Annaly Capital Management, Inc. (NYSE:NLY) (the “Company” or

“Annaly”) today announced its financial results for the quarter

ended September 30, 2018.

Quarterly Financial

Highlights

- GAAP net income of $385.4 million,

$0.29 per average common share

- Core earnings (excluding PAA) of $389.7

million, $0.30 per average common share

- GAAP return on average equity of 10.73%

and core return on average equity (excluding PAA) of 10.85%

- Book value per common share of

$10.03

- Economic leverage of 6.7x as compared

to 6.4x at June 30, 2018

- Net interest margin (excluding PAA) of

1.50% as compared to 1.56% in the prior quarter

- Increased hedge ratio to 96% as

compared to 95% at June 30, 2018

Business

Highlights

- Closed and integrated $906 million

acquisition of MTGE Investment Corp.

- Increased credit capital allocation to

30%, up from 28% at June 30, 2018 and 24% at December 31, 2017,

while maintaining strong credit quality

- Raised gross proceeds of $1.1 billion

through an overnight common equity offering and the at-the-market

("ATM") equity offering program

- Demonstrated access to diverse

financing alternatives to support each of our businesses

- Completed a residential whole loan

securitization of $383.9 million in the third quarter 2018 (debut

securitization of $327.5 million closed in the first quarter 2018)

and closed on a third securitization of $384.0 million in October

2018, for an aggregate of $1.1 billion

- Expanded and enhanced credit facilities

to support continued growth of both Commercial Real Estate and

Middle Market Lending, improving terms and reducing funding

costs

- Increased access to direct repo market,

representing over 40% of our broker-dealer's ("Arcola") balances at

September 30, 2018

- Declared 20th consecutive quarterly

dividend of $0.30 per common share

“During the third quarter, Annaly successfully continued the

execution of our internal and external growth strategies by

increasing our internal investment options, expanding our capital

base and further consolidating the industry,” commented Kevin

Keyes, Chairman, CEO and President. “We also effectively increased

our financing sources and capacity, while improving terms, as our

three credit businesses continue to perform well and complement our

Agency MBS strategies. Annaly represents a diversified, stable,

highly liquid, low beta investment option in a market where

heightened volatility has returned."

On September 7, 2018, Annaly completed the acquisition of MTGE

Investment Corp. ("MTGE"), for aggregate consideration of $906

million, representing Annaly’s third strategic acquisition since

2013. “The MTGE transaction is accretive to earnings and further

enhances our capital base,” Mr. Keyes remarked. “The acquisition

also expands our capital allocation to credit, offers significant

cost-savings to shareholders and is further evidence of Annaly’s

unique position as an industry leading consolidator.”

Financial

Performance

The following table summarizes certain key performance

indicators as of and for the quarters ended September 30,

2018, June 30, 2018 and September 30, 2017:

September 30,

2018 June 30, 2018

September 30, 2017 Book value per common share (1) $ 10.03 $

10.35 $ 11.42 Economic leverage at period-end (2) 6.7:1 6.4:1 6.9:1

GAAP net income (loss) per average common share (3) $ 0.29 $ 0.49 $

0.31 Annualized GAAP return (loss) on average equity 10.73 % 17.20

% 10.98 % Net interest margin (4) 1.49 % 1.53 % 1.33 % Average

yield on interest earning assets (5) 3.21 % 3.04 % 2.79 % Average

cost of interest bearing liabilities (6) 2.08 % 1.89 % 1.82 % Net

interest spread 1.13 % 1.15 % 0.97 %

Core Earnings

Metrics: *

Core earnings (excluding PAA) per average common share (3)(7) $

0.30 $ 0.30 $ 0.30 Core earnings per average common share (3)(7) $

0.29 $ 0.30 $ 0.26 PAA cost (benefit) per average common share $

0.01 $ — $ 0.04 Annualized core return on average equity (excluding

PAA) 10.85 % 11.05 % 10.57 % Net interest margin (excluding PAA)

(4) 1.50 % 1.56 % 1.47 % Average yield on interest earning assets

(excluding PAA) (5) 3.22 % 3.07 % 2.97 % Net interest spread

(excluding PAA) 1.14 % 1.18 % 1.15 % * Represents

non-GAAP financial measures. Please refer to the ‘Non-GAAP

Financial Measures’ section for additional information. (1) Book

value per common share includes shares of the Company's common

stock that were pending issuance to shareholders of MTGE at

September 30, 2018 in connection with the Company's acquisition of

MTGE. (2) Computed as the sum of recourse debt, to-be-announced

(“TBA”) derivative notional outstanding and net forward purchases

(sales) of investments divided by total equity. Recourse debt

consists of repurchase agreements and other secured financing

(excluding certain non-recourse credit facilities). Securitized

debt, certain credit facilities (included within other secured

financing) and mortgages payable are non-recourse to the Company

and are excluded from this measure. (3) Net of dividends on

preferred stock. The quarter ended September 30, 2017 includes

cumulative and undeclared dividends of $8.3 million on the

Company's Series F Preferred Stock as of September 30, 2017. (4)

Net interest margin represents the sum of the Company's interest

income plus TBA dollar roll income and CMBX coupon income less

interest expense and the net interest component of interest rate

swaps divided by the sum of average interest earning assets plus

average TBA contract and CMBX balances. Net interest margin

(excluding PAA) excludes the premium amortization adjustment

(“PAA”) representing the cumulative impact on prior periods, but

not the current period, of quarter-over-quarter changes in

estimated long-term prepayment speeds related to the Company’s

Agency mortgage-backed securities. (5) Average yield on interest

earning assets represents annualized interest income divided by

average interest earning assets. Average interest earning assets

reflects the average amortized cost of our investments during the

period. Average yield on interest earning assets (excluding PAA) is

calculated using annualized interest income (excluding PAA). (6)

Includes GAAP interest expense and the net interest component of

interest rate swaps. Prior to the quarter ended March 31, 2018,

this metric included the net interest component of interest rate

swaps used to hedge cost of funds. Beginning with the quarter ended

March 31, 2018, as a result of changes to the Company’s hedging

portfolio, this metric reflects the net interest component of all

interest rate swaps. (7) Beginning with the results for the quarter

ended September 30, 2018, the Company has updated its calculation

of core earnings and related metrics to reflect changes to its

portfolio composition and operations in connection with the

Company's continued growth and diversification, including the

recent acquisition of MTGE Investment Corp. Refer to the section

titled "Non-GAAP Financial Measures" for a complete discussion of

core earnings and core earnings (excluding PAA) per average common

share, and other non-GAAP financial measures. Prior period results

have not been adjusted to conform to the revised calculation as the

impact in each of those periods were not material.

