false2021FY0001378789☐☐☐P9MP1MP3MP6MP1MP3MP6MP9Mhttp://fasb.org/us-gaap/2021-01-31#OtherAssetshttp://fasb.org/us-gaap/2021-01-31#OtherAssetsP1MP6MP10YP3MP10YP3MP5YP5YP5YP6MP12Mhttp://fasb.org/us-gaap/2021-01-31#AccountsPayableAndAccruedLiabilitiesCurrentAndNoncurrenthttp://fasb.org/us-gaap/2021-01-31#AccountsPayableAndAccruedLiabilitiesCurrentAndNoncurrenthttp://fasb.org/us-gaap/2021-01-31#LongTermDebthttp://fasb.org/us-gaap/2021-01-31#LongTermDebtP3Yoneone00013787892021-01-012021-12-310001378789dei:BusinessContactMember2021-01-012021-12-310001378789us-gaap:CommonStockMember2021-01-012021-12-310001378789aer:A5.875FixedRateResetJuniorSubordinatedNotesdue2079Member2021-01-012021-12-3100013787892021-12-31xbrli:sharesiso4217:USD00013787892020-12-31iso4217:EURxbrli:shares0001378789us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-12-310001378789us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2020-12-310001378789aer:BaseLeaseRentsMember2021-01-012021-12-310001378789aer:BaseLeaseRentsMember2020-01-012020-12-310001378789aer:BaseLeaseRentsMember2019-01-012019-12-310001378789aer:MaintenanceRentsAndOtherReceiptsMember2021-01-012021-12-310001378789aer:MaintenanceRentsAndOtherReceiptsMember2020-01-012020-12-310001378789aer:MaintenanceRentsAndOtherReceiptsMember2019-01-012019-12-3100013787892020-01-012020-12-3100013787892019-01-012019-12-31iso4217:USDxbrli:shares00013787892019-12-3100013787892018-12-310001378789aer:NonCashInvestingAndFinancingActivitiesMember2021-01-012021-12-310001378789aer:NonCashInvestingAndFinancingActivitiesMember2021-12-3100013787892021-11-012021-11-300001378789aer:NonCashInvestingAndFinancingActivitiesMember2020-01-012020-12-310001378789aer:NonCashInvestingAndFinancingActivitiesMember2020-12-310001378789aer:NorwegianAirShuttleASAMemberaer:NonCashInvestingAndFinancingActivitiesMember2020-05-012020-05-310001378789aer:NonCashInvestingAndFinancingActivitiesMember2019-01-012019-12-310001378789aer:NonCashInvestingAndFinancingActivitiesMember2019-12-310001378789us-gaap:CommonStockMember2018-12-310001378789us-gaap:AdditionalPaidInCapitalMember2018-12-310001378789us-gaap:TreasuryStockMember2018-12-310001378789us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310001378789us-gaap:RetainedEarningsMember2018-12-310001378789us-gaap:ParentMember2018-12-310001378789us-gaap:NoncontrollingInterestMember2018-12-310001378789us-gaap:RetainedEarningsMember2019-01-012019-12-310001378789us-gaap:NoncontrollingInterestMember2019-01-012019-12-310001378789us-gaap:TreasuryStockMember2019-01-012019-12-310001378789us-gaap:ParentMember2019-01-012019-12-310001378789us-gaap:CommonStockMember2019-01-012019-12-310001378789us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001378789us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001378789us-gaap:CommonStockMember2019-12-310001378789us-gaap:AdditionalPaidInCapitalMember2019-12-310001378789us-gaap:TreasuryStockMember2019-12-310001378789us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001378789us-gaap:RetainedEarningsMember2019-12-310001378789us-gaap:ParentMember2019-12-310001378789us-gaap:NoncontrollingInterestMember2019-12-310001378789us-gaap:RetainedEarningsMember2020-01-012020-12-310001378789us-gaap:NoncontrollingInterestMember2020-01-012020-12-310001378789us-gaap:TreasuryStockMember2020-01-012020-12-310001378789us-gaap:ParentMember2020-01-012020-12-310001378789us-gaap:CommonStockMember2020-01-012020-12-310001378789us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001378789us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310001378789us-gaap:ParentMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310001378789srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310001378789us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001378789us-gaap:CommonStockMember2020-12-310001378789us-gaap:AdditionalPaidInCapitalMember2020-12-310001378789us-gaap:TreasuryStockMember2020-12-310001378789us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001378789us-gaap:RetainedEarningsMember2020-12-310001378789us-gaap:ParentMember2020-12-310001378789us-gaap:NoncontrollingInterestMember2020-12-310001378789us-gaap:CommonStockMember2021-01-012021-12-310001378789us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001378789us-gaap:ParentMember2021-01-012021-12-310001378789us-gaap:RetainedEarningsMember2021-01-012021-12-310001378789us-gaap:NoncontrollingInterestMember2021-01-012021-12-310001378789us-gaap:TreasuryStockMember2021-01-012021-12-310001378789us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001378789us-gaap:CommonStockMember2021-12-310001378789us-gaap:AdditionalPaidInCapitalMember2021-12-310001378789us-gaap:TreasuryStockMember2021-12-310001378789us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001378789us-gaap:RetainedEarningsMember2021-12-310001378789us-gaap:ParentMember2021-12-310001378789us-gaap:NoncontrollingInterestMember2021-12-31aer:aircraftaer:engineaer:helicopter0001378789us-gaap:CommonStockMemberaer:GECapitalAviationServicesDue2023Member2021-11-012021-11-010001378789aer:GECapitalAviationServicesDue2023Member2021-11-012021-11-010001378789aer:GeneralElectricMemberaer:AerCapHoldingsNVMember2021-11-01xbrli:pure0001378789aer:GeneralElectricMember2021-11-01aer:numberOfDirectors0001378789srt:MinimumMemberaer:GECapitalAviationServicesDue2023Member2021-11-012021-11-010001378789srt:MaximumMemberaer:GECapitalAviationServicesDue2023Member2021-11-012021-11-010001378789aer:PassengerAircraftMember2021-01-012021-12-310001378789aer:PassengerAircraftMember2021-12-310001378789aer:FreighterAircraftMember2021-01-012021-12-310001378789aer:FreighterAircraftMember2021-12-310001378789aer:HelicoptersMember2021-01-012021-12-310001378789aer:HelicoptersMember2021-12-310001378789aer:EnginesMember2021-01-012021-12-310001378789aer:EnginesMember2021-12-31aer:segment0001378789aer:FloatingRateDebtMemberus-gaap:LondonInterbankOfferedRateLIBORMember2021-12-310001378789aer:FloatingRateDebtMemberaer:OneMonthLIBORMember2021-01-012021-12-310001378789aer:ThreeMonthLIBORMemberaer:FloatingRateDebtMember2021-01-012021-12-310001378789aer:FloatingRateDebtMemberaer:SixMonthLIBORMember2021-01-012021-12-310001378789aer:GECapitalAviationServicesDue2023Member2021-11-010001378789aer:GECapitalAviationServicesDue2023Member2021-10-292021-10-290001378789aer:GECapitalAviationServicesDue2023Member2021-10-290001378789us-gaap:UnsecuredDebtMemberaer:GECASAcquisitionSeniorNotesMemberaer:GECapitalAviationServicesDue2023Member2021-10-290001378789us-gaap:UnsecuredDebtMemberaer:GECASAcquisition1899SeniorUnsecuredNotesDue2025Memberaer:GECapitalAviationServicesDue2023Member2021-11-010001378789us-gaap:CommonStockMemberaer:GECapitalAviationServicesDue2023Member2021-11-112021-11-110001378789aer:GECapitalAviationServicesDue2023Memberaer:BankingFeesMember2021-01-012021-12-310001378789aer:ProfessionalFeesAndOtherExpensesMemberaer:GECapitalAviationServicesDue2023Member2021-01-012021-12-310001378789aer:GECapitalAviationServicesDue2023Memberaer:SeveranceAndOtherCompensationExpensesMember2021-01-012021-12-310001378789aer:GECapitalAviationServicesDue2023Member2021-01-012021-12-310001378789aer:GECapitalAviationServicesDue2023Member2021-11-012021-12-310001378789aer:GECapitalAviationServicesDue2023Member2020-01-012020-12-310001378789us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2021-12-310001378789aer:MaintenanceRightsAndLeasePremiumMember2021-01-012021-12-310001378789aer:MaintenanceRightsMember2020-12-310001378789aer:MaintenanceRightsMember2019-12-310001378789aer:MaintenanceRightsMemberaer:GECapitalAviationServicesDue2023Member2021-01-012021-12-310001378789aer:MaintenanceRightsMemberaer:GECapitalAviationServicesDue2023Member2020-01-012020-12-310001378789aer:MaintenanceRightsMember2021-01-012021-12-310001378789aer:MaintenanceRightsMember2020-01-012020-12-310001378789aer:MaintenanceRightsMember2021-12-310001378789aer:LeasePremiumsMember2021-01-012021-12-310001378789aer:LeasePremiumsMember2021-12-310001378789us-gaap:CustomerRelationshipsMember2021-12-310001378789us-gaap:CustomerRelationshipsMember2020-12-310