serving as a private investment

fund. The principal business of L&B GP is serving as the general partner of L&B Capital. The principal business of L&B Management

is serving as the investment manager of each of L&B Capital, L&B Opportunity, L&B Total Return, L&B Megatrend and L&B

Secular and as the investment advisor a certain account managed (the “Managed Account”). The principal occupation of Mr. Litt

is serving as the managing principal of L&B Management. The principal occupation of Mr. Lorinsky is serving as a Principal and Portfolio

Manager of L&B Management.

As of the date hereof,

L&B Capital directly owns 1,221,250 shares of Common Stock. As of the date hereof, L&B Opportunity directly owns 566,040 shares

of Common Stock. As of the date hereof, 4,163,590 shares of Common Stock were held in the Managed Account. L&B GP, as the general

partner of L&B Capital, may be deemed the beneficial owner of the 1,221,250 shares of Common Stock owned by L&B Capital. As of

the date hereof, L&B Total Return directly owns 1,333,401 shares of Common Stock. As of the date hereof, L&B Megatrend directly

owns 38,423 shares of Common Stock. As of the date hereof, L&B Secular directly owns 18,510 shares of Common Stock. L&B Management,

as the investment manager of each of L&B Capital, L&B Opportunity, L&B Total Return, L&B Megatrend and L&B Secular

and as the investment advisor of the Managed Account, may be deemed the beneficial owner of an aggregate of 7,341,214 shares of Common

Stock owned by L&B Capital, L&B Opportunity, L&B Total Return, L&B Megatrend and L&B Secular and held in the Managed

Account. Mr. Litt, as the managing principal of L&B Management, which is the investment manager of each of L&B Capital, L&B

Opportunity, L&B Total Return, L&B Megatrend and L&B Secular and the investment advisor of the Managed Account, may be deemed

the beneficial owner of an aggregate of 7,341,214 shares of Common Stock owned by L&B Capital, L&B Opportunity, L&B Total

Return, L&B Megatrend and L&B Secular and held in the Managed Account. As of the date hereof, Mr. Lorinsky directly owns 9 shares

of Common Stock. Each Participant disclaims beneficial ownership of the shares of Common Stock he, she or it does not directly own. For

information regarding purchases and sales of securities of the Company during the past two years by certain of the Participants, see Schedule

I.

As of the date hereof,

L&B Capital and L&B Management, through the Managed Account, have entered into notional principal amount derivative agreements

(the “Derivative Agreements”) in the form of cash settled swaps with respect to 236,892 and 4,044,169 shares of Common Stock,

respectively (representing economic exposure comparable to approximately 0.16% and 2.66% of the outstanding shares of Common Stock, respectively).

Collectively, the Derivative Agreements held by such parties represent economic exposure comparable to an interest in approximately 2.82%

of the outstanding shares of Common Stock. The Derivative Agreements provide L&B Capital and L&B Management, through the Managed

Account, with economic results that are comparable to the economic results of ownership but do not provide them with the power to vote

or direct the voting or dispose of or direct the disposition of, call for the delivery of or otherwise exercise any rights in respect

of, the shares of Common Stock that are referenced in the Derivative Agreements (such shares, the “Subject Shares”). Each

of L&B Capital, L&B Management, on behalf of itself and the Managed Account, and the other Participants disclaim any beneficial

and other ownership in the Subject Shares. The counterparties to the Derivative Agreements are unaffiliated third party financial institutions.

As of the date of this

Notice, L&B Capital, L&B Opportunity, L&B Total Return, L&B Megatrend, L&B Secular and L&B Management, through

the Managed Account, have a short interest in 552,194 shares of Common Stock, 210,438 shares of Common Stock, 179,639 shares of Common

Stock, 14,283 shares of Common Stock, 6,877 shares of Common Stock and 1,881,690 shares of Common Stock, respectively.

Except as otherwise indicated

in this Proxy Statement, the securities of the Company directly owned by each of the Participants were purchased with working capital

or personal funds in open market purchases.