Other

Information

This news release and our public documents to which we refer

contain or incorporate by reference certain forward-looking

statements which are based on various assumptions (some of which

are beyond our control) and may be identified by reference to a

future period or periods or by the use of forward-looking

terminology, such as “may,” “will,” “believe,” “expect,”

“anticipate,” “continue,” or similar terms or variations on those

terms or the negative of those terms. Actual results could differ

materially from those set forth in forward-looking statements due

to a variety of factors, including, but not limited to, changes in

interest rates; changes in the yield curve; changes in prepayment

rates; the availability of mortgage-backed securities and other

securities for purchase; the availability of financing and, if

available, the terms of any financing; changes in the market value

of our assets; changes in business conditions and the general

economy; our ability to grow our commercial real estate business;

our ability to grow our residential mortgage credit business; our

ability to grow our middle market lending business; credit risks

related to our investments in credit risk transfer securities,

residential mortgage-backed securities and related residential

mortgage credit assets, commercial real estate assets and corporate

debt; risks related to investments in mortgage servicing rights;

our ability to consummate any contemplated investment

opportunities; changes in government regulations and policy

affecting our business; our ability to maintain our qualification

as a REIT for U.S. federal income tax purposes; and our ability to

maintain our exemption from registration under the Investment

Company Act of 1940, as amended. For a discussion of the risks and

uncertainties which could cause actual results to differ from those

contained in the forward-looking statements, see “Risk Factors” in

our most recent Annual Report on Form 10-K and any subsequent

Quarterly Reports on Form 10-Q. We do not undertake, and

specifically disclaim any obligation, to publicly release the

result of any revisions which may be made to any forward-looking

statements to reflect the occurrence of anticipated or

unanticipated events or circumstances after the date of such

statements, except as required by law.

Annaly is a leading diversified capital manager that invests in

and finances residential and commercial assets. Annaly’s principal

business objective is to generate net income for distribution to

its stockholders and to preserve capital through prudent selection

of investments and continuous management of its portfolio. Annaly

has elected to be taxed as a real estate investment trust, or REIT,

for federal income tax purposes. Annaly is externally managed by

Annaly Management Company LLC. Additional information on the

Company can be found at www.annaly.com.

Annaly routinely posts important information for investors on

the Company’s website, www.annaly.com. Annaly intends to use this

webpage as a means of disclosing material, non-public information,

for complying with the Company’s disclosure obligations under

Regulation FD and to post and update investor presentations and

similar materials on a regular basis. Annaly encourages investors,

analysts, the media and others interested in Annaly to monitor the

Company’s website, in addition to following Annaly’s press

releases, SEC filings, public conference calls, presentations,

webcasts and other information it posts from time to time on its

website. To sign-up for email-notifications, please visit the

“Email Alerts” section of our website, www.annaly.com, under the

“Investors” section and enter the required information to enable

notifications. The information contained on, or that may be

accessed through, the Company’s webpage is not incorporated by

reference into, and is not a part of, this document.

The Company prepares a supplemental investor presentation and a

financial summary for the benefit of its shareholders. Both the

Third Quarter 2018 Investor Presentation and the Third Quarter 2018

Financial Summary can be found at the Company’s website

(www.annaly.com) in the Investors section under Investor

Presentations.

Conference

Call

The Company will hold the third quarter 2018 earnings conference

call on November 1, 2018 at 9:00 a.m. Eastern Time. The number

to call is 888-317-6003 for domestic calls and 412-317-6061 for

international calls. The conference passcode is 0664905. There will

also be an audio webcast of the call on www.annaly.com. The replay

of the call will be available for one week following the conference

call. The replay number is 877-344-7529 for domestic calls and

412-317-0088 for international calls and the conference passcode is

10125062. If you would like to be added to the e-mail distribution

list, please visit www.annaly.com, click on Investors, then select

Email Alerts and complete the email notification form.

Financial

Statements

ANNALY CAPITAL MANAGEMENT, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF FINANCIAL

CONDITION(dollars in thousands, except per share

data)

September 30, 2018

June 30,2018

March 31,2018

December 31, 2017

(1)

September 30, 2017

(Unaudited) (Unaudited)

(Unaudited) (Unaudited)

