UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

Filed by the Registrant x

|

|

|

|

Filed by a Party other than the Registrant o

|

|

|

|

Check the appropriate box:

|

|

o

|

Preliminary Proxy Statement

|

|

o

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

o

|

Definitive Proxy Statement

|

|

x

|

Definitive Additional Materials

|

|

o

|

Soliciting Material under §240.14a-12

|

|

|

|

AMC ENTERTAINMENT HOLDINGS, INC.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

o

|

Fee paid previously with preliminary materials.

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

|

|

|

|

|

AMC Entertainment Holdings, Inc. (“AMC”) intends to make available via hyperlink on its website (investor.amctheatres.com) a recording of the interview by Jim Cramer and Carl Quintanilla with Adam Aron, Chief Executive Officer, President and Director of AMC, which originally aired on CNBC on April 1, 2021. The following is the transcript of the interview.

TRANSCRIPT

Jim Cramer: Well, let’s bring him in, all right, we got the moment here Carl, a CNBC exclusive, AMC Entertainment’s President and CEO Adam Aron, great CEO and I’m not just saying it because at one point of the CEO of the Sixers, he’s done many, many good things. So let’s cut right to it Adam.

Adam Aron: Good morning to you.

Jim Cramer: Good morning. Yeah I got to do the good morning thing. You have five billion in debt. Can you solve it? Can you solve it? That’s a lot of debt.

Adam Aron: I would like to think so. You know, AMC has proven quite adept over the past year at raising capital. One of the reasons that we have survived this horrible pandemic so far is we raised $2.8 billion of cash, and got another billion dollars of concessions from lenders and theater landlords and that’s put us in a position to run our business going forward with some degree of confidence. You know, five different times, during the last year, we were close to running out of cash, because our theaters were all closed and we had no revenues. But we raised money to survive and we’re back operating as normal companies operate. And let me just tell you, we talked about good morning, let me tell you what good morning means in America these days. The combination of vaccinations and new movie releases, “Godzilla vs. Kong” opened last night, it’s a movie about apes, and in the world of meme stocks, apes are a good thing, maybe it’s an omen, our attendance last night was about ten times what it’s been all the other Wednesdays so far in 2021. We can look ahead.

Jim Cramer: But at the same time, you got a stock that is up 380%. You know, I don’t know, Adam, I mean this is a good opportunity to share a couple hundred million shares, isn’t it?

Adam Aron: Well, and, look I want to be careful.

Jim Cramer: This is where you do it now. It’s not the time. It’s here.

Adam Aron: Dilution is something we care about but I would also tell you we are formally asking for approval from our shareholders to authorize another 500 million shares that the company could issue if it wishes. There are a lot of benefits to our shareholders of having board-authorized shares out in the market. We will be sensitive to dilution issues. At the same time, though, there’s an opportunity to bolster our cash reserves. There’s an opportunity to buy back debt at a discount. There might be an opportunity to defray some of our deferred theater rents; settling with stock instead of cash; maybe there’s some merger and acquisition opportunity where we could buy other companies inexpensively using our stock as currency, there are a lot of good reasons for shareholders to give us the authority to have more shares.

2

Jim Cramer: Isn’t it time to buy back, can we buy back the 6 3/8ths of 11/15/24 that were trading at 36. I mean, that’s a great piece of paper right now if you are going to do 500 million shares.

Adam Aron: We are very aware of buyback at a discount and that in itself would be accretive and generate profitability for AMC and increase shareholder value for our shareholders.

Jim Cramer: Alright if you get that money, is it time to play hardball, again, I mean “Black Widow,” “Cruella,” I don’t know, if I can go to AMC or if I can go to Disney+, I know Disney+ is a lot of fun to watch at home even though I love the popcorn, I love the social distancing, I mean can you, if you get the capital, can’t you say to these guys, you know what, look, we’re not playing by your rules, we’re open, and we want those with a six-week, no, with a two-month exclusivity.

Adam Aron: Well, look, I think one of the biggest benefits of AMC being the largest exhibitor in the world is that we have a seat at the table and we’re in active discussions with movie studios all the time. We consider them our partners in this ecosystem of the release of movies. We’ve been discussing windows policies for years. Some of those discussions are very easy, some of those discussions are heated, as you say. There was a lot of drama around theatrical windows starting last April that continued this January and continues at pace. But as I said, we got a seat at table because we’re an important player. And so far, we have been able to reach agreement with studios on mutually agreeable terms, what we think are good terms for the studios but also very importantly good terms for us and for AMC shareholders.

Carl Quintanilla: Adam, I don’t want to belabor this point, but Jim’s question is so key. You know, “Black Widow,” among some, was seen as a bit of a large tell about the window, because they held their cards, earlier in the year, and then they finally push it back two months, but as Jim says, you can get it at home, and it’s, a lot has been written about the fact that Disney didn’t really do exhibitors any favors. Do you agree with that?

