Current Report Filing (8-k)

October 13 2022 - 4:07PM

Edgar (US Regulatory)

0000874501FALSE00008745012022-10-062022-10-060000874501us-gaap:CommonStockMember2022-10-062022-10-060000874501us-gaap:WarrantMember2022-10-062022-10-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 6, 2022

| | |

| Ambac Financial Group, Inc. |

| (Exact name of Registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Delaware | | 1-10777 | | 13-3621676 |

| (State of incorporation) | | (Commission

file number) | | (I.R.S. employer

identification no.) |

| | | | | | | | | | | |

| One World Trade Center | New York | NY | 10007 |

| (Address of principal executive offices) |

| | | | | | | | | | | |

| (212) | 658-7470 | |

| (Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR 240.13e-4c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | | AMBC | | New York Stock Exchange |

| Warrants | | AMBCW | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 under the Securities Act (17 CFR 230.405) or Rule 12b-2 under the Exchange Act (17 CFR 240.12b-2).

| | | | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to |

| Section 13(a) of the Exchange Act. | ☐ | |

Item 1.01 Entry into a Material Definitive Agreement

On October 6, 2022, Ambac Assurance Corporation (“AAC”) entered into a Settlement Agreement and Release (the “Settlement Agreement”) with Bank of America Corporation and certain affiliates thereof (together, the “BOA Parties”) whereby the BOA Parties agreed to pay AAC the sum of $1,840,000,000 (one billion eight hundred forty million dollars) (the “Settlement Payment”) following the dismissal of AAC’s lawsuits against the BOA Parties,[1]and the withdrawal by AAC of its objections, including any pending appeals, concerning the settlements that are the subject of certain trust instructional proceedings. In exchange for the Settlement Payment, AAC, on its own behalf and on behalf of its affiliates, has agreed to release the BOA Parties and related parties (the “Released Parties”) from claims asserted or which could have been asserted in AAC’s pending litigations against the BOA Parties as well as claims that AAC and its affiliates ever had, may currently have or may have in the future against the Released Parties, subject to certain limited exceptions. The Settlement Agreement also requires AAC to dismiss other pending claims against the Released Parties, and to generally refrain from, and in certain situations hold the Released Parties harmless with respect to, certain actions taken by AAC with respect to residential mortgage-backed securities trusts created prior to the date of the Settlement Agreement involving the Released Parties.

[1] These lawsuits are captioned as follows: Ambac Assurance Corporation and the Segregated Account of Ambac Assurance Corporation v. Countrywide Home Loans, Inc., Countrywide Securities Corp., Countrywide Financial Corp., and Bank of America Corp. (Supreme Court of the State of New York, County of New York, Case No. 653979/2014, filed on December 30, 2014); Ambac Assurance Corporation and The Segregated Account of Ambac Assurance Corporation v. Countrywide Securities Corp., Countrywide Financial Corp. (a.k.a. Bank of America Home Loans) and Bank of America Corp. (Supreme Court of the State of New York, County of New York, Case No. 651612/2010, filed on September 28, 2010); and Ambac Assurance Corporation and The Segregated Account of Ambac Assurance Corporation v. First Franklin Financial Corporation, Bank of America, N.A., Merrill Lynch, Pierce, Fenner & Smith Inc., Merrill Lynch Mortgage Lending, Inc., and Merrill Lynch Mortgage Investors, Inc. (Supreme Court of the State of New York, County of New York, Case No. 651217/2012, filed April 16, 2012).

Item 2.04 Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement

On July 6, 2021, a newly formed variable interest entity and wholly-owned subsidiary of Ambac Financial Group, Inc., Sitka Holdings, LLC (“Sitka”), issued $1.175 billion par amount of LIBOR plus 4.5% senior secured notes due 2026 (the “Sitka Senior Secured Notes”). In connection with the issuance and sale of the Sitka Senior Secured Notes, on July 6, 2021, AAC issued a $1.175 billion secured note due 2026 (the "Sitka AAC Note") to Sitka. Interest on the Sitka AAC Note is payable quarterly at an annual rate of LIBOR plus 4.5%. Upon receipt of the settlement proceeds pursuant to the Settlement Agreement, AAC is required to wholly redeem the Sitka AAC Note at a price equal to 103% of the principal amount plus accrued and unpaid interest, and correspondingly, Sitka is required to wholly redeem the Sitka Senior Secured Notes on the same terms. AAC plans to wholly redeem the Sitka AAC Note, at a redemption price of approximately $1.2 billion with the proceeds from the settlement, and Sitka plans to wholly redeem the Sitka Senior Secured Notes upon receipt of the funds from the repayment of the Sitka AAC Note.

On February 12, 2018, AAC issued $240 million aggregate principal amount of 8.5% Senior PIK Notes due 2055 (the “Tier 2 Notes”) under an Indenture, dated as of February 12, 2018, by and between AAC and The Bank of New York Mellon, as trustee and as note collateral agent. The Tier 2 Notes are secured by proceeds from RMBS litigations net of reinsurance (“Net Proceeds”) in excess of $1.6 billion and are subject to mandatory redemption from Net Proceeds in excess of $1.6 billion within five business days after the receipt of such Net Proceeds. AAC plans to apply the Net Proceeds of approximately $213 million to redeem Tier 2 Notes plus accrued and unpaid interest as of the date of redemption.

EXHIBIT INDEX

| | | | | | | | |

| Exhibit | | |

| Number | | Exhibit Description |

| 101.INS | | XBRL Instance Document - the instance document does not appear in the interactive Data File because its XBRL tags are embedded within the Inline XBRL document. |

| 101.SCH | | XBRL Taxonomy Extension Schema Document. |

| 101.CAL | | XBRL Taxonomy Extension Calculation Linkbase Document. |

| 101.LAB | | XBRL Taxonomy Extension Label Linkbase Document. |

| 101.PRE | | XBRL Taxonomy Extension Presentation Linkbase Document. |

| 101.DEF | | XBRL Taxonomy Extension Definition Linkbase Document. |

| 104 | | Cover Page Interactive Data File - The cover page interactive data file does not appear in the Interactive Data File because its XBRL tags or embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | Ambac Financial Group, Inc. |

| | | (Registrant) |

| | | | | |

| Dated: | October 13, 2022 | | By: | | /s/ William J. White |

| | | | | William J. White |

| | | | | First Vice President, Secretary and Assistant General Counsel |

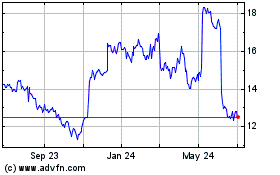

Ambac Financial (NYSE:AMBC)

Historical Stock Chart

From Mar 2024 to Apr 2024

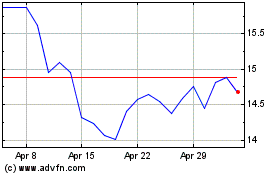

Ambac Financial (NYSE:AMBC)

Historical Stock Chart

From Apr 2023 to Apr 2024