AIG's CFO Is Latest Pick Under New Chief -- WSJ

December 05 2018 - 3:02AM

Dow Jones News

By Tatyana Shumsky and Leslie Scism

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 5, 2018).

American International Group Inc. on Tuesday named Mark Lyons

chief financial officer, the latest executive appointment under new

Chief Executive Brian Duperreault.

Mr. Lyons, who served as a senior vice president and chief

actuary for general insurance since joining AIG in June, succeeds

Sid Sankaran effective immediately.

Mr. Sankaran had been AIG's CFO since 2016. He will remain with

the company as an adviser through the year-end reporting process

for the 2018 fiscal year.

A representative from AIG declined to comment beyond the

announcement, which didn't specify what prompted the move.

The departure isn't unexpected to some industry observers, who

had thought it likely that Mr. Duperreault, who became CEO in May

2017, at some point would focus his attention on the finance

department. The move follows a wave of hiring that has installed

new leadership throughout the core unit that sells

property-casualty policies to businesses, and indicates the finance

department is now in line for an updating aimed at overhauling the

delivery of financial data.

Meyer Shields, an analyst with Keefe, Bruyette & Woods, said

he expects AIG's shares to trade up on Thursday, when the New York

Stock Exchange reopens. He said investors appropriately "hold Mr.

Lyons in high esteem following his very successful tenure" as CFO

at Arch Capital Group Ltd.

"We think that both his skill set and reputation will enhance

confidence in AIG's turnaround prospects," Mr. Shields said in a

note.

Mr. Lyon's appointment serves as Mr. Duperreault putting his

person in the top finance role, and he is likely to slide into the

role easily, said Elyse Greenspan, an analyst at Wells Fargo

Securities LLC.

Ms. Greenspan said in a note that she doesn't believe the change

portends a potentially large charge to bolster reserves. In his

capacity as actuary, Mr. Lyons spoke about AIG's reserves on its

last earnings call. "Mr. Lyons has already stated that while AIG

still needs to review 25% of the reserves, he sees 'no material red

flags' on these reserves," analyst Thomas Gallagher of Evercore ISI

said in a note.

AIG reported a $1.26 billion net loss in its third quarter, on

the back of insurance claims related to Asian typhoons, California

mudslides and Hurricane Florence in the southeastern U.S. Still,

this was a narrower loss than in the same period of 2017, when the

company posted a $1.74 billion loss after three hurricanes in a row

slammed the Caribbean and the southern U.S.

AIG's results have lagged behind many of its rivals ever since

the global financial crisis of 2008, when the New York-based

company received one of the biggest federal bailouts. AIG fully

repaid the nearly $185 billion by the end of 2012, cutting itself

roughly in half through sales of businesses and individual

assets.

Write to Tatyana Shumsky at tatyana.shumsky@wsj.com and Leslie

Scism at leslie.scism@wsj.com

(END) Dow Jones Newswires

December 05, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

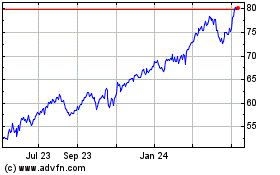

American (NYSE:AIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

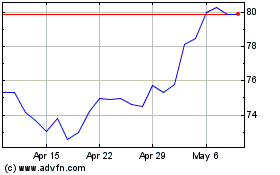

American (NYSE:AIG)

Historical Stock Chart

From Apr 2023 to Apr 2024