Air Lease Corporation (ALC) (NYSE: AL) announces financial

results for the three and six months ended June 30, 2024.

“We continue to feel the effects of ongoing delays from the

aircraft and engine manufacturers. We remain confident and

optimistic about the value of our fleet, as seen through our

aircraft sales initiatives. There is significant value in our

orderbook based on our view of long-term aircraft demand and

fundamental passenger traffic trends,” said John L. Plueger, Chief

Executive Officer and President, and Steven F. Udvar-Házy,

Executive Chairman of the Board.

Second Quarter 2024

Results

The following table summarizes our operating results for the

three and six months ended June 30, 2024 and 2023 (in millions,

except per share amounts and percentages):

Operating Results

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

$ change

% change

2024

2023

$ change

% change

Revenues

$

667.3

$

672.9

$

(5.6

)

(0.8

)%

$

1,330.6

$

1,309.0

$

21.6

1.7

%

Operating expenses

(539.5

)

(509.0

)

(30.5

)

6.0

%

(1,067.5

)

(986.8

)

(80.7

)

8.2

%

Income before taxes

127.7

164.0

(36.3

)

(22.1

)%

263.1

322.2

(59.1

)

(18.3

)%

Net income attributable to common

stockholders

$

90.4

$

122.0

$

(31.6

)

(25.9

)%

$

187.9

$

240.3

$

(52.4

)

(21.8

)%

Diluted earnings per share

$

0.81

$

1.10

$

(0.29

)

(26.4

)%

$

1.68

$

2.16

$

(0.48

)

(22.2

)%

Adjusted net income before income

taxes(1)

$

137.4

$

175.9

$

(38.5

)

(21.9

)%

$

283.6

$

342.7

$

(59.1

)

(17.2

)%

Adjusted diluted earnings per share before

income taxes(1)

$

1.23

$

1.58

$

(0.35

)

(22.2

)%

$

2.54

$

3.08

$

(0.54

)

(17.5

)%

Key Financial Ratios

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Pre-tax margin

19.1%

24.4%

19.8%

24.6%

Adjusted pre-tax margin(1)

20.6%

26.1%

21.3%

26.2%

Pre-tax return on common equity (trailing

twelve months)

10.4%

10.3%

10.4%

10.3%

Adjusted pre-tax return on common equity

(trailing twelve months)(1)

10.8%

11.2%

10.8%

11.2%

——————————————————————

(1)

Adjusted net income before income taxes,

adjusted diluted earnings per share before income taxes, adjusted

pre-tax margin and adjusted pre-tax return on common equity have

been adjusted to exclude the effects of certain non-cash items,

one-time or non-recurring items that are not expected to continue

in the future and certain other items. See note 1 under the

Consolidated Statements of Operations included in this earnings

release for a discussion of the non-GAAP measures and a

reconciliation to their most comparable GAAP financial

measures.

Highlights

- During the second quarter, we took delivery of 13 aircraft from

our orderbook, representing approximately $940 million in aircraft

investments, ending the period with 474 aircraft in our owned fleet

and approximately $31 billion in total assets. Our aircraft

investments for the quarter were lower than the $1.5 billion we

expected due to ongoing manufacturing delays.

- Sold 11 aircraft during the second quarter for approximately

$530 million in sales proceeds. During the 12 months ended June 30,

2024, we sold $1.5 billion in aircraft by net book value for sales

proceeds of $1.7 billion.

- We have approximately $1.5 billion of aircraft in our sales

pipeline1, which includes $609 million in flight equipment held for

sale as of June 30, 2024 and $896 million of aircraft subject to

letters of intent.

- We have placed 100% and 96% of our committed orderbook on

long-term leases for aircraft delivering through the end of 2025

and 2026, respectively, and have placed approximately 64% of our

entire orderbook delivering through 2029.

- We ended the quarter with $30.0 billion in committed minimum

future rental payments consisting of $16.5 billion in contracted

minimum rental payments on the aircraft in our existing fleet and

$13.5 billion in minimum future rental payments related to aircraft

which will deliver during the last six months of 2024 through

2028.

- During the second quarter, we issued $600.0 million in

aggregate principal amount of 5.30% Medium-Term Notes due 2026 and

$600.0 million in aggregate principal amount of 5.20% Medium-Term

Notes due 2031.

