Announces 2021 Guidance, Long-term Growth

Targets, and Capital Investment Plans

- Strong 2020 results of $3.91 per share, an increase of 14%

over 2019 results of $3.43 per share

- 2021 diluted earnings per share guidance range of $4.18 to

$4.28

- Five-year EPS compound annual growth rate (CAGR) of 7 to

10%

- Increasing regulated investment over the next 10

years

- Continued ESG priorities with new environmental

goals

American Water Works Company, Inc. (NYSE: AWK), the largest

publicly traded U.S. water and wastewater utility company, today

reported 2020 results of $3.91 per share, compared to $3.43 per

share in 2019. The Company today also announced 2021 diluted

earnings per share guidance, long-term EPS growth targets, and

capital investment plans.

“Highlights of our achievements in 2020, an unprecedented year,

include approximately $1.9 billion in capital investment, continued

cost management, success in growth with 23 completed regulated

acquisitions, the addition of our 17th military installation

contract, and the execution of enhanced COVID-19 safety protocols,”

said Walter Lynch, president and CEO of American Water.

“We will continue to build on that momentum in 2021, providing

essential services across our footprint, investing much needed

capital of just under $2 billion for infrastructure replacement,

resiliency, and strategic growth where we create the most value for

all of our stakeholders and an unrelenting commitment to safety and

operational excellence,” added Lynch. “Our 2021 earnings guidance

and long-term targets are based on the continued execution of our

strategic goals from the outstanding dedication and performance of

our employees.”

2021 Investor Day

American Water will host a virtual 2021 Investor Day on February

25, 2021, at 9:00 a.m. Eastern Standard Time. The event will

feature presentations by Walter Lynch, president and chief

executive officer; Susan Hardwick, executive vice president and

chief financial officer; and other company leaders. The company

will outline its vision and strategy for the future and discuss

strategic activities to drive value creation. The company will also

discuss an increased capital investment program to provide reliable

and sustainable water and wastewater services and its ongoing

effort to enhance customer experience.

Interested parties may access the video webcast through a link

on the Company’s Investor Relations website at ir.amwater.com.

Presentation slides that will be used in conjunction with the event

will also be made available online. The Company recognizes its

website as a key channel of distribution to reach public investors

and as a means of disclosing material non-public information to

comply with its obligations under SEC Regulation FD.

Following the event, an archive of the webcast will be available

for one year on American Water’s investor relations website at

ir.amwater.com/events.

The company’s earnings guidance, capital spending, dividend

growth, rate base growth and O&M efficiency forecasts are

subject to numerous risks and uncertainties, including, without

limitation, those described under “Forward-Looking Statements”

below and under “Risk Factors” in its annual and quarterly reports

filed with the Securities and Exchange Commission (SEC).

2021 Earnings Guidance and Long-Term Outlook

- 2021 earnings guidance range of $4.18 to $4.28 per

share

- Long-term EPS growth expectation of 7-10% for

2021-2025

- 2021-2025 investment plan of $10.3-$10.5 billion and

expected $22-$25 billion for the 10-year period of

2021-2030

- 2021-2025 rate base growth expectation of 7-8%

- 2021-2025 dividend growth expectation at the high end of

7-10%

- 2021-2025 plan includes $700 million of public equity

issuances to support growth

- 2025 O&M efficiency target of 30.4%

Consolidated Results

For the three months ended December 31, 2020, earnings were

$0.80 per share, compared to $0.54 per share in the same period of

2019, an increase of $0.26 per share. Results for the Regulated

Business increased $0.01 per share and results from the

Market-Based Business increased $0.22 per share. Parent Company

results improved $0.03 per share in the fourth quarter of 2020 as

compared to the same period in 2019. Consolidated results reflect a

$0.02 per share benefit from depreciation not recorded as required

by assets held for sale accounting in 2020 and the loss of $0.19

per share on the disposal of Keystone Clearwater Solutions in the

fourth quarter of 2019.

For the twelve months ended December 31, 2020, earnings were

$3.91 per share, compared to $3.43 per share in the same period of

2019, an increase of $0.48 per share. Results from the Regulated

Business increased $0.33 per share, while the Market-Based

Businesses’ results improved $0.24 per share compared to 2019.

