Annaly Capital Management, Inc. Announces Pricing of Public Offering of Series I Fixed-to-Floating Rate Cumulative Redeemable...

June 20 2019 - 5:00PM

Business Wire

Annaly Capital Management, Inc. (NYSE: NLY), a Maryland

corporation (“Annaly” or the “Company”), today announced that it

has priced a public offering of an original issuance of 16.0

million shares of its 6.750% Series I Fixed-to-Floating Rate

Cumulative Redeemable Preferred Stock (the “Series I Preferred

Stock”), liquidation preference $25.00 per share, for gross

proceeds of approximately $400 million before deducting the

underwriting discount and other estimated offering expenses. The

offering is subject to customary closing conditions and is expected

to close on or about June 27, 2019. The Company intends to apply to

list the Series I Preferred Stock on the New York Stock Exchange

under the symbol “NLYPrI.”

In connection with the offering, Annaly has granted the

underwriters a thirty-day option to purchase up to an additional

2.4 million shares of Series I Preferred Stock solely to cover

over-allotments.

Annaly intends to use the net proceeds of this offering to

redeem up to all of its outstanding 7.625% Series C Cumulative

Redeemable Preferred Stock, with an aggregate liquidation

preference of $175.0 million, plus accrued but unpaid dividends

payable therewith. Annaly intends to use the remaining net proceeds

of this offering, if any, to acquire targeted assets under the

Company’s capital allocation policy, which may include further

diversification of its investments in Agency assets as well as

residential, commercial and corporate credit assets. These

investments include, without limitation, residential credit assets

(including residential mortgage loans), middle market corporate

debt, Agency MBS pools, to-be-announced forward contracts,

adjustable rate mortgages, MSRs and commercial real estate loans,

equity and securities. Annaly may also use the net proceeds for

general corporate purposes, including, without limitation, to pay

down obligations and other working capital items.

Morgan Stanley, BofA Merrill Lynch, J.P. Morgan, RBC Capital

Markets, UBS Investment Bank, Citigroup, Goldman Sachs & Co.

LLC and Keefe, Bruyette & Woods, A Stifel Company are acting as

joint book-running managers for the offering. Sandler O’Neill +

Partners, L.P and Scotiabank are acting as co-managers for the

offering.

Annaly has filed a shelf registration statement and prospectus

with the Securities and Exchange Commission (the “SEC”), and has

filed a prospectus supplement for the offering to which this

communication relates. Before you invest in the offering, you

should read the prospectus supplement and the accompanying

prospectus and other documents Annaly has filed with the SEC for

more complete information about Annaly and the offering. You may

obtain these documents for free by visiting EDGAR on the SEC

website at http://www.sec.gov. Alternatively, Annaly, the

underwriters or any dealer participating in the offering will

arrange to send you the prospectus supplement and accompanying

prospectus if you request them by contacting:

Morgan Stanley & Co. LLC 180 Varick Street New York, New

York 10014 Attention: Prospectus Department Email:

prospectus@morganstanley.com

This press release does not constitute an offer to sell or the

solicitation of an offer to buy shares of Series I Preferred Stock,

nor shall there be any sale of these securities in any jurisdiction

in which such offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of any

such jurisdiction.

About Annaly

Annaly is a leading diversified capital manager that invests in

and finances residential and commercial assets. Annaly’s principal

business objective is to generate net income for distribution to

its stockholders and to preserve capital through prudent selection

of investments and continuous management of its portfolio. Annaly

has elected to be taxed as a real estate investment trust, or REIT,

for federal income tax purposes. Annaly is externally managed by

Annaly Management Company LLC.

Forward-Looking Statements

This news release and our public documents to which we refer

contain or incorporate by reference certain forward-looking

statements which are based on various assumptions (some of which

are beyond our control) and may be identified by reference to a

future period or periods or by the use of forward-looking

terminology, such as “may,” “will,” “believe,” “expect,”

“anticipate,” “continue,” or similar terms or variations on those

terms or the negative of those terms. Actual results could differ

materially from those set forth in forward-looking statements due

to a variety of factors, including, but not limited to, changes in

interest rates; changes in the yield curve; changes in prepayment

rates; the availability of mortgage-backed securities and other

securities for purchase; the availability of financing and, if

available, the terms of any financing; changes in the market value

of our assets; changes in business conditions and the general

economy; our ability to grow our commercial real estate business;

our ability to grow our residential mortgage credit business; our

ability to grow our middle market lending business; credit risks

related to our investments in credit risk transfer securities,

residential mortgage-backed securities and related residential

mortgage credit assets, commercial real estate assets and corporate

debt; risks related to investments in mortgage servicing rights;

our ability to consummate any contemplated investment

opportunities; changes in government regulations and policy

affecting our business; our ability to maintain our qualification

as a REIT for U.S federal income tax purposes; and our ability to

maintain our exemption from registration under the Investment

Company Act of 1940, as amended. For a discussion of the risks and

uncertainties which could cause actual results to differ from those

contained in the forward-looking statements, see “Risk Factors” in

our most recent Annual Report on Form 10-K and any subsequent

Quarterly Reports on Form 10-Q. We do not undertake, and

specifically disclaim any obligation, to publicly release the

result of any revisions which may be made to any forward-looking

statements to reflect the occurrence of anticipated or

unanticipated events or circumstances after the date of such

statements, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190620005728/en/

Annaly Capital Management, Inc. Investor Relations 1-888-8Annaly

investor@annaly.com

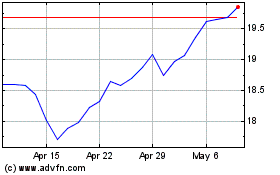

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

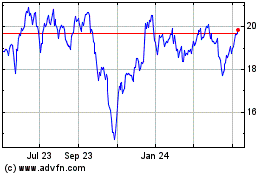

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Apr 2023 to Apr 2024