ASSETS Cash and cash equivalents $ 1,082,747 $ 1,135,329 $

984,275 $ 706,589 $ 867,840 Securities 91,338,611 88,478,689

90,539,192 92,563,572 87,989,783 Loans 4,224,203 3,692,172

3,208,617 2,999,148 2,592,922 Mortgage servicing rights 588,833

599,014 596,378 580,860 570,218 Assets transferred or pledged to

securitization vehicles 4,287,821 3,066,270 3,256,621 3,306,133

3,719,486 Real estate, net 753,014 477,887 480,063 485,953 470,928

Derivative assets 404,841 212,138 230,302 313,885 278,499 Reverse

repurchase agreements 1,234,704 259,762 200,459 — — Receivable for

unsettled trades 1,266,840 21,728 45,126 1,232 340,033 Interest

receivable 347,278 323,769 326,989 323,526 293,207 Goodwill and

intangible assets, net 103,043 91,009 92,763 95,035 97,557 Other

assets 329,868 475,230 421,448

384,117 353,708 Total assets $

105,961,803 $ 98,832,997 $ 100,382,233

$ 101,760,050 $ 97,574,181

LIABILITIES AND STOCKHOLDERS’ EQUITY Liabilities: Repurchase

agreements $ 79,073,026 $ 75,760,655 $ 78,015,431 $ 77,696,343 $

69,430,268 Other secured financing 4,108,547 3,760,487 3,830,075

3,837,528 3,713,256 Debt issued by securitization vehicles

3,799,542 2,728,692 2,904,873 2,971,771 3,357,929 Mortgages payable

511,588 309,878 309,794 309,686 311,886 Derivative liabilities

379,794 494,037 580,941 607,854 682,489 Payable for unsettled

trades 2,505,428 1,108,834 91,327 656,581 5,243,868 Interest

payable 399,605 478,439 284,696 253,068 231,611 Dividends payable

102,811 349,300 347,897 347,876 326,425 Other liabilities 125,606

68,819 74,264 207,770

121,231 Total liabilities 91,005,947

85,059,141 86,439,298 86,888,477

83,418,963 Stockholders’ Equity: Preferred

stock, par value $0.01 per share (2) 1,778,168 1,723,168 1,723,168

1,720,381 1,720,381 Common stock, par value $0.01 per share (3)

13,031 11,643 11,597 11,596 10,881 Additional paid-in capital

18,793,706 17,268,596 17,218,191 17,221,265 16,377,805 Accumulated

other comprehensive income (loss) (3,822,956 ) (3,434,447 )

(3,000,080 ) (1,126,020 ) (640,149 ) Accumulated deficit (1,811,955

) (1,800,370 ) (2,015,612 ) (2,961,749 )

(3,320,160 ) Total stockholders’ equity 14,949,994

13,768,590 13,937,264 14,865,473 14,148,758 Noncontrolling

interests 5,862 5,266 5,671

6,100 6,460 Total equity 14,955,856

13,773,856 13,942,935

14,871,573 14,155,218 Total liabilities and

equity $ 105,961,803 $ 98,832,997 $

100,382,233 $ 101,760,050 $ 97,574,181

(1) Derived from the audited consolidated

financial statements at December 31, 2017. (2)

7.875% Series A

Cumulative Redeemable Preferred Stock - Includes 0 shares

authorized, issued and outstanding at September 30, 2018, June 30,

2018, March 31, 2018 and December 31, 2017. Includes 7,412,500

authorized shares and 0 shares issued and outstanding at September

30, 2017.

7.625% Series C

Cumulative Redeemable Preferred Stock - Includes 7,000,000

shares authorized and 7,000,000 shares issued and outstanding at

September 30, 2018. Includes 12,000,000 shares authorized and

7,000,000 shares issued and outstanding at June 30, 2018 and March

31, 2018. Includes 12,000,000 shares authorized, issued and

outstanding at December 31, 2017. Includes 12,650,000 shares

authorized and 12,000,000 shares issued and outstanding at

September 30, 2017.

7.50% Series D

Cumulative Redeemable Preferred Stock - Includes 18,400,000

shares authorized, issued and outstanding.

7.625% Series E

Cumulative Redeemable Preferred Stock - Includes 0 shares

authorized, issued and outstanding at September 30, 2018. Includes

11,500,000 shares authorized and 0 shares issued and outstanding at

June 30, 2018 and March 31, 2018. Includes 11,500,000 shares

authorized, issued and outstanding at December 31, 2017 and

September 30, 2017.

6.95% Series F

Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock

- Includes 28,800,000 shares authorized, issued and outstanding at

September 30, 2018, June 30, 2018, March 31, 2018 and December 31,

2017. Includes 32,200,000 shares authorized and 28,800,000 shares

issued and outstanding at September 30, 2017.

6.50% Series G

Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock

- Includes 19,550,000 shares authorized and 17,000,000 issued and

outstanding at September 30, 2018, June 30, 2018 and March 31,

2018. Includes 0 shares authorized, issued and outstanding at

December 31, 2017 and September 30, 2017.

8.25% Series H

Cumulative Redeemable Preferred Stock - Includes 2,200,000

shares authorized, issued and outstanding at September 30, 2018.

Includes 0 shares authorized, issued and outstanding at June 30,

2018, March 31, 2018, December 31, 2017 and September 30, 2017.

(3) Includes 1,924,050,000 shares authorized and

1,303,079,555 issued and outstanding at September 30, 2018.

Includes 1,909,750,000 shares authorized and 1,164,333,831 issued

and outstanding at June 30, 2018. Includes 1,909,750,000 shares

authorized and 1,159,657,350 issued and outstanding at March 31,

2018. Includes 1,929,300,000 shares authorized and 1,159,585,078

issued and outstanding at December 31, 2017. Includes 1,917,837,500

shares authorized and 1,088,083,794 shares issued and outstanding

at September 30, 2017.

ANNALY CAPITAL MANAGEMENT, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(LOSS)(Unaudited)(dollars in thousands, except per

share data)

For the quarters ended

September 30,2018

June 30, 2018

March 31,2018

December 31,2017

September 30,2017

Net interest income: Interest

income $ 816,596 $ 776,806 $ 879,487 $ 745,423 $ 622,550 Interest

expense 500,973 442,692 367,421

318,711 268,937

Net interest

income 315,623 334,114 512,066

426,712 353,613

Realized and unrealized gains (losses): Net interest

component of interest rate swaps 51,349 31,475 (48,160 ) (82,271 )

(88,211 ) Realized gains (losses) on termination or maturity of

interest rate swaps 575 — 834 (160,075 ) — Unrealized gains

(losses) on interest rate swaps 417,203 343,475

977,285 484,447 56,854

Subtotal 469,127 374,950

929,959 242,101 (31,357 ) Net gains

(losses) on disposal of investments (324,294 ) (66,117 ) 13,468

7,895 (11,552 ) Net gains (losses) on other derivatives 94,827

34,189 (47,145 ) 121,334 154,208 Net unrealized gains (losses) on

instruments measured at fair value through earnings (39,944 )

(48,376 ) (51,593 ) (12,115 ) (67,492 )

Subtotal (269,411 ) (80,304 ) (85,270 )