Parent Company results were $0.09 per share lower in 2020 as

compared to 2019, due primarily to higher interest expense.

Regulated results are higher from the impact of increased revenues

from new rates in effect as well as earnings from acquisitions,

offset somewhat by higher operation and maintenance costs and

depreciation resulting from growth in the business. Regulated

results also reflect an estimated $0.10 per share favorable impact

year-over-year due to warmer and drier than normal weather across

several of the Company’s subsidiaries in 2020 and unusually wet

weather conditions in 2019. And finally, regulated results reflect

a $0.06 per share benefit from depreciation not recorded as

required by assets held for sale accounting in 2020. Market-Based

Business results improved compared to 2019 from the addition of

installations for the Military Services Group and new partnerships

and price increases in the Homeowner Services Group. As compared to

2019, improved results in 2020 reflect the $0.19 per share loss on

the disposal of Keystone Clearwater Solutions in the fourth quarter

of 2019. Market-Based Business and consolidated results also

include an estimated $0.02 per share unfavorable impact from the

COVID-19 pandemic, primarily in the Homeowner Services Group.

In 2020, the Company made capital investments of $1.9 billion,

including $1.8 billion dedicated primarily to infrastructure

improvements in the Regulated Businesses and $135 million for

regulated acquisitions.

Regulated Businesses

The Regulated Businesses’ net income was $154 million and $715

million in 2020, compared to $152 million and $654 million in 2019

for the fourth quarter and year to date period, respectively. The

increases are primarily due to additional authorized revenues from

infrastructure investments, acquisitions and organic growth, offset

somewhat by higher O&M expenses and depreciation to support

regulated acquisitions and other growth.

For the quarter, Regulated Businesses revenue increased

approximately $16 million from additional authorized revenues from

infrastructure investments, acquisitions and organic growth,

partially offset by a decrease in other operating revenues due to

the impacts of the Tax Cuts and Jobs Act. O&M expenses were

higher by $19 million to support regulated acquisitions and other

growth, while depreciation increased $10 million, mainly related to

infrastructure investment growth.

For the year, Regulated Businesses revenue increased

approximately $161 million from additional authorized revenues from

infrastructure investments, acquisitions and organic growth and an

estimated $23 million from warmer than normal weather in 2020 and

unusually wet weather conditions during 2019, partially offset by a

decrease in other operating revenues due to the impacts of the Tax

Cuts and Jobs Act. O&M expenses were higher by $76 million to

support growth in the Regulated Businesses and depreciation

increased by $33 million, mainly related to infrastructure

investment growth.

The Company expects additional annualized revenues of

approximately $56 million from general rate cases, including step

increases, and approximately $95 million from infrastructure

surcharges that have been completed. The Company is in various

stages of general rate cases in four jurisdictions and filed for

infrastructure surcharges in two jurisdictions, for a total

annualized revenue request of approximately $208 million.

For the year 2020, the Company’s adjusted regulated O&M

efficiency ratio (a non-GAAP financial measure) was 34.3%, compared

to 34.5% for 2019.

Market-Based Businesses

In the fourth quarter of 2020, net income in the Market-Based

Businesses was $23 million, compared to a net loss of $18 million

for the same period in 2019. 2019 results include a loss of $35

million on the disposal of Keystone Clearwater Solutions.

Net income in the Market-Based Businesses in 2020 was $91

million, compared to $46 million for the same period in 2019.

Military Services Group benefited from the addition of two

installations (Joint Base San Antonio and U.S. Military Academy at

West Point, New York), which were awarded in the third quarter of

2019. The Company became fully operational on these installations

as of June 1, 2020. In addition, results from the Homeowner

Services Group were higher on new partnerships and price increases

in 2020. Partially offsetting these increases were estimated

impacts from the COVID-19 pandemic on the Homeowner Services Group

from increased claims that likely have resulted from more work from

home activity. Lastly, 2019 results include the previously

mentioned $35 million loss on the disposal of Keystone Clearwater

Solutions.