001378789aer:OtherContractualIntangibleAssetsMember2021-12-310001378789aer:OtherContractualIntangibleAssetsMember2020-12-310001378789aer:CustomerRelationshipsAndOtherIntangibleAssetsMember2021-01-012021-12-310001378789us-gaap:CustomerRelationshipsMember2020-01-012020-12-310001378789us-gaap:CustomerRelationshipsMember2019-01-012019-12-310001378789us-gaap:CustomerRelationshipsMember2021-01-012021-12-310001378789aer:CustomerRelationshipsAndOtherIntangibleAssetsMember2021-12-310001378789aer:ShannonEngineSupportLtdMember2021-12-310001378789aer:ShannonEngineSupportLtdMember2020-12-310001378789aer:AerdragonMember2021-12-310001378789aer:AerdragonMember2020-12-310001378789aer:AerliftLeasingLtdMember2021-12-310001378789aer:AerliftLeasingLtdMember2020-12-310001378789aer:EinnVolantAircraftLeasingHoldingsLtdMember2021-12-310001378789aer:EinnVolantAircraftLeasingHoldingsLtdMember2020-12-310001378789aer:AcsalHoldcoLLCMember2021-12-310001378789aer:AcsalHoldcoLLCMember2020-12-310001378789aer:GileadAviationDesignedActivityCompanyMember2021-12-310001378789aer:GileadAviationDesignedActivityCompanyMember2020-12-310001378789aer:MubadalaInfrastructureInvestmentsLimitedMember2021-12-310001378789aer:MubadalaInfrastructureInvestmentsLimitedMember2020-12-310001378789srt:MaximumMember2021-12-310001378789aer:DeferralAgreementsMember2021-12-310001378789aer:DeferralAgreementsMember2020-12-310001378789aer:AircraftSaleReceivableMember2021-12-310001378789aer:AircraftSaleReceivableMember2020-12-310001378789aer:GeneralElectricMember2021-12-310001378789srt:MinimumMember2021-12-310001378789us-gaap:CashFlowHedgingMemberus-gaap:InterestRateCapMemberus-gaap:NondesignatedMember2021-12-310001378789us-gaap:CashFlowHedgingMemberus-gaap:InterestRateCapMemberus-gaap:NondesignatedMember2020-12-310001378789us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-12-310001378789us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001378789us-gaap:CashFlowHedgingMemberus-gaap:InterestRateCapMemberus-gaap:DesignatedAsHedgingInstrumentMember2021-12-310001378789us-gaap:CashFlowHedgingMemberus-gaap:InterestRateCapMemberus-gaap:DesignatedAsHedgingInstrumentMember2020-12-310001378789us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberus-gaap:NondesignatedMember2021-12-310001378789us-gaap:InterestRateSwapMemberus-gaap:CashFlowHedgingMemberus-gaap:NondesignatedMember2020-12-310001378789us-gaap:InterestRateSwapMember2021-01-012021-12-310001378789us-gaap:InterestRateSwapMember2020-01-012020-12-310001378789us-gaap:InterestRateSwapMember2019-01-012019-12-310001378789us-gaap:InterestRateCapMember2021-01-012021-12-310001378789us-gaap:InterestRateCapMember2020-01-012020-12-310001378789us-gaap:InterestRateCapMember2019-01-012019-12-310001378789aer:InterestRateCapsAndSwapsMember2021-01-012021-12-310001378789aer:InterestRateCapsAndSwapsMember2020-01-012020-12-310001378789aer:InterestRateCapsAndSwapsMember2019-01-012019-12-310001378789us-gaap:UnsecuredDebtMemberaer:ILFCLegacyNotesMember2021-12-310001378789us-gaap:UnsecuredDebtMemberaer:ILFCLegacyNotesMember2020-12-310001378789us-gaap:UnsecuredDebtMemberaer:AerCapTrustAICDCNotesMember2021-12-310001378789us-gaap:UnsecuredDebtMemberaer:AerCapTrustAICDCNotesMember2020-12-310001378789us-gaap:UnsecuredDebtMemberaer:AsiaAndCitiRevolvingCreditFacilitiesMember2021-12-310001378789us-gaap:UnsecuredDebtMemberaer:AsiaAndCitiRevolvingCreditFacilitiesMember2020-12-310001378789us-gaap:UnsecuredDebtMemberaer:OtherUnsecuredDebtMember2021-12-310001378789us-gaap:UnsecuredDebtMemberaer:OtherUnsecuredDebtMember2020-12-310001378789us-gaap:UnsecuredDebtMemberaer:UnsecuredDebtFairValueAdjustmentMember2021-12-310001378789us-gaap:UnsecuredDebtMemberaer:UnsecuredDebtFairValueAdjustmentMember2020-12-310001378789us-gaap:UnsecuredDebtMember2021-12-310001378789us-gaap:UnsecuredDebtMember2020-12-310001378789aer:ExportCreditFacilitiesMemberus-gaap:SecuredDebtMember2021-12-31aer:aircraftAndEngines0001378789aer:ExportCreditFacilitiesMemberus-gaap:SecuredDebtMember2020-12-310001378789aer:InstitutionalSecuredTermLoansMemberus-gaap:SecuredDebtMember2021-12-310001378789aer:InstitutionalSecuredTermLoansMemberus-gaap:SecuredDebtMember2020-12-310001378789aer:AerfundingRevolvingCreditFacilityMemberus-gaap:SecuredDebtMember2021-12-310001378789aer:AerfundingRevolvingCreditFacilityMemberus-gaap:SecuredDebtMember2020-12-310001378789us-gaap:SecuredDebtMemberaer:OtherSecuredDebtMember2021-12-310001378789us-gaap:SecuredDebtMemberaer:OtherSecuredDebtMember2020-12-310001378789aer:SecuredDebtFairValueAdjustmentMemberus-gaap:SecuredDebtMember2021-12-310001378789aer:SecuredDebtFairValueAdjustmentMemberus-gaap:SecuredDebtMember2020-12-310001378789us-gaap:SecuredDebtMember2021-12-310001378789us-gaap:SecuredDebtMember2020-12-310001378789aer:ECAPSSubordinatedDebtAndOtherNotesMemberus-gaap:SubordinatedDebtMember2021-12-310001378789aer:ECAPSSubordinatedDebtAndOtherNotesMemberus-gaap:SubordinatedDebtMember2020-12-310001378789us-gaap:SubordinatedDebtMemberaer:SubordinatedDebtVariableInterestEntitiesMember2021-12-310001378789us-gaap:SubordinatedDebtMemberaer:SubordinatedDebtVariableInterestEntitiesMember2020-12-310001378789us-gaap:SubordinatedDebtMemberaer:SubordinatedDebtFairValueAdjustmentMember2021-12-310001378789us-gaap:SubordinatedDebtMemberaer:SubordinatedDebtFairValueAdjustmentMember2020-12-310001378789us-gaap:SubordinatedDebtMember2021-12-310001378789us-gaap:SubordinatedDebtMember2020-12-310001378789aer:FloatingRateDebtMember2021-12-310001378789us-gaap:UnsecuredDebtMemberaer:AerCapTrustAICDCNotesMembersrt:MinimumMember2021-12-310001378789us-gaap:UnsecuredDebtMembersrt:MaximumMemberaer:AerCapTrustAICDCNotesMember2021-12-310001378789us-gaap:UnsecuredDebtMemberaer:AerCapTrustAICDCNotesMember2021-01-012021-12-310001378789us-gaap:UnsecuredDebtMemberaer:A175BillionGECASAcquisitionSeniorNotesDue2023Memberaer:GECapitalAviationServicesDue2023Member2021-10-290001378789us-gaap:UnsecuredDebtMemberaer:A325BillionGECASAcquisitionSeniorNotesDue2024Memberaer:GECapitalAviationServicesDue2023Member2021-10-290001378789us-gaap:UnsecuredDebtMemberaer:A10BillionGECASAcquisitionSeniorNotesDue2024Memberaer:GECapitalAviationServicesDue2023Member2021-10-290001378789us-gaap:UnsecuredDebtMemberaer:A375BillionGECASAcquisitionSeniorNotesDue2026Memberaer:GECapitalAviationServicesDue2023Member2021-10-290001378789us-gaap:UnsecuredDebtMemberaer:A375BillionGECASAcquisitionSeniorNotesDue2028Memberaer:GECapitalAviationServicesDue2023Member2021-10-290001378789us-gaap:UnsecuredDebtMemberaer:A40BillionGECASAcquisitionSeniorNotesDue2032Memberaer:GECapitalAviationServicesDue2023Member2021-10-290001378789us-gaap:UnsecuredDebtMemberaer:A15BillionGECASAcquisitionSeniorNotesDue2033Memberaer:GECapitalAviationServicesDue2023Member2021-10-290001378789us-gaap:UnsecuredDebtMemberaer:A15BillionGECASAcquisitionSeniorNotesDue2041Memberaer:GECapitalAviationServicesDue2023Member2021-10-290001378789us-gaap:UnsecuredDebtMemberaer:A500MillionGECASAcquisitionFloatingRateSeniorNotesDue2023Memberaer:GECapitalAviationServicesDue2023Member2021-10-290001378789us-gaap:UnsecuredDebtMemberaer:AsiaRevolverMember2018-03-310001378789us-gaap:UnsecuredDebtMemberaer:AsiaRevolverMember2021-08-310001378789us-gaap:UnsecuredDebtMemberaer:CitiRevolverIMember2019-10-310001378789us-gaap:UnsecuredDebtMemberaer:CitiRevolverIMember2019-10-012019-10-310001378789us-gaap:UnsecuredDebtMemberaer:CitiRevolverIIMember2021-03-300001378789aer:ExportCreditFacilitiesMembersrt:MinimumMemberus-gaap:SecuredDebtMember2021-01-012021-12-310001378789srt:MaximumMemberaer:ExportCreditFacilitiesMemberus-gaap:SecuredDebtMember2021-01-012021-12-310001378789us-gaap:SecuredDebtMemberaer:InstitutionalSecuredTermLoansSetantaFacilityMember2021-12-310001378789us-gaap:SecuredDebtMemberaer:InstitutionalSecuredTermLoansSetantaFacilityMember2020-12-310001378789aer:InstitutionalSecuredTermLoansHyperionFacilityMemberus-gaap:SecuredDebtMember2021-12-310001378789aer:InstitutionalSecuredTermLoansHyperionFacilityMemberus-gaap:SecuredDebtMember2020-12-310001378789aer:CeltagoCeltagoIIFacilitiesMemberus-gaap:SecuredDebtMember2021-12-310001378789aer:CeltagoCeltagoIIFacilitiesMemberus-gaap:SecuredDebtMember2020-12-310001378789aer:CesiumFacilityMemberus-gaap:SecuredDebtMember2021-12-310001378789aer:CesiumFacilityMemberus-gaap:SecuredDebtMember2020-12-310001378789us-gaap:SecuredDebtMemberaer:GoldfishFacilityMember2021-12-310001378789us-gaap:SecuredDebtMemberaer:GoldfishFacilityMember2020-12-310001378789us-gaap:SecuredDebtMemberaer:ScandiumMember2021-12-310001378789us-gaap:SecuredDebtMemberaer:ScandiumMember2020-12-310001378789aer:RhodiumFacilityMemberus-gaap:SecuredDebtMember2021-12-310001378789aer:RhodiumFacilityMemberus-gaap:SecuredDebtMember2020-12-310001378789us-gaap:SecuredDebtMemberaer:OtherSecuredFacilitiesMember2021-12-310001378789us-gaap:SecuredDebtMemberaer:OtherSecuredFacilitiesMember2020-12-310001378789us-gaap:SecuredDebtMemberaer:InstitutionalSecuredTermLoansSetantaFacilityMember2021-11-050001378789aer:Aerfunding1LimitedMemberaer:CharitableTrustMember2021-01-012021-12-310001378789aer:Aerfunding1LimitedMemberaer:AercapIrelandMember2021-01-012021-12-310001378789aer:TermLoanMemberaer:AerfundingRevolvingCreditFacilityMember2020-12-012020-12-310001378789aer:TermLoanMemberus-gaap:SubsequentEventMemberaer:AerfundingRevolvingCreditFacilityMember2022-03-012022-03-310001378789aer:SubordinatedDebtNotesMemberaer:ECAPSSubordinatedNotesMember2021-12-310001378789aer:SubordinatedDebtNotesMemberaer:ECAPSSubordinatedNotesMember2020-12-310001378789aer:SubordinatedDebtNotesMemberaer:A2045SubordinatedNotesMember2021-12-310001378789aer:SubordinatedDebtNotesMemberaer:A2045SubordinatedNotesMember2020-12-310001378789aer:SubordinatedDebtNotesMemberaer:A2079SubordinatedNotesMember2021-12-310001378789aer:SubordinatedDebtNotesMemberaer:A2079SubordinatedNotesMember2020-12-310001378789aer:SubordinatedDebtNotesMember2021-12-310001378789aer:SubordinatedDebtNotesMember2020-12-310001378789us-gaap:SubordinatedDebtMemberaer:ECAPSSubordinatedNotesMember2005-12-310001378789aer:SubordinatedDebtTrancheTwoMemberus-gaap:SubordinatedDebtMember2005-12-310001378789aer:SubordinatedDebtTrancheOneMemberus-gaap:SubordinatedDebtMember2005-12-310001378789aer:SubordinatedDebtTrancheTwoMemberus-gaap:SubordinatedDebtMember2005-12-012005-12-310001378789aer:SubordinatedDebtTrancheOneMemberus-gaap:SubordinatedDebtMember2005-12-012005-12-310001378789aer:ThreeMonthLIBORMemberus-gaap:SubordinatedDebtMemberaer:ECAPSSubordinatedNotesMember2005-12-012005-12-310001378789aer:TenYearConstantMaturityUSTreasuryMemberus-gaap:SubordinatedDebtMemberaer:ECAPSSubordinatedNotesMember2005-12-012005-12-310001378789us-gaap:SubordinatedDebtMemberaer:ThirtyYearConstantMaturityUSTreasuryMemberaer:ECAPSSubordinatedNotesMember2005-12-012005-12-310001378789us-gaap:SubordinatedDebtMemberaer:A2045JuniorSubordinatedNotesMember2015-06-3000013787892015-06-012015-06-300001378789us-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:SubordinatedDebtMemberaer:A2045JuniorSubordinatedNotesMember2015-06-012015-06-300001378789us-gaap:SubordinatedDebtMemberaer:A2045JuniorSubordinatedNotesMember2015-06-012015-06-30aer:deferralPeriod0001378789us-gaap:SubordinatedDebtMemberaer:A2079JuniorSubordinatedNotesMember2019-10-3100013787892019-10-012019-10-310001378789us-gaap:SubordinatedDebtMemberus-gaap:UsTreasuryUstInterestRateMemberaer:A2079JuniorSubordinatedNotesMember2019-10-012019-10-310001378789aer:CitiBridgeCreditFacilityMemberus-gaap:BridgeLoanMember2021-03-310001378789aer:CitiBridgeCreditFacilityMemberus-gaap:BridgeLoanMember2021-03-302021-03-300001378789aer:CitiTermLoanCreditAgreementMemberus-gaap:LineOfCreditMember2021-03-310001378789aer:CitiTermLoanCreditAgreementMemberus-gaap:LineOfCreditMember2021-03-302021-03-300001378789aer:CitiTermLoanCreditAgreementMemberus-gaap:LineOfCreditMember2021-11-010001378789country:IE2021-01-012021-12-310001378789country:IE2020-01-012020-12-310001378789country:IE2019-01-012019-12-310001378789country:US2021-01-012021-12-310001378789country:US2020-01-012020-12-310001378789country:US2019-01-012019-12-310001378789us-gaap:ForeignCountryMember2021-01-012021-12-310001378789us-gaap:ForeignCountryMember2020-01-012020-12-310001378789us-gaap:ForeignCountryMember2019-01-012019-12-310001378789country:IE2021-12-310001378789country:US2021-12-310001378789us-gaap:ForeignCountryMember2021-12-310001378789country:IE2020-12-310001378789country:US2020-12-310001378789us-gaap:ForeignCountryMember2020-12-310001378789country:IEaer:NoExpirationDateMember2021-12-31aer:company0001378789aer:Between2035And2038Membercountry:US2021-12-310001378789aer:NoExpirationDateMembercountry:US2021-12-3100013787892019-11-3000013787892020-01-310001378789aer:EquityIncentivePlanTwoThousandTwelveMember2012-03-310001378789aer:EquityIncentivePlanTwoThousandFourteenMember2014-05-140001378789aer:EquityIncentivePlanTwoThousandFourteenMember2021-12-310001378789aer:NvEquityPlanMembersrt:MinimumMember2021-01-012021-12-310001378789srt:MaximumMemberaer:NvEquityPlanMember2021-01-012021-12-310001378789aer:NvEquityPlanMember2021-01-012021-12-310001378789aer:TimeBasedRestrictedStockUnitsAndRestrictedStocksMember2020-12-310001378789aer:PeformanceBasedRestrictedStockUnitsAndRestrictedStocksMember2020-12-310001378789aer:TimeBasedRestrictedStockUnitsAndRestrictedStocksMember2021-01-012021-12-310001378789aer:PeformanceBasedRestrictedStockUnitsAndRestrictedStocksMember2021-01-012021-12-310001378789aer:TimeBasedRestrictedStockUnitsAndRestrictedStocksMember2021-12-310001378789aer:PeformanceBasedRestrictedStockUnitsAndRestrictedStocksMember2021-12-310001378789aer:NvEquityPlanMemberus-gaap:RestrictedStockMember2021-01-012021-12-310001378789aer:NvEquityPlanExecutivesMemberus-gaap:RestrictedStockMember2021-01-012021-12-310001378789aer:NvEquityPlanExecutivesMemberus-gaap:RestrictedStockMember2021-12-310001378789aer:FirstMilestoneMemberaer:NvEquityPlanExecutivesMemberus-gaap:RestrictedStockMember2021-12-310001378789aer:FirstMilestoneMemberaer:NvEquityPlanExecutivesMemberus-gaap:RestrictedStockMember2021-01-012021-12-310001378789aer:NvEquityPlanExecutivesMemberus-gaap:RestrictedStockMemberaer:SecondMilestoneMember2021-12-310001378789aer:NvEquityPlanExecutivesMemberus-gaap:RestrictedStockMemberaer:SecondMilestoneMember2021-01-012021-12-310001378789us-gaap:RestrictedStockUnitsRSUMemberaer:NvEquityPlanMember2021-01-012021-12-310001378789aer:LapsedRestrictionsOnRestrictedStocksMemberaer:NvEquityPlanMember2021-01-012021-12-310001378789us-gaap:ShareBasedCompensationAwardTrancheOneMember2021-12-310001378789us-gaap:ShareBasedCompensationAwardTrancheTwoMember2021-12-310001378789us-gaap:ShareBasedCompensationAwardTrancheThreeMember2021-12-310001378789aer:ShareBasedCompensationAwardTrancheFourMember2021-12-310001378789aer:ShareBasedCompensationAwardTrancheFiveMember2021-12-310001378789aer:AercapGECASPlanMember2021-12-310001378789aer:ActivesMember2021-12-31aer:employee0001378789aer:FrozenActivesMember2021-12-310001378789aer:DeferredsMember2021-12-310001378789aer:PensionersMember2021-12-3100013787892021-11-012021-12-3100013787892021-11-010001378789us-gaap:DefinedBenefitPlanDebtSecurityMember2021-12-310001378789us-gaap:DefinedBenefitPlanEquitySecuritiesMember2021-12-310001378789aer:DefinedBenefitPlanOtherMember2021-12-310001378789country:CN2021-01-012021-12-310001378789country:CNus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueSegmentMember2021-01-012021-12-310001378789country:CN2020-01-012020-12-310001378789country:CNus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueSegmentMember2020-01-012020-12-310001378789country:CN2019-01-012019-12-310001378789country:CNus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueSegmentMember2019-01-012019-12-310001378789country:US2021-01-012021-12-310001378789country:USus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueSegmentMember2021-01-012021-12-310001378789country:US2020-01-012020-12-310001378789country:USus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueSegmentMember2020-01-012020-12-310001378789country:US2019-01-012019-12-310001378789country:USus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueSegmentMember2019-01-012019-12-310001378789aer:OtherCountriesMember2021-01-012021-12-310001378789aer:OtherCountriesMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueSegmentMember2021-01-012021-12-310001378789aer:OtherCountriesMember2020-01-012020-12-310001378789aer:OtherCountriesMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueSegmentMember2020-01-012020-12-310001378789aer:OtherCountriesMember2019-01-012019-12-310001378789aer:OtherCountriesMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueSegmentMember2019-01-012019-12-310001378789us-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueSegmentMember2021-01-012021-12-310001378789us-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueSegmentMember2020-01-012020-12-310001378789us-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueSegmentMember2019-01-012019-12-310001378789country:CN2021-12-310001378789country:CNus-gaap:GeographicConcentrationRiskMemberaer:LongLivedAssetsMember2021-01-012021-12-310001378789country:CN2020-12-310001378789country:CNus-gaap:GeographicConcentrationRiskMemberaer:LongLivedAssetsMember2020-01-012020-12-310001378789country:US2021-12-310001378789country:USus-gaap:GeographicConcentrationRiskMemberaer:LongLivedAssetsMember2021-01-012021-12-310001378789country:US2020-12-310001378789country:USus-gaap:GeographicConcentrationRiskMemberaer:LongLivedAssetsMember2020-01-012020-12-310001378789aer:OtherCountriesMember2021-12-310001378789aer:OtherCountriesMemberus-gaap:GeographicConcentrationRiskMemberaer:LongLivedAssetsMember2021-01-012021-12-310001378789aer:OtherCountriesMember2020-12-310001378789aer:OtherCountriesMemberus-gaap:GeographicConcentrationRiskMemberaer:LongLivedAssetsMember2020-01-012020-12-310001378789us-gaap:GeographicConcentrationRiskMemberaer:LongLivedAssetsMember2021-01-012021-12-310001378789us-gaap:GeographicConcentrationRiskMemberaer:LongLivedAssetsMember2020-01-012020-12-310001378789aer:InvestmentInFinanceLeasesMember2020-12-310001378789us-gaap:NotesReceivableMember2020-12-310001378789us-gaap:LoansReceivableMember2020-12-310001378789aer:InvestmentInFinanceLeasesMember2021-01-012021-12-310001378789us-gaap:NotesReceivableMember2021-01-012021-12-310001378789us-gaap:LoansReceivableMember2021-01-012021-12-310001378789aer:InvestmentInFinanceLeasesMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2020-12-310001378789us-gaap:NotesReceivableMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2020-12-310001378789us-gaap:LoansReceivableMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2020-12-310001378789srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2020-12-310001378789aer:InvestmentInFinanceLeasesMember2021-12-310001378789us-gaap:NotesReceivableMember2021-12-310001378789us-gaap:LoansReceivableMember2021-12-310001378789aer:COVID19PandemicGECASTransactionMember2021-01-012021-12-31aer:category0001378789aer:CategoryAMember2021-12-310001378789aer:CategoryBMember2021-12-310001378789aer:CategoryCMember2021-12-310001378789aer:AerCapPartnersIAndAercapPartners767Memberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-01-012021-12-310001378789aer:DeucalionAviationFundsMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMemberaer:AerCapPartnersIAndAercapPartners767Member2021-01-012021-12-310001378789aer:AercapPartnersIHoldingLimitedMemberus-gaap:VariableInterestEntityPrimaryBeneficiaryMember2021-12-310001378789aer:AercapPartnersIHoldingLimitedMembersrt:ParentCompanyMember2021-12-310001378789aer:AercapPartnersIHoldingLimitedMemberaer:DeucalionAviationFundsMember2021-12-310001378789us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberaer:AercapPartners767HoldingLimitedMember2021-01-012021-12-310001378789us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberaer:AercapPartners767HoldingLimitedMember2020-12-310001378789srt:ParentCompanyMemberaer:AercapPartners767HoldingLimitedMember2020-12-310001378789aer:DeucalionAviationFundsMemberaer:AercapPartners767HoldingLimitedMember2020-12-310001378789us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberaer:Aerfunding1LimitedMember2021-12-310001378789us-gaap:VariableInterestEntityPrimaryBeneficiaryMemberaer:Aerfunding1LimitedMember2021-01-012021-12-310001378789aer:GeneralElectricMemberaer:AerCapHoldingsNVMember2021-11-010001378789aer:GeneralElectricMember2021-01-012021-12-310001378789aer:SESMember2021-12-310001378789aer:SESMember2021-01-012021-12-310001378789srt:OfficerMember2021-01-012021-12-310001378789us-gaap:CapitalAdditionsMember2021-01-012021-12-310001378789aer:EnginesHelicoptersMember2021-01-012021-12-310001378789us-gaap:FlightEquipmentMemberus-gaap:CapitalAdditionsMember2021-12-310001378789us-gaap:FlightEquipmentMemberus-gaap:CapitalAdditionsMember2021-01-012021-12-310001378789aer:AircraftMemberaer:VaspLitigationMember1992-12-310001378789aer:VaspLitigationMemberaer:EnginesMember1992-12-310001378789aer:VaspLitigationMember2017-01-012017-12-310001378789aer:VASPLitigationEnglishCourtMemberaer:VaspLitigationMember2006-01-012006-12-310001378789aer:VaspLitigationMemberaer:VASPLitigationIrishCourtMember2006-01-012006-12-310001378789aer:VASPLitigationEnglishCourtMemberaer:VaspLitigationMember2008-01-012008-12-310001378789aer:VaspLitigationMemberaer:VASPLitigationIrishCourtMember2008-01-012008-12-310001378789aer:TransbrasilLitigationMember2011-07-012011-07-31aer:claim0001378789aer:TransbrasilLitigationMemberaer:StatutoryPenaltiesMember2011-07-012011-07-310001378789aer:TransbrasilLitigationMember2011-07-310001378789aer:TransbrasilLitigationMember2013-10-012013-10-310001378789aer:RecoveryofAttorneysFeesMemberaer:TransbrasilLitigationMember2011-07-012011-07-310001378789aer:IndemnityClaimMemberaer:TransbrasilLitigationMember2011-07-012011-07-310001378789us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001378789us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001378789us-gaap:FairValueMeasurementsRecurringMember2021-12-310001378789us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2021-12-310001378789us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2021-12-310001378789us-gaap:FairValueMeasurementsRecurringMember2020-12-310001378789us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2020-12-310001378789us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2020-12-310001378789us-gaap:MeasurementInputDiscountRateMemberus-gaap:IncomeApproachValuationTechniqueMember2021-12-310001378789aer:MeasurementInputNonContractualCashFlowsMemberus-gaap:IncomeApproachValuationTechniqueMember2021-12-310001378789us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsNonrecurringMember2021-12-310001378789us-gaap:CarryingReportedAmountFairValueDisclosureMember2021-12-310001378789us-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310001378789us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310001378789us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310001378789us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310001378789us-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310001378789us-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001378789us-gaap:FairValueInputsLevel1Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001378789us-gaap:FairValueInputsLevel2Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001378789us-gaap:FairValueInputsLevel3Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001378789us-gaap:SubsequentEventMembercountry:RU2022-02-230001378789country:RU2021-12-310001378789aer:ShannonEngineSupportLtdMemberus-gaap:SubsequentEventMembercountry:RU2022-02-230001378789us-gaap:SubsequentEventMembercountry:UA2022-02-230001378789country:UA2021-12-310001378789us-gaap:SubsequentEventMembercountry:UA2022-03-300001378789aer:BaseLeaseRentsMembercountry:RU2021-01-012021-12-310001378789us-gaap:SubsequentEventMembercountry:RU2022-03-300001378789country:RUaer:RepossessedRussianAssetsMember2021-12-310001378789us-gaap:SubsequentEventMember2022-02-240001378789us-gaap:SubsequentEventMember2022-02-242022-03-30aer:financialInstitution0001378789us-gaap:SubsequentEventMemberus-gaap:InsuranceClaimsMember2022-02-24

