Aflac Global Investments to Buy Stake in Varagon Capital

January 08 2020 - 6:44AM

Dow Jones News

By Chris Wack

Aflac Global Investments, the asset management subsidiary of

Aflac Inc. (AFL), said Wednesday it is buying a significant

non-controlling minority interest in direct lending asset manager

Varagon Capital Partners L.P.

Aflac Global Investments also said it is making a multiyear

commitment to build a portfolio of up to $3 billion of middle

market loans on behalf of Aflac Japan and Aflac U.S.

Aflac said the transaction doesn't have a material impact on its

2020 capital deployment plans or overall capital and liquidity

position and is expected to close in the first quarter of 2020.

Varagon Capital said it is extending its existing strategic

partnership with American International Group (AIG).

Aflac will acquire the interests in Varagon currently held by

certain former and current partners and affiliates of Oak Hill

Capital Management. The transaction won't reduce ownership of

Varagon by management or AIG, and upon closing, Aflac and AIG will

hold equal ownership stakes.

Varagon said it will continue to operate as an independent

company with no changes to its strategy, investment philosophy,

management team, or day-to-day operations.

Write to Chris Wack at chris.wack@wsj.com

(END) Dow Jones Newswires

January 08, 2020 06:29 ET (11:29 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

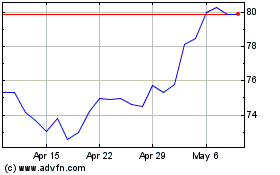

American (NYSE:AIG)

Historical Stock Chart

From Mar 2024 to Apr 2024

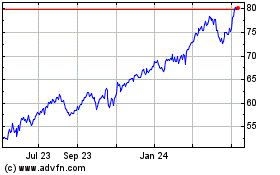

American (NYSE:AIG)

Historical Stock Chart

From Apr 2023 to Apr 2024