Dividends

On December 10, 2020, the Company's board of directors declared

a quarterly cash dividend payment of $0.55 per share of common

stock payable on March 2, 2021, to all shareholders of record as of

February 8, 2021.

Non-GAAP Financial Measures

This press release includes a presentation of adjusted Regulated

O&M efficiency ratio, which excludes from its calculation

estimated purchased water and other revenues and purchased water

expenses, the impact of certain activities related to the Freedom

Industries chemical spill, and the allocable portion of non-O&M

support services costs, mainly depreciation and general taxes. This

item constitutes a “non-GAAP financial measure” under SEC rules.

The items discussed above were excluded from the calculation as

they are not reflective of management's ability to increase the

efficiency of the Regulated Businesses.

This item is derived from American Water’s consolidated

financial information but is not presented in its financial

statements prepared in accordance with GAAP. This non-GAAP

financial measure supplements and should be read in conjunction

with the Company’s GAAP disclosures and should be considered as an

addition to, and not a substitute for, any GAAP measure. Management

believes that this non-GAAP financial measure is useful to the

Company’s investors because it directly measures improvement in the

operating performance and efficiency of the Regulated Businesses.

The Company’s adjusted Regulated O&M efficiency ratio is not

based on a standard, objective industry definition or method of

calculation and may not be comparable to other companies’ operating

measures, and thus it may have significant limitations on its

use.

Set forth in this release is a table that reconciles each of the

components used to calculate adjusted Regulated O&M efficiency

ratio to the most directly comparable GAAP financial measure.

Management is unable to present a reconciliation of adjustments

to the components of the forward-looking Regulated O&M

efficiency ratio without unreasonable effort because management

cannot reliably predict the nature, amount or probable significance

of all of the adjustments for future periods; however, these

adjustments may, individually or in the aggregate, cause the

non-GAAP financial measure component of the forward-looking ratio

to differ significantly from the most directly comparable GAAP

financial measure.

About American Water

With a history dating back to 1886, American Water is the

largest and most geographically diverse U.S. publicly-traded water

and wastewater utility company. The Company employs approximately

7,000 dedicated professionals who provide regulated and

market-based drinking water, wastewater and other related services

to over 15 million people in 46 states. More information can be

found by visiting amwater.com and follow American Water on Twitter,

Facebook and LinkedIn.

Cautionary Statement Concerning Forward-Looking

Statements

Certain statements in this press release including, without

limitation, 2021 earnings guidance, future capital spending

amounts, rate base and dividend growth projections, the impacts to

the Company of the COVID-19 pandemic, and estimated revenues from

rate cases and other government agency authorizations, are

forward-looking statements within the meaning of the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995

and the Federal securities laws. In some cases, these

forward-looking statements can be identified by words with

prospective meanings such as “intend,” “plan,” “estimate,”

“believe,” “anticipate,” “expect,” “predict,” “project,” “propose,”

“assume,” “forecast,” “outlook,” “future,” “pending,” “goal,”

“objective,” “potential,” “continue,” “seek to,” “may,” “can,”

“will,” “should” and “could” and/or the negative of such terms or

other variations or similar expressions. These forward-looking

statements are predictions based on American Water's current

expectations and assumptions regarding future events. They are not

guarantees or assurances of any outcomes, financial results of

levels of activity, performance or achievements, and readers are

cautioned not to place undue reliance upon them. The

forward-looking statements are subject to a number of estimates and

assumptions, and known and unknown risks, uncertainties and other

factors. Actual results may differ materially from those discussed

in the forward-looking statements included in this press release as

a result of the factors discussed in the Company’s Annual Report on

Form 10-K for the year ended December 31, 2020, and subsequent

filings with the SEC, and because of factors such as: the decisions

of governmental and regulatory bodies, including decisions to raise

or lower rates and regulatory responses to COVID-19; the timeliness

and outcome of regulatory commissions’ and other authorities’

