Investors in highly valued e-cigarette maker undeterred by risks

of regulation

By Juliet Chung

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 14, 2018).

Several large investment firms are sitting on windfalls from

e-cigarette maker Juul Labs Inc. -- and plan to continue backing

the controversial startup despite the risk of increased

regulation.

Tiger Global Management LLC, Darsana Capital Partners LP, D1

Capital Partners LP, Marianas Fund Management LLC and Coatue

Management LLC have invested in Juul at various points over the

last two years. Juul has rapidly appreciated in value, rising to a

roughly $16 billion valuation last summer.

A possible deal to sell a significant minority stake to Altria

Group Inc., first reported by The Wall Street Journal, could value

Juul at more than $30 billion, said people familiar with the

matter. Coatue has approached its clients about investing in Juul

at a roughly $30 billion valuation should the Altria deal fall

through. A valuation above $30 billion would make Juul one of the

world's most valuable startups, a remarkable ascent even by the

fast pace of Silicon Valley.

The firms' bets on Juul -- described by more than a dozen people

familiar with the investments -- hold both regulatory and

reputational risks given e-cigarettes' use among youth. Some

hedge-fund clients have privately expressed discomfort with the

investment or opted out of having their money in Juul.

Other investors, including Viking Global Investors LP; Willett

Advisors LLC, the family office of former New York City Mayor

Michael Bloomberg; and Valiant Capital Management LP, have

considered investing in Juul but passed for reasons including

unease about its popularity among underage users, other people

said.

The funds backing Juul are betting it can disrupt the $600

billion cigarette industry with its thumb drive-shaped vaporizer

that delivers a powerful dose of nicotine from liquid-filled pods

it also sells. Smokers want to quit, investors say, and Juul's

vaping device offers the most satisfying alternative. Its business

model is also attractive because its liquid nicotine enjoys higher

margins than traditional cigarettes, which are subject to high

taxes, but are still addictive.

Critics argue Juul, the dominant e-cigarette maker, is creating

a new generation of nicotine addicts by introducing underage users

to vaping. The company and its backers say the e-cigarettes are

meant to help adult cigarette smokers switch to a less-harmful

alternative.

One of the biggest winners on paper is $29 billion Tiger Global,

which has been an early mover among hedge-fund firms into private

investments. Tiger Global invested through its venture business in

early 2017, when Juul was a product of vaping startup Pax Labs. The

deal valued Pax around $300 million largely on the basis of Juul

and was a way for Tiger Global to bet on Juul.

Tiger Global more recently led a fundraising round for Juul in

July, when it invested $600 million.

New York stockpicking hedge funds D1 and Darsana also invested

in July. The $5 billion D1, which started trading earlier this year

as one of the biggest hedge fund launches in years, has also bet

against tobacco stocks.

Marianas bought a stake in Pax when it was valued around $300

million. Marianas founder Will Snellings at one point described the

wager to a potential investor as perhaps his greatest deal.

Mr. Snellings closed his hedge fund in 2017 but continues to

manage a special-purpose vehicle holding Juul. Some of the

investors who opted into the vehicle have been selling shares in it

on the secondary market in recent months, buyers said.

But regulation remains a risk for investors.

The Food and Drug Administration launched a probe of Juul in

April, requesting information that could help explain why its

products appeal to minors. FDA Commissioner Scott Gottlieb said in

September he was considering a ban on flavored e-cigarettes,

declaring teen use an "epidemic." Federal data released in November

showed a 78% jump in 2018 over the previous year in e-cigarette use

among high-school students.

Juul said in November it would stop selling most of its flavored

products at brick-and-mortar stores and shut down some social-media

accounts, shortly before the FDA said it would restrict flavored

e-cigarette sales. A company spokesman on Wednesday referred to a

previous statement by CEO Kevin Burns: "Our intent was never to

have youth use Juul products. But intent is not enough, the numbers

are what matter, and the numbers tell us underage use of

e-cigarette products is a problem. We must solve it."

Some investors said they hope Juul's actions will reduce youth

vaping to a point where an FDA ban on e-cigarettes altogether will

be unlikely. And while Juul has run into regulatory hurdles in

Israel, investors expect significant growth overseas even if the

company grows more slowly in the U.S.

Some hedge funds internally debated the investment given Juul's

popularity among youth and quizzed the company about its plans to

police sales before investing.

Wealthy individuals and families are also among Juul's

investors, including hedge-fund billionaire Stanley Druckenmiller

and Nicholas Pritzker, a Juul director.

Some institutions have found themselves in awkward

positions.

San Francisco philanthropy Good Ventures, started by Facebook

Inc. co-founder Dustin Moskowitz and his wife, philanthropist and

former reporter Cari Tuna, opted out of investing in Juul through

Darsana. Good Venture's mission is "to help humanity thrive,"

according to its website. Darsana gave its clients a choice about

whether to invest in the company after learning several were

uncomfortable backing it.

But Good Ventures is invested in Juul through Tiger Global,

which uses committed capital to make private investments. "Good

Ventures seeks to avoid committing to funds likely to make

investments in industries that conflict with its mission," Michael

Levine, a spokesman for Good Ventures, said in a statement.

Write to Juliet Chung at juliet.chung@wsj.com

(END) Dow Jones Newswires

December 14, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

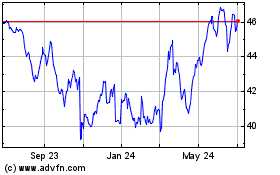

Altria (NYSE:MO)

Historical Stock Chart

From Mar 2024 to Apr 2024

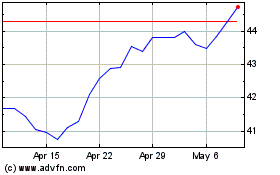

Altria (NYSE:MO)

Historical Stock Chart

From Apr 2023 to Apr 2024