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

AerCap Holdings N.V. (together with its subsidiaries, “AerCap,” “we,” “us” or the “Company”) completed the acquisition of the GE Capital Aviation Services (“GECAS”) business from General Electric (“GE”) on November 1, 2021 (the “Closing Date”). We refer to this acquisition as the “GECAS Transaction.” Under the terms of the transaction agreement, GE received 111.5 million newly issued AerCap shares, $23 billion of cash and $1 billion of AerCap senior notes. Immediately following the completion of the GECAS Transaction, GE held approximately 46% of AerCap’s issued and outstanding ordinary shares.

RISK FACTORS

Summary Risk Factors

Risks related to the GECAS Transaction

•The GECAS Transaction may not be successful and we may not achieve its anticipated benefits. In particular, we may not successfully realize anticipated growth or cost-savings opportunities or successfully integrate our business and operations with those of the GECAS business.

•The GECAS Transaction may prove disruptive and could result in the combined business failing to meet our expectations.

•We have incurred a substantial amount of debt to complete the GECAS Transaction, which has significantly increased our indebtedness and debt service obligations, increasing risks relating to our substantial level of indebtedness.

•The GECAS Transaction could adversely impact our relationship with our customers and may result in the departure of key personnel.

•Investors who were holding our ordinary shares immediately prior to the completion of the GECAS Transaction, in the aggregate, have a significantly reduced ownership and voting interest in us due to the completion of the GECAS Transaction and exercise less influence over management.

•Sales by GE of our ordinary shares issued to GE in connection with the GECAS Transaction may negatively affect the market price of our ordinary shares.

Risks related to disease, natural disasters, terrorist attacks and other world events

•The Covid-19 pandemic may continue to have a material and adverse impact on the aviation industry and our business.

•Global or regional public health developments, extreme weather or natural disasters or other force majeure events may adversely affect the demand for air travel, the financial condition of our lessees and the aviation industry more broadly, and ultimately our financial condition, results and cash flows.

•The effects of terrorist attacks and the threat of terrorist attacks, war or armed hostilities may adversely affect the financial condition of the airline industry.

•We expect the Russian invasion of Ukraine and the impact of resulting sanctions by the United States, the European Union, the United Kingdom and other countries to adversely affect our business and financial condition, results and cash flows.

Risks relating to our funding and liquidity

•We require significant capital to fund our business and service our debt, and changes in the availability of capital or in the interest rates we pay on our debt may affect our operations or financial results.

•We have a substantial level of indebtedness and we might incur significantly more debt, which could adversely impact our operating flexibility and subject us to covenants that impose restrictions that may affect our ability to operate our business.

Risks relating to market demand for, and lease rates and value of, flight equipment in our fleet

•Our business depends heavily on the level of demand for the flight equipment in our fleet, which may decline as a result of factors outside our control, thereby affecting the returns on our flight equipment investments.

•Our operations depend on flight equipment manufacturers, whose behavior may change in ways that adversely affect the lease rates and value of flight equipment in our fleet or our results of operations more broadly.

•If a decline in demand for certain flight equipment causes a decline in their projected lease rates, or if we dispose of flight equipment for a price that is less than their depreciated book value on our balance sheet, then we will recognize impairments or make fair value adjustments.

Risks related to the financial strength of our lessees

•Our financial condition depends, in part, on the financial strength of our lessees, and factors outside of our control may adversely affect our lessees’ operations, their ability to meet their payment obligations to us or their demand for our flight equipment.

•Airline bankruptcy proceedings or reorganizations may limit our ability to collect lease rentals and other payments, depress flight equipment market values and adversely affect our ability to re-lease or sell flight equipment at favorable rates, if at all, particularly where such proceedings involve our lessees.

Risks related to our relationship with our lessees

•We have limited control over the operation of our flight equipment while they are under lease and we depend on our lessees to properly maintain and insure our flight equipment, which may expose us to additional and unexpected costs.

•If our lessees encounter financial difficulties and we restructure or terminate our leases, our ability to re-lease flight equipment on favorable lease terms, collect outstanding amounts due to us, and repossess flight equipment under defaulted leases may be limited and require us to incur additional costs and expenses.

Risks related to competition and the aviation industry

•We face significant competition and our business may be adversely affected if market participants change as a result of restructuring or bankruptcies, mergers and acquisitions, or new entities entering or exiting the industry, or if existing competitors enter into new or different market segments.

•We rely on a small number of manufacturers for the supply of commercial flight equipment, and any disruption in these manufacturers’ operating abilities may cause us to experience delivery delays on our flight equipment orders. We may experience additional delivery delays and associated costs if flight equipment manufacturers deliver flight equipment that fail to meet our lessees’ expectations or the requirements of air travel regulators.

Risks related to the geopolitical, regulatory and legal exposure of our business

•We are exposed to geopolitical, economic and legal risks associated with the international operations of our business and those of our lessees, including many of the economic and political risks associated with emerging markets. We are exposed to concentrated political and economic risks in certain geographical regions in which our lessees are concentrated, particularly China.

•Our assets are subject to various environmental regulations and concerns that may be supplemented by additional regulations and requirements or become more stringent, which may negatively affect our operations.

Risks related to our IT, structure and taxation

•We depend on our information technology systems and those of third-parties, and our business may suffer if they are damaged or interrupted, including by cyberattack.

•We are incorporated in the Netherlands and it may be difficult to obtain or enforce judgments against us or our executive officers, some of our directors and some of our named experts in the United States.

•We are subject to taxation regimes in various jurisdictions, and we may become subject to additional taxes in those jurisdictions, taxes in other jurisdictions, or experience changes in our tax status in certain jurisdictions, which may affect the effective tax rates that we are subject to and the results of our operations.

Risks related to the GECAS Transaction

The GECAS Transaction may not be successful and we may not achieve its anticipated benefits. In particular, we may not successfully realize anticipated growth or cost-savings opportunities or successfully integrate our business and operations with those of the GECAS business.

Now that the GECAS Transaction has been completed, we have significantly more revenue, expenses, assets and employees than we did prior to the GECAS Transaction. In the GECAS Transaction, we have assumed all of the liabilities and other obligations of GECAS. Additionally, our management has expended, and will continue to expend, significant time and resources in connection with the GECAS Transaction, and we have incurred, and will continue to incur, significant legal, advisory and financial services fees related to the GECAS Transaction. We may not successfully or cost-effectively integrate GECAS’s business and operations into our business and operations. Even if we are able to integrate GECAS’s business and operations successfully, our future operations and cash flows will depend largely upon our ability to operate the combined company efficiently and this integration may not result in the realization of the full benefits of the growth opportunities, cost-savings or synergies that we currently expect from the GECAS Transaction within the anticipated time frame, or at all.

The GECAS Transaction may prove disruptive and could result in the combined business failing to meet our expectations.