actions concerning rates, capital structure, authorized return on

equity, capital investment, system acquisitions and dispositions,

taxes, permitting, water supply and management, and other

decisions; changes in customer demand for, and patterns of use of,

water, such as may result from conservation efforts, impacts of the

COVID-19 pandemic, or otherwise; a loss of one or more large

industrial or commercial customers due to adverse economic

conditions, the COVID-19 pandemic, or other factors; limitations on

the availability of the Company’s water supplies or sources of

water, or restrictions on its use thereof, resulting from

allocation rights, governmental or regulatory requirements and

restrictions, drought, overuse or other factors; changes in laws,

governmental regulations and policies, including with respect to

environmental, health and safety, consumer and data privacy, water

quality and water quality accountability, contaminants of emerging

concern, public utility and tax regulations and policies, and

impacts resulting from U.S., state and local elections and changes

in federal, state and local executive administrations; weather

conditions and events, climate variability patterns, and natural

disasters, including drought or abnormally high rainfall, prolonged

and abnormal ice or freezing conditions, strong winds, coastal and

intercoastal flooding, pandemics (including COVID-19) and

epidemics, earthquakes, landslides, hurricanes, tornadoes,

wildfires, electrical storms, sinkholes and solar flares; the

outcome of litigation and similar governmental and regulatory

proceedings, investigations or actions; the risks associated with

the Company’s aging infrastructure, and its ability to

appropriately maintain and replace current infrastructure and

systems, including its technology and other assets, and manage the

expansion of its businesses; exposure or infiltration of the

Company’s technology and critical infrastructure systems, including

the disclosure of sensitive, personal or confidential information

contained therein, through physical or cyber attacks or other

means; the Company’s ability to obtain permits and other approvals

for projects and construction of various water and wastewater

facilities; changes in the Company’s capital requirements; the

Company’s ability to control operating expenses and to achieve

operating efficiencies; the intentional or unintentional acts of a

third party, including contamination of the Company’s water

supplies or water provided to its customers; the Company’s ability

to obtain adequate and cost-effective supplies of equipment

(including personal protective equipment), chemicals, electricity,

fuel, water and other raw materials; the Company’s ability to

successfully meet growth projections for the Regulated Businesses

and the Market-Based Businesses, either individually or in the

aggregate, and capitalize on growth opportunities, including, among

other things, with respect to acquiring, closing and successfully

integrating regulated operations and market-based businesses,

entering into contracts and other agreements with, or otherwise

obtaining, new customers or partnerships in the Market-Based

Businesses, and realizing anticipated benefits and synergies from

new acquisitions; risks and uncertainties associated with

contracting with the U.S. government, including ongoing compliance

with applicable government procurement and security regulations;

cost overruns relating to improvements in or the expansion of the

Company’s operations; the Company’s ability to successfully develop

and implement new technologies and to protect related intellectual

property; the Company’s ability to maintain safe work sites; the

Company’s exposure to liabilities related to environmental laws and

similar matters resulting from, among other things, water and

wastewater service provided to customers; changes in general

economic, political, business and financial market conditions,

including without limitation conditions and collateral consequences

associated with the current pandemic health event resulting from

COVID-19; access to sufficient debt and/or equity capital on

satisfactory terms and when and as needed to support operations and

capital expenditures; fluctuations in interest rates; ability to

comply with affirmative or negative covenants in current or future

indebtedness of the Company or any of its subsidiaries, or the

issuance of new or modified credit ratings or outlooks by credit

rating agencies with respect to the Company or any of its

subsidiaries, or on any of their current or future indebtedness,

which could increase financing costs or funding requirements or

affect the Company's or its subsidiaries' ability to issue, repay

or redeem debt, pay dividends or make distributions; fluctuations

in the value of benefit plan assets and liabilities that could

increase the Company’s cost and funding requirements; changes in

federal or state general, income and other tax laws, including

future significant tax legislation, further rules, regulations,

interpretations and guidance by the U.S. Department of the Treasury

and state or local taxing authorities related to the enactment of

the Tax Cuts and Jobs Act, the availability of, or the Company's

compliance with, the terms of applicable tax credits and tax

abatement programs, and the Company’s ability to utilize its U.S.

