By Jaewon Kang

Kroger Co. has spent years -- and hundreds of millions of

dollars -- investing in technology to give it a digital edge in the

grocery business. But when the coronavirus changed customers'

buying habits overnight, the grocery chain wasn't as ready for the

online shift as some of its competitors.

The nation's biggest grocer, Kroger has poured money into

projects ranging from a self-driving grocery delivery robot to a

partnership to sell goods in China through Alibaba Group Holding

Ltd. It also bet that a delivery model using remote fulfillment

centers, popular in Europe, would resonate stateside. Yet, when the

pandemic sent a tsunami of customers ordering groceries online for

the first time, it was unable to meet higher demand.

The wide-ranging investments slowed adoption of technology for

grocery delivery, leaving Kroger behind some of its competitors,

said former executives, current employees and a vendor.

A Kroger spokeswoman said the technology investments and

partnerships were timely and allowed the grocer to quickly expand

e-commerce services.

In response to the pandemic, Kroger has expanded contact-free

payments and introduced contact-free delivery and low-contact

pickup. It is also testing a subscription program that provides a

year of delivery for an annual fee of $79, she said.

Kroger has notched higher sales as customers have cooked more at

home. During its first quarter ended May 23, same-store sales

excluding fuel were up 19% from a year earlier, while profit jumped

57% and digital sales nearly doubled. But other chains have posted

bigger gains. Albertsons Cos. said same-store sales rose 27% and

digital sales nearly quadrupled in its quarter ended June 20.

Target Corp.'s same-store sales jumped 24% and digital sales nearly

tripled for its quarter ended Aug. 1.

Analysts expect Kroger's second-quarter results, scheduled for

Friday, to show same-store sales excluding fuel up 10.5%. Kroger

and other companies have said many customers' grocery purchases

continue to exceed the previous norm as they remain mostly at home

and work remotely.

Online demand has at times swamped Kroger and other grocers,

despite their steps to enable more delivery and online orders.

Retailers including Kroger added time slots for pickup or delivery,

hired employees to handle online orders and relied more on

Instacart Inc. to take and fulfill grocery-delivery orders.

Jeannie Wood, 60 years old, said she prefers in-person shopping

at her local Houston Kroger because she finds Kroger's mobile app

"clunky"; for example, she said, it doesn't always offer

substitutes for out-of-stock items.

"It gets frustrating," she said.

To smooth the way for digital customers, Kroger eliminated

service fees for pickup and introduced a mobile feature that allows

shoppers to notify the store when they are en route to pick up an

online order. It also rolled out a pilot phone-order program for

customers who are elderly or lack internet access. And the Home

Chef meal-kits business Kroger bought in 2018 has generated strong

sales and user growth during the pandemic, Home Chef has said.

"We're really trying to be able to support our customers'

needs," Jody Kalmbach, Kroger's group vice president of product

experience, said in an August interview.

One of Kroger's main e-commerce investments in recent years was

a deal with U.K.-based Ocado Group PLC to build remote, largely

automated fulfillment centers that executives believed would help

the grocer fill online orders efficiently and at great scale. The

two companies said in May 2018 that Kroger would invest some $250

million for a 6% stake and planned for Orcado to build some 20

warehouses of up to 300,000 square feet in the U.S.

The first two sites are slated to open next spring. The

companies have identified nine regions to build the centers in,

including Ohio and Florida.

Kroger and Ocado didn't sign a contract until about six months

after announcing the deal, said former executives, because the

companies couldn't agree on which would control consumer-facing

functions such as the website where shoppers would place

orders.

Kroger's supply-chain leaders had advised against the Ocado

partnership because they were skeptical the warehouses would

generate profits, said former executives.

Meanwhile, Albertsons and other Kroger competitors started

shifting last year to smaller warehouses near stores that allow

them to deliver fresh food to consumers more quickly.

Kroger executives have said they continue to believe in the

Ocado model. They have said that the warehouses will vary in size

and proximity to Kroger stores and that Ocado's technology will

improve the retailer's pickup operations, too.

Other tech initiatives remain nascent. The Alibaba tie-up

focused on a narrow set of Kroger's store-branded products. And

just two Kroger stores in Texas are testing the driverless-delivery

technology the company is developing with electric-car startup Nuro

Inc.

Kroger still seems in catch-up mode in e-commerce. This fall, it

is launching a marketplace allowing third parties to sell items on

its website for delivery via its direct-to-consumer service, Kroger

Ship. The service, similar to Walmart Inc.'s marketplace, aims to

broaden the company's product offering.

Kroger has added time slots for grocery pickup and hired more

employees to support a rise in online orders. But the chain has

struggled to keep up with demand because its tech and workforce

plans for pickup orders didn't anticipate the current volume,

current and former employees said.

Out of its nearly 2,800 stores, 2,100 offer pickup and 2,400

provide delivery, the Kroger spokeswoman said.

A Kroger store manager in Ohio said pickup volume at that

location has nearly quadrupled since the pandemic started, to about

130 orders a day. He said employees struggle to meet demand and

keep customer waits at no more than five minutes, as headquarters

has instructed. Even with additional time slots and workers, pickup

slots are full on most days, he added.

Write to Jaewon Kang at jaewon.kang@wsj.com

(END) Dow Jones Newswires

September 10, 2020 08:37 ET (12:37 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

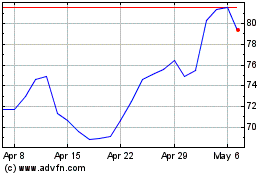

Alibaba (NYSE:BABA)

Historical Stock Chart

From Mar 2024 to Apr 2024

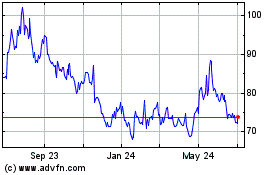

Alibaba (NYSE:BABA)

Historical Stock Chart

From Apr 2023 to Apr 2024