AMC Entertainment Holdings, Inc. (NYSE: AMC) (“AMC”) announced

today the expiration and final results for its previously announced

offers to exchange (the “Exchange Offers”) any and all of its

outstanding senior subordinated notes listed in the table below

(the “Existing Subordinated Notes”) for newly issued 10%/12%

Cash/PIK Toggle Second Lien Subordinated Secured Notes due 2026

(the “New Second Lien Notes”) and related solicitation of consents

(the “Consent Solicitations”) from eligible holders of the Existing

Subordinated Notes to certain proposed amendments (the “Proposed

Amendments”) to the indentures governing the Existing Subordinated

Notes.

The Exchange Offers and Consent Solicitations expired at 5:00

p.m., New York City time, on July 24, 2020 (such time and date, the

“Expiration Time”). As of the Expiration Time, based on information

provided by Global Bondholder Services Corporation, the information

and exchange agent for the Exchange Offers and Consent

Solicitations, the following amounts of Existing Subordinated Notes

were validly tendered and accepted in the Exchange Offers:

Series of Existing Subordinated

Notes

Total Aggregate Principal

Amount Validly Tendered

Percentage of

Outstanding Existing Subordinated Notes Validly

Tendered

6.375% Senior Subordinated Notes due

2024

£495,820,000

99.16%

5.75% Senior Subordinated Notes due

2025

$501,683,000

83.61%

5.875% Senior Subordinated Notes due

2026

$539,395,000

90.65%

6.125% Senior Subordinated Notes due

2027

$344,283,000

72.48%

Subject to the satisfaction of the conditions set forth in the

Amended Confidential Offering Memorandum, dated as of July 10, 2020

(the “Offering Memorandum”) and the Backstop Agreement, dated as of

July 10, 2020 (the “Backstop Agreement”), between AMC and certain

holders of the Existing Subordinated Notes (the “Backstop

Parties”), the settlement date of the Exchange Offer is expected to

be July 31, 2020 (the “Settlement Date”). On the Settlement Date,

approximately $1.46 billion of New Second Lien Notes are expected

to be issued.

Pursuant to the subscription rights and oversubscription rights

granted to each eligible holder of Existing Subordinated Notes as

described in the Offering Memorandum, as of the Expiration Time,

eligible holders had oversubscribed for AMC’s $200 million

aggregate principal amount of 10.5% First Lien Secured Notes (the

“New First Lien Notes”) offered pursuant to the Offering Memorandum

and, as a result, the backstop will not be utilized. In addition,

pursuant to the previously announced Commitment Letter, dated as of

July 10, 2020 (the “Commitment Letter”), between AMC, Silver Lake

Alpine, L.P. and Silver Lake Alpine (Offshore Master), L.P.

(together with Silver Lake Alpine, L.P., the “Silver Lake Funds”),

AMC will also issue $100 million of additional first lien notes

with identical terms to the New First Lien Notes (the “Additional

Silver Lake First Lien Notes”) to the Silver Lake Funds. Subject to

the satisfaction of the conditions set forth in the Offering

Memorandum, the Backstop Agreement and the Commitment Letter, the

New First Lien Notes and the Additional Silver Lake First Lien

Notes are expected to be issued on the Settlement Date.

As of the Expiration Time, AMC also received the requisite

consents sufficient to approve the Proposed Amendments to the

indentures governing the Existing Subordinated Notes, and AMC and

the trustee for the Existing Subordinated Notes will promptly

execute supplemental indentures that give effect to the Proposed

Amendments. Such amendments to the indentures governing the

Existing Subordinated Notes will become operative upon the

consummation of the Exchange Offers.

Important Information about the Exchange Offers and Consent

Solicitations

This press release is issued pursuant to Rule 135c under the

Securities Act of 1933, as amended (the "Securities Act"). This

press release is neither an offer to sell nor the solicitation of

an offer to buy the New Second Lien Notes, the New First Lien Notes

or any other securities and shall not constitute an offer,

solicitation or sale in any jurisdiction in which, or to any person

to whom, such an offer, solicitation or sale is unlawful. The New

Second Lien Notes and the New First Lien Notes have not been, and

will not be, registered under the Securities Act, any state

securities laws or the securities laws of any other jurisdiction

and may not be offered or sold in the United States absent

registration or an applicable exemption from the registration

requirements of the Securities Act and any applicable state

securities laws. The Exchange Offers, and the offering of the New

Second Lien Notes and New First Lien Notes, are being made only (1)

to persons reasonably believed to be (A) “qualified institutional

buyers” as defined in Rule 144A under the Securities Act or (B)

institutions where permitted in certain jurisdictions that can

provide certifications and other documentation satisfactory to AMC

that they are “accredited investors” as defined in subparagraphs

(a)(1), (2), (3) or (7) of Rule 501 under the Securities Act, in

each case in a private transaction in reliance upon the exemption

from the registration requirements of the Securities Act provided

by Section 4(a)(2) thereof, and (2) outside the United States, to

persons other than “U.S. persons” as defined in Rule 902 under the

Securities Act in offshore transactions in compliance with

Regulation S under the Securities Act.

The Exchange Offers and Consent Solicitations are being made

only pursuant to the Offering Memorandum. The Offering Memorandum

and other documents relating to the Exchange Offers and Consent

Solicitations will be distributed only to eligible holders. The

Exchange Offers are not being made to holders of Existing

Subordinated Notes in any jurisdiction in which the making or

acceptance thereof would not be in compliance with the securities,

blue sky or other laws of such jurisdiction. The New Second Lien

Notes and the New First Lien Notes have not been approved or

disapproved by any regulatory authority, nor has any such authority

passed upon the accuracy or adequacy of the Offering Memorandum.

