Current Report Filing (8-k)

December 15 2020 - 5:24PM

Edgar (US Regulatory)

false000091591300009159132020-12-152020-12-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________________________

FORM 8-K

_________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) December 15, 2020

_________________________________

ALBEMARLE CORPORATION

(Exact name of registrant as specified in charter)

_________________________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Virginia

|

|

001-12658

|

|

54-1692118

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

4250 Congress Street, Suite 900

Charlotte, North Carolina 28209

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (980) 299-5700

Not Applicable

(Former name or former address, if changed since last report)

_________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a- 12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange on which registered

|

|

COMMON STOCK, $.01 Par Value

|

|

ALB

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2)

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 1 – Registrant’s Business and Operations

Item 1.01. Entry into a Material Definitive Agreement.

Financing Transactions

On December 15, 2020, Albemarle Corporation (the “Company”) and Albemarle Finance Company B.V. (“AFC”), Albemarle New Holding GmbH (“ANH”), and Albemarle Wodgina Pty Ltd (“Wodgina”), entered into an amendment and restatement agreement (the “A&R Agreement”) to that certain Syndicated Facility Agreement, dated as of August 14, 2019 (the “Existing Credit Facility”), among the Company, AFC, ANH, Wodgina, the several banks and other financial institutions as may from time to time become parties thereto (collectively, the “Lenders”), JPMorgan Chase Bank N.A., as Administrative Agent, and JPMorgan Chase Bank, N.A. and BofA Securities, Inc., as joint lead arrangers.

The primary purposes of the A&R Agreement were to (a) extend the final maturity date of the existing loans that were made to ANH under the Existing Credit Facility (the “Existing Loans”) from April 19, 2021 to April 19, 2023, (b) change the applicable margin for the Existing Loans as set forth below, (c) provide for an additional term loan commitment by the Lenders to the Company (the “New Incremental Commitment”) and (d) remove AFC and Wodgina as borrowers under the Existing Credit Facility.

The New Incremental Commitment permits up to two borrowings by the Company in an aggregate amount equal to $500,000,000, denominated in U.S. dollars or Euros, for general corporate purposes. The Lenders’ commitment to provide loans under the New Incremental Commitment terminates on December 10, 2021, with each such loan maturing one year after the funding of such loan. The Company can request that the maturity date of loans under the New Incremental Commitment be extended for an additional period of up to four additional years, but any such extension is subject to the approval of the Lenders.

The Existing Loans and borrowings under the New Incremental Commitment bear interest at variable rates based on an average London inter-bank Offered Rate (“LIBOR”) for deposits in the relevant currency plus an applicable margin which ranges from 1.125% to 1.750%, depending on the Company’s credit rating from Standard & Poor’s Financial Services LLC, Moody’s Investor Services, Inc., and Fitch Ratings, Inc. As of the closing of the A&R Agreement, the applicable margin over LIBOR was 1.500%.

Loans under the New Incremental Commitment must be prepaid by an amount equal to the aggregate net cash proceeds received by the Company or any of its subsidiaries in respect of any sale or other disposition of the Fine Chemistry Services line of business of the Company and its subsidiaries.

This description of the A&R Agreement is not complete and is qualified in its entirety by reference to the entire A&R Agreement, a copy of which will be filed with the Company’s Annual Report on Form 10-K for the period ending December 31, 2020.

Section 2 – Financial Information

Item 2.03. Other Events.

The information set forth in Item 1.01 is hereby incorporated by reference into this Item 2.03.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ALBEMARLE CORPORATION

|

|

|

|

|

|

Date: December 15, 2020

|

|

By:

|

|

/s/ Karen G. Narwold

|

|

|

|

|

|

Karen G. Narwold

|

|

|

|

|

|

Executive Vice President, Chief Administrative Officer and General Counsel

|

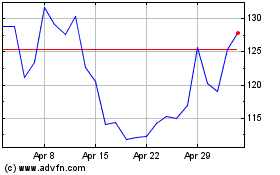

Albemarle (NYSE:ALB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Albemarle (NYSE:ALB)

Historical Stock Chart

From Apr 2023 to Apr 2024