AB InBev Names Michel Doukeris as Next CEO -- Update

May 06 2021 - 2:35AM

Dow Jones News

--AB InBev said CEO Carlos Brito will step down after 15 years

in the role

--The Budweiser brewer swung to a first-quarter profit as sales

beat expectations

--The company said beer volumes in the period exceeded

pre-pandemic levels

By Adria Calatayud

Anheuser-Busch InBev SA said Thursday that Chief Executive

Officer Carlos Brito will step down from his role and that Michel

Doukeris will succeed him, as it reported a return to first-quarter

net profit on sales that beat expectations.

The world's largest brewer--with brands such as Budweiser,

Stella Artois and Corona--said revenue returned to pre-pandemic

levels in the first quarter, with beer volumes exceeding those of

the comparable periods of 2019 and 2020 on the back of a strong

performance of its premium portfolio.

"Our business is off to a very strong start in 2021," Mr. Brito

said.

The company said its CEO succession will be effective July 1.

Mr. Doukeris has headed the group's North American operations since

January 2018, having joined the company in 1996. He has held

several commercial operations roles in Latin America, led its

operations in China and Asia Pacific for seven years and moved to

the U.S. in 2016.

Mr. Brito will step down after 15 years as CEO and 32 years with

the company, overseeing the integration of U.S. brewer

Anheuser-Busch with the Belgian-Brazilian conglomerate InBev and,

more recently, the 2016 takeover of rival SABMiller.

AB InBev said sales grew 17% in the first quarter on an organic

basis, while total organic volume growth was 13%. Organic volumes

jumped 63% in Asia Pacific and rose by 12% in South America and by

2.9% in North America. They fell 2.1% in Europe, the Middle East

and Africa, the company said.

Analysts had expected AB InBev to report first-quarter organic

growth in sales and volumes of 8.7% and 7.3%, respectively,

according to consensus estimates compiled by the company.

AB InBev made a profit for the quarter of $595 million compared

with a loss of $2.25 billion a year earlier, it said.

Revenue was $12.29 billion compared with $11.00 billion, the

company said.

AB InBev said it expects normalized earnings before interest,

taxes, depreciation and amortization to grow between 8% and 12%

this year, and revenue to grow ahead of Ebitda from a combination

of volume and price. The company had previously said it expected

its top and bottom-line results in 2021 to improve meaningfully

compared with 2020.

AB InBev said it delivered top- and bottom-line growth in the

U.S., as it continues to refocus on faster-growing core segments.

The company said Michelob Ultra and its craft brands grew strongly

in the first quarter in the U.S.

In China, the company's revenue grew more than 90%, surpassing

pre-pandemic levels, and earnings were also higher than in the

comparable periods of 2019 and 2020, the company said.

However, AB InBev's European business continues to be hurt by

significant Covid-19 restrictions on bars and restaurants, and the

company was also hit by a government-mandated one-month ban on

alcohol sales in South Africa, it said.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

May 06, 2021 02:20 ET (06:20 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

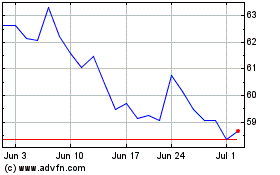

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Mar 2024 to Apr 2024

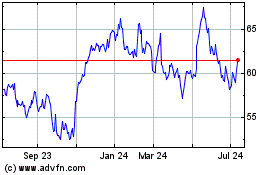

Anheuser Busch Inbev SA NV (NYSE:BUD)

Historical Stock Chart

From Apr 2023 to Apr 2024