Current Report Filing (8-k)

September 27 2019 - 4:24PM

Edgar (US Regulatory)

0000001750

false

Common Stock, $1.00 par value

AIR

0000001750

2019-09-23

2019-09-24

0000001750

us-gaap:CommonStockMember

exch:XCHI

2019-09-23

2019-09-24

0000001750

us-gaap:CommonStockMember

exch:XNYS

2019-09-23

2019-09-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

|

Common Stock, $1.00 par value

|

|

AIR

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event

Reported): September 24, 2019

AAR CORP.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

|

1-6263

|

|

36-2334820

|

|

(State of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

One AAR Place

1100 N. Wood Dale Road

Wood Dale, Illinois 60191

(Address and Zip Code of Principal Executive

Offices)

Registrant’s telephone number, including

area code: (630) 227-2000

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name of Each Exchange on Which Registered

|

|

Common

Stock, $1.00 par value

|

|

AIR

|

|

New York Stock Exchange

|

|

|

|

|

|

Chicago Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§ 240.12b—2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry

into a Material Definitive Agreement.

On September 25, 2019, the Company

entered into an Amendment No. 9 (the “Amendment”) to its credit agreement dated April 12, 2011, as amended, with

various financial institutions, as lenders and Bank of America, N.A., as administrative agent for the lenders (the “Credit

Agreement”).

Under the terms of

the Credit Agreement in effect prior to the Amendment, the aggregate revolving credit commitment amount was $500 million. The Amendment

increases that amount to $600 million. Under certain circumstances, the Company has the ability to request an increase to the revolving

credit commitment by an aggregate amount of up to $300 million.

Borrowings under the

Credit Agreement bear interest at the offered Eurodollar Rate plus 87.5 to 175 basis points based on certain financial measurements

if a Eurodollar Rate loan, or at the offered fluctuating Base Rate plus 0 to 75 basis points based on certain financial measurements

if a Base Rate loan.

The Amendment also

extends the maturity date of the Credit Agreement to September 25, 2024, and modifies certain covenants and definitions, including

the maximum adjusted total debt to EBITDA ratio, and the EBITDA definition.

Except as specifically

amended and modified by the Amendment, the terms and conditions of the Credit Agreement remain in effect.

The foregoing description

of the Amendment is qualified in its entirety by reference to the full text of the Amendment and the Credit Agreement. A

copy of the Amendment is filed as Exhibit 4.1 and incorporated herein by reference.

Item 2.03. Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth under Item 1.01

of this report is hereby incorporated into this Item 2.03 by reference.

Item

5.07. Submission of Matters to a Vote of Security Holders.

On September 24, 2019,

the Company held its 2019 annual meeting of stockholders (the “Annual Meeting”). At the Annual Meeting, 32,625,868

shares of common stock, par value $1.00 per share, or 93.03% of the 35,066,967 shares of common stock outstanding and entitled

to vote at the Annual Meeting, were present in person or by proxy.

Set forth below are

the matters acted upon by the Company’s stockholders at the Annual Meeting, as such matters are more fully described in the

Company’s proxy statement filed on August 15, 2019, and the final voting results on each such matter.

Proposal 1: Election

of Directors.

The stockholders elected

each of the Company’s three Class II director nominees for a three-year term expiring at the 2022 annual meeting, as reflected

in the following voting results:

|

Name of Nominee

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

Broker

Non-Votes

|

|

|

JAMES E. GOODWIN

|

|

|

29,408,833

|

|

|

|

1,928,919

|

|

|

|

8,596

|

|

|

|

1,279,520

|

|

|

JOHN M. HOLMES

|

|

|

31,041,947

|

|

|

|

295,825

|

|

|

|

8,576

|

|

|

|

1,279,520

|

|

|

MARC J. WALFISH

|

|

|

30,634,861

|

|

|

|

702,140

|

|

|

|

9,347

|

|

|

|

1,279,520

|

|

The continuing directors

of the Company are Anthony K. Anderson, Michael R. Boyce, Patrick J. Kelly, Duncan J. McNabb, Peter Pace, David P. Storch, Jennifer

L. Vogel and Ronald B. Woodard.

Proposal 2: Advisory

Resolution to Approve our Fiscal 2019 Executive Compensation.

The stockholders approved

the Advisory Resolution to approve our Fiscal 2019 Executive Compensation, as reflected in the following voting results:

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

Broker Non-Votes

|

|

|

|

30,335,292

|

|

|

|

996,842

|

|

|

|

14,214

|

|

|

|

1,279,520

|

|

Proposal 3: Ratification

of Appointment of Independent Registered Public Accounting Firm.

The stockholders ratified

the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending May

31, 2020, as reflected in the following voting results:

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

|

32,039,234

|

|

|

|

563,115

|

|

|

|

23,519

|

|

Item 9.01. Financial

Statements and Exhibits.

(d) Exhibits

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

4.1

|

|

Amendment No.9 dated September 25, 2019 to Credit Agreement among AAR CORP., Bank of America, N.A., as administrative agent, and the various financial institutions party thereto.

|

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: September 27, 2019

|

|

AAR CORP.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ ROBERT J. REGAN

|

|

|

|

Robert J. Regan

|

|

|

|

Vice President, General Counsel and Secretary

|

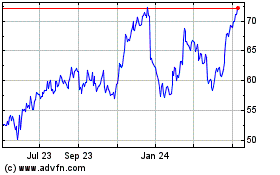

AAR (NYSE:AIR)

Historical Stock Chart

From Mar 2024 to Apr 2024

AAR (NYSE:AIR)

Historical Stock Chart

From Apr 2023 to Apr 2024