117,114 75,164

Total realized and

unrealized gains (losses) 199,716 294,646

844,689 359,215 43,807

Other income (loss) (10,643 ) 34,170 34,023 25,064 28,282

General and administrative expenses: Compensation and

management fee 45,983 45,579 44,529 44,129 41,993 Other general and

administrative expenses 80,526 18,202

17,981 15,128 15,023

Total

general and administrative expenses 126,509

63,781 62,510 59,257

57,016

Income (loss) before income taxes 378,187

599,149 1,328,268 751,734 368,686

Income taxes (7,242 )

3,262 564 4,963

1,371

Net income (loss) 385,429 595,887 1,327,704

746,771 367,315

Net income (loss) attributable to noncontrolling

interests (149 ) (32 ) (96 ) (151 )

(232 )

Net income (loss) attributable to Annaly 385,578

595,919 1,327,800 746,922 367,547

Dividends on preferred

stock (1) 31,675 31,377

33,766 32,334 30,355

Net

income (loss) available (related) to common stockholders $

353,903 $ 564,542 $ 1,294,034

$ 714,588 $ 337,192

Net

income (loss) per share available (related) to common

stockholders: Basic $ 0.29 $ 0.49 $

1.12 $ 0.62 $ 0.31 Diluted $

0.29 $ 0.49 $ 1.12 $ 0.62

$ 0.31

Weighted average number of

common shares outstanding: Basic 1,202,353,851

1,160,436,777 1,159,617,848

1,151,653,296 1,072,566,395 Diluted

1,202,353,851 1,160,979,451

1,160,103,185 1,152,138,887

1,073,040,637

Net income (loss) $ 385,429

$ 595,887 $ 1,327,704 $

746,771 $ 367,315

Other comprehensive

income (loss): Unrealized gains (losses) on available-for-sale

securities (719,609 ) (505,130 ) (1,879,479 ) (487,597 ) 195,251

Reclassification adjustment for net (gains) losses included in net

income (loss) 331,100 70,763 5,419

1,726 15,367 Other comprehensive

income (loss) (388,509 ) (434,367 ) (1,874,060 )

(485,871 ) 210,618 Comprehensive income (loss)

(3,080 ) 161,520 (546,356 ) 260,900 577,933 Comprehensive income

(loss) attributable to noncontrolling interests (149 ) (32 )

(96 ) (151 ) (232 ) Comprehensive income

(loss) attributable to Annaly (2,931 ) 161,552 (546,260 ) 261,051

578,165 Dividends on preferred stock (1) 31,675

31,377 33,766 32,334

30,355

Comprehensive income (loss) attributable to common

stockholders $ (34,606 ) $ 130,175 $

(580,026 ) $ 228,717 $ 547,810

(1) The quarter ended December 31, 2017

excludes, and the quarter ended September 30, 2017 includes,

cumulative and undeclared dividends of $8.3 million on the

Company's Series F Preferred Stock as of September 30, 2017.

ANNALY CAPITAL MANAGEMENT, INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(LOSS)(Unaudited)(dollars in thousands, except per

share data)

For the nine months ended

September 30,2018

September 30,2017

Net interest income: Interest income $ 2,472,889 $

1,747,703 Interest expense 1,311,086 689,643

Net interest income 1,161,803 1,058,060

Realized and unrealized gains (losses): Net interest

component of interest rate swaps 34,664 (288,837 ) Realized gains

(losses) on termination or maturity of interest rate swaps 1,409

(58 ) Unrealized gains (losses) on interest rate swaps 1,737,963

28,471

Subtotal 1,774,036

(260,424 ) Net gains (losses) on disposal of investments (376,943 )

(11,833 ) Net gains (losses) on other derivatives 81,871 140,104

Net unrealized gains (losses) on instruments measured at fair value

through earnings (139,913 ) (27,569 )

Subtotal

(434,985 ) 100,702

Total realized and unrealized

gains (losses) 1,339,051 (159,722 )

Other

income (loss) 57,550 90,793

General and administrative

expenses: Compensation and management fee 136,091 120,193 Other

general and administrative expenses 116,709 44,674

Total general and administrative expenses 252,800

164,867

Income (loss) before income

taxes 2,305,604 824,264

Income taxes (3,416 )

2,019

Net income (loss) 2,309,020 822,245

Net

income (loss) attributable to noncontrolling interests (277 )

(437 )

Net income (loss) attributable to Annaly

2,309,297 822,682

Dividends on preferred stock 96,818

77,301

Net income (loss) available (related) to

common stockholders $ 2,212,479 $ 745,381

Net income (loss) per share available (related) to common

stockholders: Basic $ 1.88 $ 0.72 Diluted

$ 1.88 $ 0.72

Weighted average

number of common shares outstanding: Basic 1,174,292,701

1,037,033,076 Diluted 1,174,292,701

1,037,445,177

Net income (loss) $ 2,309,020

$ 822,245

Other comprehensive income

(loss): Unrealized gains (losses) on available-for-sale

securities (3,104,218 ) 397,600 Reclassification adjustment for net

(gains) losses included in net income (loss) 407,282

48,144 Other comprehensive income (loss) (2,696,936 )

445,744 Comprehensive income (loss) (387,916 ) 1,267,989

Comprehensive income (loss) attributable to noncontrolling

interests (277 ) (437 ) Comprehensive income (loss)

attributable to Annaly (387,639 ) 1,268,426 Dividends on preferred

stock 96,818 77,301

Comprehensive income

(loss) attributable to common stockholders $ (484,457 )

$ 1,191,125

Key Financial

Data

The following table presents key metrics of the Company’s

portfolio, liabilities and hedging positions, and performance as of

and for the quarters ended September 30, 2018, June 30,

2018, and September 30, 2017:

September 30, 2018

June 30,2018

September 30, 2017

Portfolio Related

Metrics:

Fixed-rate Residential Securities as a percentage of total

Residential Securities 92 % 91 % 89 % Adjustable-rate and

floating-rate Residential Securities as a percentage of total

Residential Securities 8 % 9 % 11 % Weighted average experienced

CPR for the period 10.3 % 10.1 % 10.3 % Weighted average projected

long-term CPR at period-end 9.1 % 9.1 %

10.4 %

Liabilities and

Hedging Metrics:

Weighted average days to maturity on repurchase agreements

outstanding at period-end 55 71 65 Hedge ratio (1) 96 % 95 % 67 %

Weighted average pay rate on interest rate swaps at period-end (2)

2.10 % 2.08 % 2.27 % Weighted average receive rate on interest rate

swaps at period-end (2) 2.33 % 2.31 % 1.35 % Weighted average net

rate on interest rate swaps at period-end (2) (0.23 %) (0.23 %)

0.92 % Leverage at period-end (3) 5.9:1 6.0:1 5.4:1 Economic

leverage at period-end (4) 6.7:1 6.4:1 6.9:1 Capital ratio at

period-end 12.6 % 13.2 % 12.3 %

Performance

Related Metrics:

Book value per common share (5) $ 10.03 $ 10.35 $ 11.42 GAAP net

income (loss) per average common share (6) $ 0.29 $ 0.49 $ 0.31

Annualized GAAP return (loss) on average equity 10.73 % 17.20 %

10.98 % Net interest margin 1.49 % 1.53 % 1.33 % Average yield on

interest earning assets (7) 3.21 % 3.04 % 2.79 % Average cost of

interest bearing liabilities (8) 2.08 % 1.89 % 1.82 % Net interest

spread 1.13 % 1.15 % 0.97 % Dividend declared per common share $

0.30 $ 0.30 $ 0.30 Annualized dividend yield (9) 11.73 % 11.66 %

9.84 %

Core Earnings Metrics * Core earnings (excluding PAA)

per average common share (6) $ 0.30 $ 0.30 $ 0.30 Core earnings per

average common share (6) $ 0.29 $ 0.30 $ 0.26 PAA cost (benefit)

per average common share $ 0.01 $ — $ 0.04 Annualized core return

on average equity (excluding PAA) 10.85 % 11.05 % 10.57 % Net

interest margin (excluding PAA) 1.50 % 1.56 % 1.47 % Average yield

on interest earning assets (excluding PAA) (7) 3.22 % 3.07 % 2.97 %

Net interest spread (excluding PAA) 1.14 %

1.18 % 1.15 % * Represents non-GAAP financial

measures. Please refer to the ‘Non-GAAP Financial Measures’ section

for additional information. (1) Measures total notional balances of

interest rate swaps, interest rate swaptions and futures relative

to repurchase agreements, other secured financing and TBA notional

outstanding; excludes MSRs and the effects of term financing, both

of which serve to reduce interest rate risk. Additionally, the

hedge ratio does not take into consideration differences in

duration between assets and liabilities. (2) Excludes forward

starting swaps. (3) Debt consists of repurchase agreements, other

secured financing, securitized debt and mortgages payable. Certain

credit facilities (included within other secured financing),

securitized debt and mortgages payable are non-recourse to the

Company. (4) Computed as the sum of recourse debt, TBA derivative

notional outstanding and net forward purchases of investments

divided by total equity. (5) Book value per common share includes

shares of the Company's common stock that were pending issuance to

shareholders of MTGE at September 30, 2018 in connection with the

Company's acquisition of MTGE. (6) Net of dividends on preferred

stock. The quarter ended September 30, 2017 includes cumulative and

undeclared dividends of $8.3 million on the Company's Series F

Preferred Stock as of September 30, 2017. (7) Average yield on

interest earning assets represents annualized interest income

divided by average interest earning assets. Average interest

earning assets reflects the average amortized cost of our

investments during the period. Average yield on interest earning

assets (excluding PAA) is calculated using annualized interest

income (excluding PAA). (8) Includes GAAP interest expense and the

net interest component of interest rate swaps. Prior to the quarter

ended March 31, 2018, this metric included the net interest

component of interest rate swaps used to hedge cost of funds.

Beginning with the quarter ended March 31, 2018, as a result of

changes to the Company’s hedging portfolio, this metric reflects

the net interest component of all interest rate swaps. (9) Based on

the closing price of the Company’s common stock of $10.23, $10.29

and $12.19 at September 30, 2018, June 30, 2018 and September 30,

2017, respectively.

The following table contains additional information on our

residential and commercial investments as of the dates

presented:

For the quarters ended

September 30, 2018

June 30,2018

September 30, 2017

Agency mortgage-backed securities $ 89,290,128 $

86,593,058 $ 85,889,131 Credit risk transfer

securities 688,521 563,796 582,938 Non-agency mortgage-backed

securities 1,173,467 1,006,785 1,227,235 Commercial mortgage-backed

securities 186,495 315,050

290,479

Total securities $ 91,338,611

$ 88,478,689 $ 87,989,783

Residential mortgage loans $ 1,217,139 $ 1,142,300 $ 755,064

Commercial real estate debt and preferred equity 1,435,865

1,251,138 981,748 Loans held for sale 42,325 42,458 — Corporate

debt 1,528,874 1,256,276

856,110

Total loans $ 4,224,203 $

3,692,172 $ 2,592,922

Mortgage

servicing rights $ 588,833 $ 599,014

$ 570,218 Residential mortgage loans $

765,876 $ 523,857 $ 140,855 Commercial real estate debt 3,521,945

2,542,413 3,578,631

Assets transferred or pledged to securitization vehicles $

4,287,821 $ 3,066,270 $

3,719,486

Real estate, net $ 753,014

$ 477,887 $ 470,928

Total

residential and commercial investments $ 101,192,482

$ 96,314,032 $ 95,343,337

Non-GAAP Financial

Measures

In connection with the Company's continued growth and

diversification, including the recent acquisition of MTGE

Investment Corp., the Company has updated its calculation of core

earnings and related metrics to reflect changes to its portfolio

composition and operations. Beginning with the results for the

quarter ended September 30, 2018, core earnings has been refreshed

to include coupon income (expense) on CMBX positions (reported in

Net gains (losses) on other derivatives) and to exclude

depreciation and amortization expense on real estate and related

intangibles (reported in Other income (loss)), non-core income

(loss) allocated to equity method investments (reported in Other

income (loss)) and the income tax effect of non-core income (loss)

(reported in Income taxes). Prior period results will not be

adjusted to conform to the revised calculation as the impact in

each of those periods is not material.