- On July 31, 2024, our board of directors declared a quarterly

cash dividend of $0.21 per share on our outstanding Class A common

stock. The next quarterly dividend of $0.21 per share will be paid

on October 9, 2024 to holders of record of our Class A common stock

as of September 6, 2024.

Financial Overview

Our rental revenues for the three months ended June 30, 2024

decreased by 0.4%, to $610 million, as compared to the three months

ended June 30, 2023. Despite the growth of our fleet, our rental

revenues decreased as compared to the prior period in part due to

the sales of older aircraft with higher lease yields, and the

purchases of new aircraft, with lower initial lease yields. In

addition, we also experienced a decline in end of lease revenue of

approximately $13 million, as compared to the prior period

primarily due to fewer aircraft returns during the three months

ended June 30, 2024.

Our aircraft sales, trading and other revenues for the three

months ended June 30, 2024, decreased by 6%, to $58 million, as

compared to the three months ended June 30, 2023 primarily driven

by reduced gains from aircraft sales. We recorded $40 million in

gains from the sale of 11 aircraft for the three months ended June

30, 2024, compared to $45 million in gains from the sale of eight

aircraft for the three months ended June 30, 2023.

Our net income attributable to common stockholders for the three

months ended June 30, 2024, was $90 million, or $0.81 per diluted

share, as compared to $122 million, or $1.10 per diluted share, for

the three months ended June 30, 2023. The decrease from the prior

year period is primarily due to higher interest expense, driven by

the increase in our composite cost of funds and overall outstanding

debt balance, as well as the decline in our revenues, as discussed

above.

Adjusted net income before income taxes during the three months

ended June 30, 2024, was $137 million, or $1.23 per adjusted

diluted share, as compared to $176 million, or $1.58 per adjusted

diluted share, for the three months ended June 30, 2023. Adjusted

net income before income taxes decreased primarily due to higher

interest expense, driven by the increase in our composite cost of

funds and overall outstanding debt balance, as well as the decline

in our revenues as discussed above.

______________________

1 Aircraft in our sales pipeline is as of

June 30, 2024, adjusted for letters of intent signed through August

1, 2024.

Flight Equipment

Portfolio

As of June 30, 2024, the net book value of our fleet increased

to $26.8 billion, compared to $26.2 billion as of December 31,

2023. As of June 30, 2024, we owned 474 aircraft in our aircraft

portfolio, comprised of 354 narrowbody aircraft and 120 widebody

aircraft, and we managed 67 aircraft. The weighted average fleet

age and weighted average remaining lease term of flight equipment

subject to operating lease as of June 30, 2024 was 4.7 years and

6.9 years, respectively. We had a globally diversified customer

base comprised of 118 airlines in 59 countries as of June 30,

2024.

The following table summarizes the key portfolio metrics of our

fleet as of June 30, 2024 and December 31, 2023:

June 30, 2024

December 31, 2023

Net book value of flight equipment subject

to operating lease

$

26.8 billion

$

26.2 billion

Weighted-average fleet age(1)

4.7 years

4.6 years

Weighted-average remaining lease

term(1)

6.9 years

7.0 years

Owned fleet(2)

474

463

Managed fleet

67

78

Aircraft on order

307

334

Total

848

875

Current fleet contracted rentals

$

16.5 billion

$

16.4 billion

Committed fleet rentals

$

13.5 billion

$

14.6 billion

Total committed rentals

$

30.0 billion

$

31.0 billion

(1) Weighted-average fleet age and

remaining lease term calculated based on net book value of our

flight equipment subject to operating lease.

(2) As of June 30, 2024 and December 31,

2023, our owned fleet count included 18 and 14 aircraft classified

as flight equipment held for sale, respectively, and 13 and 12

aircraft classified as net investments in sales-type leases,

respectively, which are all included in Other assets on the

Consolidated Balance Sheet.

