China Fines Alibaba, JD.com, Vipshop Over Pricing Complaints

December 30 2020 - 10:41AM

Dow Jones News

By Chong Koh Ping

China has fined operators of three major e-commerce platforms,

including Alibaba Group Holding Ltd. and JD.com Inc., $76,600 each

for mispricing products, the latest in the barrage of regulatory

actions targeting the increasingly influential internet sector.

Beijing's State Administration for Market Regulation said

Wednesday it investigated the three platforms -- Alibaba's Tmall

Supermarket, JD.com and Vipshop Holdings Ltd. -- after receiving

complaints from consumers.

The consumers accused these platforms of raising prices of

products before offering discounts during a major shopping festival

in November, which made it look like they were getting a better

bargain then they actually were, according to the regulator. The

platforms were also involved in making false promotions and

employing bait-and-switch tactics, the regulator said.

Alibaba declined to comment. JD.com and Vipshop Holdings didn't

immediately respond to requests for comment.

While the fines were nominal for the companies, they serve as a

warning to them and the broader internet sector. In recent months,

China has been amping up its scrutiny of the powerful technology

sector that has amassed vast amounts of user data.

That campaign has so far hit billionaire Jack Ma hardest, along

with the two companies he founded -- Alibaba and fintech giant Ant

Group.

In early November, Beijing scuttled Ant's blockbuster initial

public offering that had been on track to raise at least $34.4

billion. That came after Mr. Ma, the controlling shareholder of

Ant, criticized President Xi Jinping's risk-control initiative,

while also slamming regulators for stifling innovation. On Sunday,

regulators ordered Ant to refocus its attention on its original

payments business, while the more profitable investment and loan

businesses would be curtailed.

Meanwhile, regulators last week launched an antitrust probe into

Alibaba, which owns a third of Ant, for allegations that the

company has used its dominant market position to pressure merchants

to sell only on its platforms. The Chinese government is seeking to

shrink Mr. Ma's empire and potentially take a larger stake in his

businesses.

China also introduced a set of new draft antitrust guidelines

for the technology industry last month, seeking to regulate new

internet consumer trends.

--Liza Lin contributed to this article.

(END) Dow Jones Newswires

December 30, 2020 10:26 ET (15:26 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

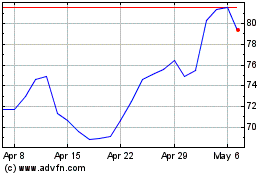

Alibaba (NYSE:BABA)

Historical Stock Chart

From Mar 2024 to Apr 2024

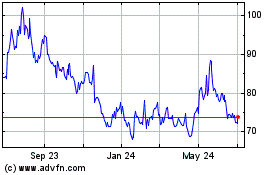

Alibaba (NYSE:BABA)

Historical Stock Chart

From Apr 2023 to Apr 2024