U.S. Banks, Card Companies Catch a Break in China Trade Deal

January 15 2020 - 7:09PM

Dow Jones News

By David Benoit and AnnaMaria Andriotis

A trade deal with China has given U.S. banks and financial

companies new hope that their decades-long attempts to crack the

Chinese market may bear fruit.

The deal signed Wednesday clears some of the obstacles that have

prevented U.S. banks, credit-card networks, insurance companies and

distressed-debt investors from operating in China.

U.S. financial institutions have long talked up the prospect of

China, where earning even a small share of the massive market could

result in sizable gains. But they have struggled to navigate the

bureaucratic thicket to obtain the licenses they need to operate

there.

JPMorgan Chase & Co., the largest U.S. bank by assets, is

waiting on the Chinese government to grant it some of the licenses

it needs to build up its investment banking and wealth-management

divisions in China. Visa Inc. and Mastercard Inc., too, need the

government's stamp of approval to get their cards more widely

accepted in China.

While short on details, the deal broadly requires China to take

action on those applications. In some cases, it sets parameters on

what the Chinese government can consider in making licensing

decisions.

Visa and Mastercard, in particular, stand to gain. Their

applications to operate in the country have languished. The deal

requires China to make a decision on those applications and to

provide a reason if it rejects them.

Mastercard is making "every effort to secure the requisite

license to be able to operate in China domestically," a company

spokesman said. "This deal is a step forward in the process."

"We see significant potential for Visa to support the continued

growth and evolution of digital payments in China," said a

spokesman for Visa.

The deal also gives U.S. distressed-debt investors more access

to the Chinese market, allowing them to buy troubled loans from

China's state-owned banks. That is a business well known to several

of Mr. Trump's top advisers on China, including Commerce Secretary

Wilbur Ross, who made his fortune investing in troubled

companies.

Still, U.S. financial companies face a number of challenges to

gaining meaningful market share in China.

China's state-owned banks dwarf U.S. banks in size, and many

Chinese consumers pay for goods and services using mobile wallets

such as WeChat Pay and Alipay that don't rely on traditional card

technology. UnionPay, China's domestic card network, has about 95%

of the market for card payments in the country, according to the

payments-industry publication Nilson Report.

Even if China grants licenses, more hurdles await. In 2018,

American Express Co. became the first U.S. card network to gain

approval to set up card-clearing services in China. Its joint

venture with a Chinese financial-technology firm is awaiting

approval for a business operating license. The People's Bank of

China has advised AmEx that it has formally received its

application, viewed by AmEx as an important step in the process.

The trade deal doesn't impact that.

China already has been taking steps to open up to foreign banks

in an effort to expand and reform its own markets. The government,

for example, has allowed foreign banks to take control of joint

ventures with domestic partners.

"They want JPMorgan to be there to help set transparency and

standards and rules," JPMorgan Chief Executive James Dimon told Fox

Business in an interview this week. "And the Chinese need, they

want to, eliminate corruption, have efficient companies and capital

allocation, and they need very good financial markets."

At a press conference announcing the deal Wednesday, President

Trump told JPMorgan executives in attendance to say hello to Mr.

Dimon for him.

Write to David Benoit at david.benoit@wsj.com and AnnaMaria

Andriotis at annamaria.andriotis@wsj.com

(END) Dow Jones Newswires

January 15, 2020 18:54 ET (23:54 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

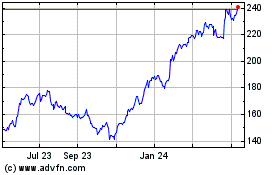

American Express (NYSE:AXP)

Historical Stock Chart

From Mar 2024 to Apr 2024

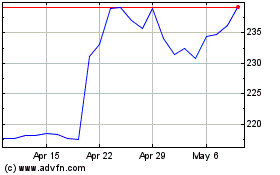

American Express (NYSE:AXP)

Historical Stock Chart

From Apr 2023 to Apr 2024