AbbVie agrees to buy Allergan, maker of Botox, in one of 2019's

largest mergers

By Cara Lombardo, Jonathan D. Rockoff and Dana Cimilluca

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (June 26, 2019).

AbbVie Inc. agreed to buy Allergan PLC for about $63 billion in

a bet by the two drugmakers that a combination will deliver new

sources of growth that they have struggled to find on their

own.

The takeover is worth about $188 a share in cash and stock, the

companies said. The price represents a 45% premium over Allergan's

closing share price Monday of $129.57. If not for a surge in the

shares in recent days on expectations for a breakup of the company,

the premium would be even bigger.

Buying Dublin-based Allergan would deliver a dominant position

in the $8 billion-plus market for Botox and other beauty drugs, as

well as a number of popular eye treatments, as AbbVie braces for

the end of patent protection for the world's top-selling drug,

Humira.

The companies' portfolios have some overlap in treatments for

brain, women's health, stomach and other disorders, though the

combination would take AbbVie into the new realm of frown-line

smoothing, eyelash lengthening and double-chin removal.

Allergan's nearly $16 billion in yearly revenue would also give

AbbVie another source of cash to hunt for a new generation of

products.

Lately, Wall Street has been clamoring for change at Allergan,

with its shares trading at a fraction of their peak of more than

$330 in the summer of 2015. Analysts have been saying the company

could split into two pieces, but few expected Chief Executive Brent

Saunders to pull off a sale, especially at such a lofty

premium.

AbbVie CEO Richard Gonzalez said the company's board about a

year ago started discussions that led to a decision to pursue a

large acquisition. AbbVie wanted to boost the size of its

non-Humira business, Mr. Gonzalez said Tuesday on a conference call

with reporters.

The company zeroed in on Allergan about five to six months ago,

Mr. Gonzalez said.

Mr. Gonzalez said he let Mr. Saunders know that AbbVie would be

interested if Allergan decided to explore strategic options.

Discussions continued in April, Mr. Gonzalez said, when Mr.

Saunders visited Mr. Gonzalez in Chicago. More talks and due

diligence followed, leading to Tuesday's deal announcement, which

confirmed a report earlier in the day by The Wall Street

Journal.

Mr. Gonzalez will remain chairman and CEO of AbbVie, which will

continue to be based in the Chicago area. Two Allergan directors

including Mr. Saunders will join AbbVie's board when the deal

closes.

About two-thirds of the purchase price is in cash, with Allergan

stockholders receiving 0.8660 AbbVie share and $120.30 in cash for

each share they own, for total consideration of $188.24 a

share.

Allergan stock jumped 25% to $162.43 Tuesday while AbbVie shares

fell 16% to $65.70.

The deal, worth about $80 billion including debt, is the second

this year that would knit together two of the world's biggest

pharmaceutical companies. Earlier this year, Bristol-Myers Squibb

Co. agreed to pay $74 billion for rival cancer drugmaker Celgene

Corp.

AbbVie has been pursuing deals of various sizes in an effort to

diversify beyond Humira ever since the company was split from

Abbott Laboratories in 2013.

Humira, a rheumatoid-arthritis treatment, rang up $19.1 billion

of AbbVie's $32.8 billion of revenue last year. But lower-priced

versions, known as biosimilars, are on sale in Europe and are

scheduled to go on sale in the U.S. in 2023.

AbbVie had tried to strike a big deal in 2014, when it reached

an agreement to buy Irish rare-disease drugmaker Shire for $54

billion. But AbbVie called off the deal later that year amid

efforts by the Obama administration to restrict such tax-lowering

transactions, known as inversions.

Other attempts to find new big-selling cancer, immune and other

drugs have also stumbled, except for a roughly $20 billion deal in

2015 for Pharmacyclics Inc., the maker of the Imbruvica cancer

therapy. AbbVie shares the treatment's rights with Johnson &

Johnson.

But Imbruvica, which generated $3.6 billion in revenue for

AbbVie last year, can't alone make up for the approaching loss of

Humira sales.

In Allergan, AbbVie will take on a once-highflying drugmaker

that has also struggled to find new sales growth.

Allergan's shares soared to more than twice their current level

four years ago as the company and Mr. Saunders became Wall Street

darlings following a series of bold acquisitions. Allergan's luster

has faded in the past few years as opportunities for deal making

have dwindled along with the stock and only its aesthetic-medicine

business grew to investors' satisfaction.

Allergan, which started as a California pharmacy and then carved

a niche as an eye-treatment business, rocketed into the ranks of

big drugmakers after exploiting Botox for smoothing frown lines and

wrinkles.

A combination with Irish drugmaker Actavis in 2015 transformed

the company. Mr. Saunders has been CEO since 2014 and chairman

since 2016.

For a time, Pfizer Inc. was going to buy Allergan for about $150

billion, but that transaction, also an inversion, fell through amid

pushback from the Obama administration.

Then investors soured on the company, partly due to concerns

that it wouldn't be able to replace sales from eye drug Restasis,

which was losing its patent protection.

Investors also drove down the stock on a failed plan to bolster

Restasis by selling its patent rights to an Indian tribe, as well

as mixed messages from management about the company's prospects.

Rivals are trying to edge in on Botox, and the company's efforts to

develop new drugs, such as a depression treatment, faltered.

The concerns triggered pressure from Wall Street. Mr. Saunders

said on an earnings call last month that there is a sense of

urgency within the company and pledged that the board was reviewing

all options.

Analysts predicted Allergan could split itself in two, with one

business dedicated to fast-growing brands and segments such as

aesthetics and eye care, and the other focused on gastrointestinal

and women's health treatments.

Allergan in recent years came into the crosshairs of David

Tepper's activist hedge fund Appaloosa LP, which criticized the

company's performance and pressured it to separate the roles of

chairman and CEO. The company had said it would separate the roles

at its next leadership transition. In May, Allergan shareholders

voted down a shareholder proposal from Appaloosa to separate the

positions.

Also to satisfy investors, Allergan in the past year tried to

sell its women's health and anti-infective drug businesses but said

in January it would keep them.

--Peter Loftus contributed to this article.

Write to Cara Lombardo at cara.lombardo@wsj.com, Jonathan D.

Rockoff at Jonathan.Rockoff@wsj.com and Dana Cimilluca at

dana.cimilluca@wsj.com

(END) Dow Jones Newswires

June 26, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

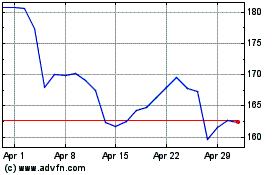

AbbVie (NYSE:ABBV)

Historical Stock Chart

From Mar 2024 to Apr 2024

AbbVie (NYSE:ABBV)

Historical Stock Chart

From Apr 2023 to Apr 2024