The process of integrating our operations with GECAS may require a disproportionate amount of resources and management attention. Our management team may encounter unforeseen difficulties in managing the integration. In order to successfully combine AerCap and GECAS and operate the combined business, our management team will need to focus on realizing anticipated synergies and cost savings on a timely basis while maintaining the efficiency of our operations. Any substantial diversion of management attention to difficulties in operating the combined business could affect our revenues and ability to achieve operational, financial and strategic objectives.

We have incurred a substantial amount of debt to complete the GECAS Transaction, which has significantly increased our indebtedness and debt service obligations, increasing risks relating to our substantial level of indebtedness.

As of December 31, 2021, the principal amount of our outstanding indebtedness, which excluded debt issuance costs, debt discounts and debt premium of $344 million, was $50.5 billion. To finance the cash portion of the consideration for the GECAS Transaction, we have incurred $24 billion of additional long-term debt, including $1 billion of additional debt issued to GE as additional consideration for the GECAS Transaction. Our ability to make payments on our debt, fund our other liquidity needs, and make planned capital expenditures will depend on the combined company’s ability to generate cash in the future. We cannot guarantee that the combined company will generate sufficient cash or that we will have alternative measures available to us to meet our debt obligations. The substantial level of our indebtedness after giving effect to the GECAS Transaction may limit our ability to raise additional financing on favorable terms or at all in the future, limit our flexibility in planning for, or reacting to, changes in our business or industry or make us more vulnerable to downturns in our business, our industry or the economy in general, in ways that could negatively affect the price of our ordinary shares as well as our business and financial condition.

The GECAS Transaction could adversely impact our relationship with our customers and may result in the departure of key personnel.

The GECAS Transaction could cause disruptions to our business. For example, our customers may refrain from leasing or re-leasing our aircraft until they determine whether the GECAS Transaction will affect our business, including, but not limited to, the pricing of our leases, the availability of certain aircraft, and our customer support. Our customers may also choose to lease aircraft and purchase services from our competitors until they determine whether the GECAS Transaction will affect our business or our relationship with them. Uncertainty concerning potential changes to us and our business could also harm our ability to enter into agreements with new customers. In addition, key personnel may depart for a variety of reasons, including perceived uncertainty regarding the effect of the GECAS Transaction on their employment.

Investors who were holding our ordinary shares immediately prior to the completion of the GECAS Transaction, in the aggregate, have a significantly reduced ownership and voting interest in us due to the completion of the GECAS Transaction and exercise less influence over management.

Investors holding our ordinary shares immediately prior to the completion of the GECAS Transaction, in the aggregate, owned a significantly smaller percentage of the combined company immediately after the completion of the GECAS Transaction. Immediately following the completion of the GECAS Transaction, GE held approximately 46% of our issued and outstanding ordinary shares, and our existing shareholders held approximately 54% of our issued and outstanding ordinary shares. The ordinary shares received by GE are subject to certain voting restrictions and standstill provisions. Furthermore, pursuant to the terms of the shareholders’ agreement, GE is entitled to nominate two directors for election to our Board of Directors. Consequently, existing shareholders, collectively, are able to exercise less influence over the management and policies of the combined company than they were able to exercise over the management and our policies immediately prior to the completion of the GECAS Transaction.

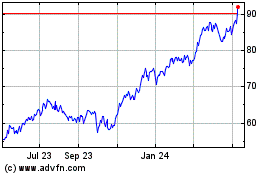

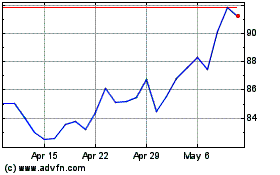

Sales by GE of our ordinary shares issued to GE in connection with the GECAS Transaction may negatively affect the market price of our ordinary shares.

The ordinary shares issued to GE pursuant to the GECAS Transaction are subject to a lock-up period that will expire in stages over a nine to 15 month period following the completion of the GECAS Transaction on November 1, 2021. Sales by GE of these ordinary shares, or the perception in the market that those sales could occur following the expiration of the lock-up period, may negatively affect the price of our ordinary shares.

Risks related to disease, natural disasters, terrorist attacks and other world events

The Covid-19 pandemic may continue to have a material and adverse impact on our business.

On March 11, 2020, the World Health Organization declared that the Covid-19 outbreak was a pandemic. The Covid-19 pandemic and responsive government actions have caused significant economic disruption and a dramatic reduction in commercial airline traffic, resulting in a broad adverse impact on air travel, the aviation industry and demand for commercial aircraft globally, all of which has impacted our results of operations. The continued impact of the Covid-19 pandemic on our business will depend, among other things, on the duration of the pandemic and the speed and effectiveness of vaccination efforts; the rate of recovery in air travel and the aviation industry, including the future demand for commercial aircraft; and global economic conditions.

We have agreed with many of our lessees to defer rent obligations and if the financial condition of our customers remains weak or weakens further, we may grant further accommodations.

If we determine that the collectability of lessee rental payments is no longer probable (including any deferral thereof), we are then required to recognize rental revenues using a cash accounting method rather than an accrual method. In the period we conclude that collection of lease payments is no longer probable, we recognize any difference between revenue amounts recognized to date under the accrual method and payments that have been collected from the lessee, including security deposit amounts held, as a current period adjustment to lease revenue. Subsequently, we recognize revenues based on the lesser of the straight-line rental income and the lease payments collected from the lessee until such time that collection is probable, which could materially reduce our reported revenue. During the year ended December 31, 2021, we recognized rent payments from a number of our lessees using the cash method, which resulted in a decrease in basic lease rents of $296 million. If the financial condition of any additional lessees worsens, we may determine to recognize rent payments from these lessees using the cash method, which could, in future periods, further decrease basic lease rents.

Many national governments have provided financial assistance to airlines. In some cases, governments have imposed conditions on airline recipients of assistance, and governments may also impose conditions on any future assistance, such as requiring airlines to remove less environmentally friendly aircraft from their fleets or obtain concessions from their creditors, including aircraft lessors, which could adversely impact our business. Refer to “Item 3. Key Information—Risk Factors—Risks related to the financial strength of our lessees—Our financial condition is dependent, in part, on the financial strength of our lessees.”

In addition to a reduction in basic lease rents, the significant decline in air travel has resulted, and may continue to result, in lower utilization of our aircraft and engines, which is likely to reduce future supplemental maintenance rent and end-of-lease (“EOL”) compensation payable to us.

We are observing, as a result of the significant and sustained decline in international air passenger traffic and an expectation of a long recovery time for international air traffic, a shift by some airlines away from current technology widebody aircraft in favor of new technology widebody aircraft. If airlines continue to experience prolonged financial hardships or bankruptcies, or there are other adverse developments to the air travel industry arising from the pandemic, aircraft values may decline further, thereby increasing the likelihood that in future quarters we recognize additional impairment charges with respect to our aircraft. Refer to “Item 5. Critical accounting policies and estimates—Event-driven impairment and impairment calculation charges.” In addition, any bankruptcy, insolvency, reorganization or other restructuring of our lessees may result in their grounding our flight equipment, negotiating reductions in lease rentals or altogether rejecting their leases, all of which could depress asset market value and adversely affect our ability to timely re-lease or sell flight equipment at favorable rates, if at all. Refer to “Item 3. Key Information—Risk Factors—Risks related to the financial strength of our lessees—If our lessees encounter financial difficulties and we restructure or terminate our leases, including as a result of customer reorganizations or bankruptcies, we are likely to obtain less favorable lease terms.”

While we expect that, even with current market conditions, our liquidity is more than sufficient to satisfy our anticipated operational and other business needs over the next 12 months, we cannot assure you that operating cash flow will not be lower than we expect due to, for example, higher than expected deferral arrangements or payment defaults. Although we currently have a number of sources of liquidity, in some cases the availability of these sources is contingent upon our ability to satisfy certain financial covenants. Refer to Note 15—Debt to our Consolidated Financial Statements included in this annual report. To the extent that the Covid-19 pandemic adversely affects our ability to comply with any of these covenants, it may also have the effect of exacerbating many of the other risks identified in “Item 3—Risk Factors—Risks related to our funding and liquidity—The agreements governing our debt contain various covenants that impose restrictions on us that may affect our ability to operate our business.” Even though we do not currently foresee any difficulty or inability to remain in compliance with these financial covenants, to the extent we do not do so, we may be in default under, and/or unable to draw upon, these sources of liquidity or may be required to negotiate amendments with our counterparties, the terms of which could be unfavorable to us.

Additionally, the Covid-19 pandemic has led us to adopt remote working arrangements (which remain in place in a small number of our locations), which could negatively affect our operations and may require us to implement new processes, procedures and controls to respond to further changes in our business environment. We also depend on certain key officers and employees; should any of them become ill and unable to work, it could impact our productivity and business continuity.

Global or regional public health developments, extreme weather or natural disasters or other force majeure events may adversely affect the demand for air travel, the financial condition of our lessees and the aviation industry more broadly, and ultimately our financial condition, results and cash flows.

