Prospectus Filed Pursuant to Rule 424(b)(7) (424b7)

May 31 2022 - 4:12PM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(7)

Registration No. 333-260157

PROSPECTUS SUPPLEMENT NO. 2

(TO PROSPECTUS DATED OCTOBER 8, 2021)

4,959,856 SHARES OF CLASS A COMMON STOCK OFFERED

BY THE SELLING STOCKHOLDERS

This prospectus supplement registers an additional

4,959,856 shares of the Company’s Class A common stock for offer and sale, from time to time, in one or more offerings, by the selling

stockholders named in the prospectus dated October 8, 2021 (the “prospectus”), included in American Well Corporation’s

Registration Statement on Form S-3, if and to the extent as they may determine in methods described in the “Plan of Distribution”

section of the prospectus. This prospectus supplement should be read in conjunction with the prospectus and is not complete without, and

may not be used or delivered except in connection with, the prospectus.

On May 11, 2022, the Company, SilverCloud Health

Holdings, Inc. and Fortis Advisors LLC entered into Amendment No. 1 to the Agreement and Plan of Merger, dated July 28, 2021, by and among

the Company, SilverCloud Health Holdings Inc., and Fortis Advisors LLC (the “Original Acquisition Agreement”) to provide for,

among other things, the issuance to former shareholders of SilverCloud Health Holdings, Inc. an aggregate of 4,959,856 shares of the Company’s

Class A common stock in lieu of the Company’s obligation to make the Earn-Out Payment as set forth in the Original Acquisition Agreement.

The Company is filing this prospectus supplement to register for resale an aggregate of 4,959,856 additional shares of Class A common

stock by the selling stockholders.

Applicable percentage ownership after this offering

gives effect to the sale of all shares of Class A common stock registered by the prospectus and this prospectus supplement.