federal and state income tax net operating loss carryforwards;

migration of customers into or out of the Company’s service

territories; the use by municipalities of the power of eminent

domain or other authority to condemn the systems of one or more of

the Company’s utility subsidiaries, or the assertion by private

landowners of similar rights against such utility subsidiaries; any

difficulty or inability to obtain insurance for the Company, its

inability to obtain insurance at acceptable rates and on acceptable

terms and conditions, or its inability to obtain reimbursement

under existing or future insurance programs and coverages for any

losses sustained; the incurrence of impairment charges related to

the Company’s goodwill or other assets; labor actions, including

work stoppages and strikes; the Company’s ability to retain and

attract qualified employees; civil disturbances or unrest, or

terrorist threats or acts, or public apprehension about future

disturbances, unrest, or terrorist threats or acts; and the impact

of new, and changes to existing, accounting standards.

These forward-looking statements are qualified by, and should be

read together with, the risks and uncertainties set forth above and

the risk factors included in American Water's annual, quarterly and

other SEC filings, and readers should refer to such risks,

uncertainties and risk factors in evaluating such forward-looking

statements. Any forward-looking statements speak only as of the

date of this press release. American Water does not have or

undertake any obligation or intention to update or revise any

forward-looking statement, whether as a result of new information,

future events, changed circumstances or otherwise, except as

otherwise required by the federal securities laws. Furthermore, it

may not be possible to assess the impact of any such factor on the

Company’s businesses, either viewed independently or together, or

the extent to which any factor, or combination of factors, may

cause results to differ materially from those contained in any

forward-looking statement. The foregoing factors should not be

construed as exhaustive.

AWK-IR

American Water Works Company, Inc. and

Subsidiary Companies

Consolidated Statements of

Operations

(In millions, except per share data)

For the Three Months Ended

December 31,

For the Years Ended December

31,

2020

2019

2020

2019

(Unaudited)

Operating revenues

$

923

$

902

$

3,777

$

3,610

Operating expenses:

Operation and maintenance

429

412

1,622

1,544

Depreciation and amortization

153

152

604

582

General taxes

78

71

303

280

Loss on asset dispositions and

purchases

—

43

—

34

Impairment charge.

—

—

—

—

Total operating expenses, net

660

678

2,529

2,440

Operating income

263

224

1,248

1,170

Other income (expense):

Interest, net

(99

)

(98

)

(395

)

(382

)

Non-operating benefit costs, net

12

4

49

16

Other, net

5

6

22

29

Total other income (expense)

(82

)

(88

)

(324

)

(337

)

Income before income taxes

181

136

924

833

Provision for income taxes

36

38

215

212

Net income attributable to common

shareholders

$

145

$

98

$

709

$

621

Basic earnings per share: (a)

Net income attributable to common

shareholders

$

0.80

$

0.54

$

3.91

$

3.44

Diluted earnings per share: (a)

Net income attributable to common

shareholders

$

0.80

$

0.54

$

3.91

$

3.43

Weighted-average common shares

outstanding:

Basic

181

181

181

181

Diluted

181

181

182

181

(a)

Amounts may not calculate due to

rounding.

American Water Works Company, Inc. and

Subsidiary Companies

Consolidated Balance Sheets

(In millions, except share and per share

data)

December 31, 2020

December 31, 2019

ASSETS

Property, plant and equipment

$

25,614

$

23,941

Accumulated depreciation

(5,904

)

(5,709

)

Property, plant and equipment, net

19,710

18,232

Current assets:

Cash and cash equivalents

547

60

Restricted funds

29

31

Accounts receivable, net of allowance for

uncollectible accounts of $60 and $41, respectively

321

294

Unbilled revenues

206

172

Materials and supplies

47

44

Assets held for sale

629

566

Other

127

118

Total current assets

1,906

1,285

Regulatory and other long-term assets:

Regulatory assets

1,127

1,128

Operating lease right-of-use assets

95

103

Goodwill

1,504

1,501

Postretirement benefit assets

173

159

Intangible assets

55

67

Other

196

207

Total regulatory and other long-term

assets

3,150

3,165

Total assets

$

24,766

$

22,682

American Water Works Company, Inc. and

Subsidiary Companies

Consolidated Balance Sheets

(In millions, except share and per share

data)

