Amended Tender Offer Statement by Issuer (sc To-i/a)

March 02 2023 - 7:23AM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO/A

(Rule 13e-4)

Tender Offer Statement Under Section 14(d)(1)

or 13(e)(1)

of the Securities Exchange Act of 1934

(Amendment No. 2)

ALTICE USA, INC.

(Name of Subject Company (Issuer) and Name of

Filing Person (Offeror))

Stock Options to Purchase Class A Common Stock, Par

Value $0.01 Per Share

(Title of Class of Securities)

02156K103

(CUSIP Number of Class of Securities)

Michael E.

Olsen

Executive Vice

President, General Counsel and Secretary

Altice USA,

Inc.

1 Court Square

West

Long Island

City, NY 11101

Tel: 516-803-2300

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications on Behalf of the Filing Person)

Copy to:

Gillian Emmett Moldowan

Scott Petepiece

Derrick Lott

Richard Alsop

Shearman & Sterling LLP

599 Lexington Avenue

New York, NY 10022

Telephone: +1 (212) 848-4000

| x | Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing

with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule

and date of its filing. |

Amount Previously Paid: $2,480.91 Filing

Party: Altice USA, Inc.

Form or Registration No.:

Schedule TO-I Date Filed: January 23, 2023

| o | Check the box if the filing relates solely to preliminary communications made before the commencement of

a tender offer. |

Check the appropriate

boxes below to designate any transactions to which the statement relates:

| o | third-party tender offer subject to Rule 14d-1. |

| x | issuer tender offer subject to Rule 13e-4. |

| o | going-private transaction subject to Rule 13e-3. |

| o | amendment to Schedule 13D under Rule 13d-2. |

Check the following box

if the filing is a final amendment reporting the results of the tender offer: x

If applicable, check the appropriate box(es) below to designate the appropriate

rule provision(s) relied upon:

| o | Rule 13e-4(i) (Cross-Border Issuer Tender Offer). |

| o | Rule 14d-1(d) (Cross-Border Third-Party Tender Offer). |

This Amendment No. 2 to Schedule TO (together

with any exhibits and annexes attached hereto, this “Amendment No. 2”), is filed by Altice USA, Inc., a Delaware

corporation (the “Company”), and amends and supplements the Tender Offer Statement on Schedule TO filed by the

Company with the Securities and Exchange Commission on January 23, 2023 (together with any amendments and supplements thereto, the “Schedule

TO”). The Schedule TO relates to an offer (the “Exchange Offer”) to provide eligible employees

(which includes current employees of the Company and its wholly owned subsidiaries and excludes all members of the Company’s Board

of Directors (including its Executive Chairman), the Chief Executive Officer of the Company (the “CEO”) and

his direct reports who have employment agreements and all employees of non-wholly owned subsidiaries of the Company) with the opportunity

to exchange outstanding eligible stock options for a number of restricted stock units and deferred cash-denominated awards, upon the

terms and subject to the conditions set forth in the Offer to Exchange Eligible Options for Replacement Awards dated January 23, 2023

(the “Offer to Exchange”), including the Offering Memorandum beginning on page 17 thereof (the “Offering

Memorandum”), and the Election Form on the Exchange Offer Website, attached as Exhibits (a)(1)(A) and (a)(1)(C), respectively,

to the Schedule TO and incorporated herein by reference.

This Amendment No. 2 is the final amendment

to the Schedule TO and is being made to report the results of the Exchange Offer. Except as otherwise set forth in this Amendment No.

2, the information set forth in the Schedule TO remains unchanged and is incorporated herein by reference to the extent relevant to the

items in this Amendment No. 2. Capitalized terms used but not defined herein have the meanings ascribed to them in the Schedule TO.

Items 1 through 9; Item 11.

The Offer to Exchange and Items 1 through 9 and Item 11 of the Schedule

TO, to the extent such Items 1 through 9 and Item 11 incorporate by reference the information contained in the Offer to Exchange, are

hereby amended and supplemented by adding the following paragraph thereto:

“The Exchange Offer expired

at 5:00 p.m. Eastern Time on March 1, 2023. Pursuant to the terms and conditions of the Offer to Exchange, the Company accepted for

exchange, in the aggregate, Eligible Options to purchase 24,015,508 shares of the Company’s Class A common stock, representing

approximately 89.3% of the total shares of Class A common stock underlying the Eligible Options. Upon expiration of the Exchange

Offer, all tendered Eligible Options were cancelled, and subject to the terms of the Offer to Exchange and the Amended and Restated

Altice USA 2017 Long Term Incentive Plan, as amended, the Company will promptly grant 3,430,433

restricted stock units and $34,309,284 of deferred cash-denominated awards, representing all the Replacement Awards granted in

exchange for the tendered Eligible Options. The vesting terms of the Replacement Awards are described in detail in the Offer to

Exchange.”