| Name of Selling Stockholder |

Number of Shares of Class A Common Stock Offered |

After the Offering |

| Class A |

Class B |

Class C |

% of Voting Power(1) |

| Shares |

% |

Shares |

% |

Shares |

% |

| ACT V Co-investment Limited Partnership (2) |

6,285 |

— |

— |

— |

— |

— |

— |

— |

| ACT V Venture Capital Fund LP (3) |

412,699 |

— |

— |

— |

— |

— |

— |

— |

| AIB Seed Capital Fund Limited Partnership (4) |

118,894 |

— |

— |

— |

— |

— |

— |

— |

| AIB Start Up Accelerator Fund LP (5) |

54,019 |

— |

— |

— |

— |

— |

— |

— |

| AVIA Equity, LLC (6) |

23,410 |

— |

— |

— |

— |

— |

— |

— |

| B Capital Fund, L.P. (7) |

974,280 |

— |

— |

— |

— |

— |

— |

— |

| Ben Dromey |

1,180 |

— |

— |

— |

— |

— |

— |

— |

| Brian Murray |

2,949 |

— |

— |

— |

— |

— |

— |

— |

| David Kidd |

8,846 |

— |

— |

— |

— |

— |

— |

— |

| David O’Callaghan |

2,949 |

— |

— |

— |

— |

— |

— |

— |

| David Sockel |

12,713 |

— |

— |

— |

— |

— |

— |

— |

| Derek Angove |

1,180 |

— |

— |

— |

— |

— |

— |

— |

| Derek Richards |

89,431 |

— |

— |

— |

— |

— |

— |

— |

| Dessie Keegan |

2,949 |

— |

— |

— |

— |

— |

— |

— |

| Enterprise Ireland (8) |

163,356 |

— |

— |

— |

— |

— |

— |

— |

| Gavin Doherty |

55,540 |

— |

— |

— |

— |

— |

— |

— |

| Inception Health Investments, LLC (9) |

41,937 |

— |

— |

— |

— |

— |

— |

— |

| UnityPointHealth System (d/b/a Iowa Health System) (10) |

251,626 |

— |

— |

— |

— |

— |

— |

— |

| James Bligh |

214,836 |

— |

— |

— |

— |

— |

— |

— |

| James Powell |

4,422 |

— |

— |

— |

— |

— |

— |

— |

| John Sharry |

55,540 |

— |

— |

— |

— |

— |

— |

— |

| Karen Tierney |

207,327 |

— |

— |

— |

— |

— |

— |

— |

| Ken Cahill |

431,954 |

— |

— |

— |

— |

— |

— |

— |

| Kevin Higgins |

76,864 |

— |

— |

— |

— |

— |

— |

— |

| Kevin Winters |

978 |

— |

— |

— |

— |

— |

— |

— |

| Landingzone Limited (11) |

30,510 |

— |

— |

— |

— |

— |

— |

— |

| Landingzone Limited (12) |

184,914 |

— |

— |

— |

— |

— |

— |

— |

| Landingzone Limited (13) |

8,246 |

— |

— |

— |

— |

— |

— |

— |

| Leon Nangle |

1,769 |

— |

— |

— |

— |

— |

— |

— |

| Lloyd Humphreys |

5,898 |

— |

— |

— |

— |

— |

— |

— |

| LRVHealth, LP (14) |

272,595 |

— |

— |

— |

— |

— |

— |

— |

| Maryann Hanratty |

2,949 |

— |

— |

— |

— |

— |

— |

— |

| MemorialCare Innovation Fund, L.P. (15) |

335,501 |

— |

— |

— |

— |

— |

— |

— |

| Mohammed Shabbir |

1,180 |

— |

— |

— |

— |

— |

— |

— |

| Michelle McGill |

11,711 |

— |

— |

— |

— |

— |

— |

— |

| Michele Wilson |

1,956 |

— |

— |

— |

— |

— |

— |

— |

| Noemi Vigano |

2,949 |

— |

— |

— |

— |

— |

— |

— |

| Olga Kudrautseva |

1,180 |

— |

— |

— |

— |

— |

— |

— |

| OSF Healthcare System (16) |

167,751 |

— |

— |

— |

— |

— |

— |

— |

| Outcomes Collective Silver Cloud, LP (17) |

146,782 |

— |

— |

— |

— |

— |

— |

— |

| Patrick Flynn |

12,713 |

— |

— |

— |

— |

— |

— |

— |

| Regina Dolan |

1,064 |

— |

— |

— |

— |

— |

— |

— |

| Rosemary Byrne |

2,949 |

— |

— |

— |

— |

— |

— |

— |

| Skydeck Holdings II LLC (18) |

41,937 |

— |

— |

— |

— |

— |

— |

— |

| Stephen McNeil |

1,942 |

— |

— |

— |

— |

— |

— |

— |

| SVB Financial Group (19) |

10,443 |

— |

— |

— |

— |

— |

— |

— |

| The Harcourt Venture Fund Limited Partnership (20) |

496,753 |

— |

— |

— |

— |

— |

— |

— |

| * | Denotes less than 1% of beneficial ownership. |

| (1) | Percentage of total voting power represents voting power with respect to all shares of Class A common stock, Class B common stock

and Class C common stock, as a single class. The holders of Class B common stock will at all times be entitled to 51% of our voting power,

and holders of Class A common stock and Class C common stock are entitled to one vote per share (except that holders of Class C common

stock do not vote on director elections). For more information about the voting rights of our common stock, see “Description of

Capital Stock—Common Stock” in the prospectus. |

| (2) | ACT 2000 Limited is the General Partner of the selling stockholder and has voting and investment control over the securities held

by the selling stockholder. John O'Sullivan is Director of ACT 2000 Limited. The business address of the selling stockholder, ACT 2000

Limited and John O'Sullivan is 6 Richview Office Park, Clonskeagh, D14 A4V6, Ireland. |

| (3) | ACT V GP Limited is the General Partner of the selling stockholder and has voting and investment control over the securities held

by the selling stockholder. John O'Sullivan is Director of ACT V GP Limited. The business address of the selling stockholder, ACT V GP

Limited and John O'Sullivan is 6 Richview Office Park, Clonskeagh, D14 A4V6, Ireland. |

| (4) | Dublin Seed Capital General Partner Limited is General Partner of the selling stockholder and has voting and investment control over

the securities held by the selling stockholder. The business address of the selling stockholder is 5 Rosslyn Court, Bray, Co. Wicklow,

A98 DN27, Ireland. |

| (5) | ACT 2011 GP Limited is the General Partner of the selling stockholder and has voting and investment control over the securities held

by the selling stockholder. John O'Sullivan is Director of ACT 2011 GP Limited. The business address of the selling stockholder, ACT 2011