Except as set forth in

this Proxy Statement (including the Schedules hereto), (i) during the past ten (10) years, no Participant has been convicted in a criminal

proceeding (excluding traffic violations or similar misdemeanors); (ii) no Participant directly or indirectly beneficially owns any securities

of the Company; (iii) no Participant owns any securities of the Company which are owned of record but not beneficially; (iv) no Participant

has purchased or sold any securities of the Company during the past two (2) years; (v) no part of the purchase price or market value of

the securities of the Company owned by any Participant is represented by funds borrowed or otherwise obtained for the purpose of acquiring

or holding such securities; (vi) no Participant is, or within the past year was, a party to any contract, arrangements or understandings

with any person with respect to any securities of the Company, including, but not limited to, joint ventures, loan or option arrangements,

puts or calls, guarantees against loss or guarantees of profit, division of losses or profits, or the giving or withholding of proxies;

(vii) no associate of any Participant owns beneficially, directly or indirectly, any securities of the Company; (viii) no Participant

owns beneficially, directly or indirectly, any securities of any parent or subsidiary of the Company; (ix) no Participant or any of his,

her or its associates was a party to any transaction, or series of similar transactions, since the beginning of the Company’s last

fiscal year, or is a party to any currently proposed transaction, or series of similar transactions, to which the Company or any of its

subsidiaries was or is to be a party, in which the amount involved exceeds $120,000; (x) no Participant or any of his, her or its associates

has any arrangement or understanding with any person with respect to any future employment by the Company or its affiliates, or with respect

to any future transactions to which the Company or any of its affiliates will or may be a party; and (xi) no Participant has a substantial

interest, direct or indirect, by securities holdings or otherwise in any matter to be acted on at the Annual Meeting.

There are no material proceedings

to which any Participant or any of his, her or its associates is a party adverse to the Company or any of its subsidiaries or has a material

interest adverse to the Company or any of its subsidiaries. With respect to the Land & Buildings Nominees, none of the events enumerated

in Item 401(f)(1)-(8) of Regulation S-K of the Exchange Act occurred during the past ten (10) years.

OTHER MATTERS AND ADDITIONAL INFORMATION

Land & Buildings is

unaware of any other matters to be considered at the Annual Meeting. However, should other matters, which Land & Buildings is not

aware of a reasonable time before this solicitation, be brought before the Annual Meeting, the persons named as proxies on the enclosed

BLUE universal proxy card will vote on such matters in their discretion.

Some banks, brokers and

other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This

means that only one copy of this Proxy Statement may have been sent to multiple stockholders in your household. We will promptly deliver

a separate copy of the document to you if you contact our proxy solicitor, Saratoga, at the following address or phone number: 520 8th

Avenue, 14th Floor, New York, New York 10018 or call toll free at (888) 368-0379. If you want to receive separate copies of our proxy

materials in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should

contact your bank, broker or other nominee record holder, or you may contact our proxy solicitor at the above address or phone number.

The information concerning

the Company and the proposals in the Company’s proxy statement contained in this Proxy Statement has been taken from, or is based

upon, publicly available documents on file with the SEC and other publicly available information. Although we have no knowledge that would

indicate that statements relating to the Company contained in this Proxy Statement, in reliance upon publicly available information, are

inaccurate or incomplete, to date we have not had access to the books and records of the Company, were not involved in the preparation

of such information and statements and are not in a position to verify such information and statements. All information relating to any

person other than the Participants is given only to the knowledge of Land & Buildings.

This Proxy Statement is

dated [_______], 2022. You should not assume that the information contained in this Proxy Statement is accurate as of any date other than

such date, and the mailing of this Proxy Statement to stockholders shall not create any implication to the contrary.

STOCKHOLDER PROPOSALS

Proposals of stockholders

intended to be presented at Aimco’s Annual Meeting of Stockholders to be held in 2023 (the “2023 Annual Meeting”) must

be received by Aimco, marked to the attention of the Corporate Secretary, no later than [_], 2023, to be included in Aimco’s proxy

statement and form of proxy for that meeting. Proposals must comply with the requirements as to form and substance established by the

SEC for proposals in order to be included in the proxy statement. Nominations for directors pursuant to “proxy access” provided

for in the Bylaws must adhere to the terms of the Bylaws and will be considered untimely if received by the Company before [_], 2023,

or after [_] 2023. Proposals of stockholders or director nominations submitted to Aimco for consideration at the 2023 Annual Meeting outside

the processes of Rule 14a-8 or “proxy access” (i.e., the procedures for placing a stockholder’s proposal or director

nominee in Aimco’s proxy materials) will be considered untimely if received by the Company before [_], 2023, or after [_], 2023.

In addition, to comply with the Universal Proxy Rules, stockholders who intend to solicit proxies in support of director nominees other

than the Company’s nominees must set forth the information required by Rule 14a-19 under the Exchange Act of 1934 when providing

notice to the Company.

The information set forth

above regarding the procedures for submitting stockholder proposals for consideration at the 2023 Annual Meeting is based on information

contained in the Company’s proxy statement and the Bylaws. The incorporation of this information in this Proxy Statement should

not be construed as an admission by Land & Buildings that such procedures are legal, valid or binding.

CERTAIN ADDITIONAL INFORMATION

WE HAVE OMITTED FROM THIS

PROXY STATEMENT CERTAIN DISCLOSURE REQUIRED BY APPLICABLE LAW THAT IS EXPECTED TO BE INCLUDED IN THE COMPANY’S PROXY STATEMENT RELATING

TO THE ANNUAL MEETING BASED ON OUR RELIANCE ON RULE 14A-5(C) UNDER THE EXCHANGE ACT. THIS DISCLOSURE IS EXPECTED TO INCLUDE, AMONG OTHER

THINGS, CURRENT BIOGRAPHICAL INFORMATION ON THE COMPANY’S DIRECTORS AND EXECUTIVE OFFICERS, INFORMATION CONCERNING EXECUTIVE COMPENSATION

AND DIRECTOR COMPENSATION, INFORMATION CONCERNING THE COMMITTEES OF THE BOARD AND OTHER INFORMATION CONCERNING THE BOARD, INFORMATION

CONCERNING CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS, INFORMATION ABOUT THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM AND OTHER IMPORTANT INFORMATION. SEE SCHEDULE I FOR INFORMATION REGARDING PERSONS WHO BENEFICIALLY OWN MORE THAN 5% OF THE SHARES

AND THE OWNERSHIP OF THE SHARES BY THE DIRECTORS AND MANAGEMENT OF THE COMPANY.

Land & Buildings Capital Growth Fund, L.P.

__________, 2022

SCHEDULE I

TRANSACTIONS IN SECURITIES OF THE COMPANY

DURING THE PAST TWO YEARS

Nature of

Transaction |

Shares of Common Stock

Purchased / (Sold) |

Date of

Purchase / Sale |

LAND & BUILDINGS CAPITAL GROWTH FUND, LP

| Purchase of Common Stock |

24,700 |

10/01/2020 |

| Sale of Common Stock1 |

(49,300) |

10/23/2020 |

| Sale of Common Stock1 |

(51,700) |

10/26/2020 |

| Sale of Common Stock1 |

(25,053) |

10/27/2020 |

| Sale of Common Stock1 |

(26,647) |

10/28/2020 |

| Sale of Common Stock |

(23,880) |

11/02/2020 |

| Purchase of Common Stock |

188,720 |

11/03/2020 |

| Purchase of Common Stock |

31,250 |

11/03/2020 |

| Sale of Common Stock1 |

(98,185) |

11/05/2020 |

| Sale of Common Stock1 |

(33,515) |

11/06/2020 |

| Purchase of Common Stock |

13,300 |

11/09/2020 |

| Purchase of Common Stock |

42,400 |

11/11/2020 |

| Purchase of Common Stock |

4,324 |

11/16/2020 |

| Purchase of Common Stock |

1,619 |

11/17/2020 |

| Sale of Common Stock1 |

(57,915) |

11/20/2020 |

| Purchase of Common Stock |

54,600 |

11/23/2020 |

| Purchase of Common Stock |

54,100 |

11/24/2020 |

| Sale of Common Stock |

(141,680) |

12/02/2020 |

| Sale of Common Stock |

(59,862) |

12/02/2020 |