By Ira Iosebashvili

A rally in stocks has triggered unusual circumstances for some

of Wall Street's biggest investors -- they are holding many of the

same companies.

A list of the market's most crowded trades includes Mastercard

Inc., Microsoft Corp., Amazon.com Inc., Abbott Laboratories and

PayPal Holdings Inc., according to analysts at Bernstein, who

tracked institutional ownership, price momentum, earnings forecasts

and valuations.

The overlap in the top 50 stocks holdings between mutual funds

and hedge funds -- two types of investors whose styles typically

differ -- now stands at near-record levels, a study by Bank of

America Merrill Lynch found.

Investors are drawn to stocks that have performed well and risen

fast. Shares that notched the fastest gains last year are valued

nearly 25% higher than normally relative to their next 12 months of

earnings, Bank of America's study showed. Big movers include

Chipotle Mexican Grill Inc., Starbucks Corp. and VeriSign Inc.

Some consequences of the trend were on display last week, after

earnings surprises from Amazon, Ford Motor Co., Tesla Inc. and

Google's parent Alphabet Inc. sparked outsize moves in their share

prices. Tesla and Ford, two stocks that have trended higher in

recent months, declined sharply when those companies reported

disappointing results. Meanwhile, Google's stock soared after the

company reported that revenues rose 19% over the same period last

year.

Big surges, like Google's 9.6% gain on Friday, can make those

companies even more appealing to trend-following investors, further

concentrating them in a relatively small group of stocks, analysts

said.

At the same time, few are willing to risk going against the

crowd. Stocks that are comparatively cheap have attracted little

interest, according to BofAML's research. Short interest on what is

known as FAANG stocks -- Facebook Inc., Apple Inc., Amazon, Netflix

Inc. and Alphabet -- is at historic lows, the bank said.

"This huge world of investible assets has shrunk down to a small

cohort, " said Savita Subramanian, equity and quantitative

strategist at Bank of America Merrill Lynch. "We're all in this

echo chamber where everyone goes to the same dinners and drinks the

same Kool-Aid."

This week investors are awaiting a spate of key economic

reports, including data on consumer spending, manufacturing and

Friday's nonfarm-payroll report, which investors will be gleaning

for information on how the U.S. economy fared in July.

While most believe the Federal Reserve will deliver a 25

basis-point rate cut at its meeting on Wednesday, strong economic

data could challenge projections for how much the central bank will

ease monetary policy during the rest of the year, a potential

obstacle for the market's rally.

As earnings season rolls on, investors will also get a look at

results from a range of companies, including Apple and Mastercard.

These two companies are among those that have provided money

managers safety in numbers.

Years of tepid expansion have also made investors hesitant to

broaden their holdings outside of the companies delivering

eye-catching results. That caution has been exacerbated in recent

months, as slowing growth around the world sparked fears of a

looming recession, widening the valuation gap between growth and

value stocks to record levels, data from DWS Group showed.

Yet some investors worry that the concentration of money in a

short list of stocks could exacerbate market declines if bad news

sparks a rush to the exits. Some of the same large tech stocks led

a May selloff that pulled the Nasdaq Composite into correction

territory with a more than 10% decline from its highs, a steeper

drop than the ones that hit the Dow Jones Industrial Average and

S&P 500.

Contrarian and value-oriented strategies have waned in

popularity in recent years as investors struggle to outperform

market-tracking funds. Disagreement among analysts about a

company's earning prospects can also make shares comparatively

unpopular.

Kent Engelke, managing director at Capitol Securities

Management, has avoided those big tech stocks over the last three

years, concentrating instead on finding stocks that are undervalued

relative to the rest of the market. Lately, that has led him to

invest in unglamorous areas like consumer nondurables and the oil

sector.

"I'm miserable," he said. "The last three years have been among

the most difficult ever out of 33 in the industry because we

haven't owned FAANG."

He plans on sticking to his guns, however, convinced that the

rally can fall apart if the Fed eases monetary policy less than

expected or if companies' balance sheets worsen.

That could result in "a really big, ugly selloff," he said.

So far, few investors seem inclined to change their approach,

although many are now increasing their positions in assets that

would take the edge off a potential hit to their portfolios. Prices

for gold, a popular destination for nervous investors, are near

their highest level in six years, while the Swiss franc stands at a

two-year high against the euro.

Analysts at UBS Global Wealth Management said that markets may

be overestimating how far the Fed will cut rates and that trade

tensions between the U.S. and China could weigh on growth. They

have balanced their position in U.S. stocks, which is overweight

relative to their benchmark, with positions in havens like

long-maturity Treasurys and the Japanese yen.

"We don't think the alarms should be ignored," Mark Haefele,

chief investment officer at UBS Global Wealth Management, said in a

note to clients. "But we also think the long-term opportunity cost

of aborting is likely to be too high."

Write to Ira Iosebashvili at ira.iosebashvili@wsj.com

(END) Dow Jones Newswires

July 28, 2019 05:44 ET (09:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

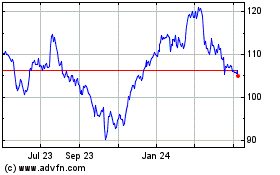

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Mar 2024 to Apr 2024

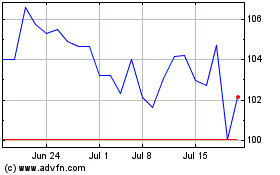

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Apr 2023 to Apr 2024