The following table details the regional concentration of our

flight equipment subject to operating leases:

June 30, 2024

December 31, 2023

Region

% of Net Book Value

% of Net Book Value

Europe

40.6

%

37.7

%

Asia Pacific

36.5

%

39.8

%

Central America, South America, and

Mexico

9.5

%

9.0

%

The Middle East and Africa

7.6

%

7.9

%

U.S. and Canada

5.8

%

5.6

%

Total

100.0

%

100.0

%

The following table details the composition of our owned fleet

by aircraft type:

June 30, 2024

December 31, 2023

Aircraft type

Number of

Aircraft

% of Total

Number of

Aircraft

% of Total

Airbus A220-100

4

0.8

%

2

0.4

%

Airbus A220-300

15

3.2

%

13

2.8

%

Airbus A319-100

1

0.2

%

1

0.2

%

Airbus A320-200

27

5.7

%

28

6.0

%

Airbus A320-200neo

23

4.9

%

25

5.4

%

Airbus A321-200

22

4.6

%

23

5.0

%

Airbus A321-200neo

104

21.9

%

95

20.6

%

Airbus A330-200(1)

13

2.7

%

13

2.8

%

Airbus A330-300

5

1.1

%

5

1.1

%

Airbus A330-900neo

23

4.9

%

23

5.0

%

Airbus A350-900

15

3.2

%

14

3.0

%

Airbus A350-1000

8

1.7

%

7

1.5

%

Boeing 737-700

3

0.6

%

3

0.6

%

Boeing 737-800

67

14.1

%

73

15.8

%

Boeing 737-8 MAX

57

12.0

%

52

11.2

%

Boeing 737-9 MAX

30

6.3

%

29

6.3

%

Boeing 777-200ER

1

0.2

%

1

0.2

%

Boeing 777-300ER

24

5.1

%

24

5.2

%

Boeing 787-9

25

5.3

%

25

5.4

%

Boeing 787-10

6

1.3

%

6

1.3

%

Embraer E190

1

0.2

%

1

0.2

%

Total(2)

474

100.0

%

463

100.0

%

(1) As of June 30, 2024 and December 31,

2023, aircraft count includes two Airbus A330-200 aircraft

classified as freighters.

(2) As of June 30, 2024 and December 31,

2023, our owned fleet count included 18 and 14 aircraft classified

as flight equipment held for sale, respectively, and 13 and 12

aircraft classified as net investments in sales-type leases,

respectively, which are all included in Other assets on the

Consolidated Balance Sheet.

Debt Financing

Activities

We ended the second quarter of 2024 with total debt financing,

net of discounts and issuance costs, of $19.7 billion. As of June

30, 2024, 88.3% of our total debt financing was at a fixed rate and

98.5% was unsecured. As of June 30, 2024, our composite cost of

funds was 3.99%. We ended the quarter with total liquidity of $8.2

billion.

As of the end of the periods presented, our debt portfolio was

comprised of the following components (dollars in millions, except

percentages):

June 30, 2024

December 31, 2023

Unsecured

Senior unsecured securities

$

17,493

$

16,330

Term financings

2,004

1,628

Revolving credit facility

90

1,100

Total unsecured debt financing

19,587

19,058

Secured

Export credit financing

197

205

Term financings

94

101

Total secured debt financing

291

306

Total debt financing

19,878

19,364

Less: Debt discounts and issuance

costs

(199

)

(181

)

Debt financing, net of discounts and

issuance costs

$

19,679

$

19,183

Selected interest rates and

ratios:

Composite interest rate(1)(2)

3.99

%

3.77

%

Composite interest rate on fixed-rate

debt(1)

3.63

%

3.26

%

Percentage of total debt at a

fixed-rate

88.34

%

84.71

%

(1) This rate does not include the effect

of upfront fees, facility fees, undrawn fees or amortization of

debt discounts and issuance costs.

(2) Our composite interest rate as of

March 31, 2024 was 4.03%.

Conference Call

In connection with this earnings release, Air Lease Corporation

will host a conference call on August 1, 2024 at 4:30 PM Eastern

Time to discuss the Company's financial results for the second

quarter of 2024.

Investors can participate in the conference call by dialing 1

(888) 596-4144 domestic or 1 (646) 968-2525 international. The

passcode for the call is 5952437.

The conference call will also be broadcast live through a link

on the Investors page of the Air Lease Corporation website at

www.airleasecorp.com. Please visit the website at least 15 minutes

prior to the call to register, download and install any necessary

audio software. A replay of the broadcast will be available on the

Investors page of the Air Lease Corporation website.

For your convenience, the conference call can be replayed in its

entirety beginning on August 1, 2024 until 11:59 PM ET on August 8,

2024. If you wish to listen to the replay of this conference call,

please dial 1 (800) 770-2030 domestic or 1 (647) 362-9199

international and enter passcode 5952437.

