Uber, GM, Alibaba: Stocks That Defined the Week

November 06 2020 - 8:53PM

Dow Jones News

By Derek Hall

Uber Technologies Inc.

Uber picked up an Election Day win. California residents voted

Tuesday to exempt ride-hailing and food-delivery companies from a

state requirement to reclassify drivers as employees. Gig-economy

companies plan to use the victory as a model to defend against

similar regulation and lobby for national legislation. Uber has

still yet to deliver a profit however, posting a decline of 53% in

gross bookings for rides in the latest quarter. Uber shares rose

15% Wednesday.

Clorox Co.

The need to kill coronavirus is giving new life to Clorox's

household unit. The company booked record sales growth in its

recent quarter as Covid-19 continues to ravage much of the world.

The household-supplies producer said profit doubled to $415 million

thanks to a 27% jump in sales, the fastest growth in at least two

decades. The company still isn't meeting the pandemic-driven demand

for its namesake disinfecting wipes and sprays and is looking to

bolster supply through added production capacity and third-party

manufacturers. Executives are planning to use the windfall to

expand into new regions and product categories, which could help

close the massive gap with rival giants like Procter & Gamble

Co. and Reckitt Benckiser Group PLC. Clorox shares rose 4.2%

Monday.

Alibaba Group Holding Ltd. ADR

The suspension of Ant Group Co.'s dual IPOs in Shanghai and Hong

Kong was a stunning blow to Alibaba and Chinese tech billionaire

Jack Ma. The surprise move came after Chinese regulators met Monday

with Ant executives and Mr. Ma, the co-founder of both Alibaba and

Ant. Alibaba holds a 33% stake in Ant. The turn of events brought a

sudden halt to what would have been the world's biggest initial

public offering. The move put a damper on Alibaba's earnings

announcement, which was delivered Thursday and highlighted the

increased demand for digital services that's been spurred by

pandemic restrictions. American depositary shares of Alibaba fell

8.1% Tuesday.

Biogen Inc.

Biogen got a boost thanks to remarks by a U.S. Food and Drug

Administration staffer, who gave a positive assessment of Biogen's

experimental Alzheimer's drug in documents released Wednesday.

Approval of the treatment has become increasingly important to the

drugmaker as its stable of aging multiple-sclerosis drugs faces

increased competition from newer therapies and generic

alternatives. A separate FDA reviewer was more critical and cited

conflicting evidence for the effectiveness of the drug. If

approved, the drug will likely generate billions of dollars in new

revenue and provide years of growth for the biotech giant. Biogen

shares rose 44% Wednesday.

T-Mobile US Inc.

T-Mobile said it would dial up billions in savings next year due

to its takeover of rival Sprint. The cellphone carrier delivered

strong quarterly results Thursday and said the recent merger with

Sprint will yield $1.2 billion of annual savings, more than enough

to cover a $200 million federal fine it inherited from Sprint. The

company added 689,000 new postpaid phone subscribers in the latest

quarter, ahead of rivals Verizon Communications Inc. and AT&T

Inc., and got a boost to its customer count from remote learning

during the pandemic. T-Mobile shares rose 5.4% Friday.

General Motors Co.

GM is once again firing on all cylinders. The company on

Thursday posted a $4 billion profit for the latest quarter, driven

by increased production of pickups and a surge in demand for new

vehicles that helped the entire industry rebound from

pandemic-related losses. Executives cautioned that results could

moderate in the fourth quarter, as the number of Covid-19

infections continues to rise, especially in the industry's Midwest

manufacturing base. The still-undecided presidential election could

also have big implications for auto makers. GM shares rose 5.4%

Thursday.

Qualcomm Inc.

A chip giant is expecting a power surge from 5G. Qualcomm

projects that 2021 shipments of 5G smartphones will at least double

this year's expected total -- good news for a company that is a

leading supplier of the chips that power the new Apple Inc. 5G

phones launched last month, as well as other networking equipment

and Internet-of-Things devices. The company said Thursday that

revenue jumped 73% in the latest quarter, exceeding Wall Street

expectations. Qualcomm shares rose 13% Thursday.

(END) Dow Jones Newswires

November 06, 2020 20:38 ET (01:38 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

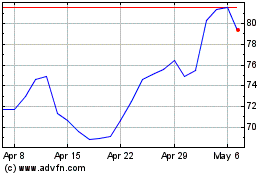

Alibaba (NYSE:BABA)

Historical Stock Chart

From Mar 2024 to Apr 2024

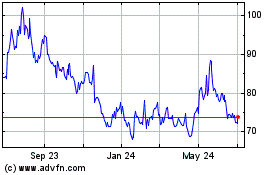

Alibaba (NYSE:BABA)

Historical Stock Chart

From Apr 2023 to Apr 2024