Duck Creek Valuation Tops $3.5 Billion as IPO Priced Above Views

August 14 2020 - 6:26AM

Dow Jones News

By Colin Kellaher

Duck Creek Technologies Inc. said its initial public offering of

15 million shares was priced at $27 apiece, above already increased

expectations.

The Boston provider of software and services to the insurance

industry, which is backed by private-equity firm Apax Partners L.P.

and Accenture PLC, on Wednesday had raised the expected pricing

range of the IPO to $23 to $25 a share from $19 to $21 each.

Duck Creek will have about 130.6 million shares outstanding

after the IPO, assuming the underwriters exercise an option to buy

an additional 2.25 million shares., for a valuation of about $3.53

billion at the $27-a-share pricing.

Duck Creek shares are slated to begin trading Friday under the

symbol DCT.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

August 14, 2020 06:11 ET (10:11 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

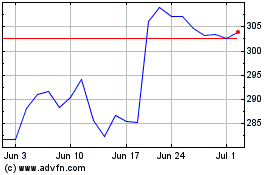

Accenture (NYSE:ACN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Accenture (NYSE:ACN)

Historical Stock Chart

From Apr 2023 to Apr 2024