December 31, 2020

December 31, 2019

CAPITALIZATION AND LIABILITIES

Capitalization:

Common stock ($0.01 par value; 500,000,000

shares authorized; 186,466,707 and 185,903,727 shares issued,

respectively)

$

2

$

2

Paid-in-capital

6,747

6,700

Retained earnings (accumulated

deficit)

102

(207

)

Accumulated other comprehensive loss

(49

)

(36

)

Treasury stock, at cost (5,168,215 and

5,090,855 shares, respectively)

(348

)

(338

)

Total common shareholders' equity

6,454

6,121

Long-term debt

9,329

8,639

Redeemable preferred stock at redemption

value

4

5

Total long-term debt

9,333

8,644

Total capitalization

15,787

14,765

Current liabilities:

Short-term debt

1,282

786

Current portion of long-term debt

329

28

Accounts payable

189

203

Accrued liabilities

591

596

Accrued taxes

50

46

Accrued interest

88

84

Liabilities related to assets held for

sale

137

128

Other

215

174

Total current liabilities

2,881

2,045

Regulatory and other long-term

liabilities:

Advances for construction

270

240

Deferred income taxes and investment tax

credits

2,113

1,893

Regulatory liabilities

1,770

1,806

Operating lease liabilities

81

89

Accrued pension expense

388

411

Other

83

78

Total regulatory and other long-term

liabilities

4,705

4,517

Contributions in aid of construction

1,393

1,355

Commitments and contingencies

Total capitalization and liabilities

$

24,766

$

22,682

American Water Works Company, Inc. and

Subsidiary Companies

Adjusted Regulated Operation and

Maintenance Efficiency Ratio (A Non-GAAP, unaudited

measure)

(Dollars in millions)

2020

2019

2018

Total operation and maintenance

expenses

$

1,622

$

1,544

$

1,479

Less:

Operation and maintenance

expenses—Market-Based Businesses

389

393

362

Operation and maintenance

expenses—Other

(25

)

(31

)

(42

)

Total operation and maintenance

expenses—Regulated Businesses

1,258

1,182

1,159

Less:

Regulated purchased water expenses

149

135

133

Allocation of non-operation and

maintenance expenses

41

31

31

Impact of Freedom Industries settlement

activities (a)

—

(4

)

(20

)

Adjusted operation and maintenance

expenses—Regulated Businesses (i)

$

1,068

$

1,020

$

1,015

Total operating revenues

$

3,777

$

3,610

$

3,440

Less:

Operating revenues—Market-Based

Businesses

540

539

476

Operating revenues—Other

(18

)

(23

)

(20

)

Total operating revenues—Regulated

Businesses

3,255

3,094

2,984

Less:

Regulated purchased water revenues (b)

149

135

133

Other revenue

(7

)

—

—

Adjusted operating revenues—Regulated

Businesses (ii)

$

3,113

$

2,959

$

2,851

Adjusted O&M efficiency

ratio—Regulated Businesses (i) / (ii)

34.3

%

34.5

%

35.6

%

(a)

Includes the impact of a settlement in

2018 with one of the Company’s general liability insurance

carriers, and a reduction in the first quarter of 2019 of a

liability, each related to the Freedom Industries chemical spill in

West Virginia.

(b)

The calculation assumes regulated

purchased water revenues approximate regulated purchased water

expenses.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210224006102/en/

Edward Vallejo Vice President, Investor Relations 856-955-4445

edward.vallejo@amwater.com

Maureen Duffy Senior Vice President, Communications and External

Affairs 856-955-4163 maureen.duffy@amwater.com

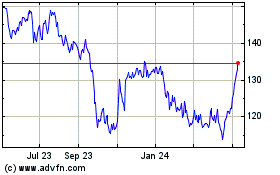

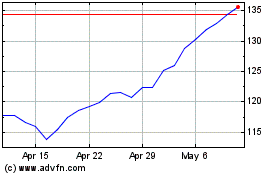

American Water Works (NYSE:AWK)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Water Works (NYSE:AWK)

Historical Stock Chart

From Apr 2023 to Apr 2024