Angel Oak Mortgage REIT, Inc. Completes $317 Million Standalone Securitization, Driving Margin Expansion and Setting the Stage for Continued Growth

October 16 2024 - 4:15PM

Business Wire

Company demonstrates quick, accretive

deployment of capital, covering cost of July senior unsecured notes

issuance within one quarter and establishing runway for continued

growth.

Angel Oak Mortgage REIT, Inc. (NYSE: AOMR), (the

“Company,” “we,” and “our”), a leading real estate finance company

focused on acquiring and investing in first-lien non-QM loans and

other mortgage-related assets in the U.S. mortgage market, today

announced the closing of AOMT 2024-10, an approximately $317

million scheduled principal balance securitization backed by a pool

of residential mortgage loans. The senior tranche received an AAA

rating from Fitch Ratings.

“The execution of AOMT 2024-10 serves as a testament to the AOMR

business model and our affiliated origination, purchase, and

securitization platforms provided through the Angel Oak ecosystem.

As we indicated in our second quarter earnings discussions, the

loans contributed to this deal were largely purchased with the

proceeds from our July senior unsecured notes issuance,

demonstrating our ability to quickly deploy capital into accretive

investments. With this deal, we have covered the cost of capital

from the July senior notes offering and have set the stage for

compounded growth in the fourth quarter and beyond,” said Sreeni

Prabhu, Chief Executive Officer and President of Angel Oak Mortgage

REIT, Inc. “We plan to quickly recycle the capital released from

AOMT 2024-10 into newly originated, high-quality non-QM loans and

drive compounded balance sheet growth, net interest margin

accretion, and strong future securitization execution.”

Key Highlights and Updates

- AOMT 2024-10 includes a portfolio of 661 non-QM loans with a

scheduled principal balance of $316.8 million with a weighted

average loan coupon of 7.79%, a weighted average original

loan-to-value ratio of 70.3%, a weighted average original FICO

score of 754. The A1 through B1 tranches, as well as a portion of

the B2 tranche, were sold. The Company will retain the economics of

the unsold tranches.

- The deal lowers the weighted average funding cost for the loans

underlying the securitization by over 110 basis points, which is

incremental to the 50 basis points of warehouse funding cost relief

from the Federal Reserve Bank’s September rate cut.

- With this securitization, the Company reduces its whole loan

warehouse debt by $260 million, reducing its total recourse debt to

equity ratio in kind.

Forward Looking Statements This press release contains

certain forward-looking statements that are subject to various

risks and uncertainties, including, without limitation, statements

relating to the performance of the Company’s investments.

Forward-looking statements are generally identifiable by use of

forward-looking terminology such as “may,” “will,” “should,”

“potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,”

“estimate,” “believe,” “could,” “project,” “predict,” “continue,”

or by the negative of these words and phrases or other similar

words or expressions. Forward-looking statements are based on

certain assumptions, discuss future expectations, describe existing

or future plans and strategies, contain projections of results of

operations, liquidity and/or financial condition, or state other

forward-looking information. The Company’s ability to predict

future events or conditions, their impact or the actual effect of

existing or future plans or strategies is inherently uncertain.

Although the Company believes that such forward-looking statements

are based on reasonable assumptions, actual results and performance

in the future could differ materially from those set forth in or

implied by such forward-looking statements. You are cautioned not

to place undue reliance on these forward‐looking statements, which

reflect the Company’s views only as of the date of this press

release. Additional information concerning factors that could cause

actual results and performance to differ materially from these

forward-looking statements is contained from time to time in the

Company’s filings with the Securities and Exchange Commission.

Except as required by applicable law, neither the Company nor any

other person assumes responsibility for the accuracy and

completeness of the forward‐looking statements. The Company does

not undertake any obligation to update any forward-looking

statements contained in this press release as a result of new

information, future events or otherwise.

About Angel Oak Mortgage REIT, Inc. Angel Oak Mortgage

REIT, Inc. is a real estate finance company focused on acquiring

and investing in first lien non-QM loans and other mortgage-related

assets in the U.S. mortgage market. The Company’s objective is to

generate attractive risk-adjusted returns for its stockholders

through cash distributions and capital appreciation across interest

rate and credit cycles. The Company is externally managed and

advised by an affiliate of Angel Oak Capital Advisors, LLC, which,

collectively with its affiliates, is a leading alternative credit

manager with market leadership in mortgage credit that includes

asset management, lending, and capital markets. Additional

information about the Company is available at

www.angeloakreit.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241016198133/en/

Investors: investorrelations@angeloakreit.com

855-502-3920

IR Agency Contact: Nick Teves or Joseph Caminiti Alpha IR

Group AOMR@alpha-ir.com 312-445-2870

Company Contact: KC Kelleher, Angel Oak Mortgage REIT,

Inc. Head of Corporate Finance & Investor Relations

404-528-2684 kc.kelleher@angeloakcapital.com

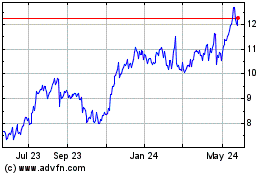

Angel Oak Mortgage REIT (NYSE:AOMR)

Historical Stock Chart

From Oct 2024 to Nov 2024

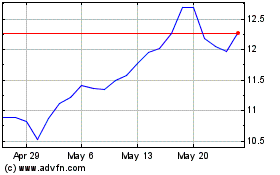

Angel Oak Mortgage REIT (NYSE:AOMR)

Historical Stock Chart

From Nov 2023 to Nov 2024