SIGNATURE

After due inquiry and to

the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: March 2, 2023

| |

|

|

| |

ALTICE USA, INC. |

| |

|

|

| |

By: |

/s/ Michael E. Olsen

|

| |

|

|

| |

Name: |

Michael E. Olsen |

| |

Title: |

Executive Vice President, General Counsel and Secretary |

EXHIBIT INDEX

| |

Index No. |

|

|

Description. |

|

|

| |

(a)(1)(A) |

|

|

Offer to Exchange Eligible Options for Replacement Awards, dated January 23, 2023.* |

|

|

| |

(a)(1)(B) |

|

|

Form of Announcement Email to Eligible Participants.* |

|

|

| |

(a)(1)(C) |

|

|

Election Form on the Exchange Offer Website.* |

|

|

| |

(a)(1)(D) |

|

|

Form of Confirmation Email to Eligible Participants.* |

|

|

| |

(a)(1)(E) |

|

|

Form of Reminder Email.* |

|

|

| |

(a)(1)(F) |

|

|

Form of Final Reminder Email.* |

|

|

| |

(a)(1)(G) |

|

|

Form of Notice of Expiration of Exchange Offer Email.* |

|

|

| |

(a)(1)(H) |

|

|

Screenshots from the Exchange Offer Website.* |

|

|

| |

(a)(1)(I) |

|

|

Employee Informational Presentation.* |

|

|

| |

(a)(1)(J) |

|

|

Summary Term Sheet—Questions and Answers, incorporated herein by reference to pages 4 through 16 of Exhibit (a)(1)(A) to this Schedule TO. |

|

|

| |

(a)(1)(K) |

|

|

Form of Restricted Stock Unit Award Agreement for Replacement Awards under the Amended and Restated Altice USA 2017 Long Term Incentive Plan, as amended.* |

|

|

| |

(a)(1)(L) |

|

|

Form of Deferred Cash-Denominated Award Agreement for Replacement Awards under the Amended and Restated Altice USA 2017 Long Term Incentive Plan, as amended.* |

|

|

| |

(a)(2) |

|

|

Not applicable. |

|

|

| |

(a)(3) |

|

|

Not applicable. |

|

|

| |

(a)(4) |

|

|

Offer to Exchange Eligible Options for Replacement Awards, dated January 23, 2023, incorporated herein by reference to Exhibit (a)(1)(A) to this Schedule TO. |

|

|

| |

(a)(5) |

|

|

Definitive Information Statement on Schedule 14C filed with the SEC on December 30, 2022 and incorporated herein by reference. |

|

|

| |

(b) |

|

|

Not applicable. |

|

|

| |

(d)(1) |

|

|

Amended and Restated Stockholders and Registration Rights Agreement, dated June 7, 2018, by and among Altice USA, Inc. and the stockholders party thereto (incorporated herein by reference to Exhibit 4.1 of the Company’s Current Report on Form 8-K (File No. 001-38126) filed on June 13, 2018). |

|

|

| |

(d)(2) |

|

|

Stockholders’ Agreement, dated June 7, 2018, by and among Altice USA, Inc., Next Alt S.à r.l. and A4 S.A. (incorporated herein by reference to Exhibit 10.1 of the Company’s Current Report on Form 8-K (File No. 001-38126) filed on June 13, 2018). |

|

|

| |

(d)(3) |

|

|

Altice USA 2017 Long Term Incentive Plan, as amended (incorporated herein by reference to Exhibit 99.1 of the Company’s Registration Statement on Form S-8 (File No. 333-228907) filed on December 19, 2018). |

|

|

| |

(d)(4) |

|

|

Altice USA 2017 Long Term Incentive Plan, Form of Nonqualified Stock Option Award Agreement (incorporated herein by reference to Exhibit 99.1 of the Company’s Current Report on Form 8-K (File No. 001-38126) filed on January 3, 2018). |

|

|

| |

(d)(5) |

|

|

Altice USA 2017 Long Term Incentive Plan, Form of Nonqualified Stock Option Award Agreement (incorporated herein by reference to Exhibit 99.1 of the Company’s Form 10-Q (File No. 001-38126) filed on May 1, 2020). |

|

|

| |

(d)(6) |

|

|

Altice USA 2017 Long Term Incentive Plan, as amended (incorporated herein by reference to Exhibit 99.1 of the Company’s Form S-8 (File No. 333-239085) filed on June 10, 2020). |

|

|

|

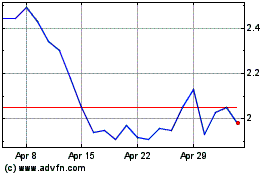

Altice USA (NYSE:ATUS)

Historical Stock Chart

From Mar 2024 to Apr 2024

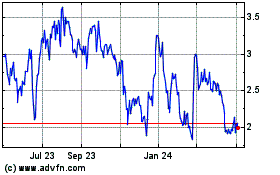

Altice USA (NYSE:ATUS)

Historical Stock Chart

From Apr 2023 to Apr 2024