ZYNLONTA® (loncastuximab tesirine-lpyl) net

sales of $21.3 million in the third quarter of 2022 (+23% vs. 2Q

2022)

Cash runway expected into early 2025

Company to host conference call today at 8:30

a.m. EST

ADC Therapeutics SA (NYSE: ADCT) today reported financial

results for the third quarter ended September 30, 2022 and provided

business updates.

“In the third quarter, we made good progress executing our

strategy. We are pleased with the strong ZYNLONTA® performance as

the new initiatives we started in the second and third quarters of

the year begin to gain traction,” said Ameet Mallik, Chief

Executive Officer of ADC Therapeutics. “We are encouraged by the

initial results of LOTIS-5 in earlier lines of diffuse large B-cell

lymphoma with ZYNLONTA and rituximab. We continue to prioritize and

develop our pipeline and maintain our cash runway into early

2025.”

Recent Highlights and

Developments

ZYNLONTA (loncastuximab tesirine-lpyl)

- ZYNLONTA generated net sales of $21.3 million in the third

quarter of 2022, representing 23% growth over the second quarter of

2022. This was driven by a renewed focus on customer-facing

execution and the new initiatives put in place in the second and

third quarters of 2022 targeting physicians, community practices

and networks, and patients and caregivers.

- Initial safety run-in results of 20 patients from the LOTIS-5

Phase 3 trial of ZYNLONTA in combination with rituximab in relapsed

or refractory diffuse large B-cell lymphoma (DLBCL) were presented

at the Annual Meeting of the Society of Hematologic Oncology (SOHO

2022), demonstrating an overall response rate of 75%, a complete

response rate of 40% and no safety events materially different from

those observed in prior clinical trials.

- The Committee for Medicinal Products for Human Use (CHMP) of

the European Medicines Agency (EMA) adopted a positive opinion

recommending the marketing authorization of ZYNLONTA (loncastuximab

tesirine) for the treatment of relapsed or refractory DLBCL.

Cami (camidanlumab tesirine)

- The Cami pivotal Phase 2 data in relapsed or refractory Hodgkin

lymphoma (HL) were presented in an encore presentation at SOHO

2022, demonstrating an overall response rate of 70% and a complete

response rate of 33% with previously reported safety profile.

- The Company held a pre-Biologics License Application (BLA)

meeting in September 2022 and a Type C meeting with the U.S. Food

and Drug Administration (FDA) in late October. During the Type C

meeting, the FDA provided strong guidance that, for it to consider

an accelerated approval path, a randomized confirmatory Phase 3

study must be well underway and ideally fully enrolled at the time

of any BLA filing for Cami. As a result, the Company will not

submit the BLA for Cami next year, as it is estimated that it would

take at least two years to fully enroll a randomized confirmatory

Phase 3 study. The Company is engaged with the FDA in an ongoing

and constructive dialogue regarding their guidance and the

potential regulatory path forward. At this time, the Company is

pausing any material investments in the HL program and will

evaluate options for Cami in HL with a disciplined and strategic

approach to resource allocation.

- The Phase 1b study of Cami in combination with pembrolizumab in

solid tumors showed signals of immunomodulatory activity. However,

the signals were not compelling enough for the Company to move

forward on its own, so the current trial will not proceed. The

Company recognizes the considerable effort required to fully pursue

this opportunity may be better suited for a partner with

immuno-oncology development expertise.

Pipeline

- ADCT-602 (targeting CD22): Initial data showing

encouraging clinical activity from the Phase 1/2 study of ADCT-602

for patients with relapsed or refractory acute lymphoblastic

leukemia has been released in an American Society of Hematology

(ASH) abstract by The University of Texas MD Anderson Cancer

Center. Additional data will be disclosed in an oral presentation

at the 64th ASH Annual Meeting.

- ADCT-901 (targeting KAAG1): Dose escalation in the Phase

1 trial is proceeding. The Company expects to have an indication of

the safety and tolerability, as well as any early signals of

antitumor activity, in 2023.

- ADCT-601 (targeting AXL): The Phase 1b trial is ongoing.