Our international operations expose us to risks associated with unforeseen global and regional events. Epidemic diseases such as Covid-19, Ebola, measles, Severe Acute Respiratory Syndrome (SARS), H1N1 (swine flu) and Zika virus could materially and adversely affect the overall amount of air travel. These epidemic diseases, or the fear of these diseases, could result in government-imposed travel restrictions and reduced passenger demand for travel. The occurrence of severe weather events or natural disasters, including floods, earthquakes and volcanic eruptions, may make airlines unable to operate to or from certain regions or impact demand for air travel and the frequency or severity of these types of events may worsen as a result of climate change. The occurrence or outbreak of any of the above events or other force majeure events could adversely affect commercial airline traffic, reduce demand for flight equipment leases or impair the financial condition of the aviation industry, including our lessees. As a result, our lessees may not be able to satisfy their payment obligations to us. These events may also cause damage to our flight equipment, the extent of losses from which may not be fully covered by insurance. For these and other reasons, our financial results may be materially and adversely affected by the occurrence of such events.

The effects of terrorist attacks, war or armed hostilities may adversely affect the financial condition of the airline industry and our lessees’ ability to meet their lease payment obligations to us.

Terrorist attacks and the threat of terrorist attacks, war or armed hostilities, or the fear of such events, have historically had a negative impact on the aviation industry and could result in:

•higher costs to the airlines due to the increased security measures;

•decreased passenger and air cargo demand and revenue;

•the imposition of “no-fly zone” or other restrictions on commercial airline traffic in certain regions, including the recent landing and overflight restrictions on Russian airlines in response to the Russian invasion of Ukraine and corresponding restrictions on airlines in the European Union, United States and other jurisdictions imposed by Russia;

•uncertainty of the price and availability of jet fuel and the cost and practicability of obtaining fuel hedges;

•higher financing costs and difficulty in raising the desired amount of proceeds on favorable terms, if at all;

•significantly higher premiums or reduced coverage amounts for aviation insurance coverage for future claims caused by acts of war, terrorism, sabotage, hijacking and other similar perils, which may be insufficient to comply with the current requirements of aircraft lenders and lessors or applicable government regulations, or the unavailability of certain types of insurance;

•reliance by aircraft lenders or lessors on government programs for specified types of aviation insurance, which may not be available at the relevant time or under which governments may not pay in a timely fashion;

•inability of airlines to reduce their operating costs and conserve financial resources, taking into account the increased costs incurred as a consequence of such events;

•special charges recognized by some operators, such as those related to the impairment of aircraft and engines and other long-lived assets stemming from the grounding of aircraft as a result of terrorist attacks, economic conditions and airline reorganizations; and

•an airline becoming insolvent and/or ceasing operations.

Such events are likely to cause our lessees to incur higher costs and to generate lower revenues, which could result in a material adverse effect on their financial condition and liquidity, including their ability to make rental and other lease payments to us or to obtain the types and amounts of insurance we require. This in turn could lead to aircraft groundings or additional lease restructurings and repossessions, increase our cost of re-leasing or selling flight equipment, impair our ability to re-lease or otherwise dispose of flight equipment on favorable terms or at all, or reduce the proceeds we receive for our flight equipment in a disposition.

We expect the Russian invasion of Ukraine and the impact of resulting sanctions by the United States, the European Union, the United Kingdom and other countries to adversely affect our business and financial condition, results and cash flows.

On February 24, 2022, Russia launched a large-scale military invasion of Ukraine and is now engaged in a broad military conflict with Ukraine (the “Ukraine Conflict”). In response, the United States, the European Union, the United Kingdom and other countries have imposed broad, far-reaching sanctions against Russia, certain Russian persons and certain activities involving Russia or Russian persons. These sanctions include prohibitions regarding the supply of aircraft and aircraft components to Russian persons or for use in Russia, subject to certain wind-down periods.

Prior to the Ukraine Conflict, we had 135 owned aircraft on lease to Russian airlines, as well as 14 owned engines on lease to Russian airlines. We had no helicopters on lease to Russian customers. The aggregate net carrying value of our owned assets leased to Russian airlines was approximately $3.1 billion (which includes flight equipment net book value of $3.3 billion, maintenance rights assets and other lease-related assets of approximately $500 million and maintenance liabilities and other lease-related liabilities of approximately $700 million) as of December 31, 2021. Additionally, our Shannon Engine Support (“SES”) joint venture had 14 engines on lease to Russian airlines prior to the Ukraine Conflict.

In addition, we had seven owned aircraft on lease to Ukrainian airlines, with an aggregate net carrying value of approximately $125 million as of December 31, 2021. As of March 30, 2022, five of these aircraft are in temporary storage outside of Ukraine. As of March 30, 2022, the remaining two aircraft are grounded in Ukraine, but the exact status of these aircraft remains difficult to ascertain.

We intend to fully comply with all applicable sanctions and we have terminated the leasing of all of our aircraft and engines with Russian airlines. These terminations will result in reduced revenues and operating cash flows. Basic lease rents from our owned aircraft and engines leased to Russian airlines were approximately $33 million for the month of December 2021.

We have sought to repossess all of our aircraft and engines from Russian airlines and remove them from Russia. As of March 30, 2022, we had detained 22 of our owned aircraft and three of our 14 owned engines outside of Russia. The net carrying value as of December 31, 2021, of the owned aircraft and engines that we have removed from Russia was approximately $400 million.

It is unclear whether we will be able to repossess any additional aircraft or engines from our former Russian airline customers, or, if we do so, when we will be able to do so, and we do not know what the condition of these assets will be at the time of repossession or whether any such aircraft could be re-leased or sold. Any failure to promptly repossess our aircraft and engines will adversely affect our business and financial results. Many of these Russian airlines have continued to fly our aircraft and engines notwithstanding the leasing terminations and our repeated demands for the return of our assets. Our aircraft and engines that remain in Russia may suffer damage or deterioration due to inadequate maintenance and lack of spare parts.

As a result, we expect to recognize an impairment on our assets in Russia which have not been returned to us as early as the first quarter of 2022. While we have not yet determined the amount of this impairment, it may amount to the total net carrying value of these assets. We may also recognize an impairment on our assets that we have repossessed from Russian airlines as a result of our inability to re-lease them or otherwise.

We had letters of credit related to our aircraft and engines leased to Russian airlines as of February 24, 2022 of approximately $260 million, all confirmed by financial institutions in Western Europe. We have presented requests for payment to all of these institutions. As of March 30, 2022, we had received payments of approximately $175 million related to these letters of credit. We have initiated legal proceedings against one financial institution which rejected our payment demands in respect of certain letters of credit. We continue to work with other financial institutions toward receiving payments on the remaining letters of credit. We intend to pursue all available legal claims concerning these letters of credit but the timing and amount of any payments under these remaining letters of credit are uncertain.

Our lessees are required to provide insurance coverage with respect to leased aircraft and we are named as insureds under those policies in the event of a total loss of an aircraft or engine. We also purchase insurance which provides us with coverage when our aircraft or engines are not subject to a lease or where a lessee’s policy fails to indemnify us. We have submitted an insurance claim for approximately $3.5 billion with respect to all aircraft and engines remaining in Russia and intend to pursue all of our claims under these policies with respect to our assets leased to Russian airlines as of February 24, 2022. However, the timing and amount of any recoveries under these policies are uncertain.

In addition, we intend to pursue all available legal claims related to our assets leased to Russian airlines as of February 24, 2022. However, the timing and amount of any recoveries under any of these claims are uncertain.

It is not possible to predict the broader or longer-term consequences of the Ukraine Conflict, which could include expansion of the conflict, further sanctions, embargoes, regional instability, geopolitical shifts and adverse effects on macroeconomic conditions, security conditions, fuel prices, currency exchange rates and financial markets. Such geopolitical instability and uncertainty could have a negative impact on our ability to lease aircraft, engines and helicopters, collect payments from, and support customers in certain regions based on trade restrictions, embargoes and export control law restrictions, and logistics restrictions including closures of air space, and could materially and adversely affect our business.

Risks relating to our funding and liquidity

We require significant capital to fund our business.

As of December 31, 2021, we had 417 new aircraft, 30 engines and 16 helicopters on order, which will require substantial purchase contract payments. In order to meet these commitments and to maintain an adequate level of unrestricted cash, we will need to raise additional funds by accessing committed debt facilities, securing additional financing from banks or through capital markets transactions, or possibly by selling flight equipment.

If we are unable to meet our purchase commitments as they come due, we will be subject to several risks, including:

•forfeiting deposits and progress payments to manufacturers and having to pay certain significant costs related to these commitments such as actual damages and legal, accounting and financial advisory expenses;

•defaulting on our lease commitments, which could result in monetary damages and strained relationships with lessees;

•failing to realize the benefits of purchasing and leasing such flight equipment; and

•risking harm to our business reputation, which would make it more difficult to purchase and lease flight equipment in the future on agreeable terms, if at all.