About Air Lease Corporation (NYSE: AL)

Air Lease Corporation is a leading global aircraft leasing

company based in Los Angeles, California that has airline customers

throughout the world. Air Lease Corporation and its team of

dedicated and experienced professionals are principally engaged in

purchasing new commercial aircraft and leasing them to its airline

customers worldwide through customized aircraft leasing and

financing solutions. Air Lease Corporation routinely posts

information that may be important to investors in the “Investors”

section of its website at www.airleasecorp.com. Investors and

potential investors are encouraged to consult Air Lease

Corporation’s website regularly for important information. The

information contained on, or that may be accessed through, Air

Lease Corporation’s website is not incorporated by reference into,

and is not a part of, this press release.

Forward-Looking Statements

This press release contains statements that constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Those statements appear

in a number of places in this press release and include statements

regarding, among other matters, the state of the airline industry,

our access to the capital and debt markets, the impact of aircraft

and engine delivery delays and manufacturing flaws, our aircraft

sales pipeline and expectations, and other macroeconomic conditions

and other factors affecting our financial condition or results of

operations. Words such as “can,” “could,” “may,” “predicts,”

“potential,” “will,” “projects,” “continuing,” “ongoing,”

“expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,”

“estimates” and “should,” and variations of these words and similar

expressions, are used in many cases to identify these

forward-looking statements. Any such forward-looking statements are

not guarantees of future performance and involve risks,

uncertainties, and other factors that may cause our actual results,

performance or achievements, or industry results to vary materially

from our future results, performance or achievements, or those of

our industry, expressed or implied in such forward-looking

statements. Such factors include, among others:

- our inability to obtain additional capital on favorable terms,

or at all, to acquire aircraft, service our debt obligations and

refinance maturing debt obligations;

- increases in our cost of borrowing, decreases in our credit

ratings, or changes in interest rates;

- our inability to generate sufficient returns on our aircraft

investments through strategic acquisition and profitable

leasing;

- the failure of an aircraft or engine manufacturer to meet its

contractual obligations to us, including or as a result of

manufacturing flaws and technical or other difficulties with

aircraft or engines before or after delivery;

- our ability to recover losses related to aircraft detained in

Russia, including through insurance claims and related

litigation;

- obsolescence of, or changes in overall demand for, our

aircraft;

- changes in the value of, and lease rates for, our aircraft,

including as a result of aircraft oversupply, manufacturer

production levels, our lessees’ failure to maintain our aircraft,

inflation, and other factors outside of our control;

- impaired financial condition and liquidity of our lessees,

including due to lessee defaults and reorganizations, bankruptcies

or similar proceedings;

- increased competition from other aircraft lessors;

- the failure by our lessees to adequately insure our aircraft or

fulfill their contractual indemnity obligations to us, or the

failure of such insurers to fulfill their contractual

obligations;

- increased tariffs and other restrictions on trade;

- changes in the regulatory environment, including changes in tax

laws and environmental regulations;

- other events affecting our business or the business of our

lessees and aircraft manufacturers or their suppliers that are

beyond our or their control, such as the threat or realization of

epidemic diseases, natural disasters, terrorist attacks, war or

armed hostilities between countries or non-state actors; and

- any additional factors discussed under “Part I — Item 1A. Risk

Factors,” in our Annual Report on Form 10-K for the year ended

December 31, 2023, and other Securities and Exchange Commission

(“SEC”) filings, including future SEC filings.

All forward-looking statements are necessarily only estimates of

future results, and there can be no assurance that actual results

will not differ materially from expectations. You are therefore

cautioned not to place undue reliance on such statements. Any

forward-looking statement speaks only as of the date on which it is

made, and we do not intend and undertake no obligation to update

any forward-looking information to reflect actual results or events

or circumstances after the date on which the statement is made or

to reflect the occurrence of unanticipated events.

Air Lease Corporation and

Subsidiaries

CONSOLIDATED BALANCE

SHEETS

(In thousands, except share

and par value amounts)

June 30, 2024

December 31, 2023

(unaudited)

Assets

Cash and cash equivalents

$

454,123

$

460,870

Restricted cash

1,533

3,622

Flight equipment subject to operating

leases

32,643,461

31,787,241

Less accumulated depreciation

(5,854,095

)

(5,556,033

)

26,789,366

26,231,208

Deposits on flight equipment purchases

1,131,899

1,203,068

Other assets

2,641,456

2,553,484

Total assets

$

31,018,377

$

30,452,252

Liabilities and Shareholders’