Adam Aron: Well, look, I’d rather not comment publicly about what Disney is doing or isn’t doing or what their strategy is or what their strategy isn’t. I will tell you that Disney and AMC as two companies have been very close partners for decades, and decades, and I expect to be very close partners with Disney for decades and decades to come. I’m not worried about the competition from the home. “Godzilla vs. Kong” was available at home on some streaming services, and almost a quarter of a million people were at our theaters last night, just in the United States alone. On a Wednesday. That’s a good omen. People, you know, if this pandemic has taught us anything, people want to get out of their houses and their apartments, and going to the movie theater is something that people have loved for more than a century and it’s a cheap date, it’s a cheap night out and a very nice break from being cooped up where you live 24/7.

Jim Cramer: I couldn’t agree more, Adam. To me, it is a date. I mean the dinner, I got a restaurant, but the date is to go to the movies. Talk about partners, you have a very interesting partner in the people who are on Reddit, and WallStreetBets and I know you earlier said you find it so appealing, about the Reddit phenomenon is the affection and allegiance that Americans have across the country and you point blank say that it is really true that millions and millions of

3

people rallied behind saving AMC, so I don’t know, I think they could rally behind 500 million shares.

Adam Aron: Well, look, Jim, you know, “Save AMC” was a hashtag that was trending on Twitter, the single most tweeted hashtag, one of those days in January. Look, there are a lot of things going on with the so-called Reddit phenomenon. But I think one of them is there are a lot of people out there who have an affection for AMC, who did not want to see hedge funds short our stock, and try to force us into bankruptcy. And they stood by our side and we appreciate that. And now, as we go forward, we want to run this company right. These people are now our shareholders and we want to do what’s best for our shareholders. Increase long-term shareholder value. And as you said, one of the smartest ways we can do that right now is increase the available share count at AMC, and then use those shares wisely. Not in the next week, in the next month, and even in the next year, but over the next five weeks and five months and five years, ten weeks and ten months and ten years.

Jim Cramer: You read my mind. The last question, I thought the shorts were trying to just drive you out of business. I thought the shorts were taking the stock down, creating some level of fear and then making it so the bonds rolled over, making it hard for you to be able to raise money. You hit upon what I think was actual truth about the shorts.

Adam Aron: Look, I do. There clearly were people who were campaigning to force us to run dry on cash. Once you get in this cycle of approaching insolvency, it’s almost a self-fulfilling prophecy and most companies get in that zone, wind up having to file. By contrast, because of the confidence in AMC, and our future, by retail investors, we sold over $800 million worth of stock in December and January alone and we raised a lot of money, we bolstered our cash reserves, and we, as I say in the press statement, in mid-January, we took near-term imminent bankruptcy completely off the table. Now, with vaccinations moving at a very brisk pace, with new movie releases coming, with people coming back to theaters in quantity again, as was the case last night with “Godzilla vs. Kong,” and we think it will be the case with other new movies released in April and May and June and July. Look, we got a brighter future.

Jim Cramer: I just want to be sure, it’s, there’s a little ticker that said it was $500 million. I thought I heard 500 million shares.

Adam Aron: My experience is that Jim Cramer is never wrong, and you are correct. We have asked our shareholders for approval for 500 million new shares to be authorized. That doesn’t mean we’ll use all of those shares right away, but it does give the company optionality and flexibility; and optionality and flexibility when you’re navigating these uncharted waters of pandemic are very good things.

Jim Cramer: I want to congratulate you, I know it was five times. Fabulous article in the New York Times about you, you are fighter. And the one thing I’m bummed about is you gave me no Churchill. How can you give me no Churchill, Adam?

Adam Aron: I did in the middle of the dire times, when we were tight on cash, on an earnings call, as you were alluding, I quoted the famous, “We’ll fight them on the beaches” Churchill speech saying that AMC was in a war-time mentality and we were not going to let hedge funds

4

or short sellers take us out and we were going to go throw everything we had at saving AMC, and we think that’s exactly what we’ve done. Now, we’re not totally out of the woods yet. And we still need more vaccinations to come. We need more movies to be released. We do need to see a return to normalcy in the United States. But as we look ahead, we think the odds are much better that that will be the outcome.

Jim Cramer: Well I want to thank Adam Houdini Aron, who has piloted and people should read this Times profile, a lot of people would have given up, you not only took on the shorts but you’re just going to be the winner and maybe even the last man standing. Have a great time in Florida with Jeff Steinfeld this weekend.

Adam Aaron: Thank you, Jim.

5

Additional Information and Where to Find It

This communication may be deemed solicitation material in respect of the Annual Meeting of stockholders (the “Annual Meeting”) of AMC Entertainment Holdings, Inc. (“AMC” or the “Company”). This communication does not constitute a solicitation of any vote or approval. In connection with the Annual Meeting, the Company plans to file with the Securities and Exchange Commission (the “SEC”) and mail or otherwise provide to its stockholders a proxy statement regarding the business to be conducted at the Annual Meeting. The Company may also file other documents with the SEC regarding the business to be conducted at the Annual Meeting. This document is not a substitute for the proxy statement or any other document that may be filed by the Company with the SEC.

BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT IN ITS ENTIRETY WHEN IT BECOMES AVAILABLE AND ANY OTHER DOCUMENTS FILED BY THE COMPANY WITH THE SEC IN CONNECTION WITH THE BUSINESS TO BE CONDUCTED AT THE ANNUAL MEETING BEFORE MAKING ANY VOTING OR INVESTMENT DECISION WITH RESPECT TO THE BUSINESS TO BE CONDUCTED AT THE ANNUAL MEETING BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE BUSINESS TO BE CONDUCTED AT THE ANNUAL MEETING.

Stockholders may obtain a free copy of the proxy statement and other documents the Company files with the SEC (when available) through the website maintained by the SEC at www.sec.gov. The Company makes available free of charge on its investor relations website at www.investor.amctheatres.com copies of materials it files with, or furnishes to, the SEC.

Participants in the Solicitation

The Company and its directors, executive officers and certain employees and other persons may be deemed to be participants in the solicitation of proxies from the Company’s stockholders in connection with the business to be conducted at the Annual Meeting. Security holders may obtain information regarding the names, affiliations and interests of the Company’s directors and executive officers in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020, which was filed with the SEC on March 12, 2021 (the “2021 Form 10-K”). To the extent the holdings of the Company’s securities by the Company’s directors and executive officers have changed since the amounts set forth in the Company’s 2021 Form 10-K, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC.

Forward Looking Statements

This communication includes “forward-looking statements” within the meaning of the federal securities laws. In many cases, these forward-looking statements may be identified by the use of words such as “will,” “may,” “could,” “would,” “should,” “believes,” “expects,” “anticipates,” “estimates,” “intends,” “indicates,” “projects,” “goals,” “objectives,” “targets,” “predicts,” “plans,” “seeks,” and variations of these words and similar expressions. Examples of forward-

6

looking statements include statements we make regarding the impact of COVID-19, future attendance levels and our liquidity. Any forward-looking statement speaks only as of the date on which it is made. These forward-looking statements may include, among other things, statements related to AMC’s current expectations regarding the performance of its business, financial results, liquidity and capital resources, and the impact to its business and financial condition of, and measures being taken in response to, the COVID-19 virus, and are based on information available at the time the statements are made and/or management’s good faith belief as of that time with respect to future events, and are subject to risks, trends, uncertainties and other facts that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. These risks, trends, uncertainties and facts include, but are not limited to, risks related to: AMC’s ability to obtain additional liquidity, which if not realized or insufficient to generate the material amounts of additional liquidity that will be required unless it is able to achieve more normalized levels of operating revenues, likely would result in AMC seeking an in-court or out-of-court restructuring of its liabilities; the potential impact of AMC’s existing or potential lease defaults; the impact of the COVID-19 virus on AMC, the motion picture exhibition industry, and the economy in general, including AMC’s response to the COVID-19 virus related to suspension of operations at theatres, personnel reductions and other cost-cutting measures and measures to maintain necessary liquidity and increases in expenses relating to precautionary measures at AMC’s facilities to protect the health and well-being of AMC’s customers and employees; AMC’s significant indebtedness, including its borrowing capacity and its ability to meet its financial maintenance and other covenants; the manner, timing and amount of benefit AMC receives under the CARES Act or other applicable governmental benefits and support; the impact of impairment losses; motion picture production and performance; AMC’s lack of control over distributors of films; intense competition in the geographic areas in which AMC operates; increased use of alternative film delivery methods or other forms of entertainment; shrinking exclusive theatrical release window; AMC Stubs A-List not meeting anticipated revenue projections; general and international economic, political, regulatory and other risks; limitations on the availability of capital; AMC’s ability to refinance its indebtedness on favorable terms; availability of financing upon favorable terms or at all; risks relating to impairment losses, including with respect to goodwill and other intangibles, and theatre and other closure charges; and other factors discussed in the reports AMC has filed with the SEC. Should one or more of these risks, trends, uncertainties or facts materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those indicated or anticipated by the forward-looking statements contained herein. Accordingly, you are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved. For a detailed discussion of risks, trends and uncertainties facing AMC, see the section entitled “Risk Factors” in the Company’s 2021 Form 10-K filed with the SEC, and the risks, trends and uncertainties identified in its other public filings. AMC does not intend, and undertakes no duty, to update any information contained herein to reflect future events or circumstances, except as required by applicable law.

7

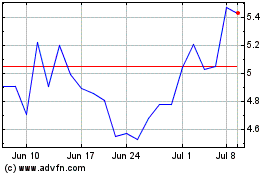

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Apr 2023 to Apr 2024