Any of these events could materially and adversely affect our financial results.

To service our debt and meet our other cash needs, we will require a significant amount of cash, which may not be available.

Our ability to make payments on, and to repay or refinance, our debt, depends largely upon our operating performance, which is in part subject to factors beyond our control. In addition, our ability to borrow funds to make payments on our debt depends on our maintaining specified financial ratios and satisfying financial condition tests and other covenants in certain of the agreements governing our debt. Our business may not generate sufficient cash flow from operations and future borrowings may not be available in amounts sufficient to pay our debt and to satisfy our other liquidity needs.

If our cash flows and capital resources are insufficient to fund our debt service obligations, we may be forced to seek alternatives, such as to reduce or delay investments and flight equipment purchases, sell assets, restructure or refinance our indebtedness, or seek additional capital, including through new types of debt, equity or hybrid securities. Our ability to restructure or refinance our debt will depend on the condition of the capital markets and our financial condition at such time. Any refinancing of our debt could be at higher interest rates and might require us to comply with more onerous covenants, which could further restrict our business operations. These alternative measures may not be successful and may not permit us to meet our scheduled debt service obligations or to meet our flight equipment purchase commitments as they come due. Failure to make payments on our debt would result in a default under those agreements and could result in a default under other agreements containing cross default provisions. Moreover, the issuance of additional equity may be dilutive to existing shareholders or otherwise may be on terms not favorable to us or existing shareholders.

Despite our substantial indebtedness, we might incur significantly more debt.

Despite our current indebtedness levels, we may increase our levels of debt in the future to finance our operations, including to purchase aircraft or to meet our contractual obligations, or for any other purpose. The agreements relating to our debt, including our indentures, term loan facilities, Export Credit Agency (“ECA”)-guaranteed financings, revolving credit facilities, securitizations, other commercial bank financings, and other financings do not prohibit us from incurring additional debt. As of December 31, 2021, we had approximately $10.6 billion of undrawn lines of credit available under our revolving credit and term loan facilities and other available secured debt, subject to certain conditions, including compliance with certain financial covenants. If we increase our total indebtedness, our debt service obligations will increase, and we will become more exposed to the risks arising from our substantial level of indebtedness.

Our level of indebtedness, which requires significant debt service payments, could adversely impact our operating flexibility and financial results.

The principal amount of our outstanding indebtedness, which excludes debt issuance costs, debt discounts and debt premium of $344 million, was $50.5 billion as of December 31, 2021, (approximately 68% of our total assets as of December 31, 2021), and our interest payments, net of amounts capitalized, were $1.1 billion for the year ended December 31, 2021. Due to the capital-intensive nature of our business, we expect that we will incur additional indebtedness in the future and continue to maintain significant levels of indebtedness.

Our level of indebtedness:

•requires a substantial portion of our cash flows from operations to be dedicated to interest and principal payments and therefore not available to fund our operations, working capital, capital expenditures, expansion, acquisitions or general corporate or other purposes;

•may impair our ability to obtain additional financing on favorable terms or at all in the future;

•may limit our flexibility in planning for, or reacting to, changes in our business and industry; and

•may make us more vulnerable to downturns in our business, our industry or the economy in general.

The agreements governing our debt contain various covenants that impose restrictions on us that may affect our ability to operate our business.

Certain of our indentures, term loan facilities, ECA-guaranteed financings, revolving credit facilities, securitizations, other commercial bank financings, and other agreements governing our debt impose operating and financial restrictions on our activities that limit our operational flexibility. Among other negative covenants customary for such financings, certain of these restrictions limit our ability to incur additional indebtedness, create liens on, sell or access certain assets, declare or pay certain dividends and distributions or enter into certain transactions, investments, acquisitions, loans, guarantees or advances. Additionally, a substantial portion of our owned aircraft are held through SPEs or finance structures that finance or refinance the aircraft through funding agreements that place restrictions on distributions of funds to us.

Agreements governing certain of our indebtedness also contain financial covenants, including requirements that we comply with certain loan-to-value, interest coverage and leverage ratios. These restrictions could impede our ability to operate our business by, among other things, limiting our ability to take advantage of financing, merger and acquisition and other corporate opportunities. Our ability to comply with these covenants may be affected by events beyond our control. Failure to comply with any of the covenants in our financing agreements would result in a default under those agreements and could result in a default under other agreements containing cross default provisions. Under these circumstances, we may have insufficient funds or other resources to satisfy all our obligations.

Changes in interest rates may increase our cost of borrowing or otherwise adversely affect our net income.

We use a mix of fixed rate and floating rate debt to finance our business. Any increase in our cost of borrowing directly impacts our net income. Our cost of borrowing is affected by the interest rates that we obtain on our debt financings, which can fluctuate based on, among other things, general market conditions, the market’s assessment of our credit risk, prevailing interest rates in the market, fluctuations in U.S. Treasury rates and other benchmark rates, changes in credit spreads or swap spreads, and the duration of the debt we issue. If interest rates increase, we will be obligated to make higher interest payments to the lenders of our floating rate debt to the extent that it is not hedged. Please refer to “Item 11—Quantitative and Qualitative Disclosures About Market Risk—Interest rate risk” for further details on our interest rate risk. In addition, we are exposed to the credit risk that the counterparties to our derivative contracts will default on their obligations.

Decreases in interest rates may adversely affect our interest revenue on cash deposits and our lease revenue. During the year ended December 31, 2021, approximately 1.2% of our basic lease rents from flight equipment under operating leases was attributable to leases with lease rates tied to floating interest rates and approximately 98.8% was derived from leases with fixed lease rates. A decrease in interest rates would cause a decrease in our lease revenue from leases with lease rates tied to floating interest rates. We could also experience reduced lease revenue from our fixed rate leases if interest rates decrease because these are based, in part, on prevailing interest rates at the time we enter into the lease. As a result, new fixed rate leases we enter into at a time of lower interest rates may be at lower lease rates than had no such interest rate decrease occurred, adversely affecting our lease revenue.

Moreover, if interest rates were to rise sharply, we would not immediately be able to fully offset the negative impact on our net income by increasing lease rates, even if the market were able to bear the increased lease rates. Our leases are generally for multiple years with fixed lease rates over the life of the lease and, therefore, lags will exist because our lease rates with respect to a particular aircraft cannot generally be increased until the expiration of the lease.

Negative changes in our credit ratings may limit our ability to obtain financing or increase our borrowing costs.

Our cost of borrowing and access to the capital markets are affected by our credit ratings.

We are currently subject to periodic review by independent credit rating agencies S&P, Moody’s and Fitch, each of which currently maintains an investment grade rating with respect to us.

We cannot assure you that these credit ratings will remain in effect for any given period of time or that a rating will not be lowered, suspended or withdrawn. Any actual or anticipated changes in our credit ratings, could negatively impact our ability to obtain secured or unsecured financing, increase our borrowing costs or limit our access to the capital markets, which could adversely impact our financial results.

The discontinuation, reform or replacement of benchmark indices may negatively affect our interest rate exposure.

Interest rate benchmarks, including the London Interbank Offered Rates (“LIBOR”), are the subject of ongoing reform and, in some cases, discontinuation. The discontinuation or replacement of such benchmarks may disrupt the broader financial markets or could negatively impact our interest expense, and hedging transactions that we use in respect of floating rate instruments based on such benchmarks may not be effective to protect us against any such negative impact. On July 27, 2017, the Chief Executive of the U.K. Financial Conduct Authority (the “FCA”), which regulates LIBOR, announced that the FCA will no longer persuade or compel banks to submit rates for the calculation of LIBOR after 2021. This has subsequently been extended to June 2023 for the major USD LIBOR tenors. We are party to certain debt instruments, derivative contracts and leases that use benchmark rates, such as LIBOR, which will require us to transition these instruments, contracts and leases to alternative reference rates in the event of their discontinuation. We cannot guarantee that we will be able to reach agreement with our lenders and other counterparties with respect to any such amendments and the replacement of an existing benchmark rate with an alternate benchmark rate may negatively impact the value of those contracts to us, expose us to additional financial, tax, legal, operational or other costs, or expose us to additional interest rate-related risks, such as different alternative reference rates applying to our assets compared to our liabilities. As of December 31, 2021, we had approximately $7.9 billion of floating rate debt outstanding that used either one-month, three-month or six-month USD LIBOR as the applicable reference rate to calculate interest on such debt, of which $6.0 billion is set to mature after June 30, 2023. As of December 31, 2021, we had approximately $6.3 billion notional amount of floating rate derivatives outstanding that used either one-month, three-month or six-month USD LIBOR. Certain of our floating rate debt and derivatives contain LIBOR transition fall-back provisions and we expect to transition to the Secured Overnight Financing Rate (“SOFR”) on or before June 30, 2023.

Risks relating to market demand for, and lease rates and value of flight equipment in our fleet

We may be unable to generate sufficient returns on our flight equipment investments.