Equity

Accrued interest and other payables

$

916,998

$

1,164,140

Debt financing, net of discounts and

issuance costs

19,679,063

19,182,657

Security deposits and maintenance reserves

on flight equipment leases

1,654,107

1,519,719

Rentals received in advance

128,992

143,861

Deferred tax liability

1,331,971

1,281,837

Total liabilities

$

23,711,131

$

23,292,214

Shareholders’ Equity

Preferred Stock, $0.01 par value;

50,000,000 shares authorized; 10,600,000 (aggregate liquidation

preference of $850,000) shares issued and outstanding at June 30,

2024 and December 31, 2023, respectively

$

106

$

106

Class A common stock, $0.01 par value;

500,000,000 shares authorized; 111,376,884 and 111,027,252 shares

issued and outstanding at June 30, 2024 and December 31, 2023,

respectively

1,114

1,110

Class B Non-Voting common stock, $0.01 par

value; authorized 10,000,000 shares; no shares issued or

outstanding

—

—

Paid-in capital

3,294,959

3,287,234

Retained earnings

4,010,916

3,869,813

Accumulated other comprehensive income

151

1,775

Total shareholders’ equity

$

7,307,246

$

7,160,038

Total liabilities and shareholders’

equity

$

31,018,377

$

30,452,252

Air Lease Corporation and

Subsidiaries

CONSOLIDATED STATEMENTS OF

INCOME

(In thousands, except share,

per share amounts and percentages)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

(unaudited)

Revenues

Rental of flight equipment

$

609,505

$

611,733

$

1,223,834

$

1,229,506

Aircraft sales, trading and other

57,783

61,171

106,764

79,540

Total revenues

667,288

672,904

1,330,598

1,309,046

Expenses

Interest

190,004

172,174

371,599

323,786

Amortization of debt discounts and

issuance costs

13,292

13,646

26,401

26,719

Interest expense

203,296

185,820

398,000

350,505

Depreciation of flight equipment

281,982

268,586

559,242

528,266

Selling, general and administrative

45,432

45,832

93,175

93,447

Stock-based compensation expense

8,837

8,715

17,112

14,611

Total expenses

539,547

508,953

1,067,529

986,829

Income before taxes

127,741

163,951

263,069

322,217

Income tax expense

(24,795

)

(31,550

)

(52,257

)

(61,096

)

Net income

$

102,946

$

132,401

$

210,812

$

261,121

Preferred stock dividends

(12,508

)

(10,425

)

(22,933

)

(20,850

)

Net income attributable to common

stockholders

$

90,438

$

121,976

$

187,879

$

240,271

Earnings per share of common

stock:

Basic

$

0.81

$

1.10

$

1.69

$

2.16

Diluted

$

0.81

$

1.10

$

1.68

$

2.16

Weighted-average shares of common stock

outstanding

Basic

111,372,434

111,021,133

111,273,514

110,982,557

Diluted

111,740,821

111,239,004

111,712,719

111,307,049

Other financial data

Pre-tax margin

19.1

%

24.4

%

19.8

%

24.6

%

Pre-tax return on common equity (trailing

twelve months)

10.4

%

10.3

%

10.4

%

10.3

%

Adjusted net income before income

taxes(1)

$

137,362

$

175,887

$

283,649

$

342,697

Adjusted diluted earnings per share before

income taxes(1)

$

1.23

$

1.58

$

2.54

$

3.08

Adjusted pre-tax margin(1)

20.6

%

26.1

%

21.3

%

26.2

%

Adjusted pre-tax return on common equity

(trailing twelve months)(1)

10.8

%

11.2

%

10.8

%

11.2

%

(1)

Adjusted net income before income taxes

(defined as net income attributable to common stockholders

excluding the effects of certain non-cash items, one-time or

non-recurring items that are not expected to continue in the future

and certain other items), adjusted pre-tax margin (defined as

adjusted net income before income taxes divided by total revenues),

adjusted diluted earnings per share before income taxes (defined as

adjusted net income before income taxes divided by the weighted

average diluted common shares outstanding) and adjusted pre-tax

return on common equity (defined as adjusted net income before

income taxes divided by average common shareholders' equity) are

measures of operating performance that are not defined by GAAP and

should not be considered as an alternative to net income

attributable to common stockholders, pre-tax margin, earnings per

share, diluted earnings per share and pre-tax return on common

equity, or any other performance measures derived in accordance

with GAAP. Adjusted net income before income taxes, adjusted

pre-tax margin, adjusted diluted earnings per share before income

taxes and adjusted pre-tax return on common equity are presented as

supplemental disclosure because management believes they provide

useful information on our earnings from ongoing operations.