The study includes a monotherapy arm including patients with AXL

gene amplification and a combination arm with gemcitabine in

patients with sarcoma.

Corporate Update

- The Company announced a $175 million senior secured term loan

from Owl Rock, a division of Blue Owl Capital, Inc., and Oaktree

Capital Management, L.P. and settlement of existing senior secured

convertible notes with Deerfield. The Company also entered into a

share purchase agreement with Owl Rock for an investment of $6.25

million.

- Kristen Harrington-Smith has been appointed the Company’s new

Chief Commercial Officer, effective November 17, 2022. Ms.

Harrington-Smith is a seasoned leader with over 20 years of

experience in the pharmaceutical industry. Most recently, she has

served as Chief Commercial Officer of Immunogen. She has also

served as Vice President and Head, US Hematology and Vice President

and Head, US CAR-T at Novartis Pharmaceuticals.

- Peter Graham was appointed the Company’s Chief Legal Officer,

effective November 1, 2022. Mr. Graham is a senior legal executive

with over 25 years of legal, transactional and executive management

experience in biotechnology, pharmaceutical and medical device

companies.

Upcoming Expected

Milestones

ZYNLONTA

- Receive a regulatory decision from the European Commission for

third-line DLBCL in 4Q 2022

Pipeline

ADCT-901 (targeting KAAG1)

- Preliminary results of safety and tumor response for the Phase

1 dose-escalation trial in multiple solid tumors in 2023

ADCT-602 (targeting CD-22)

- University of Texas MD Anderson Cancer Center to present oral

presentation of Phase 1/2 data at ASH Annual Meeting in 4Q

2022

ADCT-212 (targeting PSMA)

- Progress toward IND filing and initiation of Phase 1 trial in

2023

ADCT-701 (targeting DLK-1)

- Progress toward IND filing and initiation of Phase 1 trial in

2023

Third Quarter Financial

Results

Cash and Cash Equivalents

Cash and cash equivalents were $380.9 million as of September

30, 2022, compared to $376.8 million as of June 30, 2022. Based on

the Company’s business plan and expected milestones from Sobi and

Healthcare Royalty Partners, the cash runway extends into early

2025. Potential near-term milestone payments from those agreements

include a $50 million milestone from Sobi upon European regulatory

approval of ZYNLONTA in third-line DLBCL and a $75 million

milestone from our HealthCare Royalty Partners agreement for the

first EU commercial sale.

Product Revenue

Product revenue (net) was $21.3 million for the quarter,

compared to $13.1 million for the same quarter in 2021. Net

revenues are for U.S. sales of ZYNLONTA.

License Revenue

License revenue was $55.0 million for the current quarter.

During July 2022, the Company entered into an exclusive license

agreement with Sobi for the development and commercialization of

ZYNLONTA for all hematologic and solid tumor indications outside of

the U.S., greater China, Singapore and Japan. Under the terms of

the agreement, the Company received an upfront payment of $55.0

million.

Cost of Product Sales

Cost of product sales was $1.3 million for the quarter, compared

to $0.5 million for the same quarter in 2021, an increase of $0.8

million primarily related to impairment charges for product

intermediates not meeting the Company’s specifications. The

specification issues did not, and are not expected to, impact the

Company’s ability to supply commercial product.

Research and Development (R&D) Expenses

R&D expenses were $41.7 million for the quarter ended

September 30, 2022, compared to $36.8 million for the same quarter

in 2021. R&D expenses increased as a result of continued

investments in the pipeline.

Selling and Marketing (S&M) Expenses

S&M expenses were $16.8 million for the quarter ended

September 30, 2022, compared to $17.0 million for the same quarter

in 2021. The decrease in S&M expenses is related to lower

share-based compensation partly offset by higher expenses relating

to the ongoing commercial launch of ZYNLONTA.

G&A Expenses

G&A expenses were $19.6 million for the quarter ended

September 30, 2022, compared to $16.6 million for the same quarter

in 2021. G&A expenses increased primarily due to costs

associated with the recent CEO transition as well as higher

share-based compensation and professional expenses.