To supplement its consolidated financial statements, which are

prepared and presented in accordance with U.S. generally accepted

accounting principles (“GAAP”), the Company provides the following

non-GAAP measures:

- core earnings and core earnings

(excluding PAA);

- core earnings and core earnings

(excluding PAA) per average common share;

- annualized core return on average

equity (excluding PAA);

- interest income (excluding PAA);

- economic interest expense;

- economic net interest income (excluding

PAA);

- average yield on interest earning

assets (excluding PAA);

- net interest margin (excluding PAA);

and

- net interest spread (excluding

PAA).

These measures should not be considered a substitute for, or

superior to, financial measures computed in accordance with GAAP.

While intended to offer a fuller understanding of the Company’s

results and operations, non-GAAP financial measures also have

limitations. For example, the Company may calculate its non-GAAP

metrics, such as core earnings, or the PAA, differently than its

peers making comparative analysis difficult. Additionally, in the

case of non-GAAP measures that exclude the PAA, the amount of

amortization expense excluding the PAA is not necessarily

representative of the amount of future periodic amortization nor is

it indicative of the term over which the Company will amortize the

remaining unamortized premium. Changes to actual and estimated

prepayments will impact the timing and amount of premium

amortization and, as such, both GAAP and non-GAAP results.

These non-GAAP measures provide additional detail to enhance

investor understanding of the Company’s period-over-period

operating performance and business trends, as well as for assessing

the Company’s performance versus that of industry peers. Additional

information pertaining to the Company’s use of these non-GAAP

financial measures, including discussion of how each such measure

is useful to investors, and reconciliations to their most directly

comparable GAAP results are provided below.

Core earnings and core earnings (excluding PAA), core

earnings and core earnings (excluding PAA) per average common share

and annualized core return on average equity (excluding

PAA)

The Company's principal business objective is to generate net

income for distribution to its stockholders and to preserve capital

through prudent selection of investments and continuous management

of its portfolio. The Company generates net income by earning a net

interest spread on its investment portfolio, which is a function of

interest income from its investment portfolio less financing,

hedging and operating costs. Core earnings, which is defined as the

sum of (a) economic net interest income, (b) TBA dollar roll income

and CMBX coupon income, (c) realized amortization of MSRs, (d)

other income (loss) (excluding depreciation and amortization

expense on real estate and related intangibles, non-core income

allocated to equity method investments and other non-core

components of other income (loss)), (e) general and administrative

expenses (excluding transaction expenses and non-recurring items)

and (f) income taxes (excluding the income tax effect of non-core

income (loss) items), and core earnings (excluding PAA), which is

defined as core earnings excluding the premium amortization

adjustment representing the cumulative impact on prior periods, but

not the current period, of quarter-over-quarter changes in

estimated long-term prepayment speeds related to the Company’s

Agency mortgage-backed securities, are used by the Company's

management and, the Company believes, used by analysts and

investors to measure its progress in achieving this objective.

The Company seeks to fulfill this objective through a variety of

factors including portfolio construction, the degree of market risk

exposure and related hedge profile, and the use and forms of

leverage, all while operating within the parameters of the

Company's capital allocation policy and risk governance

framework.

The Company believes these non-GAAP measures provide management

and investors with additional details regarding the Company’s

underlying operating results and investment portfolio trends by (i)

making adjustments to account for the disparate reporting of

changes in fair value where certain instruments are reflected in

GAAP net income (loss) while others are reflected in other

comprehensive income (loss), and (ii) by excluding certain

unrealized, non-cash or episodic components of GAAP net income

(loss) in order to provide additional transparency into the

operating performance of the Company’s portfolio. Annualized core

return on average equity (excluding PAA), which is calculated by

dividing core earnings (excluding PAA) over average stockholders’

equity, provides investors with additional detail on the core

earnings generated by the Company’s invested equity capital.

The following table presents a reconciliation of GAAP financial

results to non-GAAP core earnings for the periods presented:

For the quarters ended

September 30, 2018

June 30,2018

September 30, 2017

(dollars in thousands, except per share data) GAAP net

income (loss) $ 385,429 $ 595,887 $ 367,315 Net

income (loss) attributable to noncontrolling interests (149 )

(32 ) (232 ) Net income (loss) attributable to Annaly

385,578 595,919 367,547

Adjustments to exclude reported realized

and unrealized (gains) losses: Realized (gains) losses on

termination or maturity of interest rate swaps (575 ) — —

Unrealized (gains) losses on interest rate swaps (417,203 )

(343,475 ) (56,854 ) Net (gains) losses on disposal of investments

324,294 66,117 11,552 Net (gains) losses on other derivatives

(94,827 ) (34,189 ) (154,208 ) Net unrealized (gains) losses on

instruments measured at fair value through earnings 39,944 48,376

67,492

Adjustments to exclude components of other (income)

loss: Depreciation and amortization expense related to

commercial real estate 9,278 — — Non-core (income) loss allocated

to equity method investments (1) (2,358 ) — — Non-core other

(income) loss (2) 44,525 — —

Adjustments to exclude components

of general and administrative expenses and income taxes:

Transaction expenses and non-recurring items (3) 60,081 — — Income

tax effect of non-core income (loss) items 886 — —

Adjustments

to add back components of realized and unrealized (gains)

losses: TBA dollar roll income and CMBX coupon income (4)

