Current Report Filing (8-k)

February 17 2022 - 5:06PM

Edgar (US Regulatory)

0001039828false00010398282022-02-152022-02-150001039828us-gaap:CommonStockMember2022-02-152022-02-150001039828us-gaap:SeriesAPreferredStockMember2022-02-152022-02-150001039828us-gaap:SeriesBPreferredStockMember2022-02-152022-02-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 15, 2022

AMERICAN EQUITY INVESTMENT LIFE HOLDING COMPANY

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Iowa | 001-31911 | 42-1447959 |

(State or other jurisdiction

of incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

6000 Westown Parkway

West Des Moines, IA 50266

(Address of principal executive offices and zip code)

(515) 221-0002

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $1 | | AEL | | New York Stock Exchange |

| Depositary Shares, each representing a 1/1,000th interest in a share of 5.95% Fixed-Rate Reset Non-Cumulative Preferred Stock, Series A | | AELPRA | | New York Stock Exchange |

| Depositary Shares, each representing a 1/1,000th interest in a share of 6.625% Fixed-Rate Reset Non-Cumulative Preferred Stock, Series B | | AELPRB | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On February 17, 2022, the registrant issued a press release announcing its financial results for the fourth quarter and year ended December 31, 2021, a copy of which is attached as Exhibit 99.1 and is incorporated herein by reference. The registrant's financial supplement for the fourth quarter and year ended December 31, 2021, is attached as Exhibit 99.2 and is incorporated herein by reference.

The information, including exhibits attached hereto, furnished under this Item 2.02 shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, except as otherwise expressly stated in such filing.

Item 7.01 Regulation FD Disclosure

On February 17, 2022, American Equity Investment Holding Company issued a supplemental slide presentation, a copy of which is attached hereto as Exhibit 99.3 and is incorporated herein by reference. The slides highlight information about American Equity Investment Holding Company’s business results. These slides are furnished and not filed pursuant to instruction B.2 of Form 8-K.

The Company regularly evaluates its capital structure and potential financing transactions, including facilities that provide for contingent capital. Any such transaction may be material.

Item 1.01 Entry Into a Material Definitive Agreement

On February 15, 2022, American Equity Investment Life Holding Company (the “Company”) established a new five-year credit agreement for $300 million in unsecured delayed draw term loan commitments (the “Agreement”). The Agreement is part of the Company’s plans for access to liquidity for general corporate purposes as it continues to implement its strategic transformation to an at-scale origination, spread- and capital light fee-based business, and to manage capital to grow as well as produce returns for shareholders.

Under the Agreement, the Company may draw up to three loans until six months after it closes. Loans will bear a spread-adjusted term Secured Overnight Financing Rate (“SOFR”) plus a margin ranging from 0.250% to 1.000% for base rate borrowings and 1.250% to 2.000% for SOFR borrowings, based on the Company’s S&P credit rating for senior unsecured long-term debt securities without third-party credit enhancement. The spread adjustment will range from 0.10% to 0.25% based on the interest period applicable to the loans.

The Company agreed to two financial covenants: (1) a quarter-end debt to capital ratio not to exceed 0.35 to 1.00, and (2) a quarter-end net worth of at least 70% of its net worth as of December 31, 2021, plus one-half of the Company’s subsequent quarterly operating income excluding notable items and one-half of any net cash proceeds from all subsequent equity issuances. However, the Company's equity issuances and repurchases in connection with phase two of the Brookfield Asset Management Reinsurance Partners Ltd.'s investment in the Company are excluded from the calculation of the net worth covenant. The Agreement also includes customary representations and warranties, affirmative and negative covenants, and events of default.

This description of the Agreement among the Company, certain lenders (the “Lenders”), and Citizens Bank, N.A., as administrative agent, is qualified by reference to the full text of the agreement, which is attached as Exhibit 10.1, and which is incorporated herein by reference.

The Lenders and/or their affiliates have from time to time provided, and may in the future provide, various financial advisory, commercial banking, investment banking and other services to the Company and its affiliates, for which they received or may receive customary compensation and expense reimbursement.

The forward-looking statements above, such as plans, may, and will, are based on assumptions and expectations that involve risks and uncertainties, including the "Risk Factors" the Company describes in its U.S. Securities and Exchange Commission filings. The Company's future results could differ, and it has no obligation to correct or update any of these statements.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The information set forth above in “Item 1.01 Entry Into a Material Definitive Agreement” of this Current Report is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

| | | | | | | | |

Exhibit Number | | Description |

| 10.1 | | |

| 99.1 | | |

| 99.2 | | |

| 99.3 | | |

| 104 | | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: February 17, 2022

| | | | | | | | | | | |

| | AMERICAN EQUITY | |

| | INVESTMENT LIFE HOLDING COMPANY | |

| | | | |

| | | | |

| By: | /s/ Axel Andre | |

| | Axel Andre | |

| | Chief Financial Officer and Executive Vice President | |

| | | | |

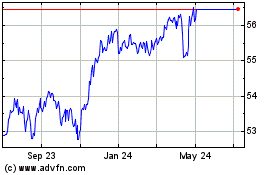

American Equity Investme... (NYSE:AEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

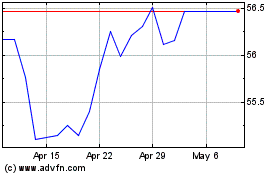

American Equity Investme... (NYSE:AEL)

Historical Stock Chart

From Apr 2023 to Apr 2024