Net Loss and Adjusted Net Loss

Net loss was $50.6 million, or a net loss of $0.65 per basic and

diluted share, for the quarter ended September 30, 2022. This

compares to a net loss of $71.5 million, or a net loss of $0.93 per

basic and diluted share, for the same quarter in 2021.

Adjusted net income was $10.3 million, or an adjusted net income

of $0.13 per basic and diluted share, for the quarter ended

September 30, 2022. This compares to an adjusted net loss of $45.6

million, or an adjusted net loss of $0.59 per basic and diluted

share, for the same quarter in 2021.

The decrease in net loss and adjusted net loss for the quarter

ended September 30, 2022, as compared to the same period in 2021,

was primarily due to higher product and license revenue, partially

offset by the increase in cost of product sales, R&D and

G&A expenses.

In addition, net loss decreased for the third quarter of 2022 as

a result of income and lower charges arising from changes in the

fair value of our warrant obligations and derivatives,

respectively. These benefits were partially offset by the loss on

extinguishment of our convertible loans and derivatives and higher

interest and cumulative catch-up expense associated with the

deferred royalty obligation with HealthCare Royalty Partners.

Conference Call Details

ADC Therapeutics management will host a conference call and live

audio webcast to discuss third quarter 2022 financial results and

provide a company update today at 8:30 a.m. Eastern Time. To access

the conference call, please register here. Registrants will receive

the dial-in number and unique PIN. It is recommended that you join

10 minutes before the event, though you may pre-register at any

time. A live webcast of the call will be available under “Events

and Presentations” in the Investors section of the ADC Therapeutics

website at ir.adctherapeutics.com. The archived webcast will be

available for 30 days following the call.

About ZYNLONTA® (loncastuximab tesirine-lpyl)

ZYNLONTA® is a CD19-directed antibody drug conjugate (ADC). Once

bound to a CD19-expressing cell, ZYNLONTA is internalized by the

cell, where enzymes release a pyrrolobenzodiazepine (PBD) payload.

The potent payload binds to DNA minor groove with little

distortion, remaining less visible to DNA repair mechanisms. This

ultimately results in cell cycle arrest and tumor cell death.

The U.S. Food and Drug Administration (FDA) has approved

ZYNLONTA (loncastuximab tesirine-lpyl) for the treatment of adult

patients with relapsed or refractory (r/r) large B-cell lymphoma

after two or more lines of systemic therapy, including diffuse

large B-cell lymphoma (DLBCL) not otherwise specified (NOS), DLBCL

arising from low-grade lymphoma and also high-grade B-cell

lymphoma. The trial included a broad spectrum of heavily

pre-treated patients (median three prior lines of therapy) with

difficult-to-treat disease, including patients who did not respond

to first-line therapy, patients refractory to all prior lines of

therapy, patients with double/triple hit genetics and patients who

had stem cell transplant and CAR-T therapy prior to their treatment

with ZYNLONTA. This indication is approved by the FDA under

accelerated approval based on overall response rate and continued

approval for this indication may be contingent upon verification

and description of clinical benefit in a confirmatory trial.

ZYNLONTA is also being evaluated as a therapeutic option in

combination studies in other B-cell malignancies and earlier lines

of therapy.

About ADC Therapeutics

ADC Therapeutics (NYSE: ADCT) is a commercial-stage

biotechnology company improving the lives of those affected by

cancer with its next-generation, targeted antibody drug conjugates

(ADCs). The Company is advancing its proprietary PBD-based ADC

technology to transform the treatment paradigm for patients with

hematologic malignancies and solid tumors.

ADC Therapeutics’ CD19-directed ADC ZYNLONTA (loncastuximab

tesirine-lpyl) is approved by the FDA for the treatment of relapsed

or refractory diffuse large b-cell lymphoma after two or more lines

of systemic therapy. ZYNLONTA is also in development in combination

with other agents. In addition to ZYNLONTA, ADC Therapeutics has

multiple ADCs in ongoing clinical and preclinical development.

ADC Therapeutics is based in Lausanne (Biopôle), Switzerland and

has operations in London, the San Francisco Bay Area and New

Jersey. For more information, please visit

https://adctherapeutics.com/ and follow the Company on Twitter and

LinkedIn.