56,570 62,491 94,326 MSR amortization (5) (19,913 ) (19,942

) (16,208 ) Core earnings * 386,280 375,297 313,647

Less: Premium amortization adjustment cost (benefit) 3,386

7,516 39,899 Core earnings

(excluding PAA) * $ 389,666 $ 382,813 $

353,546 GAAP net income

(loss) per average common share $ 0.29 $ 0.49

$ 0.31 Core earnings per average common share * $

0.29 $ 0.30 $ 0.26 Core earnings

(excluding PAA) per average common share * $ 0.30 $

0.30 $ 0.30 Annualized GAAP return (loss) on

average equity 10.73 % 17.20 % 10.98 % Annualized

core return on average equity (excluding PAA) * 10.85 %

11.05 % 10.57 % * Represents a non-GAAP

financial measure. (1) Beginning with the quarter ended September

30, 2018, the Company excludes non-core (income) loss allocated to

equity method investments, which represents the unrealized (gains)

losses allocated to equity interests in a portfolio of MSR, which

is a component of Other income (loss). (2) Represents the amount of

consideration paid for the acquisition of MTGE Investment Corp. in

excess of the fair value of net assets acquired. This amount is

primarily attributable to a decline in portfolio valuation between

the pricing and closing dates of the transaction and is consistent

with changes in market values observed for similar instruments over

the same period. (3) Represents costs incurred in connection with

the MTGE transaction and costs incurred in connection with a

securitization of residential whole loans. (4) TBA dollar roll

income and CMBX coupon income each represent a component of Net

gains (losses) on other derivatives. CMBX coupon income totaled

$1.2 million for the quarter ended September 30, 2018. There were

no adjustments for CMBX coupon income prior to September 30, 2018.

(5) MSR amortization represents the portion of changes in fair

value that is attributable to the realization of estimated cash

flows on the Company’s MSR portfolio and is reported as a component

of Net unrealized gains (losses) on instruments measured at fair

value.

From time to time, the Company enters into TBA forward contracts

as an alternate means of investing in and financing Agency

mortgage-backed securities. A TBA contract is an agreement to

purchase or sell, for future delivery, an Agency mortgage-backed

security with a specified issuer, term and coupon. A TBA dollar

roll represents a transaction where TBA contracts with the same

terms but different settlement dates are simultaneously bought and

sold. The TBA contract settling in the later month typically prices

at a discount to the earlier month contract with the difference in

price commonly referred to as the “drop”. The drop is a reflection

of the expected net interest income from an investment in similar

Agency mortgage-backed securities, net of an implied financing

cost, that would be foregone as a result of settling the contract

in the later month rather than in the earlier month. The drop

between the current settlement month price and the forward

settlement month price occurs because in the TBA dollar roll

market, the party providing the financing is the party that would

retain all principal and interest payments accrued during the

financing period. Accordingly, TBA dollar roll income generally

represents the economic equivalent of the net interest income

earned on the underlying Agency mortgage-backed security less an

implied financing cost.

TBA dollar roll transactions are accounted for under GAAP as a

series of derivatives transactions. The fair value of TBA

derivatives is based on methods similar to those used to value

Agency mortgage-backed securities. The Company records TBA

derivatives at fair value on its Consolidated Statements of

Financial Condition and recognizes periodic changes in fair value

as Net gains (losses) on other derivatives in the Consolidated

Statements of Comprehensive Income (Loss), which includes both

unrealized and realized gains and losses on derivatives (excluding

interest rate swaps).

TBA dollar roll income is calculated as the difference in price

between two TBA contracts with the same terms but different

settlement dates multiplied by the notional amount of the TBA

contract. Although accounted for as derivatives, TBA dollar rolls

capture the economic equivalent of net interest income, or carry,

on the underlying Agency mortgage-backed security (interest income

less an implied cost of financing). TBA dollar roll income is

reported as a component of Net gains (losses) on other derivatives

in the Consolidated Statements of Comprehensive Income (Loss).

The CMBX index is a synthetic tradable index referencing a

basket of 25 commercial mortgage-backed securities ("CMBS") of a

particular rating and vintage. The CMBX index allows investors to

take a long exposure (referred to as selling protection) or short

exposure (referred to as buying protection) on the respective

basket of CMBS securities and is structured as a “pay-as-you-go”

contract whereby the protection buyer pays to the protection seller

a standardized running coupon on the contracted notional amount.

The Company reports income (expense) on CMBX positions in Net gains

(losses) on other derivatives in the Consolidated Statements of

Comprehensive Income (Loss). The coupon payments received or paid

on CMBX positions are equivalent to interest income (expense) and

therefore included in core earnings.

Premium Amortization Expense ("PAA")

In accordance with GAAP, the Company amortizes or accretes

premiums or discounts into interest income for its Agency

mortgage-backed securities, excluding interest-only securities,

multifamily and reverse mortgages, taking into account estimates of

future principal prepayments in the calculation of the effective

yield. The Company recalculates the effective yield as differences

between anticipated and actual prepayments occur. Using third-party

model and market information to project future cash flows and

expected remaining lives of securities, the effective interest rate

determined for each security is applied as if it had been in place

from the date of the security’s acquisition. The amortized cost of

the security is then adjusted to the amount that would have existed

had the new effective yield been applied since the acquisition

date. The adjustment to amortized cost is offset with a charge or

credit to interest income. Changes in interest rates and other

market factors will impact prepayment speed projections and the

amount of premium amortization recognized in any given period.

The Company’s GAAP metrics include the unadjusted impact of

amortization and accretion associated with this method. Certain of

the Company’s non-GAAP metrics exclude the effect of the PAA, which

quantifies the component of premium amortization representing the

cumulative impact on prior periods, but not the current period, of

quarter-over-quarter changes in estimated long-term CPR.

The following table illustrates the impact of the PAA on premium

amortization expense for the Company’s Residential Securities

portfolio for the quarters ended September 30, 2018,

June 30, 2018, and September 30, 2017:

For the quarters ended

September 30, 2018

June 30,2018

September 30, 2017

(dollars in thousands) Premium amortization expense

(accretion) $ 187,537 $ 202,426 $

220,636 Less: PAA cost (benefit) 3,386 7,516

39,899 Premium amortization expense (excluding

PAA) $ 184,151 $ 194,910

$ 180,737

For the quarters ended

September 30, 2018

June 30,2018

September 30, 2017

(per average common share) Premium amortization expense

(accretion) $ 0.16 $ 0.17 $ 0.21 Less: PAA cost (benefit) (1) 0.01

— 0.04 Premium

amortization expense (excluding PAA) $ 0.15 $

0.17 $ 0.17 (1) The Company

separately calculates core earnings per average common share and

core earnings (excluding PAA) per average common share, with the

difference between these two per share amounts attributed to the

PAA cost (benefit) per average common share. As such, the reported

value of the PAA cost (benefit) per average common share may not

reflect the result of dividing the PAA cost (benefit) by the

weighted average number of common shares outstanding due to

rounding.