GP Limited and John O'Sullivan is 6 Richview Office Park, Clonskeagh, D14 A4V6, Ireland. |

| (6) | The business address of the selling stockholder is 515 N. State St., Suite 300, Chicago, IL 60654. |

| (7) | B Capital Group Partners, L.P. is the General Partner of the selling stockholder and has voting and investment control over the securities

held by the selling stockholder. B Capital Group Investors, Ltd. is the General Partner of B Capital Group Partners, L.P. and has voting

and investment control over the securities held by the selling stockholder. The business address of the selling stockholder, B Capital

Group Partners, L.P. and B Capital Group Investors, Ltd. is PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands. |

| (8) | The business address of the selling stockholder is Eastpoint Business Park, Enterprise Ireland, Block P4A/B/C East Point Plaza, Alfie

Byrne Rd., Dublin 3, D03 E5R6, Ireland. |

| (9) | Michael Anderes is President of the selling stockholder and has voting and investment control over securities held by the selling

stockholder. The business address of the selling stockholder and Michael Anderes is W129 N7055 Northfield Dr., Menomonee Falls, WI 53051. |

| (10) | The business address of the selling stockholder is 1776 West Lakes Pkwy., West Des Moines, IA 50266. |

| (11) | The selling stockholder holds the securities in trust for The Provost Fellows, Foundation Scholars, and other members of the Board,

of the College of the Holy and Undivided Trinity of Queen Elizabeth Near Dublin, which has voting and investment control over the securities

held by the selling stockholder. The business address of the selling stockholder is Dogpatch Labs, The CHQ Building, Custom House Quay,

Dublin 1, D01 Y6H7, Ireland. |

| (12) | The selling stockholder holds the securities in trust for the Minister for the Environment, Climate and Communications, which has

voting and investment control over the securities held by the selling stockholder. The business address of the selling stockholder is

Dogpatch Labs, The CHQ Building, Custom House Quay, Dublin 1, D01 Y6H7, Ireland. |

| (13) | The selling stockholder holds the securities in trust for Parent Plus Limited, which has voting and investment control over the securities

held by the selling stockholder. The business address of the selling stockholder is Dogpatch Labs, The CHQ Building, Custom House Quay,

Dublin 1, D01 Y6H7, Ireland. |

| (14) | LRVHealth Partners, LLC, the General Partner of the selling stockholder and has voting and investment control over the securities

held by the selling stockholder. LRVHealth Partners, LLC is managed by three members and a majority vote is required for investment decisions.

The business address of the selling stockholder and LRVHealth Partners, LLC is 33 Arch St., Suite 1700, Boston, MA 02110. |

| (15) | The business address of the selling stockholder is 100 Oceangate, Suite P-275, Long Beach, CA 90802. |

| (16) | Robert C. Sehring is Chief Executive Officer and Sister Diane Marie McGrew, O.S.F., is President of the selling stockholder and have

voting and investment control over the securities held by the selling stockholder and disclaim beneficial ownership over the securities

held by the selling stockholder. The address of the selling stockholder is 1306 N. Berkeley Ave., Peoria, IL 61603. |

| (17) | The business address of the selling stockholder is 5910 Courtyard Dr., Suite 210, Austin, TX 78731. |

| (18) | The business address of the selling stockholder is 1 S. Wacker Dr., Suite 1810, Chicago, IL 60606. |

| (19) | The business address of the selling stockholder is 80 E. Rio Salado Pwky, Suite 101, Tempe, AZ 85281. |

| (20) | Investec Ventures Ireland Limited is the General Partner and Manager of the selling stockholder and has voting and investment control

over the securities held by the selling stockholder. The business address of the selling stockholder and Investec Ventures Ireland Limited

is The Harcourt Building, Harcourt Street, Dublin 2, D02 F721, Ireland. |

Investing in our securities involves certain risks.

See the “Risk Factors” section beginning on page 2 of the prospectus and in our Securities and Exchange Commission filings

that are incorporated by reference therein.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved these securities, or determined if this prospectus supplement is truthful

or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement

is May 31, 2022.

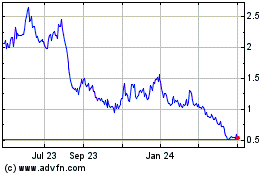

American Well (NYSE:AMWL)

Historical Stock Chart

From Mar 2024 to Apr 2024

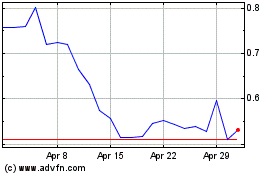

American Well (NYSE:AMWL)

Historical Stock Chart

From Apr 2023 to Apr 2024