American Express Down 2%; Bank of America Cuts to Underperform

September 23 2020 - 11:18AM

Dow Jones News

By Michael Dabaie

American Express Co. shares fell 2% to $96.32 in morning

trading.

Bank of America Global Research downgraded American Express to

Underperform from Neutral and lowered its price objective to $95

from $106.

Bank of America noted that it has been impressed by management's

execution and the company's resilience during Covid-19, but said it

is concerned about near-to-medium term billing volumes,

particularly airline and lodging spend.

"Travel spend could take some time to fully recover based on the

results of BofA's Proprietary Global Travel Survey and industry

commentary. AXP is over-indexed to travel and we think prolonged

travel spend weakness will weaken sentiment for the shares," Bank

of America said in the analyst note.

BofA sector analysts estimate it could be 2024 before spending

volumes on airlines and lodging are at 2019 levels, and a full

recovery is dependent on a vaccine being available and widely

administered, the analyst note said.

"This is consistent with results from our proprietary Global

Travel Survey...which suggests over a third of consumers are

waiting for a vaccine to be available before travelling

internationally and a significant portion are concerned about

getting on an airplane or staying in a hotel. As such, we think

travel could be an overhang for AXP billings growth over the

near-to-medium term," Bank of America said.

Write to Michael Dabaie at michael.dabaie@wsj.com

(END) Dow Jones Newswires

September 23, 2020 11:03 ET (15:03 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

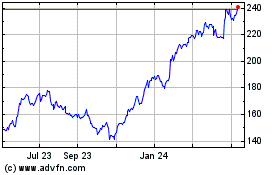

American Express (NYSE:AXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

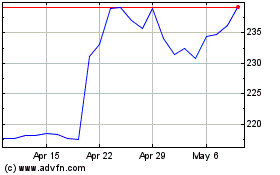

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2023 to Apr 2024