Management and our board of directors use

adjusted net income before income taxes, adjusted pre-tax margin,

adjusted diluted earnings per share before income taxes and

adjusted pre-tax return on common equity to assess our consolidated

financial and operating performance. Management believes these

measures are helpful in evaluating the operating performance of our

ongoing operations and identifying trends in our performance,

because they remove the effects of certain non-cash items, one-time

or non-recurring items that are not expected to continue in the

future and certain other items from our operating results. Adjusted

net income before income taxes, adjusted pre-tax margin, adjusted

diluted earnings per share before income taxes and adjusted pre-tax

return on common equity, however, should not be considered in

isolation or as a substitute for analysis of our operating results

or cash flows as reported under GAAP. Adjusted net income before

income taxes, adjusted pre-tax margin, adjusted diluted earnings

per share before income taxes and adjusted pre-tax return on common

equity do not reflect our cash expenditures or changes in our cash

requirements for our working capital needs. In addition, our

calculation of adjusted net income before income taxes, adjusted

pre-tax margin, adjusted diluted earnings per share before income

taxes and adjusted pre-tax return on common equity may differ from

the adjusted net income before income taxes, adjusted pre-tax

margin, adjusted diluted earnings per share before income taxes and

adjusted pre-tax return on common equity or analogous calculations

of other companies in our industry, limiting their usefulness as a

comparative measure.

The following table shows the

reconciliation of the numerator for adjusted pre-tax margin (in

thousands, except percentages):

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

(unaudited)

Reconciliation of the numerator for

adjusted pre-tax margin (net income attributable to common

stockholders to adjusted net income before income taxes):

Net income attributable to common

stockholders

$

90,438

$

121,976

$

187,879

$

240,271

Amortization of debt discounts and

issuance costs

13,292

13,646

26,401

26,719

Stock-based compensation expense

8,837

8,715

17,112

14,611

Income tax expense

24,795

31,550

52,257

61,096

Adjusted net income before income

taxes

$

137,362

$

175,887

$

283,649

$

342,697

Denominator for adjusted pre-tax

margin:

Total revenues

$

667,288

$

672,904

$

1,330,598

$

1,309,046

Adjusted pre-tax margin(a)

20.6

%

26.1

%

21.3

%

26.2

%

(a) Adjusted pre-tax margin is adjusted

net income before income taxes divided by total revenues

The following table shows the

reconciliation of the numerator for adjusted diluted earnings per

share before income taxes (in thousands, except share and per share

amounts):

Three Months Ended June

30,

Six Months Ended

June 30,

2024

2023

2024

2023

(unaudited)

Reconciliation of the numerator for

adjusted diluted earnings per share net income attributable to

common stockholders to adjusted net income before income

taxes):

Net income attributable to common

stockholders

$

90,438

$

121,976

$

187,879

$

240,271

Amortization of debt discounts and

issuance costs

13,292

13,646

26,401

26,719

Stock-based compensation expense

8,837

8,715

17,112

14,611

Income tax expense

24,795

31,550

52,257

61,096

Adjusted net income before income

taxes

$

137,362

$

175,887

$

283,649

$

342,697

Denominator for adjusted diluted

earnings per share:

Weighted-average diluted common shares

outstanding

111,740,821

111,239,004

111,712,719

111,307,049

Adjusted diluted earnings per share before

income taxes(b)

$

1.23

$

1.58

$

2.54

$

3.08

(b) Adjusted diluted earnings per share

before income taxes is adjusted net income before income taxes

divided by weighted-average diluted common shares outstanding

The following table shows the

reconciliation of pre-tax return on common equity to adjusted

pre-tax return on common equity (in thousands, except

percentages):

Trailing Twelve Months

Ended June 30,

2024

2023

(unaudited)

Reconciliation of the numerator for

adjusted pre-tax return on common equity (net income attributable

to common stockholders to adjusted net income before income

taxes):

Net income attributable to common

stockholders

$

520,530

$

475,113

Amortization of debt discounts and

issuance costs

53,734

53,363

Recovery of Russian fleet

(67,022

)

(30,877

)

