Altus Power, Inc. Announces New Financing Agreement To Optimize Recent Acquisition from D.E. Shaw Renewable Investments

January 05 2023 - 7:00AM

Business Wire

New agreement refinances and upsizes assumed

DESRI facility up to $141.3 million at an effective fixed rate of

4.885% for five years

Altus Power, Inc. (“Altus Power” or the “Company”) (NYSE: AMPS),

the premier independent developer, owner and operator of

commercial-scale solar facilities, announced that on December 23,

2022, it refinanced and upsized the term loan facility assumed with

the recently executed D.E. Shaw Renewable Investments (DESRI)

portfolio. The principal amount of the facility was upsized to

$141.3 million consisting of a term loan facility for approximately

$125.7 million and letters of credit for approximately $15.6

million. The financing agreement includes an interest rate swap

which provides for an effective fixed rate of 4.885% for a term of

five years.

“This agreement secures long-term financing for our new assets

from DESRI at an attractive fixed rate while also increasing the

facility size to reflect the contracted cash flow profile of the

assets,” commented Dustin Weber, CFO of Altus Power. “With the

addition of this facility, we continue to demonstrate access to

multiple sources of capital.”

The lenders for the term loan are KeyBanc Capital Markets Inc.,

KeyBank National Association, and Huntington National Bank.

About Altus Power, Inc.

Altus Power, based in Stamford, Connecticut, is the premier

independent commercial-scale clean electrification company serving

commercial, industrial, public sector and community solar customers

with end-to-end solutions. Altus Power originates, develops, owns

and operates locally-sited solar generation, energy storage and

charging infrastructure across the nation. Visit www.altuspower.com

to learn more.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230105005416/en/

Altus Power Chris Shelton, Head of IR

InvestorRelations@altuspower.com

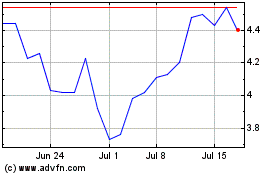

Altus Power (NYSE:AMPS)

Historical Stock Chart

From Mar 2024 to Apr 2024

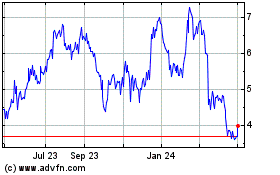

Altus Power (NYSE:AMPS)

Historical Stock Chart

From Apr 2023 to Apr 2024