By Jing Yang, Liza Lin and Keith Zhai

Pressure is mounting on Alibaba's cloud-computing division after

years of breakneck expansion, as competition in the industry

intensifies and political issues hurt the Chinese company's ability

to win business overseas and government contracts at home.

Alibaba investors have banked on cloud computing to drive

significant growth, as competition in the company's main e-commerce

business heats up. In recent months, however, the cloud unit has

parted ways with a major customer, was given the cold shoulder by

some Chinese government clients and has overhauled its

organizational structure, people familiar with the matter said.

Alibaba Group Holding Ltd. reported last week that cloud

computing revenue grew 37% in the quarter ended March 31 from the

same period a year earlier, the slowest quarterly growth since it

went public on the New York Stock Exchange in 2014. The company

said the slowdown was due to the loss of a major Chinese internet

client's international business due to "non-product related

requirements."

That client was ByteDance Ltd., the owner of the social-video

app TikTok, which terminated a deal to store its international data

on Alibaba Cloud, some of the people said. When ending the

relationship, ByteDance bought servers from Alibaba, they said.

The moves reflected Beijing-based ByteDance's desire to handle

its own fast-expanding cloud-computing needs, the people said.

Growing U.S. pressure on the use of Chinese-owned computer services

to store Americans' data accelerated the process, one of the people

said. In August, the Trump administration warned against the use of

Chinese cloud-computing services including Alibaba's.

Alibaba Cloud declined to comment on its relationship with

Bytedance.

Bytedance, which counts Carlyle Group Inc. and General Atlantic

among its backers and is one of the world's most valuable tech

startups, is building an in-house cloud-computing capability to

host its services globally. The company has been gradually

unwinding its business on the mainland with Alibaba Cloud, people

familiar with the matter said. Bytedance's operations include the

popular news-aggregator app Jinri Toutiao, Alibaba Cloud

customer.

That would deal a further blow to Alibaba Cloud, which has

plowed billions of dollars into the business and just turned

profitable in the past two quarters on the basis of adjusted

earnings before interest, taxes, amortization and depreciation.

"We understand that Alibaba Cloud still has material exposure to

Bytedance's domestic cloud workload, and worry that 'Bytedance

risk' could rear its head again in future quarters," Bernstein

analyst Robin Zhu said in a note Tuesday.

Bytedance was caught up in growing U.S.-China tensions last

year, as the Trump administration tried to ban and force the sale

of its TikTok app, citing concerns about the security of data

collected from its millions of American users. TikTok attracted

more than 81 million downloads in the U.S. last year, data from

mobile-analytics firm Sensor Tower shows. A U.S. court blocked the

ban, and the sale was shelved indefinitely as President Biden

reviewed his predecessor's policy toward the company.

In a U.S. federal court hearing last year, a senior ByteDance

executive said the company hosted TikTok's U.S. users' data in the

U.S. on cloud services provided by third parties including Alphabet

Inc.'s Google and Microsoft Corp. The Chinese firm had kept a

backup copy of TikTok's U.S. data in data centers in Singapore,

where one of the cloud providers it used was Alibaba, a person

familiar with the matter said.

Alibaba was the first Chinese technology giant to make the foray

into cloud computing -- renting processing power and data-storage

services to external clients -- by leveraging the already enormous

computing needs of its e-commerce marketplace. Cloud brought in

$2.6 billion in sales in the March quarter, compared with $24.6

billion for Alibaba's core commerce business. It is now the largest

provider of cloud-infrastructure service in China and the-fourth

largest in the world after Amazon.com Inc.'s Amazon Web Services,

Microsoft's Azure and Google Cloud, according to research firm

Canalys.

Yet Huawei Technologies Co. has been chipping away at Alibaba

Cloud's market share at home. The Chinese telecom giant almost

doubled its market share in China to 16% last year from 2019,

according to Canalys. Alibaba's share fell to 41% from 44% over the

same period, Canalys data showed.

IDC, another industry-data provider, shows a smaller decline in

Alibaba Cloud's market share in China over the same period.

Last month, Alibaba Cloud revamped its organizational structure

to add more geographic managers to give local teams across China

more power and accountability for growing sales and retaining

customers, people familiar with the company said. The move was seen

by some in the company as a direct response to Huawei's rising

market share, the people said.

China's cloud-computing industry is a restricted one. Regulators

require overseas cloud providers to form joint ventures to operate

in the country. That has helped Alibaba grow, but the company faces

new hurdles as Beijing cracks down on the e-commerce giant, its

financial-technology affiliate Ant Group Co. and founder Jack

Ma.

Regulators hit Alibaba with a record $2.8 billion fine in April

for abusing its dominant position over rivals and merchants on its

e-commerce platform. Late last year, they halted Ant's $34 billion

IPO as it neared the finish line; this year they forced the fintech

giant to restructure as a financial holding company subject to

more-stringent regulations.

Alibaba Cloud in recent months has run into difficulty winning

new contracts or even securing meetings with some of its government

and state-owned enterprise clients, according to people familiar

with the matter, as regulators scrutinize its e-commerce business

and Ant Group.

The company was the top cloud contractor for central-government

departments in the first quarter of 2019, according to state-run

Xinhua News Agency.

"As seen in recent quarters, Alibaba Cloud's revenues have been

primarily driven by the continuous growth from customers in the

internet, finance and retail industries, and the public sector," a

spokeswoman for the unit said.

Alibaba Cloud isn't completely shut out -- it has landed some

government contracts in the past few months, according to

government procurement records and company releases.

Still, Alibaba's recent regulatory troubles could cast a shadow

on decision-making by local governments and hurt the company's

ability to win future contracts in the government cloud market,

said Charlie Dai, a cloud-industry analyst at research firm

Forrester Research.

"The fierce competition in the government market and the

complexity in private cloud markets are some of the major

challenges toward Alibaba Cloud's business growth in the domestic

market," Mr. Dai said.

Write to Jing Yang at Jing.Yang@wsj.com, Liza Lin at

Liza.Lin@wsj.com and Keith Zhai at keith.zhai@wsj.com

(END) Dow Jones Newswires

May 23, 2021 07:14 ET (11:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

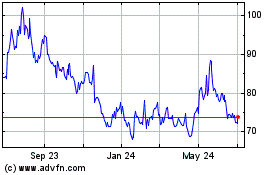

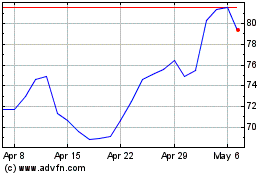

Alibaba (NYSE:BABA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alibaba (NYSE:BABA)

Historical Stock Chart

From Apr 2023 to Apr 2024