None of AMC, the dealer manager, the solicitation agent, the

exchange agent, the information agent or any trustee (or its

agents) of the Existing Subordinated Notes, the New Second Lien

Notes or the New First Lien Notes makes any recommendation as to

whether holders of the Existing Subordinated Notes should

participate in the Exchange Offers or consent to the Proposed

Amendments.

This press release, the Offering Memorandum and any other

documents or materials relating to the Exchange Offers and Consent

Solicitations may only be communicated to persons in the United

Kingdom in circumstances where Section 21 of the Financial Services

and Markets Act 2000 (the "FSMA") does not apply. Accordingly, this

press release and the Offering Memorandum are only for circulation

to (i) persons who are outside the United Kingdom, (ii) investment

professionals falling within Article 19(5) of the FSMA (Financial

Promotion) Order 2005, as amended (the "Order"), (iii) high net

worth entities, and other persons to whom the communication may

lawfully be communicated, falling within Article 49(2)(a) to (d) of

the Order or (iv) persons to whom an invitation or inducement to

engage in investment activity (within the meaning of Section 21 of

the FSMA) in connection with the communication may otherwise

lawfully be communicated or caused to be communicated (all such

persons together being referred to for purposes of this paragraph

as "relevant persons"). The New Second Lien Notes will only be

available to, and any invitation, offer or agreement to subscribe,

purchase or otherwise acquire such New Second Lien Notes will be

engaged in only with, relevant persons. Any person who is not a

relevant person should not act or rely on the Offering Memorandum

or any of its contents and may not participate in the Exchange

Offers.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the federal securities laws. In many cases, these

forward-looking statements may be identified by the use of words

such as “will,” “may,” “should,” “believes,” “expects,”

“anticipates,” “estimates,” “intends,” “projects,” “goals,”

“objectives,” “targets,” “predicts,” “plans,” “seeks,” and

variations of these words and similar expressions. Any

forward-looking statement speaks only as of the date on which it is

made. These forward-looking statements may include, among other

things, statements related to the expected timing of and future

actions with respect to the Exchange Offers and Consent

Solicitations, the completion of the transactions contemplated

thereby and statements related to AMC’s current expectations

regarding the performance of its business, financial results,

liquidity and capital resources, and the impact to its business and

financial condition of, and measures being taken in response to,

the COVID-19 virus, and are based on information available at the

time the statements are made and/or management’s good faith belief

as of that time with respect to future events, and are subject to

risks, trends, uncertainties and other facts that could cause

actual performance or results to differ materially from those

expressed in or suggested by the forward-looking statements. These

risks, trends, uncertainties and facts include, but are not limited

to, risks related to: the impact of the COVID-19 virus on AMC, the

motion picture exhibition industry, and the economy in general,

including AMC’s response to the COVID-19 virus related to

suspension of operations at theatres, personnel reductions and

other cost-cutting measures and measures to maintain necessary

liquidity and increases in expenses relating to precautionary

measures at AMC’s facilities to protect the health and well-being

of AMC’s customers and employees; the general volatility of the

capital markets and the market price of AMC’s Class A common stock;

motion picture production and performance; AMC’s lack of control

over distributors of films; increased use of alternative film

delivery methods or other forms of entertainment; general and

international economic, political, regulatory and other risks,

including risks related to the United Kingdom’s exit from the

European Union or widespread health emergencies, or other pandemics

or epidemics; risks and uncertainties relating to AMC’s significant

indebtedness, including AMC’s borrowing capacity under its

revolving credit agreement; AMC’s ability to execute cost cutting

and revenue enhancement initiatives as previously disclosed and in

connection with response to COVID-19; limitations on the

availability of capital; AMC’s ability to refinance its

indebtedness on favorable terms; availability of financing upon

favorable terms or at all; risks relating to impairment losses,

including with respect to goodwill and other intangibles, and

theatre and other closure charges; and other factors discussed in

the reports AMC has filed with the SEC. Should one or more of these

risks, trends, uncertainties or facts materialize, or should

underlying assumptions prove incorrect, actual results may vary

materially from those indicated or anticipated by the

forward-looking statements contained herein. Accordingly, you are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date they are made.

Forward-looking statements should not be read as a guarantee of

future performance or results and will not necessarily be accurate

indications of the times at, or by, which such performance or

results will be achieved. For a detailed discussion of risks,

trends and uncertainties facing AMC, see the section entitled “Risk

Factors” in the Offering Memorandum, the section entitled “Risk

Factors” in AMC’s Form 10-K for the year ended December 31, 2019

and Form 10-Q for the three months ended March 31, 2020, each as

filed with the SEC, and the risks, trends and uncertainties

identified in its other public filings. AMC does not intend, and

undertakes no duty, to update any information contained herein to

reflect future events or circumstances, except as required by

applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200727005207/en/

INVESTOR RELATIONS: John Merriwether, 866-248-3872

InvestorRelations@amctheatres.com

MEDIA CONTACTS: Ryan Noonan, (913) 213-2183

rnoonan@amctheatres.com

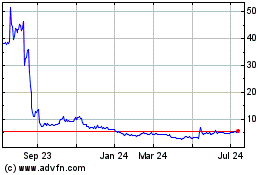

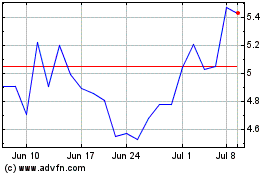

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

AMC Entertainment (NYSE:AMC)

Historical Stock Chart

From Apr 2023 to Apr 2024