ZYNLONTA® is a registered trademark of ADC Therapeutics SA.

Use of Non-IFRS Financial Measures

In addition to financial information prepared in accordance with

IFRS, this document also contains certain non-IFRS financial

measures based on management’s view of performance including:

- Adjusted net loss and income

- Adjusted net loss and income per share

Management uses such measures internally when monitoring and

evaluating our operational performance, generating future operating

plans and making strategic decisions regarding the allocation of

capital. We believe that these adjusted financial measures provide

useful information to investors and others in understanding and

evaluating our operating results in the same manner as our

management and facilitate operating performance comparability

across both past and future reporting periods. These non-IFRS

measures have limitations as financial measures and should be

considered in addition to, and not in isolation or as a substitute

for, the information prepared in accordance with IFRS. When

preparing these supplemental non-IFRS measures, management

typically excludes certain IFRS items that management does not

believe are indicative of our ongoing operating performance.

Furthermore, management does not consider these IFRS items to be

normal, recurring cash operating expenses; however, these items may

not meet the IFRS definition of unusual or non-recurring items.

Since non-IFRS financial measures do not have standardized

definitions and meanings, they may differ from the non-IFRS

financial measures used by other companies, which reduces their

usefulness as comparative financial measures. Because of these

limitations, you should consider these adjusted financial measures

alongside other IFRS financial measures.

The following items are excluded from adjusted net loss and

adjusted net loss per share:

Shared-Based Compensation Expense: We exclude share-based

compensation expense from our adjusted financial measures because

share-based compensation expense, which is non-cash, fluctuates

from period to period based on factors that are not within our

control, such as our stock price on the dates share-based grants

are issued. Share-based compensation expense has been, and will

continue to be for the foreseeable future, a recurring expense in

our business and an important part of our compensation

strategy.

Certain Other Items: We exclude certain other significant items

that we believe do not represent the performance of our business,

from our adjusted financial measures. Such items are evaluated by

management on an individual basis based on both quantitative and

qualitative aspects of their nature. While not all-inclusive,

examples of certain other significant items excluded from our

adjusted financial measures would be: changes in the fair value of

derivatives and warrant obligations and the effective interest

expense associated with the Facility Agreement with Deerfield and

the senior secured term loan facility, loss on extinguishment,

transaction costs associated with debt or equity issuances that are

expenses pursuant to IFRS, and the effective interest expense and a

cumulative catch-up adjustment associated with the deferred royalty

obligation under the royalty purchase agreement with HealthCare

Royalty Partners.

See the attached Reconciliation of IFRS Measures to Non-IFRS

Measures for explanations of the amounts excluded and included to

arrive at the non-IFRS financial measures.

Forward-Looking Statements

This press release contains statements that constitute

forward-looking statements. All statements other than statements of

historical facts contained in this press release, including

statements regarding our future results of operations and financial

position, business and commercialization strategy, market

opportunities, products and product candidates, research pipeline,

ongoing and planned preclinical studies and clinical trials,

regulatory submissions and approvals, projected revenues and

expenses and the timing of revenues and expenses, timing and

likelihood of success, as well as plans and objectives of

management for future operations, are forward-looking statements.

Forward-looking statements are based on our management’s beliefs

and assumptions and on information currently available to our

management. Such statements are subject to risks and uncertainties,

and actual results may differ materially from those expressed or

implied in the forward-looking statements due to various factors,

including those described in our filings with the U.S. Securities

and Exchange Commission. No assurance can be given that such future

results will be achieved. Such forward-looking statements contained

in this document speak only as of the date of this press release.

We expressly disclaim any obligation or undertaking to update these

forward-looking statements contained in this press release to

reflect any change in our expectations or any change in events,

conditions, or circumstances on which such statements are based

unless required to do so by applicable law. No representations or

warranties (expressed or implied) are made about the accuracy of

any such forward-looking statements.

