Current Report Filing (8-k)

September 23 2022 - 5:07PM

Edgar (US Regulatory)

ANNALY CAPITAL MANAGEMENT INC 6.95% Series F Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock 6.50% Series G Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock 6.75% Series I Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock false 0001043219 --12-31 0001043219 2022-09-23 2022-09-23 0001043219 us-gaap:CommonStockMember 2022-09-23 2022-09-23 0001043219 nly:A6.95SeriesFFixedtoFloatingRateCumulativeRedeemablePreferredStockMember 2022-09-23 2022-09-23 0001043219 nly:A6.50SeriesGFixedtoFloatingRateCumulativeRedeemablePreferredStockMember 2022-09-23 2022-09-23 0001043219 nly:A6.75SeriesIFixedtoFloatingRateCumulativeRedeemablePreferredStockMember 2022-09-23 2022-09-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): September 23, 2022

Annaly Capital Management, Inc.

(Exact name of registrant as specified in its charter)

Commission file number 001-13447

|

|

|

| Maryland |

|

22-3479661 |

| (State of incorporation) |

|

(I.R.S. Employer Identification No.) |

|

| 1211 Avenue of the Americas New York, New York 10036 (Address of principal executive offices) |

(212) 696-0100

Registrant’s telephone number, including area code

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of Each Class |

|

Trading Symbol |

|

Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 per share |

|

NLY |

|

New York Stock Exchange |

| 6.95% Series F Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock |

|

NLY.F |

|

New York Stock Exchange |

| 6.50% Series G Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock |

|

NLY.G |

|

New York Stock Exchange |

| 6.75% Series I Fixed-to-Floating Rate Cumulative Redeemable Preferred Stock |

|

NLY.I |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.03 |

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

After the close of business on September 23, 2022, Annaly Capital Management, Inc. (the “Company”) effected the previously announced 1-for-4 reverse stock split (the “Reverse Stock Split”) of its outstanding shares of common stock, par value $0.01 per share (the “Common Stock”). On September 22, 2022, the Company filed with the State Department of Assessments and Taxation of Maryland two Articles of Amendment (the “Amendments”) to its charter that: (i) provided for a 1-for-4 reverse stock split of the issued and outstanding shares of Common Stock, effective at 5:00 p.m. Eastern Time on September 23, 2022; and (ii) provided for the par value of the Common Stock to be changed from $0.04 per share (as a result of the Reverse Stock Split) back to $0.01 per share, effective at 5:01 p.m. Eastern Time on September 23, 2022. Fractional shares resulting from the Reverse Stock Split will be paid in cash based on the closing price of the Common Stock on the New York Stock Exchange (“NYSE”) on September 23, 2022, after taking into account the Reverse Stock Split. The Reverse Stock Split affected all record holders of Common Stock uniformly and did not affect any record holder’s percentage ownership interest, except for de minimis changes as a result of the elimination of fractional shares. The Reverse Stock Split did not affect the number of the Company’s authorized shares of Common Stock.

The Common Stock will begin trading on a split-adjusted basis on the NYSE at the opening of trading on September 26, 2022. The Common Stock continues to trade on the NYSE under the symbol “NLY” with a new CUSIP number: 035710839.

The foregoing description of the Amendments does not purport to be complete and is subject to and qualified in its entirety by reference to the Amendments, which are filed as Exhibit 3.1 and Exhibit 3.2 to this Current Report on Form 8-K and are incorporated herein by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

ANNALY CAPITAL MANAGEMENT, INC. (REGISTRANT) |

| Date: September 23, 2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By: |

|

/s/ Anthony C. Green |

|

|

|

|

Name: |

|

Anthony C. Green |

|

|

|

|

Title: |

|

Chief Corporate Officer & Chief Legal Officer |

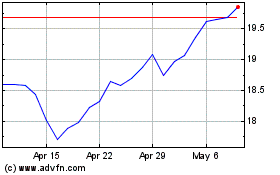

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Mar 2024 to Apr 2024

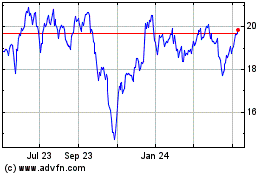

Annaly Capital Management (NYSE:NLY)

Historical Stock Chart

From Apr 2023 to Apr 2024