By Stella Yifan Xie, Jing Yang and Ian Talley

A window is closing for Chinese financial-technology giant Ant

Group Co. to pull off a record-breaking initial public offering

ahead of the U.S. presidential election, as regulators in mainland

China and Hong Kong have yet to sign off on the company's plans to

go public.

Ant, the owner of popular Chinese mobile-payments network Alipay

and the world's most valuable startup, in August filed IPO

documents with stock exchanges in Hong Kong and Shanghai. The

company could raise more than $30 billion in the concurrent

offerings and earn a market valuation between $200 billion and $300

billion, The Wall Street Journal previously reported.

Hangzhou, China-based Ant, an affiliate of Alibaba Group Holding

Ltd., was earlier targeting to list its shares in both markets by

late October, according to investors who were briefed by bankers

working on the sale.

Some company insiders had also wanted to complete the IPO before

the U.S. elections on Nov. 3, to avoid running into potential

choppy financial markets in the ensuing days and weeks, according

to people familiar with the matter. Tensions between the U.S. and

China have also been high, and could escalate depending on the

election outcome.

Spokespeople for Ant have previously said there was never a

formal timetable for its listing. A spokeswoman declined to comment

Friday.

That is now looking unlikely, even though the Shanghai Stock

Exchange in mid-September greenlighted Ant's listing plans. The

stock exchange of Hong Kong has yet to hold a hearing to determine

whether the offering can proceed, and the deal also needs a signoff

from the China Securities Regulatory Commission before Ant can

start selling its shares on the mainland.

Ant will be the first Chinese company in a decade to list in

both markets at the same time, and coordinating the two efforts is

proving to be a complicated process. In Hong Kong, companies

typically take about two weeks to go public from the time they

launch their offering after getting a green light from the

exchange.

Even though Ant's dual IPOs will bypass the world's largest

exchanges in America, and the company has very little business in

the U.S., worsening relations between the two countries have placed

Ant in the crosshairs of potential attempts by the Trump

administration to curb the company's activities. Three major U.S.

investment banks are among the sponsors of the Hong Kong leg of

Ant's IPO.

The U.S. State Department recently proposed that Ant be added to

the Commerce Department's so-called entity list, which is designed

to prevent companies from exporting sensitive technology abroad,

according to a person familiar with the matter. News of the

proposal was earlier reported by Reuters.

The entity list, in essence a trade blacklist, restricts the

export, re-export or transfer of technology and other items that

include weapons. Dozens of Chinese companies are already on the

list, including telecom giant Huawei Technologies Co.

A year ago, Megvii Technology Ltd., a Beijing-based developer of

facial-recognition technology, was among eight companies that were

added to the list. Megvii, which Ant owns a minority stake in, at

the time was preparing for an IPO in Hong Kong, which, like the Ant

deal, was led by U.S. banks.

The IPO was postponed after Megvii's underwriting banks became

lukewarm about the deal in light of the U.S. government ban, the

Journal previously reported.

It is unclear what security justification the U.S. would have

for adding Ant to the entity list. An interagency panel of

representatives from the Departments of State, Defense, and Energy

-- and chaired by a Commerce officer -- must consider the proposal

within 30 days of its submission. A majority of representatives

have to approve the proposal for Ant to be added to the entity

list.

Most of Ant's business is in China, where Alipay has more than

one billion users and handled 118 trillion yuan, equivalent to

$17.6 trillion, in payment transactions in the 12 months to

June.

Last year 5.5% of Ant's 120.6 billion yuan in revenue came from

abroad, according to its listing prospectus. Ant earlier scaled

back ambitions to expand in the U.S. after a failed $1.2 billion

bid for MoneyGram International Inc. that was blocked on

national-security concerns in 2018.

In 2016, Ant acquired Kansas City, Mo.- based EyeVerify Inc.,

which provides biometric verification technology, for an

undisclosed amount.

In the U.S., Alipay has tie-ups with Walgreens Boots Alliance

Inc. and other retailers to provide its network as a payment option

for Chinese shoppers with Alipay digital wallets that are linked to

their bank accounts in China. It can't be used by non-Chinese

citizens outside of China.

Ant hasn't been notified of any State Department proposal, and

the company hasn't had any interaction with U.S. government

officials on the issues, according to people close to the

company.

Martin Chorzempa, a research fellow who follows China's

financial sector at the Peterson Institute for International

Economics, said that unlike the addition of China's Huawei and its

subsidiaries to the blacklist, there are no accusations he is aware

of that Ant has violated any U.S. laws.

"This fits into the general pattern of wanting to look really

tough on China by taking symbolic actions that don't have a strong

negative effect -- but make a lot of noise," said Mr.

Chorzempa.

Shaun Wu, a Hong Kong-based attorney at Paul Hastings LLP, said

the Trump administration has increasingly shown that it is willing

to impose tough restrictions or even prohibitions on Chinese tech

giants, in particular.

But, there is no prohibition on U.S. investors buying shares in

companies that are on the entity list, said Mr. Chorzempa, adding

he doesn't believe the threatened listing will deter them. Ant's

coming IPOs have already drawn substantial interest from big

investors from the U.S. to Asia, according to people familiar with

the matter.

Banks handling the sale have been in discussions with

institutions that plan to subscribe for shares in the IPO, and five

big asset managers in China recently closed new mutual funds that

could invest as much as six billion yuan in the Shanghai leg of the

offering. Millions of Alipay users invested in those new funds.

--Xie Yu contributed to this article.

Write to Stella Yifan Xie at stella.xie@wsj.com, Jing Yang at

Jing.Yang@wsj.com and Ian Talley at ian.talley@wsj.com

(END) Dow Jones Newswires

October 16, 2020 13:53 ET (17:53 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

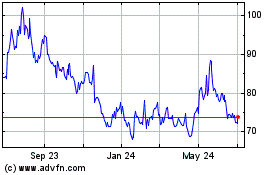

Alibaba (NYSE:BABA)

Historical Stock Chart

From Mar 2024 to Apr 2024

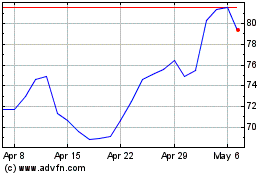

Alibaba (NYSE:BABA)

Historical Stock Chart

From Apr 2023 to Apr 2024