ADC Therapeutics SA

Condensed Consolidated Interim

Statement of Operations (Unaudited)

(in KUSD except for per share

data)

For the Three Months Ended

September 30,

For the Nine Months Ended

September 30,

2022

2021

2022

2021

Product revenues, net

21,321

13,147

55,110

16,907

License revenue

55,000

—

85,000

—

Total revenue

76,321

13,147

140,110

16,907

Operating expense

Cost of product sales

(1,295)

(502)

(4,090)

(623)

Research and development expenses

(41,676)

(36,805)

(139,165)

(115,510)

Selling and marketing expenses

(16,847)

(17,045)

(52,876)

(46,177)

General and administrative expenses

(19,617)

(16,587)

(56,868)

(53,536)

Total operating expense

(79,435)

(70,939)

(252,999)

(215,846)

Loss from operations

(3,114)

(57,792)

(112,889)

(198,939)

Other income (expense)

Financial income

273

16

18,597

46

Financial expense

(11,356)

(4,265)

(29,374)

(8,820)

Non-operating (expense) income

(37,122)

(9,363)

(10,805)

12,560

Total other (expense) income

(48,205)

(13,612)

(21,582)

3,786

Loss before taxes

(51,319)

(71,404)

(134,471)

(195,153)

Income tax benefit (expense)

711

(145)

2,828

(492)

Net loss

(50,608)

(71,549)

(131,643)

(195,645)

Net loss attributable to:

Owners of the parent

(50,608)

(71,549)

(131,643)

(195,645)

Net loss per share, basic and diluted

(0.65)

(0.93)

(1.70)

(2.55)

ADC Therapeutics SA

Condensed Consolidated Interim

Balance Sheet (Unaudited)

(in KUSD)

September 30,

2022

December 31,

2021

ASSETS

Current assets

Cash and cash equivalents

380,860

466,544

Accounts receivable, net

23,251

30,218

Inventory

15,745

11,122

Other current assets

18,243

17,298

Total current assets

438,099

525,182

Non-current assets

Property, plant and equipment

3,169

4,066

Right-of-use assets

6,708

7,164

Intangible assets

14,598

13,582

Interest in joint venture

34,687

41,236

Deferred tax asset

33,599

26,049

Other long-term assets

899

693

Total non-current assets

93,660

92,790

Total assets

531,759

617,972

LIABILITIES AND SHAREHOLDERS'

EQUITY

Current liabilities

Accounts payable

11,611

12,080

Other current liabilities

62,658

50,497

Lease liabilities, short-term

835

1,029

Current income tax payable

—

3,754

Senior secured term loans, short-term

12,469

—

Convertible loans, short-term

—

6,575

Total current liabilities

87,573

73,935

Non-current liabilities

Senior secured term loans, long- term

96,731

—

Convertible loans, long-term

—

87,153

Convertible loans, derivatives

—

37,947

Warrant obligations

4,293

—

Deferred royalty obligation, long-term

208,218

218,664

Deferred gain of joint venture

23,539

23,539

Lease liabilities, long-term

6,622

6,994

Defined benefit pension liabilities

—

3,652

Total non-current liabilities

339,403

377,949

Total liabilities

426,976

451,884

Equity attributable to owners of the

parent

Share capital

6,699

6,445

Share premium

1,007,510

981,827

Treasury shares

(101)

(128)

Other reserves

148,045

102,646

Cumulative translation adjustments

(842)

183

Accumulated losses

(1,056,528)

(924,885)

Total equity attributable to owners of

the parent

104,783

166,088

Total liabilities and equity

531,759

617,972

ADC Therapeutics SA

Reconciliation of IFRS

Measures to Non-IFRS Measures (Unaudited)

(in KUSD except for share and

per share data)

Three Months Ended September

30,

Nine Months Ended September

30,

in KUSD (except for share and per share

data)

2022

2021

2022

2021

Net loss

(50,608)

(71,549)

(131,643)

(195,645)

Adjustments:

Share-based compensation expense (i)

14,565

14,798

42,293

47,016

Convertible loans, derivatives, change in

fair value expense (income) (ii)

4,660

6,943

(25,650)

(16,279)

Convertible loans, second tranche,

derivatives, transaction costs (iii)

—

—

—

148

Loss on extinguishment (iv)

42,114

—

42,114

—

Senior secured term loans, warrants,

change in fair value income (ii)