Stock-based compensation expense

37,116

26,179

Income tax expense

130,175

123,419

Adjusted net income before income

taxes

$

674,533

$

647,197

Reconciliation of denominator for

pre-tax return on common equity to adjusted pre-tax return on

common equity:

Common shareholders' equity as of

beginning of the period

$

6,002,653

$

5,589,634

Common shareholders' equity as of end of

the period

$

6,457,246

$

6,002,653

Average common shareholders' equity

$

6,229,950

$

5,796,144

Adjusted pre-tax return on common

equity(c)

10.8

%

11.2

%

(c) Adjusted pre-tax return on common

equity is adjusted net income before income taxes divided by

average common shareholders’ equity

Air Lease Corporation and

Subsidiaries

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In thousands)

Six Months Ended June

30,

2024

2023

(unaudited)

Operating Activities

Net income

$

210,812

$

261,121

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation of flight equipment

559,242

528,266

Stock-based compensation expense

17,112

14,611

Deferred taxes

50,575

59,114

Amortization of prepaid lease costs

50,579

36,064

Amortization of discounts and debt

issuance costs

26,401

26,719

Gain on aircraft sales, trading and other

activity

(97,978

)

(86,838

)

Changes in operating assets and

liabilities:

Other assets

(25,377

)

7,028

Accrued interest and other payables

8,555

38,986

Rentals received in advance

(14,778

)

(4,172

)

Net cash provided by operating

activities

785,143

880,899

Investing Activities

Acquisition of flight equipment under

operating lease

(1,466,104

)

(2,416,609

)

Payments for deposits on flight equipment

purchases

(179,213

)

(134,825

)

Proceeds from aircraft sales, trading and

other activity

430,476

1,261,476

Acquisition of aircraft furnishings,

equipment and other assets

(191,952

)

(125,541

)

Net cash used in investing activities

(1,406,793

)

(1,415,499

)

Financing Activities

Cash dividends paid on Class A common

stock

(46,703

)

(44,382

)

Cash dividends paid on preferred stock

(22,933

)

(20,850

)

Tax withholdings on stock-based

compensation

(9,384

)

(3,354

)

Net change in unsecured revolving

facility

(1,010,000

)

(20,000

)

Proceeds from debt financings

3,024,408

1,538,087

Payments in reduction of debt

financings

(1,503,849

)

(1,287,880

)

Debt issuance costs

(7,534

)

(9,149

)

Security deposits and maintenance reserve

receipts

198,377

188,471

Security deposits and maintenance reserve

disbursements

(9,568

)

(5,925

)

Net cash provided by financing

activities

612,814

335,018

Net decrease in cash

(8,836

)

(199,582

)

Cash, cash equivalents and restricted cash

at beginning of period

464,492

780,017

Cash, cash equivalents and restricted cash

at end of period

$

455,656

$

580,435

Supplemental Disclosure of Cash Flow

Information

Cash paid during the period for interest,

including capitalized interest of $21,709 and $21,336 at June 30,

2024 and 2023, respectively

$

390,120

$

325,365

Cash paid for income taxes

$

21,313

$

5,573

Supplemental Disclosure of Noncash

Activities

Buyer furnished equipment, capitalized

interest and deposits on flight equipment purchases applied to

acquisition of flight equipment and other assets

$

351,720

$

552,058

Flight equipment subject to operating

leases reclassified to flight equipment held for sale

$

744,559

$

1,339,087

Flight equipment subject to operating

leases reclassified to investment in sales-type lease

$

33,629

$

—

Cash dividends declared on Class A common

stock, not yet paid

$

23,389

$

22,205

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731309412/en/

Investors: Jason Arnold Vice President, Investor

Relations Email: investors@airleasecorp.com

Media: Laura Woeste Senior Manager, Media and Investor

Relations Email: press@airleasecorp.com

Ashley Arnold Senior Manager, Media and Investor Relations

Email: press@airleasecorp.com

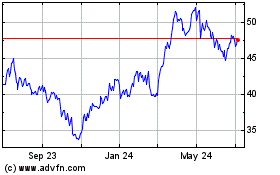

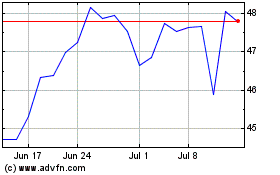

Air Lease (NYSE:AL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Air Lease (NYSE:AL)

Historical Stock Chart

From Nov 2023 to Nov 2024