Interest income (excluding PAA), economic interest expense

and economic net interest income (excluding PAA)

Interest income (excluding PAA) represents interest income

excluding the effect of the PAA, and serves as the basis for

deriving average yield on interest earning assets (excluding PAA),

net interest spread (excluding PAA) and net interest margin

(excluding PAA), which are discussed below. The Company believes

this measure provides management and investors with additional

detail to enhance their understanding of the Company’s operating

results and trends by excluding the component of premium

amortization expense representing the cumulative impact on prior

periods, but not the current period, of quarter-over-quarter

changes in estimated long-term prepayment speeds related to the

Company’s Agency mortgage-backed securities (other than

interest-only securities), which can obscure underlying trends in

the performance of the portfolio.

Economic interest expense includes GAAP interest expense and the

net interest component of interest rate swaps. Prior to the quarter

ended March 31, 2018, economic interest expense included the net

interest component of interest rate swaps used to hedge cost of

funds. Beginning with the quarter ended March 31, 2018, as a result

of changes to the Company’s hedging portfolio, this metric reflects

the net interest component of all interest rate swaps. The Company

uses interest rate swaps to manage its exposure to changing

interest rates on its repurchase agreements by economically hedging

cash flows associated with these borrowings. Accordingly, adding

the net interest component of interest rate swaps to interest

expense, as computed in accordance with GAAP, reflects the total

contractual interest expense and thus, provides investors with

additional information about the cost of the Company's financing

strategy.

Similarly, economic net interest income (excluding PAA), as

computed below, provides investors with additional information to

enhance their understanding of the net economics of our primary

business operations.

For the quarters ended

September 30, 2018

June 30,2018 September

30, 2017 (dollars in thousands)

Interest Income

(Excluding PAA) Reconciliation

GAAP interest income $ 816,596 $

776,806 $ 622,550 Premium amortization adjustment 3,386

7,516 39,899 Interest income

(excluding PAA) * $ 819,982 $ 784,322

$ 662,449

Economic Interest

Expense Reconciliation

GAAP interest expense $ 500,973 $ 442,692 $ 268,937 Add: Net

interest component of interest rate swaps (51,349 )

(31,475 ) 78,564 Economic interest expense * $

449,624 $ 411,217 $

347,501

Economic Net

Interest Income (Excluding PAA) Reconciliation

Interest income (excluding PAA) * $ 819,982 $ 784,322 $ 662,449

Less: Economic interest expense * 449,624

411,217 347,501 Economic net interest income

(excluding PAA) * $ 370,358 $ 373,105

$ 314,948

* Represents a non-GAAP financial

measure.

Average yield on interest earning assets (excluding PAA), net

interest spread (excluding PAA) and net interest margin (excluding

PAA)

Net interest spread (excluding PAA), which is the difference

between the average yield on interest earning assets (excluding

PAA) and the average cost of interest bearing liabilities, and net

interest margin (excluding PAA), which is calculated as the sum of

interest income (excluding PAA) plus TBA dollar roll income and

CMBX coupon income less interest expense and the net interest

component of interest rate swaps divided by the sum of average

interest earning assets plus average TBA contract and CMBX

balances, provide management with additional measures of the

Company’s profitability that management relies upon in monitoring

the performance of the business.

Disclosure of these measures, which are presented below,

provides investors with additional detail regarding how management

evaluates the Company’s performance.

For the quarters ended September

30, 2018 June 30,2018

September 30, 2017

Economic Metrics

(Excluding PAA)

(dollars in thousands) Average interest earning assets $

101,704,957 $ 102,193,435 $ 89,253,094

Interest income (excluding PAA) * $ 819,982 $ 784,322 $ 662,449

Average yield on interest earning assets (excluding PAA) * 3.22 %

3.07 % 2.97 % Average interest bearing liabilities $

86,638,082 $ 87,103,807 $ 76,382,315 Economic interest expense * $

449,624 $ 411,217 $ 347,501 Average cost of interest bearing

liabilities 2.08 % 1.89 % 1.82 %

Economic net interest income (excluding PAA) * $ 370,358 $ 373,105

$ 314,948 Net interest spread (excluding PAA) * 1.14 %

1.18 % 1.15 % Interest income

(excluding PAA) * $ 819,982 $ 784,322 $ 662,449 TBA dollar roll

income and CMBX coupon income 56,570 62,491 94,326 Interest expense

(500,973 ) (442,692 ) (268,937 ) Net interest component of interest

rate swaps 51,349 31,475

(88,211 )

Subtotal $ 426,928 $ 435,596

$ 399,627 Average interest earnings

assets $ 101,704,957 $ 102,193,435 $ 89,253,094 Average TBA

contract and CMBX balances 12,216,863

9,407,819 19,291,834

Subtotal $

113,921,820 $ 111,601,254

$ 108,544,928 Net interest margin (excluding PAA) * 1.50 %

1.56 % 1.47 %

* Represents a non-GAAP financial

measure.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181031005793/en/

Annaly Capital Management, Inc.Investor

Relations1-888-8Annalywww.annaly.com

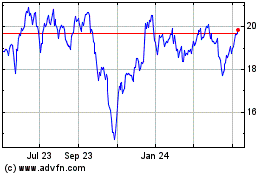

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

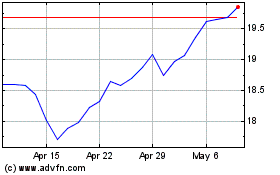

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Apr 2023 to Apr 2024