(2,543)

—

(2,543)

—

Effective interest expense on convertible

loans (v)

1,536

2,961

7,684

7,393

Deerfield warrants obligation, change in

fair value income (ii)

(9,418)

—

(9,418)

—

Senior secured term loan facility,

warrants, transaction costs (iii)

245

—

245

—

Effective interest expense on senior

secured term loan facility (v)

1,933

—

1,933

—

Deferred royalty obligation interest

expense (vi)

5,669

1,246

17,356

1,246

Deferred royalty obligation cumulative

catch-up adjustment expense (income) (vi)

2,175

—

(16,113)

—

Adjusted net income (loss)

10,328

(45,601)

(73,742)

(156,121)

Net loss per share, basic and diluted

(0.65)

(0.93)

(1.70)

(2.55)

Adjustment to net loss per share, basic

and diluted

0.78

0.34

0.75

0.52

Adjusted net income (loss) per share,

basic and diluted

0.13

(0.59)

(0.95)

(2.03)

Weighted average shares outstanding, basic

and diluted

78,372,680

76,739,770

77,374,388

76,730,117

(i)

Share-based compensation expense

represents the cost of equity awards issued to our directors,

management and employees. The fair value of awards is computed at

the time the award is granted, including any market and other

performance conditions, and is recognized over the vesting period

of the award by a charge to the income statement and a

corresponding increase in other reserves within equity. See note

18, “Share-based compensation” to the unaudited condensed

consolidated interim financial statements. These accounting entries

have no cash impact.

(ii)

Change in the fair value of the

convertible loan derivatives, senior secured term loan facility

warrants and the Deerfield warrant obligation results from the

valuation at the end of each accounting period. See note 14,

“Senior secured term loan facility and warrants”, note 15

“Convertible Loans” and note 16, “Deerfield warrants” to the

unaudited condensed consolidated interim financial statements.

There are several inputs to these valuations, but those most likely

to result in significant changes to the valuations are changes in

the value of the underlying instrument (i.e., changes in the price

of our common shares) and changes in expected volatility in that

price. These accounting entries have no cash impact.

(iii)

The transaction costs allocated to the

convertible loan second tranche derivative as well as the senior

secured term loan facility warrant obligation represent actual

costs. We do not believe that these costs reflect the performance

of our ongoing business.

(iv)

As a result of the exchange agreement

entered into on August 15, 2022, the Company recognized a loss on

extinguishment which primarily consists of the difference between

the aggregate principal amount and carrying amount of the

convertible loans and exit fee as well as the unpaid interest

payments through the maturity date. See note 15, “Convertible

loans” to the unaudited condensed consolidated interim financial

statements.

(v)

Effective interest expense on convertible

loans and senior secured term loans relates to the increase in the

value of our loans in accordance with the effective interest

method. See note 14, “Senior secured term loan facility and

warrants” and note 15, “Convertible loans” to the unaudited

condensed consolidated interim financial statements.

(vi)

Deferred royalty obligation interest

expense relates to the accretion expense on our deferred royalty

obligation pursuant to the royalty purchase agreement with HCR and

cumulative catch-up adjustment expense relates to changes in the

expected payments to HCR based on a periodic assessment of our

underlying revenue projections. See note 19, “Deferred royalty

obligation” to the unaudited condensed consolidated interim

financial statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221108005150/en/

Investors Eugenia Litz ADC Therapeutics

Eugenia.Litz@adctherapeutics.com +44 7879 627205 Amanda Loshbaugh

ADC Therapeutics amanda.loshbaugh@adctherapeutics.com +1

917-288-7023 Media Mary Ann Ondish ADC Therapeutics

maryann.ondish@adctherapeutics.com +1 914-552-4625

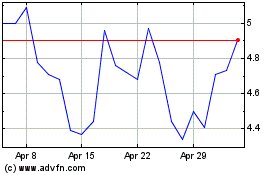

ADC Therapeutics (NYSE:ADCT)

Historical Stock Chart

From Mar 2024 to Apr 2024

ADC Therapeutics (NYSE:ADCT)

Historical Stock Chart

From Apr 2023 to Apr 2024