Dufry Sets out Rights Offering Following Deals With Alibaba, Advent

October 06 2020 - 3:53AM

Dow Jones News

By Joshua Kirby

Dufry AG on Tuesday laid out the terms of the planned rights

issuance that will increase its share capital to up to 401 million

Swiss francs ($438.2 million), following investment agreements from

Alibaba Group Holding Ltd. and Advent International Corp.

The Swiss travel retailer said the board of directors would

propose to issue up to about 24.7 million new shares with a par

value of CHF5 each at an extraordinary general meeting scheduled

for Tuesday. This would increase its share capital by up to CHF123

million to a maximum CHF401 million, Dufry said.

On Monday, Dufry said Alibaba would take a stake in the company,

and the two would launch a joint venture in China. Dufry previously

secured a commitment from private-equity firm Advent International

to invest up to CHF415 million via a purchase of shares.

Alibaba plans to buy shares at CHF28.50--the same price as

Advent International--but won't invest more than CHF250 million,

Dufry said.

The capital increase will take place in an at-market rights

offering, with existing shareholders holding pre-emptive rights on

the shares. Existing shareholders will get one subscription right

for the new shares at a rate of four new shares for every nine

already held. These rights will lapse if not exercised during the

period of Oct. 12-Oct. 19, Dufry added. The international offering

period will run from Oct. 12 to Oct. 20.

As previously reported, the expected CHF700 million in proceeds

from the capital increase will be used in part to purchase the

remaining equity interest in U.S. travel-retail store operator

Hudson Ltd. and for general corporate purposes.

The new shares are expected to start trading on the SIX Swiss

Exchange on Oct. 22.

Write to Joshua Kirby at joshua.kirby@dowjones.com

(END) Dow Jones Newswires

October 06, 2020 03:38 ET (07:38 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

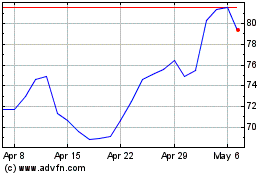

Alibaba (NYSE:BABA)

Historical Stock Chart

From Mar 2024 to Apr 2024

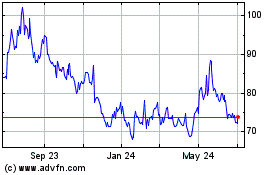

Alibaba (NYSE:BABA)

Historical Stock Chart

From Apr 2023 to Apr 2024